The Sand Rush

The resilience of the Shale Revolution in in the face of the 2015-16 oil price collapse is due in large part to dramatic improvements in productivity. Exploration and Production companies have strived to achieve more while using less of everything. Fewer rigs, for shorter times; less cement by drilling multiple wells on a pad; less water by recycling, and so on. But there’s one commodity whose volumes are growing substantially. Sand.

Hydraulic fracturing (“fracking”) involves pumping water combined with some other chemicals and sand (called “proppant”) into wells at high pressure. The rock cracks in millions of places as a result, and the sand allows the hydrocarbons to flow as the grains prop open these numerous cracks.

As fracking techniques have evolved, it’s turning out that more sand is better than less. Finer sand props open tinier cracks as well as being easier to transport. The need for more sand per well along with the increasing rig count have led to a big jump in sand use by the industry. A year ago I was at a dinner at which a senior executive from Antero Midstream (AM) described how this was playing out. Subsequently we’ve seen E&P companies such as Pioneer Natural Resources (PXD) note the advances made through increased sand utilization.

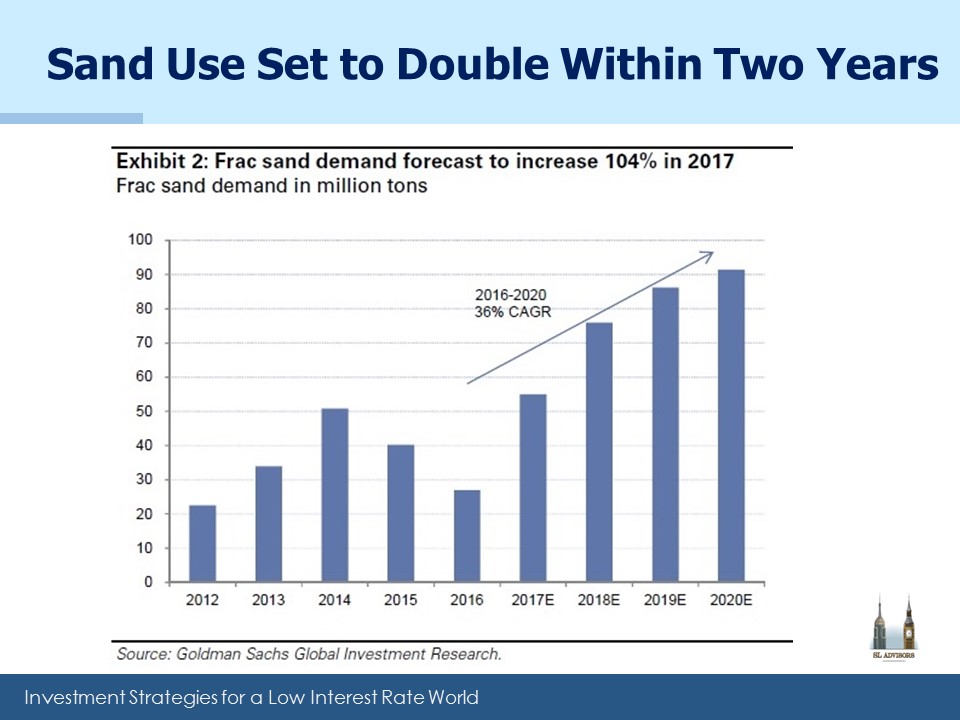

Goldman Sachs sees 36% annual growth in sand use by the industry, far faster than projections of oil and gas production. It means the price per ton of sand is increasing, and success for suppliers relies heavily on logistics.

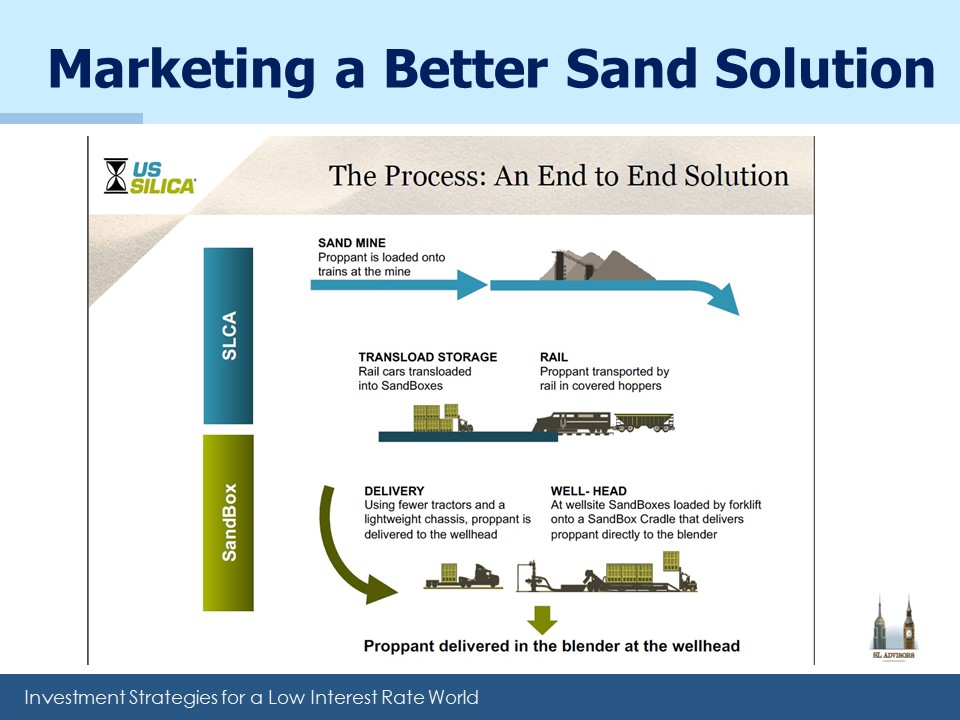

Sand is heavy, so proximity to customers saves on transportation. Wisconsin is a key supplier of sand to the Bakken Shale in North Dakota. Illinois ships sand to the Permian in West Texas, although in-state Texan mine sources clearly have a big edge. Access to rail transportation is another key differentiator for suppliers, as are improvements in ease of delivery. Faster drop-off reduces truck waiting times and helps profitability. U.S. Silica (SLCA) is a leading supplier of sand to the oil and gas industry. They have positioned themselves as a consolidator in an industry still wrestling with too much debt. Their advantages include ready access to four large rail networks as well as substantial assets in Texas, both of which allow them to deliver sand more cheaply than their peers.

Last year SLCA acquired a company called Sandbox. Sandbox shipping containers allow for easier handling of sand, cutting delivery times as well as reducing the release of silica dust. SLCA has ambitious goals for their patented container technology, aiming to increase market share from 10% to 40-50%. Sandbox represents a form of vertical integration by SLCA using better technology as they seek wider margins in a tightening market. It’s one of the less well known stories in the Shale Revolution, but provides an example of the type of innovation that is driving increased output as we head towards Energy Independence. Notwithstanding its drop on Thursday following earnings, we continue to like its longer term prospects.

We are invested in SLCA