The Inflation Reintroduction Act

The Inflation Reduction Act (IRA) may be the least appropriately named legislation in recent memory. That doesn’t detract from its impactfulness. Ever since its passage last summer, energy companies have been exploring ways to benefit from the uncapped tax credits and other subsidies available.

The IRA provided an improved tax credit of $180 per tonne under Section 45Q of the Internal Revenue Code for Direct Air Capture (DAC) of CO2. Occidental is building the world’s biggest DAC facility in Texas to extract CO2 from the ambient air and store it underground. They also increased the tax credit for CO2 that’s captured as emissions from facilities such as petrochemical plants to $130 per tonne.

Even CO2 used in Enhanced Oil Recovery (EOR) generates up to $85 per tonne in tax credits if it’s permanently stored underground. Tax credits for CO2 used in EOR does seem at odds with far left wing views of the energy transition but reflects a more pragmatic approach than some expected.

The Congressional Budget Office (CBO) estimated the expense of all these provisions at $3.2BN over a decade. Last year, when Credit Suisse was still expecting to thrive as an independent company, they estimated the cost of all these revised tax credits at $52BN. Bloomberg New Energy Finance has estimated the cost could be over $100BN. Assuming a multiplier effect on government spending, Credit Suisse thinks the economic boost over a decade could be $1.7TN.

The tax credits are uncapped, so there’s no legislated limit on how high they can go. They’re credits not payments, which ordinarily would restrict their recipients to companies with a tax obligation. But the IRA allows the tax credits to be sold. Even though this would likely require a discount to face value to induce a transaction, the transferability greatly increases the pool of potential users and therefore the ultimate cost.

More recently, Goldman Sachs has estimated that the IRA will cost $1.2TN. Last year, Senate Democrats put the cost at $369BN. There’s a growing realization that the IRA represents substantial stimulus and will move the US towards lower greenhouse gas emissions. The IRA relies on incentives to reduce emissions, contrasting with the European approach which relies on penalizing emissions. Economists favor the latter. The US political system responds better to the carrot than the stick.

There are probably hundreds of companies that will benefit from the largesse of the IRA. Next Carbon Solutions is a division of NextDecade. They expect to be able to provide “end-to-end carbon capture and storage (CCS) solutions for industrial facilities.” They are planning to “partner with industrial facilities to invest in the deployment of CCS.” Management has even suggested to us that the carbon solutions business could be more important than the LNG facility they’re planning.

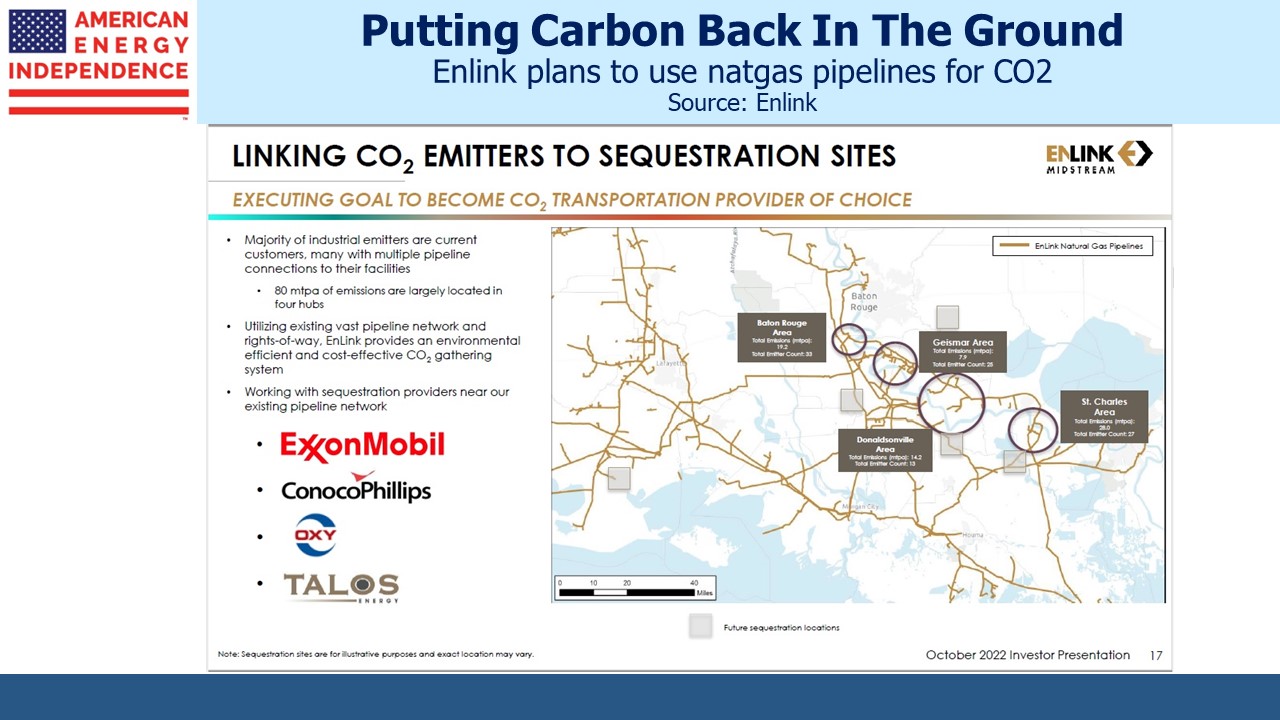

Another company that’s well positioned is Enlink. They recently signed a CO2 transportation agreement with a company in Louisiana. The Bayou state is the second largest industrial emitter of CO2, more than half of which comes from petrochemical and manufacturing businesses along the Mississippi River Corridor. Enlink already has an existing natural gas network that reaches this area and believes it can repurpose certain pipelines to carry CO2. They plan to gather gaseous CO2 and move it to central compression facilities where it’ll be converted to a supercritical state before being injected into appropriate geological formations. Many receptive rock formations exist in the area.

The improved 45Q tax credits in the IRA have made this a bigger opportunity.

In what seems like a regular occurrence, Cheniere raised full year guidance when releasing their 1Q23 earnings yesterday morning. Investors are becoming harder to impress; EBITDA of almost $3.6BN was $1.1BN ahead of consensus, yet the stock slumped 3%.

Enterprise Products Partners came in slightly ahead of expectations. Earnings for other energy infrastructure companies have provided few surprises, as is usually the case.

Meanwhile, Fed chair Jay Powell will hold a much-anticipated press conference following what most expect to be a 0.25% increase. JPMorgan advises parsing the FOMC’s statement to see if reference to “some additional policy firming” is changed to “any additional policy firming”. Such a revision would signify a pause in tightening. There still exists a wide divergence between the 2.9% yield on December 2024 Fed Funds futures and the 4% “blue dot” for that time from the last FOMC projection materials issued in March.

Inflation has been 1% or more above the Fed’s 2% target for two years, as we noted on Sunday (see Not Yet Cool Enough). Excessive Covid stimulus was part of the cause. The IRA shows that parsimony still has no place in setting US budget priorities. We think infrastructure offers some protection against persistent inflation.

We have three funds that seek to profit from this environment: