The Growing LNG Trade

Nearly three years ago, French utility company Engie pulled out of negotiations with NextDecade (NEXT) to buy Liquefied Natural Gas (LNG). Concerns about leaks during the production of natural gas (methane) were the reason. Methane is a GreenHouse Gas (GHG) that is many times more potent than CO2 over a decade or so at trapping heat in the atmosphere. Over longer periods it decomposes, whereas CO2 remains for a century or more.

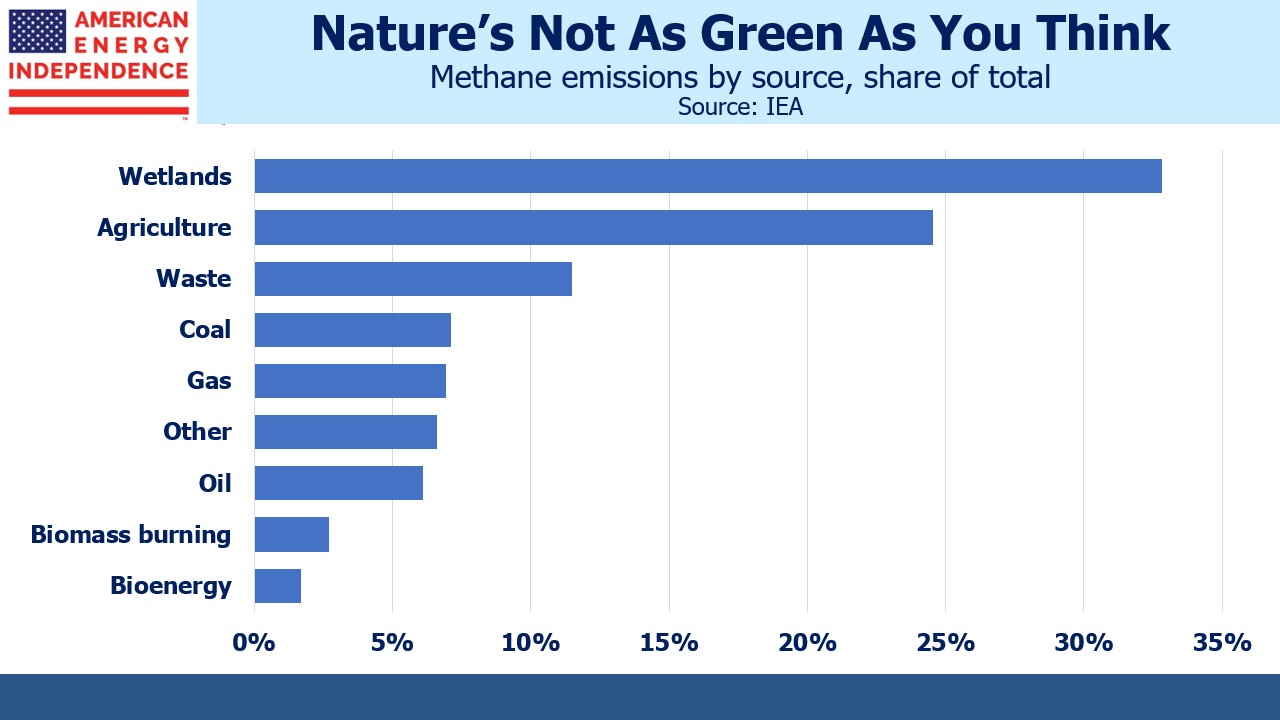

Energy sector methane leaks are far from the biggest source. The International Energy Agency (IEA) estimates that natural gas related leaks are only 7% of the total. A third of methane emissions occur naturally in wetlands. Agriculture is responsible for a quarter, mostly from ruminants (cows and sheep) belching and farting. Several companies are developing a seaweed-based animal food additive that would alter the digestive process of such animals.

Last year I met Steve Turner, CEO of Australian company Sea Forest at a wedding. Usually a Brit and an Aussie talk trash about each other’s national cricket teams upon meeting for the first time, but I quickly learned Steve’s company was turning asparagopsis into a solution to agricultural methane emissions (see How Seaweed Can Fight Global Warming). It’s an area worth following.

Anyway, Engies’s conclusion in 2020 that US natural gas was harming the planet was a big setback for NEXT, which was trying to line up enough buyers of LNG from their planned Rio Grande terminal in Brownsville, TX to justify making a Final Investment Decision (FID) to go ahead. The company responded within a few months by launching NEXT Carbon Solutions to develop Carbon Capture and Storage (CCS) at Rio Grande. Recognizing the sensitivity of European buyers like Engie to the environmental impact of their product, they committed to provide “responsibly sourced gas” that is certified as being produced with minimal leaks, and to ensure their liquefaction process is GHG emission-free, by using a combination of renewable energy and CCS.

NEXT negotiated agreements with other buyers to provide environmentally friendly gas. In April 2022 Engie returned and signed a 15 year deal for 1.9 Million Tonnes Per Annum (MTPA). Russia’s invasion of Ukraine dramatically changed Europe’s access to natural gas, but the changes NEXT had implemented addressed Engie’s earlier objections. FID on the Rio Grande LNG project came in July.

Bechtel Energy has the contract to build the facility, having been Cheniere’s longtime construction partner for their Sabine Pass, LA and Corpus Christie, TX terminals. Recently Bechtel Energy’s President, Paul Marsden, and NEXT’s CEO Matt Schatzman, held a videotaped mutual lovefest during which each emphasized the climate-friendly features of the project. Climate extremists should be supportive, because by displacing coal in the world’s biggest emitters such as China and India, US LNG is a most effective counter to rising GHGs.

NEXT’s FID in July was poorly received by the market because they were left with 20.8% of the economics in Trains 1-3 (Phase 1), less than the approximately one third investors had been led to expect. Global Infrastructure Partners and the sovereign wealth funds of Singapore and Abu Dhabi share 62.5% in exchange for $4.75BN of equity capital. France’s TotalEnergies took 16.7% in exchange for $1.1BN and a 20 year commitment to buy 5.8 MTPA. The $6.1BN in equity plus $11.8BN in debt financing makes Rio Grande Phase 1 the largest greenfield energy project financing in U.S. history.

The modest 20.8% stake retained by NEXT looked as if they’d been out-negotiated.

Global LNG demand is rising. Research firm ICIS Analytics expects the US to increase its market share from 22% to 31% over the next five years. Germany, the Philippines and Vietnam all began importing LNG for the first time earlier this year. More countries are expected to follow. The EU continues to buy LNG from Russia, as they try and impose sanctions that don’t drive energy prices up. Belgium and Spain are the world’s second and third-biggest importers of Russian LNG this year. They aim to stop completely by 2027.

NEXT currently trades at the low end of the $6-8 per share valuation range sell side analysts ascribe for Phase 1. The upside potential for the stock relies on the completion of Trains 4-5 (Phase 2). The Rio Grande project is estimated to work out at $700-800 per tonne of capacity for 17.6 million tonnes per annum. Qatar’s expansion is estimated to cost $900 per tonne. Total’s Mozambique LNG project has faced many problems and is reported to cost $1,500.

Rio Grande Phase 2 will benefit from the site preparation done for Phase 1, and as a result could cost under $500 per tonne. What’s unknown is what NEXT’s percentage ownership of Phase 2 will be. The market currently places minimal value if any on Phase 2. NEXT should be able to negotiate a much bigger stake, because Total already has an option on 32% of its capacity. Timing is uncertain, but the odds of Phase 2 ultimately going ahead look good to us. NEXT will be part of America’s increasing share of global LNG.

We have three funds that seek to profit from this environment: