The GOP House Tax Bill Implications

Yesterday we received the first details on tax reform as the House Republicans unveiled their plan. To residents of high-tax states (including your blogger in NJ) it looks like the Republican Tax Hike Plan. Putting aside the impact on some individuals, our thoughts on the investment consequences are as follows:

MLP investors should benefit, because the structure is untouched and we interpret the plan as allowing the 25% business owner pass-through rate to apply to taxable income, rather than ordinary income tax rates. This is more valuable the higher your income. Around 80% of MLP distributions are tax-deferred, and many long-time MLP holders are familiar with receiving a large tax bill when they sell, since taxes on distributions that were deferred are owed at that point. Former Kinder Morgan Partners (KMP) investors are acutely aware of the unwelcome tax bill they received back in 2014 when Kinder Morgan Inc (KMI) acquired KMP’s assets, simplifying their corporate structure but triggering the above mentioned tax event. Under the House proposal, if that was to happen in 2018 the KMP tax bill would be based on the 25% pass-through rate. This will be a consideration for those MLP businesses considering simplification transactions in which the GP buys the MLP, since the acquiring GP won’t have to offer as much consideration to the MLP holders given the likely reduced tax burden.

We didn’t see anything else that was negative for MLPs, notwithstanding the weakness in the sector following release of the plan.

The other items related to corporate taxes affect most corporations, not just those in energy infrastructure. The lower tax rate is obviously good – how good depends on your tax rate. Energy infrastructure businesses generally pay a lower rate than 35% because they have substantial non-cash depreciation charges. By contract, companies in the Consumer Staples sector (which figures prominently in our Low Vol strategies) are generally paying corporate taxes at close to the 35% rate. Those taxed at higher rates will obviously benefit more from a new, lower 20% corporate rate.

Interest expense is capped at 30% of EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization). So a company with $1MM of EBITDA could deduct up to $300K of interest expense. Assuming they were borrowing at 5%, this would allow them to borrow up to $6MM (i.e. 5% interest on $6MM is $300K) and still deduct the expense. A Debt:EBITDA leverage ratio of 6:1, as in this example, is higher than most energy infrastructure businesses, where 4X-5X is more typical and is coming down. Clearly, if rates were higher this would reduce the amount of tax-deductible debt. A 10% cost of borrowing would impose a 3X Debt:EBITDA tax-deductible leverage limit – probably not a bad idea at such high rates anyway. Faster depreciation schedules may further reduce taxes for some companies, and energy infrastructure businesses are likely beneficiaries.

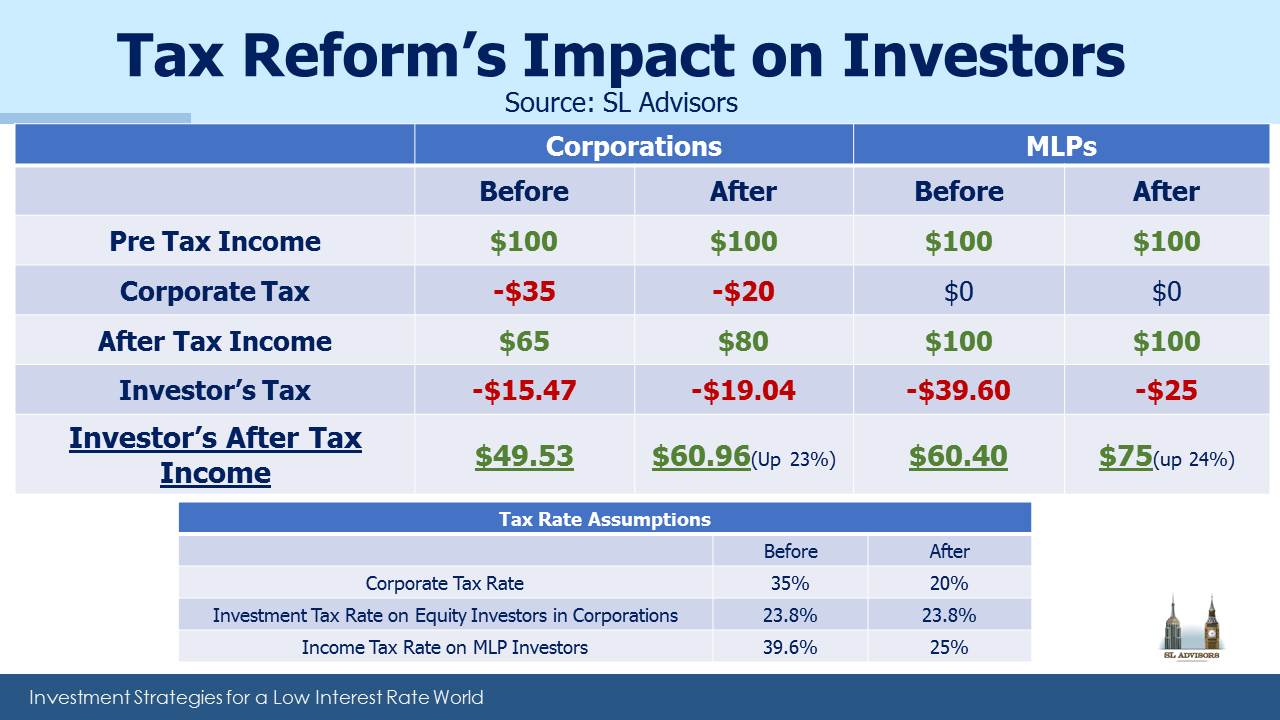

In April we offered our thoughts on proposed tax reform (see MLPs and Tax Reform). Below is an updated table comparing the impact on energy infrastructure C-corps and MLPs. Tax reform is beneficial to both classes of investment.

The lower corporate tax rate on its own reduces the tax advantage of MLPs versus C-corps. But the pass-through 25% tax rate on distributions when taxable is an improvement for investors. So we don’t see anything here that renders the MLP structure less attractive. C-corps in the energy sector today aren’t anywhere near the 35% rate. Since taxes on investment income (qualified dividends and capital gains) aren’t changing, a lightly taxed C-corp might be less tax-efficient (since its dividends are taxable) than an MLP where the investor can benefit more than the corporation from the tax-deductible depreciation. In short, MLPs can still be advantageous.

The main problem for the structure this year has been an evident unwillingness of traditional MLP investors to provide growth capital (see The Changing MLP Investor and More on the Changing MLP Investor). Maybe the more attractive tax treatment to investors will help.

We are invested in KMI