The Fed’s Yield Curve Problem

What’s the best shape for the yield curve? Today’s flat verging on inverted shape isn’t optimal. It suggests the market is worried that the Fed will tighten too much, causing a recession. It also makes it hard for banks to make much money extending credit, because they typically lend for longer maturities while funding themselves at the short end. With no curve there’s no positive carry.

But a curve can be too steep as well. If the market was worried that the Fed was going to be inattentive to inflation, long term yields would rise relative to the short end. In some respects the yield curve is a measure of confidence in the Fed’s execution of its mandate. A curve that’s positive without reflecting runaway inflation – a Goldilocks curve – reflects confidence in the future. A ten year treasury yield 2-4% above the Fed Funds rate might be that ‘not too hot not too cold” happy medium. It’s occurred to me that the Fed could do worse than adopt a strategy of maintaining a Goldilocks curve – adjusting the Fed Funds rate in response to changes in long term yields. If they maintained the spread between the ten year note and Fed Funds at 2-4%, they’d be setting monetary policy based on what financial markets are recommending.

A strategy of targeting a constant slope to the yield curve is made more complicated by the presence of so many return-agnostic buyers in the US treasury market. Negative real yields distort the expectations message the bond market would otherwise transmit. As long as there are foreign central banks, sovereign wealth funds and pension funds insistent on holding assets even if they destroy value in real terms, long term treasury yields present a distorted view of the market’s outlook for inflation.

The Fed has added to this by inflating their balance sheet – former Fed chair Ben Bernanke showed the world how Quantitative Easing (QE) could be non-inflationary if practiced correctly, as it was during the 2008-09 Great Financial Crisis (GFC). Current chair Jay Powell made it part of the Fed’s toolbox when Covid caused a recession. QE was really a one-off tool to help unfreeze financial markets, but we can now assume that it will be used whenever the Fed is facing a recession.

The economy is more responsive to long term yields than the Fed Funds rate. Most residential mortgages are fixed rate. Corporate capital spending is partly financed with bond issuance. The Fed is trying to make financial conditions less accommodative, but even though their own forecast is for the Fed Funds rate to reach nearly 3% by late next year, ten year treasury yields remain stubbornly low at around 2.7%, a level that hardly translates into tight monetary conditions.

The Fed is part of the problem, because Covid QE saw their balance sheet grow to $9TN. Recognizing the importance of long term yields on economic activity, they bought bonds to push yields down. The Fed only just stopped adding to their balance sheet last month.

Having decided to operate directly in the bond market to lower yields during a recession, it’s logical for the Fed to take steps to increase bond yields when trying to slow growth – such as now.

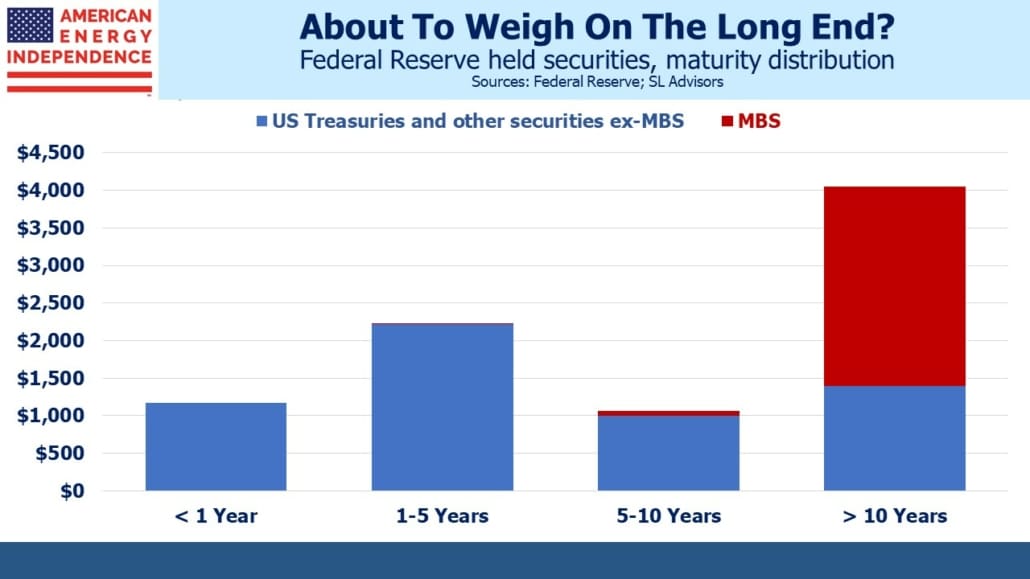

The release of minutes last week showing the Fed intends to reduce their balance sheet by $95BN per month drew much attention. But it’s not that impactful. The Fed has $1.1TN of securities with maturities of under one year, so their planned monthly reduction simply amounts to letting these securities roll off and not reinvesting the proceeds. But even if the Fed decided to auction this $1TN in short maturity securities it would have little impact, because the Fed targets a rate for Fed Funds and buys/sells short term securities to achieve their desired rate.

A meaningful reduction in the balance sheet would involve selling long term securities, especially the $2.6TN in Mortgage Backed Securities (MBS) with maturities of ten years and longer. The minutes make clear that the FOMC is uncomfortable with the current balance sheet size and wants to reduce it faster than following the GFC without being disruptive. They also need long term rates higher to as to tighten financial conditions.

Former Federal Reserve Bank of New York President Bill Dudley says the Fed “hasn’t really accomplished much yet” with its efforts to control inflation, and will need to tighten financial conditions to push bond yields higher and stock prices lower. “If financial conditions don’t cooperate with the Fed, the Fed’s going to have to do more until financial markets do cooperate,”

The opposite of QE means selling long term bonds. It’s hard to see how the Fed could auction their holdings of US treasuries without complicating the US Treasury’s always ample schedule of new issuance. But MBS auctions would be less problematic and look inevitable; a necessary step to cool a hot housing market that the Fed’s earlier buying of MBS helped create.

Nobody wants a flat yield curve. The Fed will likely conclude a steeper curve is a necessary element of their effort to curb inflation. Mortgage rates have probably bottomed for good.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.