The Fed’s Aspirational Base Case

There were few places to hide last quarter. The S&P500 was –4.6% with nine of its eleven sectors losing. Energy sparkled at +39% and Utilities were +4.8%. Bonds were even worse, with the Bloomberg Aggregate –6.2%. Close to our hearts, pipelines (as defined by the American Energy Independence Index) were +24.5%.

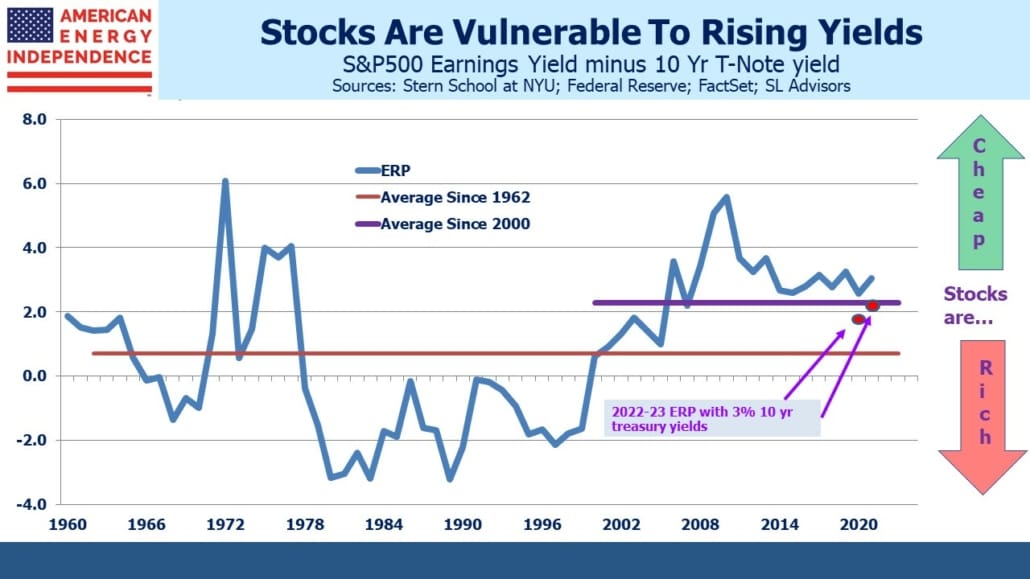

Low yields have underpinned stocks for many years, so a deteriorating Equity Risk Premium (ERP) is weakening the case for “TINA” (There Is No Alternative). Although bonds remain a long way from offering a fair return, yields have risen far enough that stocks no longer look compelling. Factset bottom-up estimates for S&P500 EPS growth are 9%, putting the ERP close to its 20 year average. As a successful and now retired bond trader used to say, 3% on the ten year note is only a nine iron away. This would make stocks look decidedly neutral.

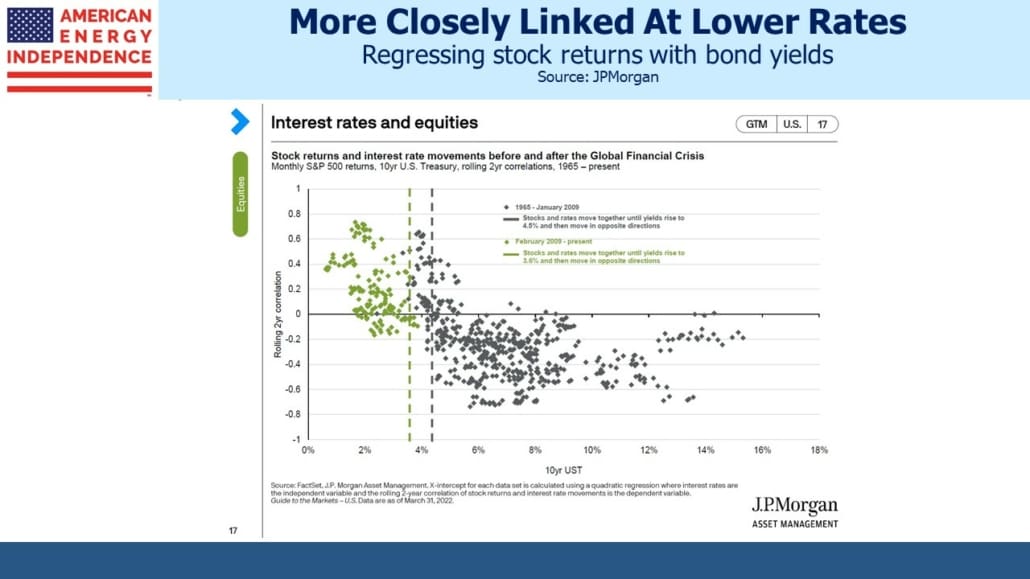

Correctly calling interest rates is of greater import to one’s equity portfolio. JPMorgan produced an interesting chart that shows bond yields and equity returns are more highly correlated when rates are low. There’s no doubt low rates have driven investors to assume greater risk. Inconveniently, most of this relationship is since the Great Financial Crisis (GFC), so it’s unclear if the correlation has risen because rates are low, or because something changed structurally following the GFC. If ten year yields move above 3.6%, JPMorgan’s chart suggests the correlation will turn negative, meaning rising rates would be good for stocks. It’s hard to imagine, but inflation is changing many things.

Larry Summers and Bill Dudley are competing via erudite blog posts for the title of most articulate Fed critic. Dudley recently said that The Fed has made a U.S. recession inevitable thanks to its slothful removal of monetary support. Jamie Dimon said in his annual letter that “the medicine (fiscal spending and QE) was probably too much and lasted too long.”

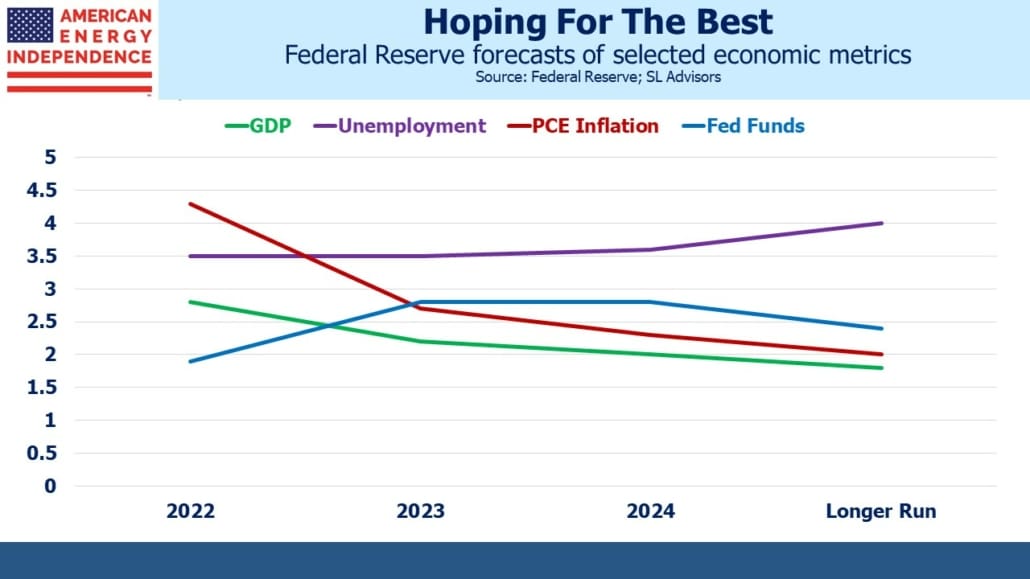

Summers warned investors, The stock market liked the Fed’s plan to raise interest rates. It’s wrong. He took issue with the recently released FOMC forecast, which presents an impossibly optimistic outlook. He notes that the Fed is expecting inflation to moderate while pushing Fed Funds barely above their neutral target, all while maintaining close to full employment. Should Jay Powell and his FOMC colleagues pull this off, they will have threaded the proverbial needle and challenged economic orthodoxy. It’s more correctly an objective, or an upside case, rather than a forecast. No business could submit a budget with such hopeful outcomes.

This makes the future path of interest rates quite wide. If inflation doesn’t moderate, will the Fed push rates high enough to cause higher unemployment? How willing will they be to risk a recession? In August 2020 chair Powell revealed a subtle but significant change in how they regard their dual mandate of maximum employment consistent with stable prices.

Decades of declining real rates and an unemployment rate that continued to fall without causing wage pressures persuaded the Fed to allow inflation more upside than in the past. Since that symposium two years ago in Jackson their policy, “emphasizes that maximum employment is a broad-based and inclusive goal.” Data shows that minorities suffer employment more quickly than the general population, so the Fed is presumably now more sensitive to minority rates of unemployment. This isn’t necessarily a bad policy, but it is a modification and comes with increased tolerance for inflation.

The Fed now assesses “shortfalls” not “deviations” from maximum employment, since “employment can run at or above real-time estimates of its maximum level without causing concern.” And most notably, “following periods when inflation has been running below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

Both Dudley and Summers impose a traditional Fed policy function on today’s situation. That would regard our current inflation spike as a manifest policy error demanding a prompt response. By contrast, Powell has admitted that inflation is too high but has yet to concede a policy error. Their revised consensus statement allows for some inflation risk in pursuit of getting everyone a job, so 7.9% inflation is less of a mistake than if, say, Paul Volcker was in charge.

If the FOMC projections turn out to be correct, stocks will do very well. The risk for equities is that inflation doesn’t moderate as expected – will an FOMC stung by their error tighten too much in response? Or will they place greater importance on near term maximum employment, always waiting for another month of hopefully better data? It’s unclear, but if Larry Summers is right that the FOMC forecasts are short on “intellectual rigor and honest realism” the Fed’s fealty to their reinterpreted mandate will be tested.

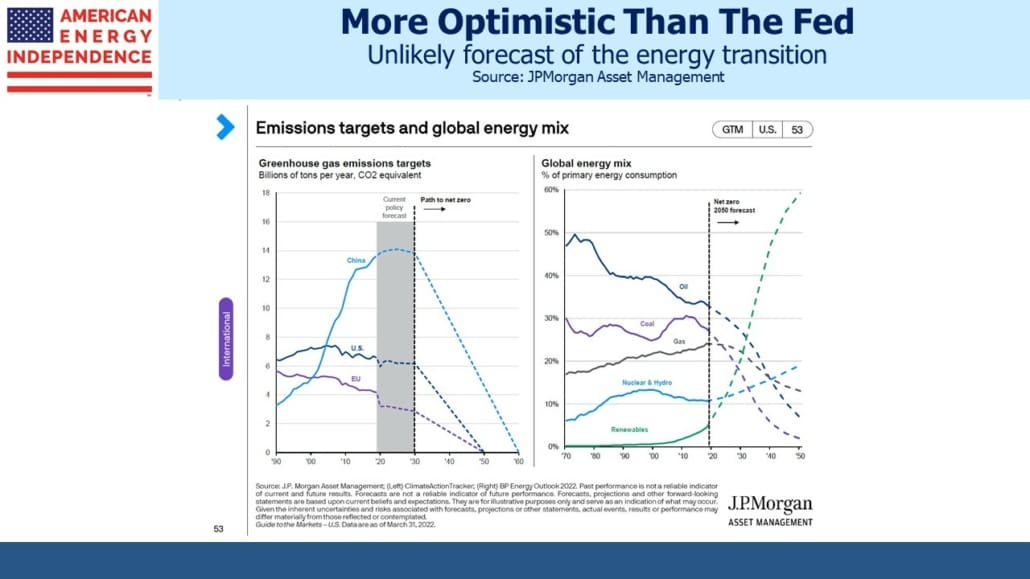

Perhaps because we cover interest rates and energy markets, connections often leap out. It’s politically correct (even “woke”) to assume wildly unrealistic assumptions about renewables, because it suggests endorsement of the policies required. So JPMorgan includes a chart showing global primary energy from renewables reaching a 60% share by 2050 from under 5% today. Fossil fuel use collapses so that oil, gas and coal in aggregate are less than 20% of primary energy use in 2050 versus 78% today.

Because JPMorgan is not quite as idealistic as the chart suggests, an extensive footnote warns that it’s based on the Net Zero outlook from this year’s BP Energy Outlook. The Net Zero scenario, which isn’t BP’s central case, roughly aligns with the UN’s goals. In other words, it’s what many climate scientists believe should be happening, not necessarily what they expect. JPMorgan adds that forecasts are “not a reliable indicator of future performance.” In other words, it’s not their forecast.

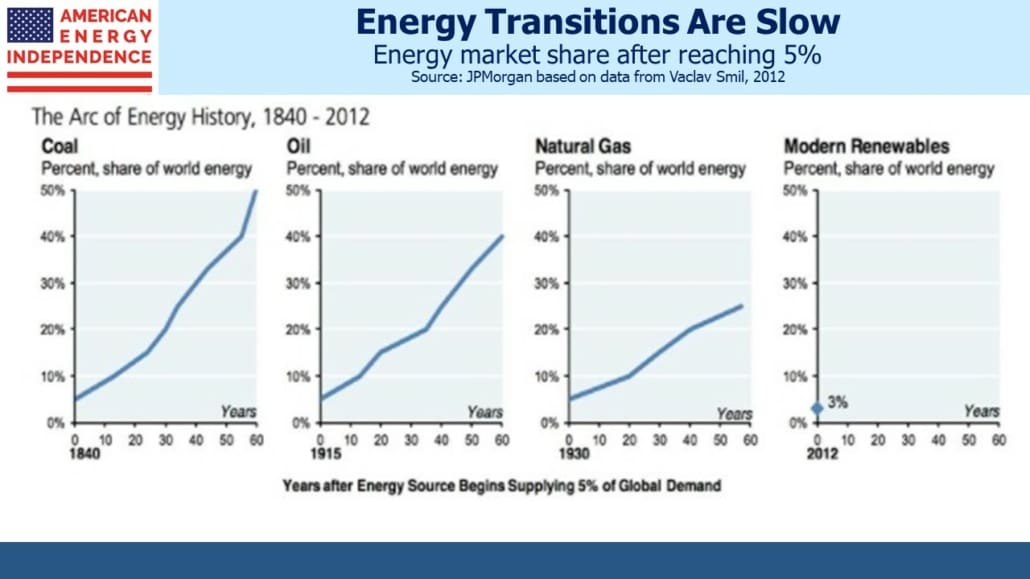

Ten years ago JPMorgan published a series of charts based on work by highly regarded polymath Vaclav Smil on the slow pace of energy transitions. It took coal 60 years after reaching 5% to provide half the world’s energy. Oil and natural gas still haven’t reached that level and probably never will. The forecast that renewables will provide half the world’s energy within two decades is aspirational, and even less likely to be accurate than the Fed’s. Any serious effort to reduce emissions will use more natural gas instead of coal, increase nuclear power substantially and incorporate carbon capture. Improbable forecasts that are presented as Base Case are never good. Larry Summers would agree.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.