The Fed Is Losing Believers

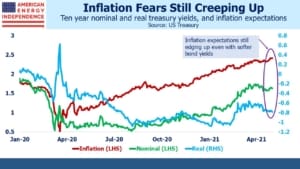

This Friday’s non-farm payroll report is more important than normal. With the Fed in single-minded pursuit of half their twin mandate (maximum employment), the stable prices objective is receding. The recent stalling in the bond market sell-off doesn’t correspond to equanimity over inflation. Declining real rates have accompanied the drop in nominal ones. In April, ten-year treasury yields dropped by 9bps, but TIPs yields fell by 0.13%. So inflation expectations edged up by 4bps. Investors now expect CPI inflation to average 2.42% over the next decade.

The Fed has a stated goal of 2% inflation over the long term and plans to tolerate inflation above this level during a recovery in order to anchor expectations at 2%. Investors are increasingly skeptical. Moreover, real yields are now solidly negative. They crossed below 0% for the first time during Covid early last year and have never recovered. With the Fed buying $120BN in bonds per month, partial debt monetization in support of higher employment is government policy. Stephanie Kelton’s book, The Deficit Myth, explains all (see Modern Monetary Theory Goes Mainstream).

It is a populist policy – voters are more aware of the cost of borrowing than the return on lending. And stocks are near all-time highs, so there’s little obviously wrong. But rising inflation expectations are a warning that the Fed will at some point need to confront a policy that has gone too far. The FOMC is not good at forecasting (Bond Investors Are Right To Worry).

In Fed chair Powell’s recent press conference, he said, “So it seems unlikely, frankly, that we would see inflation moving up in a persistent way that would actually move inflation expectations up while there was still significant slack in the labor market.”

Powell added, “…for inflation to move up in a persistent way that really starts to move inflation expectations up, that would have to—that would take some time and you would think it would be quite likely that we’d be in very strong labor markets for that to be happening.”

Put together, Powell doesn’t expect inflation expectations to rise until (a) actual inflation is rising, and (b) we are approaching full employment. Inflation expectations have been rising for over a year, and passed through the Fed’s 2% long term definition of price stability in early January. His comments sound as if he believes expectations will respond to actual inflation, whereas markets are forward-looking.

It sounds as if Powell doesn’t believe inflation expectations are rising.

On Saturday, Warren Buffett responded to a question by noting, “This economy right now, 85% of it is running in super high gear, and you’re seeing some inflation…” In another response, he said, “We’re seeing very substantial inflation. It’s very interesting. We’re raising prices. People are raising prices to us, and it’s being accepted.” Even Treasury Secretary and former Fed chair Janet Yellen said, “It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat…”

The list of those who share Jay Powell’s perspective is shrinking.

Anecdotal evidence of rising inflation is stacking up. Since the Fed is focused on maximum employment, every non-farm payroll report will be scrutinized for signs that this goal is within reach. Only wage inflation will justify a shifting monetary stance – all other forms are temporary (supply constraints), mean reverting (food and energy) or ignored completely (housing).

One could interpret persistent negative real yields as an indication that the Fed’s bond buying has continued too long. Credit doesn’t seem tight – the high yield bond market remains firm. It’s almost as if the Fed selectively accepts only data that supports its view. To listen to Jay Powell’s frustration with constant questions on inflation, a behavioral finance expert might diagnose overconfidence. The FOMC has misplaced high conviction around current policies.

Last week Dallas Fed president Robert Kaplan said, “At the earliest opportunity, I think it will be appropriate for us to start talking about adjusting those purchases,” He’s the first to openly break ranks.

JPMorgan expects Friday’s non-farm payroll report to show an increase of one million jobs. Jay Powell noted that 8.5 million fewer jobs exist than was the case pre-Covid. The actual slack in the economy may be less than that – Friday’s report will provide further evidence of the economy’s strong recovery.

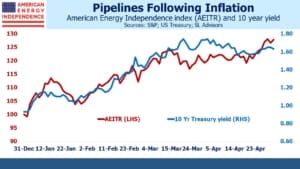

Pipeline stocks have performed well as a hedge against rising inflation expectations. That’s likely to continue.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.