Tellurian Drifts Into Stronger Hands

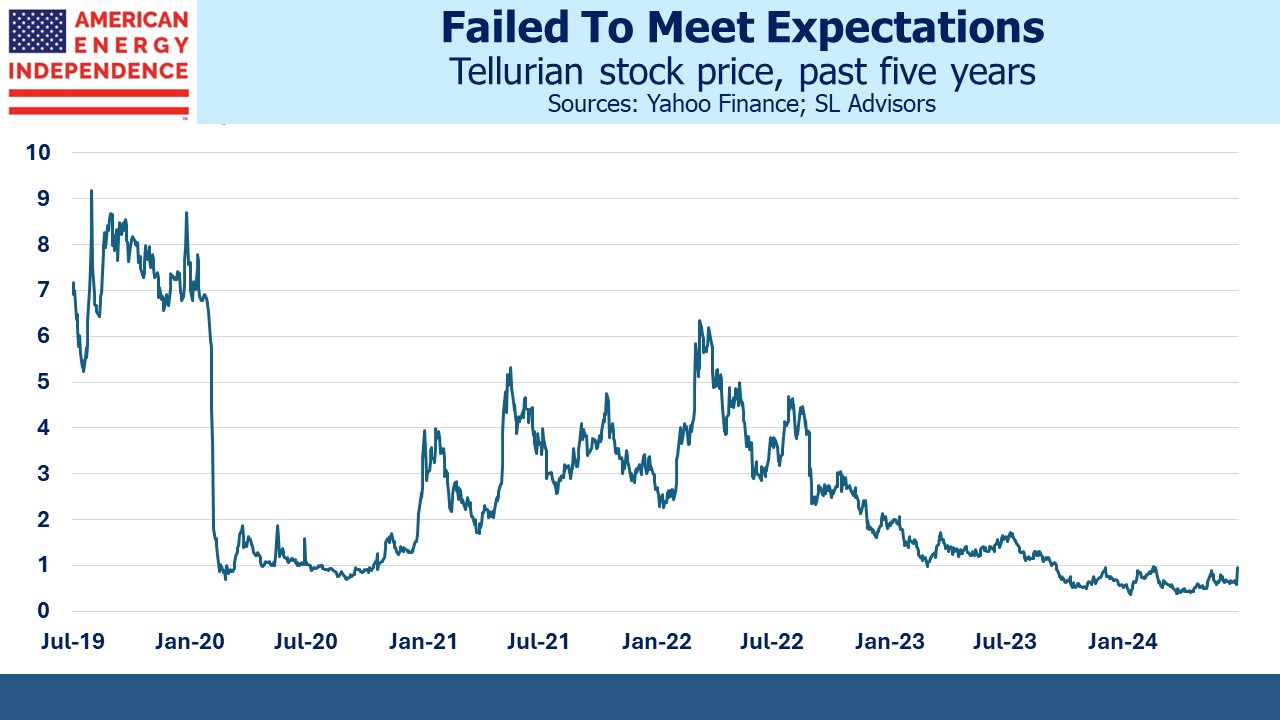

Tellurian finally put its investors out of their misery, selling to Woodside for $1 per share. The 75% premium to the prior day’s close is only impressive because the stock has sunk so low to this point. Founder Charif Souki was never able to obtain financing for this LNG wannabe. In 2022 in one of his regular videos on Youtube he memorably issued a mea culpa (see What’s Next For Tellurian?) for insisting on retaining natural gas price exposure in the Sale Purchase Agreements (SPAs).

This made the business model riskier because the future cashflows from liquefaction were less certain. Potential investors balked; SPAs expired because Tellurian hadn’t started work on their Driftwood LNG terminal.

Souki is a visionary with an excessive risk appetite. At Cheniere he wanted to start a natural gas trading business, which would have introduced more earnings volatility to a company with visible, long term cashflows from liquefaction. He was eventually pushed out.

At Tellurian the collapse in energy stocks during the pandemic resulted in a margin call on his personal, leveraged holdings in the company. Souki persuaded TELL’s board to compensate him for successfully getting the Driftwood LNG terminal started even though he hadn’t (watch Tellurian Pays For Performance in Advance).

Souki was pushed out in a repeat of his exit from Cheniere. Like Joe Biden, he stayed at it for too long.

TELL’s price drifted lower as the odds of Driftwood being completed receded. The LNG permit pause added further uncertainty.

A couple of years ago TELL was trading at $4.50. Its acquisition by Woodside more than 75% below that price reflects the low odds of Driftwood ever being financed. Woodside is betting that the LNG permit pause will be lifted, most likely by an incoming President Trump. Kamala Harris, younger and to the left of Biden, might even keep it in place if she’s elected.

The most likely outcome is that the Driftwood LNG export terminal, now in the hands of a company with the resources to finance it, will be completed. This will be a win for the climate by allowing LNG buyers to use less coal, and for our domestic energy sector.

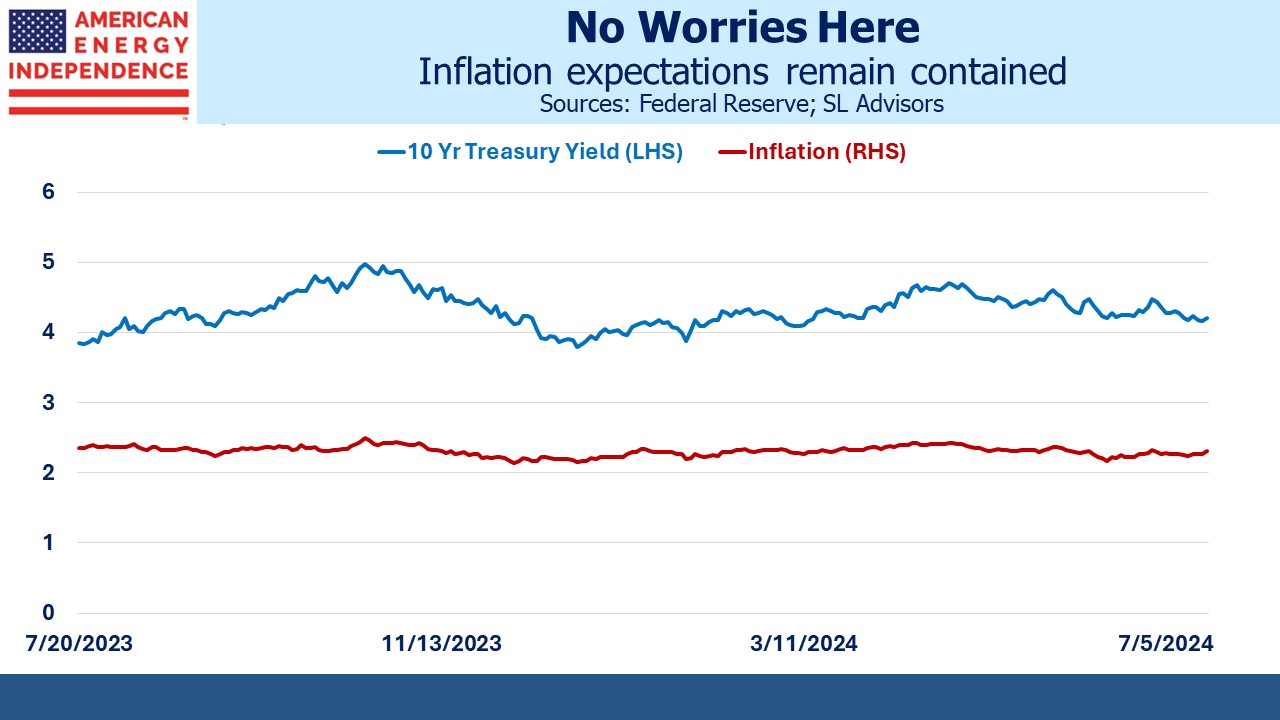

With all the chatter of the Trump Trade and the inflationary impact of a Republican-controlled White House and Congress, the bond market is remarkably non-plussed. For the past year, ten-year inflation expectations as derived from the TIPs market have stayed in a tight range between 2.15% and 2.5%.

The Personal Consumption Expenditures (PCE) deflator, the Fed’s preferred measure, runs around 0.25% to 0.5% lower than CPI. This is because it’s constructed using dynamic weights that reflect actual spending patterns rather than the fixed weights in the CPI.

So as a practical matter bond investors are endorsing the Fed’s desired inflation objective of 2%. Given that monetary policy allows for some asymmetry – an inflation overshoot is less problematic than an undershoot – you could even argue that bond investors think there’s little asymmetry in the outlook.

Stocks have rallied during the summer, due to indications from Fed chair Jay Powell that rate cuts are coming but also because the odds of a Trump election victory have increased. Trump’s odds of winning didn’t dip with Biden’s withdrawal over the weekend.

VP Kamala Harris is a great opportunity for Trump to run against a liberal Democrat from California. She may yet turn out to be a better campaigner than she was during the primary four years ago, when she withdrew at an early stage. Otherwise, Republicans look set to sweep both houses of Congress too.

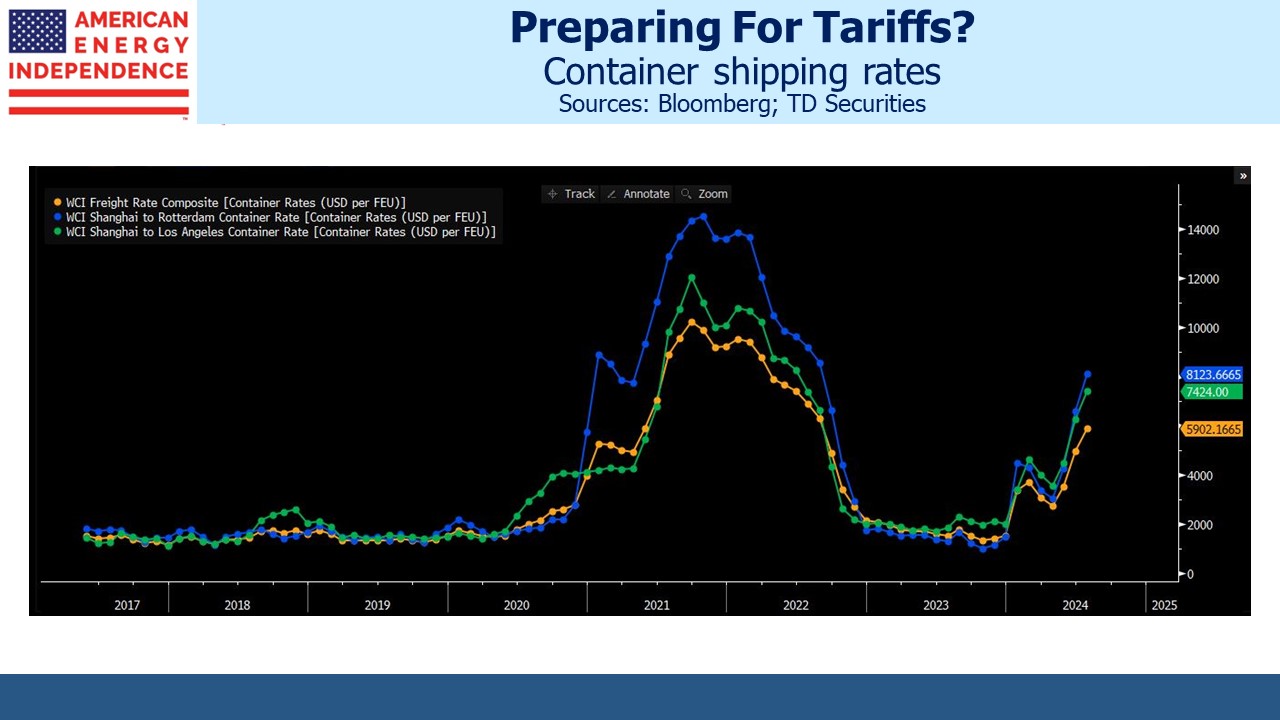

Container rates have been moving steadily higher this year, reaching levels last seen during the pandemic. There are signs that companies are building inventories of goods in the US, anticipating sharply higher tariffs after the election. Shipping rates from Shanghai to Los Angeles have more than quadrupled this year.

Ten year yields at 4.38%, approximately unchanged over the past month, don’t reflect the Trump Rally that is apparently driven in part by higher inflation expectations. Betting markets favor Trump over Harris by roughly a 2:1 margin. Democrats appear to be rejecting a competitive convention, thus foregoing the opportunity for a more centrist candidate to emerge.

Long term bond yields offer scant compensation for America’s fiscal outlook and there’s a good possibility of one party controlling both the White House and Congress. Therefore, shorting long term treasury notes expecting deficits and inflation to move higher looks like a good trade to this blogger.

We have three have funds that seek to profit from this environment: