Tax Fears Hit MLPs

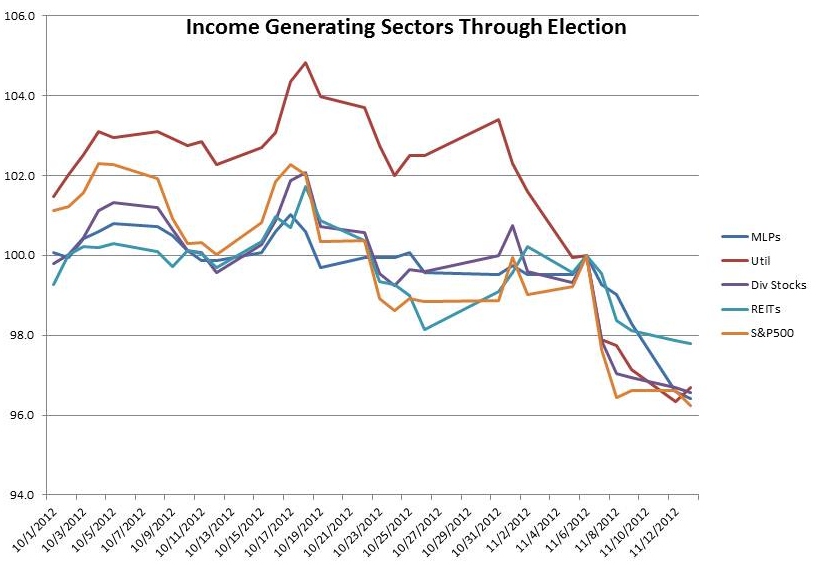

MLPs have been weak recently. On Monday the Alerian MLP Index (AMZX) sank almost 2%, on a day when equities were broadly unchanged. For the month, MLPs are down 4.7%, although still up almost 6% on the year. Much of the damage has taken place since the election. As the chart shows, MLPs have lost 3.6% since President Obama won re-election to a second term. However, most other income generating sectors and the overall market are all down more than 3% (REITs have held in slightly better).

Clearly the Fiscal Cliff and its resolution have weighed on the market. A failure to prevent automatic sequestration and tax hikes would probably tip the U.S. into another recession and concerns over that outcome have anecdotally been a headwind to capital spending and hiring for several months. But investors are also starting to contemplate the impact of tax hikes on various sectors, and are adjusting prices accordingly. Higher taxes on dividends and capital gains have seemed likely all year. Congressional inaction would result in dividends being taxed at over 40% (including the Affordable Care Act surcharge) for high income taxpayers, a substantial leap from the current 15%. While the proposals being floated don’t go that far, higher taxes on investment income at least for some taxpayers seem likely.

Which is why the retreat in MLPs may be the start of an opportunity. Most MLP income is treated as a return of capital with a consequent adjusted cost basis for the holder. Taxes on this component of income are ultimately paid when the MLP is sold and are assessed at the taxpayer’s ordinary income tax rate. Wholesale tax reform could of course change this treatment, although that’s not currently on the cards and in my opinion is highly unlikely. Supporting capital formation in support of energy infrastructure seems like a sensible strategy for the U.S. at all times, but especially as the U.S. is just a few years away from being the world’s largest oil producer and increasingly energy independent. And private equity managers continue to pay just 15% on their carried interest from running funds (Mitt Romney is an example) and while ultimately that obvious loophole will surely be closed, its continued existence reveals the power of lobbyists. Holders of MLP units are passive investors, so not in the same category as PE managers whose income is effectively taxed at 15%. And Congress has estimated the tax treatment of MLPs as being worth just $300 million, not an obvious target.

So if taxes on conventional investment income rise, MLPs might in fact be relatively more attractive. In the near term fund flows out of all income generating sectors may continue to pressure the sector. The Alerian MLP ETF (AMLP) has drawn in many smaller investors who don’t mind (or don’t realize) that the 1099 they receive rather than a K-1 costs them 35% of the return they might otherwise earn. Short term flows from these investors may continue to put pressure on MLPs in general. But nothing fundamental has changed for the underlying businesses so there’s little reason to take realized, taxable gains.