Tariffs And Mismanaging The Economy

A new administration took office determined to change the economy’s direction with overhauled policies. The leader and key advisers huddled, drawing up their plans in relative secrecy. Once ready, they were unveiled with great fanfare, heralding a new dawn in economic stewardship.

Markets, caught by surprise without having had the opportunity to assess them via leaks, reacted with horror as the looming hit to GDP, unanticipated by the new administration or investors, was immediately reflected in prices.

This was how the new UK government under then-Prime Minister Liz Truss began in September 2022. In her case the UK gilt market was shocked by the scale of proposed borrowing. Yields rose. Sterling fell. The government’s unrealistic plans were widely criticized, including by many in her own Conservative party.

A tabloid famously wondered whether her time in office would outlast a lettuce and helpfully posted a photo of Truss next to one, continuously broadcast via a webcam. The lettuce visibly decayed, but her time as PM was shorter still at 49 days.

The UK parliamentary system can change its PM with a speed and brutality unmatched in the US. The British Conservative party has historically shown its leaders less loyalty than the US Republican party, and our political system doesn’t offer the same flexibility. If not, Thursday’s tariff-induced $3TN loss of equity market value would be the beginning of the end.

The exit ramp could be Congress withdrawing the emergency powers which President Trump has invoked that give him the ability to impose tariffs. We have no insight into how far markets must decline to induce such. The US Senate passed a resolution, but a veto-proof two thirds majority in both chambers will be required.

There’s a scale of equity market losses that will be sufficient, but we’re not there yet. Given the unpredictability with which tariffs have been used, the president’s current autonomy over their implementation will remain in Damoclesian fashion to limit any animal spirits to the upside.

To quote my friend and former head of bond trading, in the meantime, “Down’s a long way.”

The economy, financial markets and even the president will all be better served if Congress reasserts its authority in this area. Republicans may care to recall that after Liz Truss the UK Conservatives never regained their reputation for competent economic stewardship and suffered a thumping electoral defeat to the Labour Party last year.

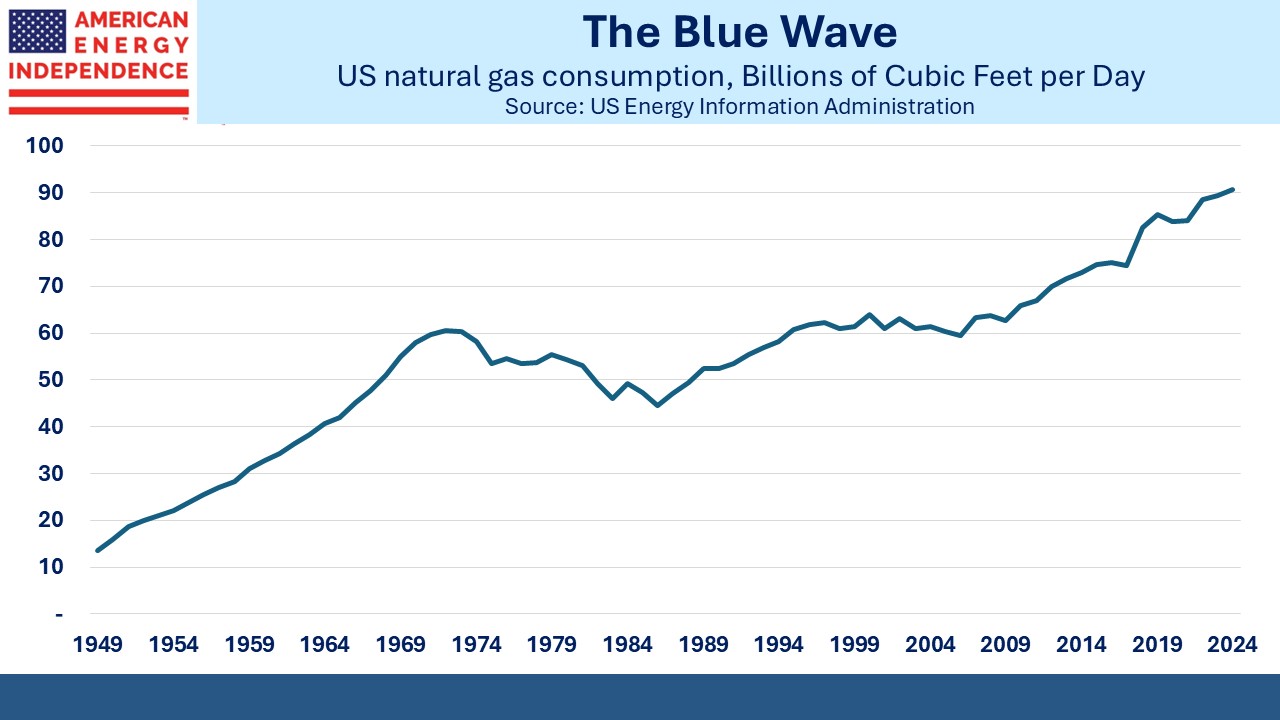

While investors endure more tariff trauma with its associated equity market volatility, it’s worth remembering that demand for US natural gas has historically been virtually impervious to fluctuations in GDP growth. We think this will continue, supporting volume throughput across the related infrastructure.

Since the shale revolution released enormous amounts of domestic gas, consumption has grown. The 2008 financial crisis was barely a blip. Even during the 2020 pandemic when crude oil prices briefly went negative because of lockdowns, natural gas volumes fell 1.7% but quickly recovered. Within a couple of years they were 3.7% higher. Over the past decade consumption has grown at a 2.2% compounded annual rate.

The US Energy Information Administration expects production to grow at 2% this year and next.

It’s not hard to see why.

Coal to gas switching has resulted in cheaper, cleaner power over the past fifteen years. Pennsylvania’s Homer City coal burning power plant is being converted into the natural gas Homer City Energy Campus. It’ll produce 4.5 GW, enough to power 2-3 million homes although local data centers will be the main users. That will require around 0.8 Billion Cubic Feet per Day (BCF/D) of natural gas, around 0.7% of US output. When operational in 2027 it’ll be the biggest natural gas power plant in the country.

Demand from data centers and LNG exports will continue to underpin natural gas demand growth.

In one bright spot a few days prior to Liberation Day, Vietnam announced it was cutting its import tax on LNG from 5% to 2%. The White House is assuming that our trade partners will generally not engage in rounds of reciprocal tariff hikes. We need more examples like this.

I was in London last week where I reconnected with several people from high school that I had seen once or not at all in the ensuing 45 years. We had much to catch up on. Satisfyingly, people whose company I enjoyed as a teenager remain that way today. I’ve never regretted emigrating to the US but always enjoy returning to where I grew up.

We have two have funds that seek to profit from this environment: