Talking Midstream In the Volunteer State

Midstream energy infrastructure is offering solid defense during a period when Presidential ruminations on tariffs or Jay Powell’s career prospects regularly cause 2% daily market moves. Operating a pipeline business is dull by comparison. These companies are largely immune to trade wars. They just keep generating cash and raising dividends.

Last week Energy Transfer (ET) announced a distribution hike of over 3%. Western Midstream came in with 4%. Earlier in the month Kinder Morgan announced a 2% dividend hike. Enbridge reaffirmed 3% annual increases that were originally forecast in December.

It’s not just that midstream is mostly a domestic business with limited exposure to foreign markets. China was only 5% of US LNG exports last year. If they dropped to zero, we’d just ship to other countries.

Kinder Morgan estimates that more expensive steel imports will add 1% to the cost of new projects. But capex isn’t a big driver of most midstream companies’ profits anymore, in part due to persistent lawsuits from climate extremists weaponizing the legal system and causing delays. Lower capex has boosted free cash flow, supporting dividend hikes, buybacks and reduced leverage.

If you meet a climate protester (and there seem to be fewer of them nowadays), hug them and offer transportation to their next event.

When you combine this limited exposure to tariff turmoil with the inherent stability of energy volumes, it’s hard to see why the fundamental values of these companies have changed at all over the past month. So far none has revised earnings guidance.

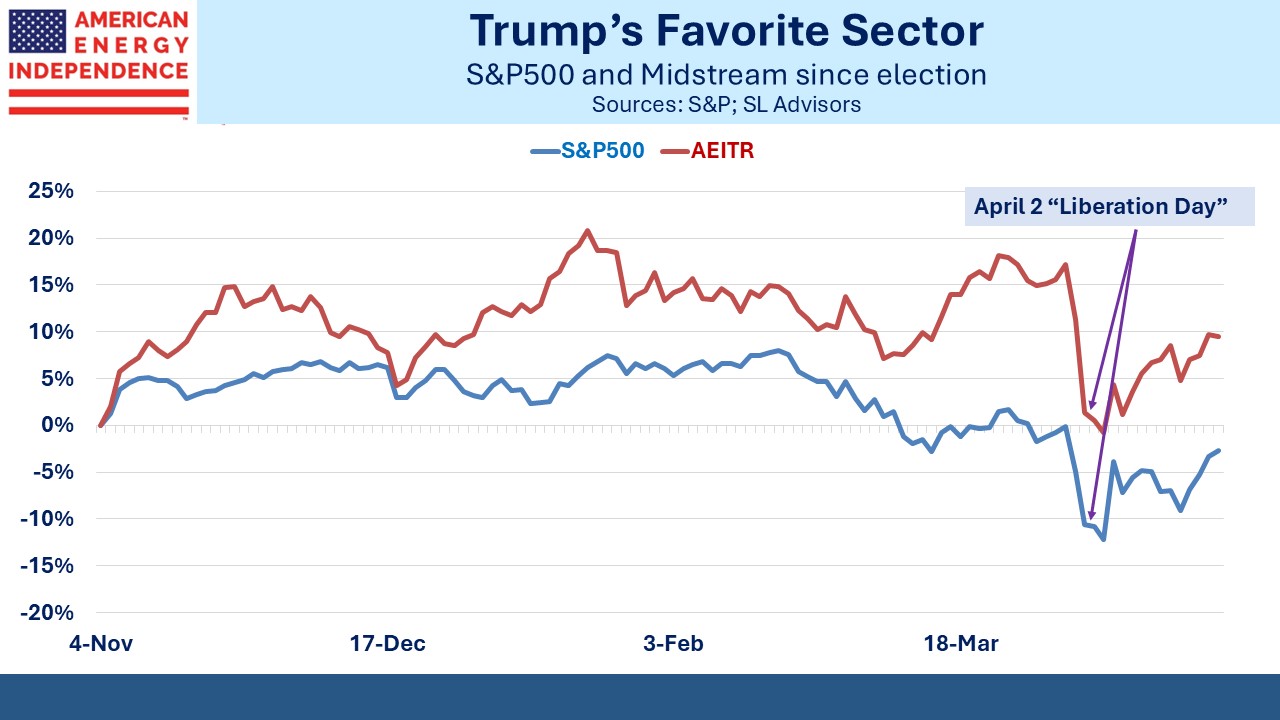

The American Energy Independence Index (AEITR) has sustained its positive return since the election, even though it was already widely believed that Trump would be good for the energy sector. Although still down since “Liberation Day”, it has retained its outperformance versus the S&P500.

Apart from China, across the rest of Asia countries are increasing their imports of US Liquefied Natural Gas (LNG). Japan, South Korea, India, Taiwan and Vietnam have all either set new records or indicated a desire to buy more. It’s a good way to reduce their trade deficits with the US.

Last week we were in Tennessee, dubbed “The Volunteer State” for its strong tradition of military service. In Memphis my wife fulfilled a lifelong dream to visit Elvis Presley’s Graceland while I enjoyed meeting clients over lunch. The next day another client lunch in Nashville afforded a brief opportunity afterwards to visit Andrew Jackson’s Hermitage. Jackson’s consequential life included leading the American army to victory at the Battle of New Orleans, concluding the War of 1812 and ejecting the British from US soil.

I’m glad it turned out that way.

I always enjoy fielding questions from potential investors, as they often reveal concerns others may have about the sector. The meetings in Tennessee provided plenty. The upside for natural gas consumption from data centers is well understood, but nuclear power still causes some to ask whether this will become the solution of choice. The Vogtle nuclear plant in nearby Georgia took fifteen years to complete and cost more than 2X initial estimates.

We should be adding nuclear, but critics argue that the Nuclear Regulatory Commission is excessively bureaucratic and demands multiple redundant safety systems. There are always opponents able to use the court system to slow construction, raising costs and scrambling IRR projections.

Absent changes, investing in nuclear energy remains unattractive. Small Modular Reactors (SMRs) continue to inspire hope, but so far haven’t moved beyond pilot projects designed for proof of concept. Three years ago NextEra CEO John Ketchum called SMRs, “an opportunity to lose money in smaller batches.”

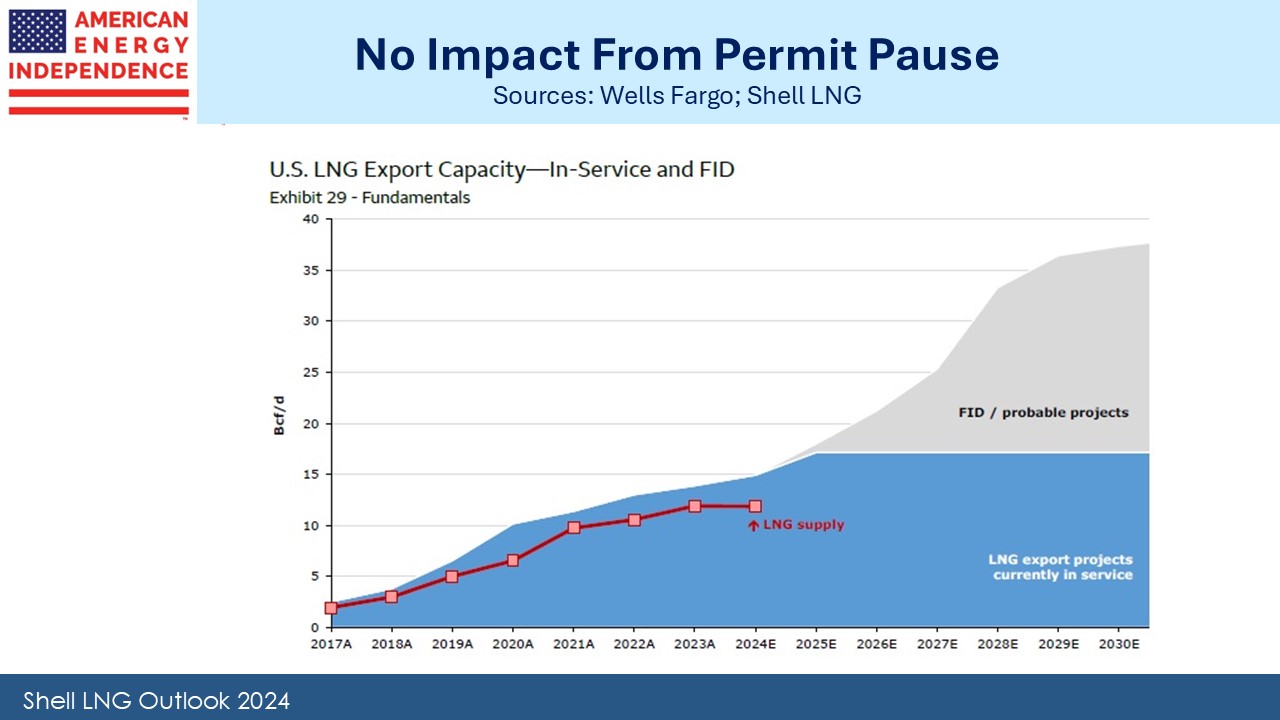

The impact of the LNG permit pause often draws questions. When the Biden administration imposed this in January 2024, it didn’t impact projects that were already under construction. New projects needing a permit to begin construction had to wait. Three to five years is the typical timeframe to completion, although Venture Global’s modular approach has reduced this.

Trump canceled the pause as one of his first official acts upon taking office. But as the chart from Shell shows, there never was any discernible impact on our increasing LNG export capacity.

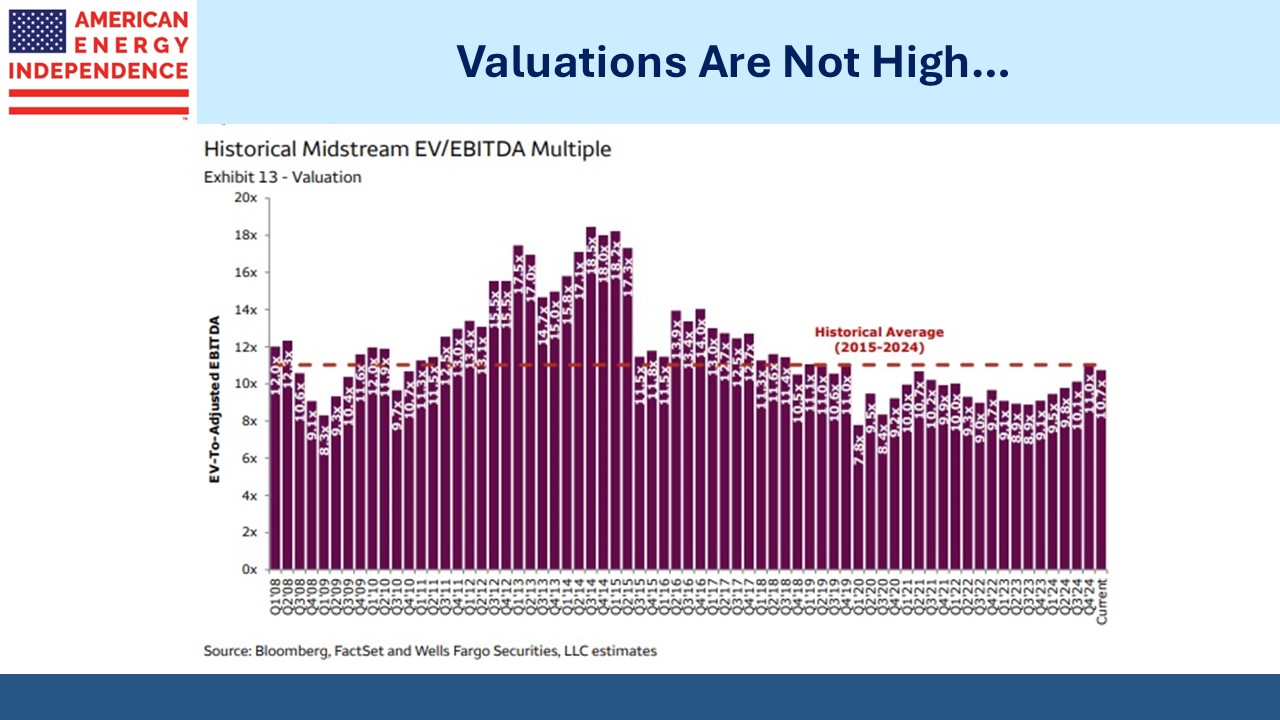

The case for midstream continues to be underpinned by demand growth, valuation and White House support. The sector isn’t as cheap as late 2023, but Enterprise Value/EBITDA (EV/EBITDA) recently dipped back below its ten year average following the ongoing tariff turmoil. Given the positive fundamentals which include dividend hikes, amply covered payouts and declining leverage, there doesn’t seem much to prevent valuations moving higher.

Since the industry roughly finances itself with equal amounts of debt and equity, a one turn improvement in EV/EBITDA from, say, 10.7X to 11.7X (i.e. +9.3%) would push equity values up around twice that. Alternatively, adding the sector’s dividend yield (5%), long-term dividend growth (3%) and buybacks (2-3% of market cap) implies a 10-11% total return without any change in valuation.

These solid fundamentals are what’s behind strong relative performance. They remain in place.

We have two have funds that seek to profit from this environment: