Suppose The Deficit Matters

For our entire careers the US budget deficit has hung over markets like the sword of Damocles. It was a political issue in 1992 when Bill Clinton beat George Bush, a victory enabled by Ross Perot siphoning off Republican voters with his warnings of fiscal catastrophe.

Under Clinton we briefly ran a budget surplus, part of an improving trend Bush had started by reneging on his pledge to not raise taxes (“Read my lips. No new taxes”). That cost Bush the election, and as the Clinton surplus melted away so did popular concern about the deficit. Today there are no fiscal hawks, because they can’t get elected. The bull market in bonds that started in 1982 lasted almost four decades. But it’s over.

When investors consider America’s ballooning debt, they shake their heads at the looming disaster and then forget about it as they select asset classes and securities. Few consider what it might mean for their portfolios.

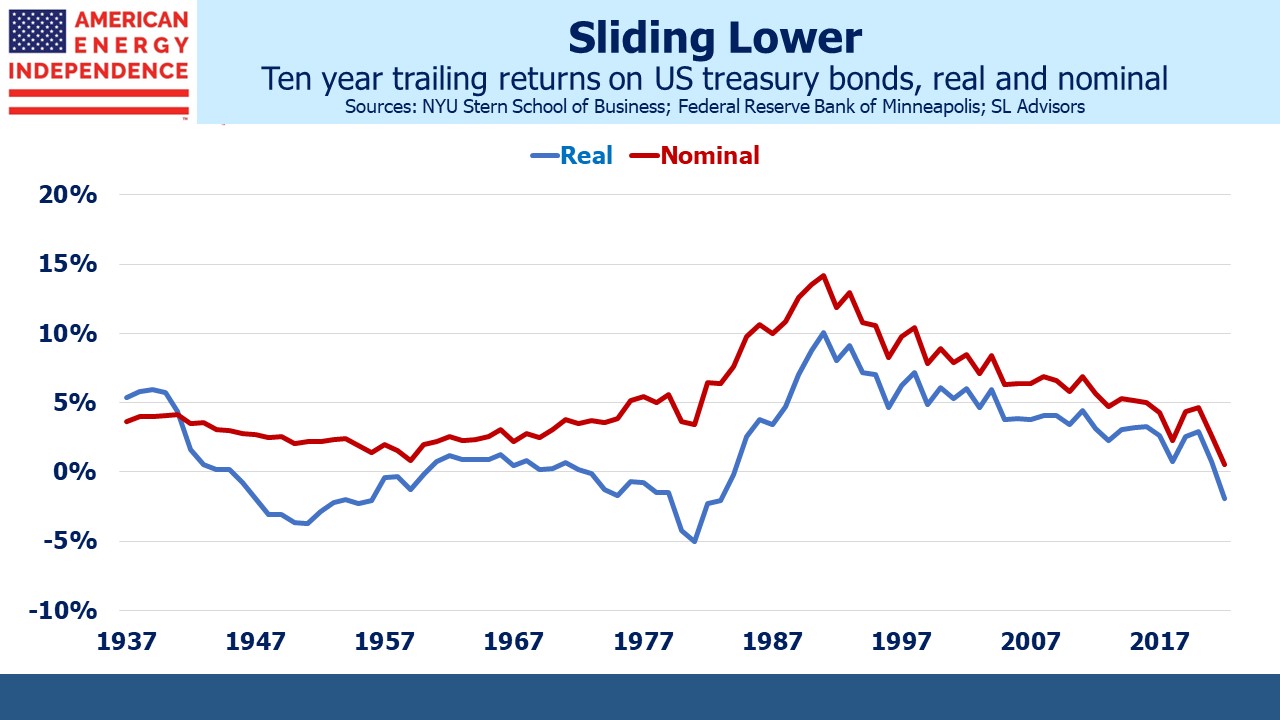

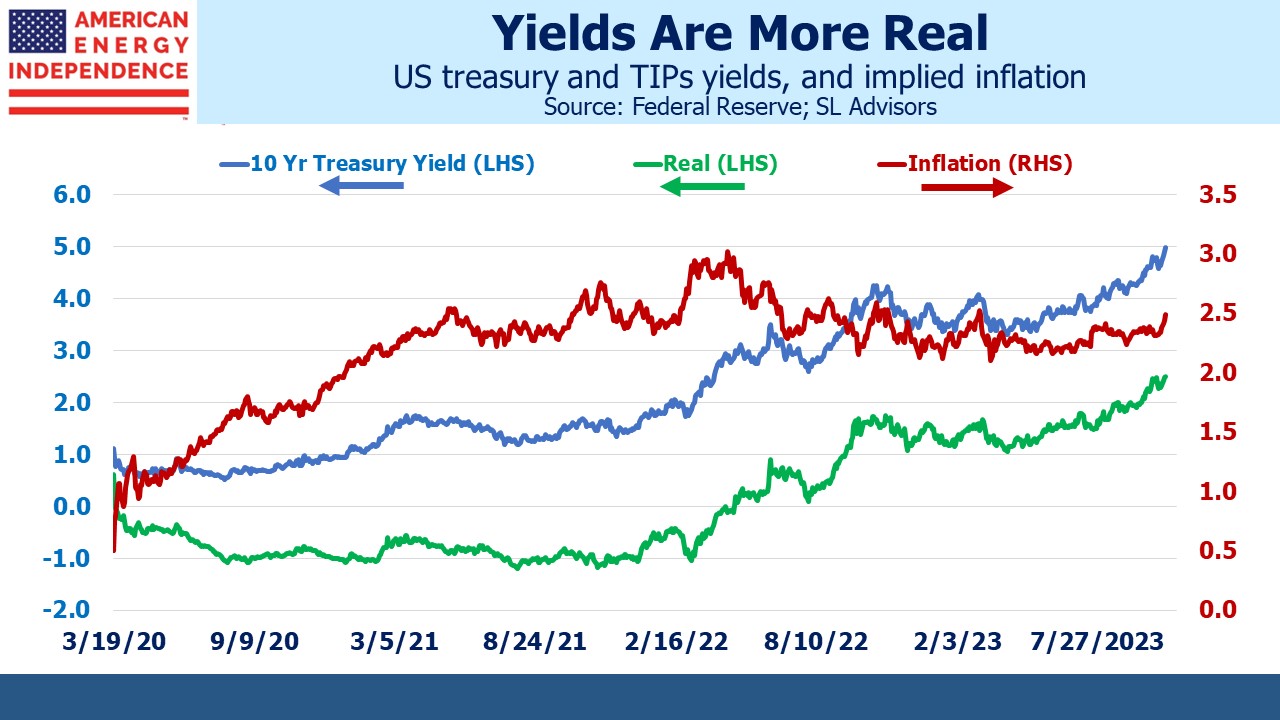

In the 1970s bond investors suffered negative real returns as inflation rose faster than interest rates. Paul Volcker famously crushed inflation, but bond investors soon demanded higher real returns that briefly touched 10% as compensation for the risk of inflation’s return. Nominal and real yields steadily fell as inflation remained quiescent.

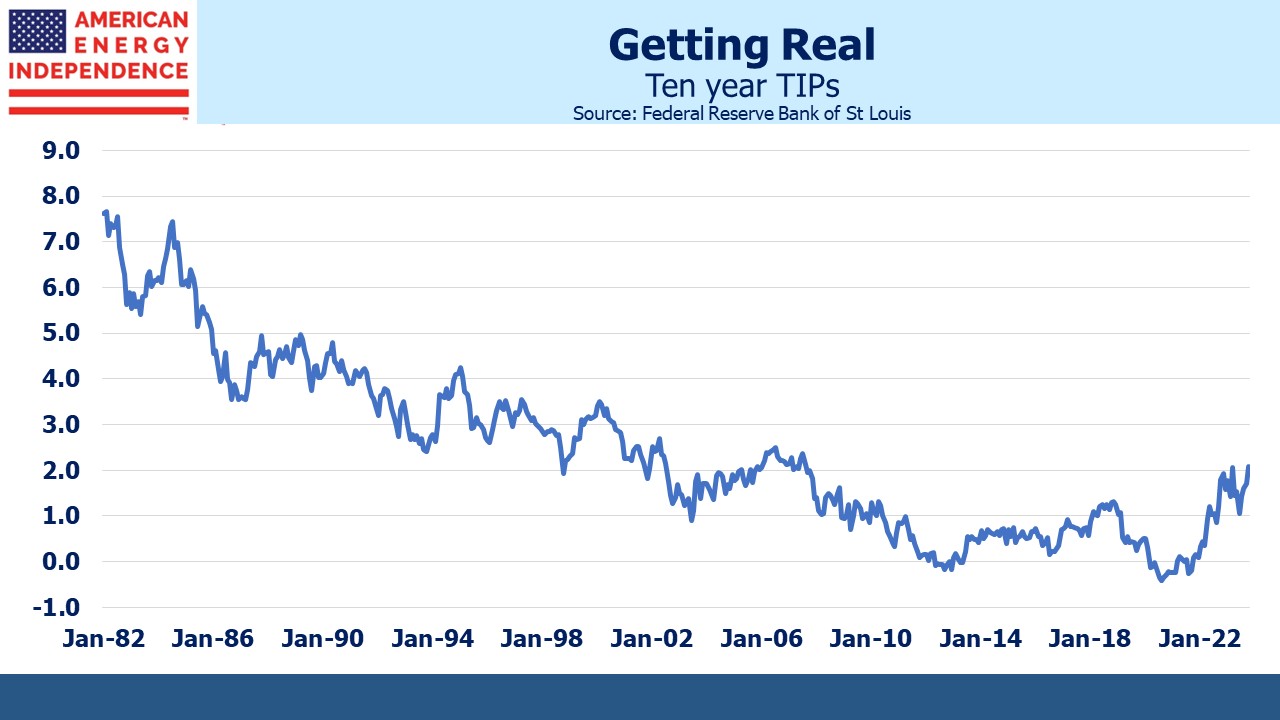

Yields on ten year Treasury Inflation Protected Securities (TIPs) have declined more or less continuously since their first issuance in 1982. Because investors care about returns net of inflation, the decline in real returns has affected all asset classes. The drivers are complex and the subject of much academic research. Inflation uncertainty can cause investors to demand higher returns, which is why the Fed is so focused on restoring it to 2%. Broad technological advancement can improve productivity, driving realized real returns higher, as can an increased need for capital. Central bank buying of bonds, Quantitative Easing, has depressed real returns.

There’s no accepted method for forecasting what real returns will be. But it’s clear that investors want them higher.

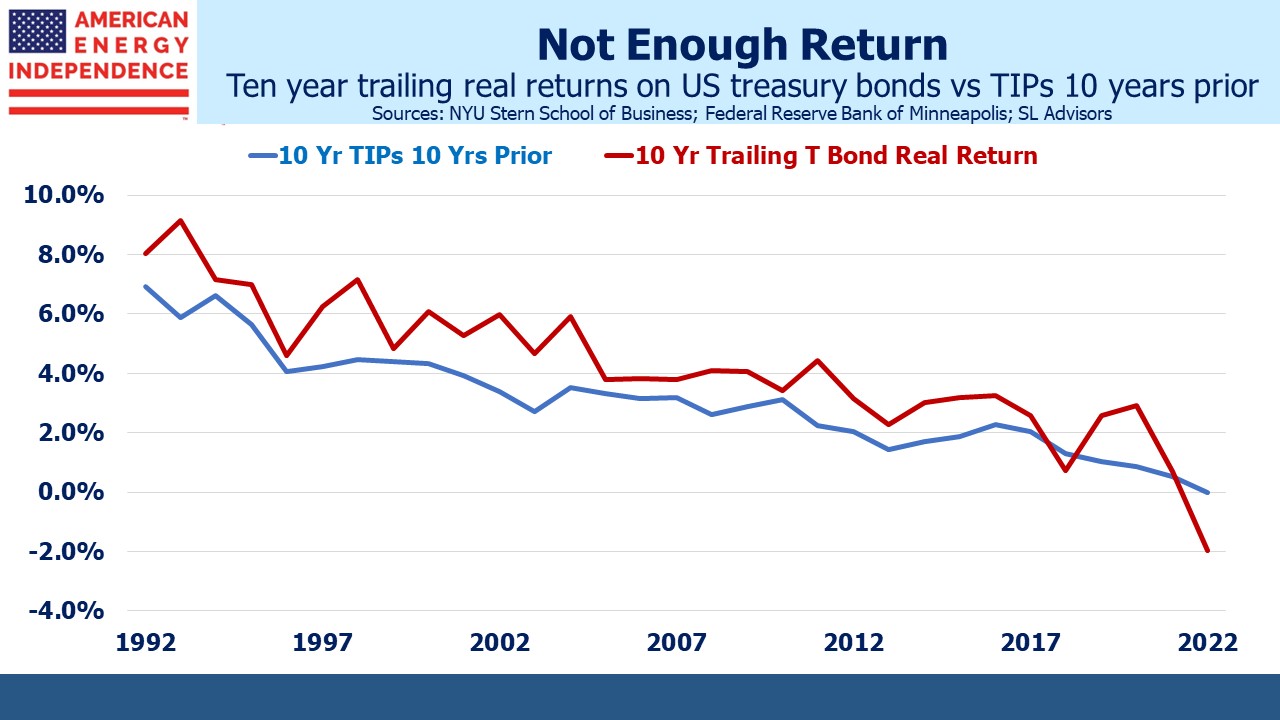

TIPs have provided a reasonable forecast on future returns. The third chart overlays ten year TIPs with the subsequent ten year bond return. The 1992 trailing ten year bond return was 8%. In 1982, ten year TIPs yielded 7%. The forecast reflected in this yield was within 1% of what bond buyers realized over the following decade.

It’s in this context that we should consider today’s rising TIPs yields. The downward trend is over. Real yields, which were inexplicably negative during the early stages of the pandemic in 2020, have moved up through 2% and are close to 2.5%.

Treasury Secretary Janet Yellen believes it’s because of the strong economy. US GDP rose 4.9% in 3Q23, driven by a 4% increase in consumption expenditures. Other factors could be at work. Bonds have benefited from substantial buying by the Fed and other central banks who aren’t return oriented. The Fed is now letting its balance sheet shrink. China is reducing its exposure. Perhaps they’re worried about these assets being frozen if at some point we’re at conflict over Taiwan.

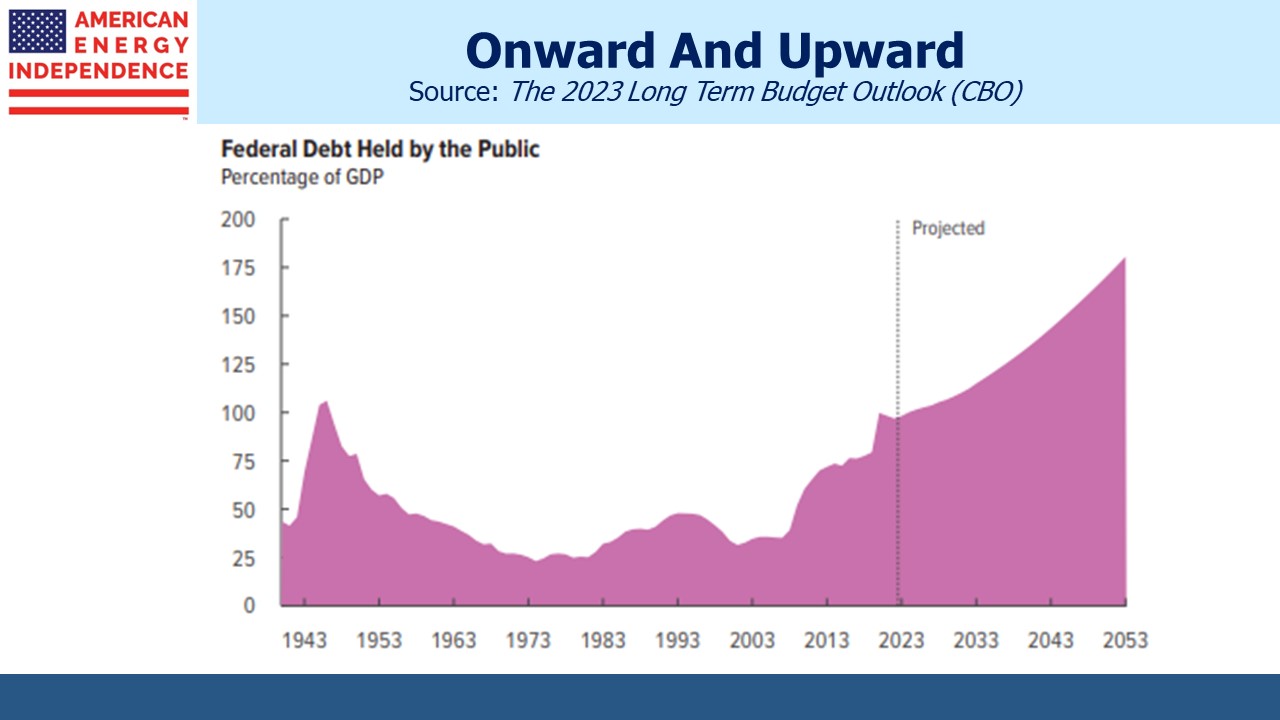

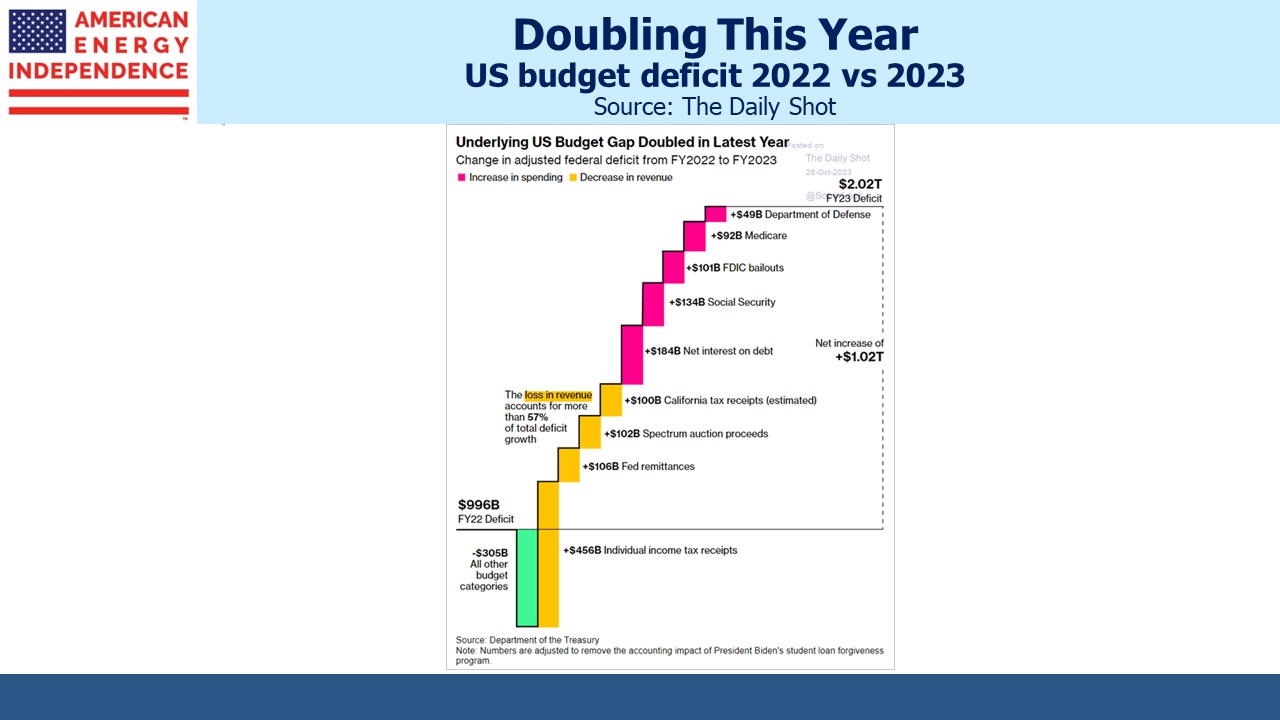

The fiscal outlook could be another consideration. As non-commercial buyers are withdrawing, the return-oriented investor is the marginal buyer. Three month t-bills at 5.5% look attractive. But are thirty year bonds at 5% offering sufficient compensation for the chart at the beginning of the blog? The Fed’s commitment to 2% inflation is only as strong as the desire in Congress to support them. Taming inflation caused by the pandemic has brought forward by two years the point at which interest expense equals 3% of GDP (from 2030 to 2028). Higher rates have a deleterious effect on our fiscal outlook, because we owe so much money.

At some point over the life of the new thirty year bond the US Treasury will sell next month, the constraint posed by interest expense on discretionary spending is likely to become a topic of Congressional debate. The fealty to 2% inflation will be considered alongside other worthy goals.

Populism continues to promote deceptively simple solutions to today’s complicated problems in both political parties. We may endure another government shutdown as the new Republican speaker, whose views are right of his predecessor, pursues the facile and incorrect path of refusing to pay for what you said you’d pay for.

Populists aren’t a good credit risk.

Naturally a blog on midstream energy infrastructure will express the belief that it offers protection from the reckoning of decades of fiscal incontinence. Meaningful cash returns now will be preferable to the delayed gratification of future growth when the purchasing power of those deferred cash flows is uncertain.

Rising TIPs yields may just reflect the dawning realization of what investors already know – that our fiscal future is unlikely to be pain-free.

We have three have funds that seek to profit from this environment: