Stocks Have Been Cheaper

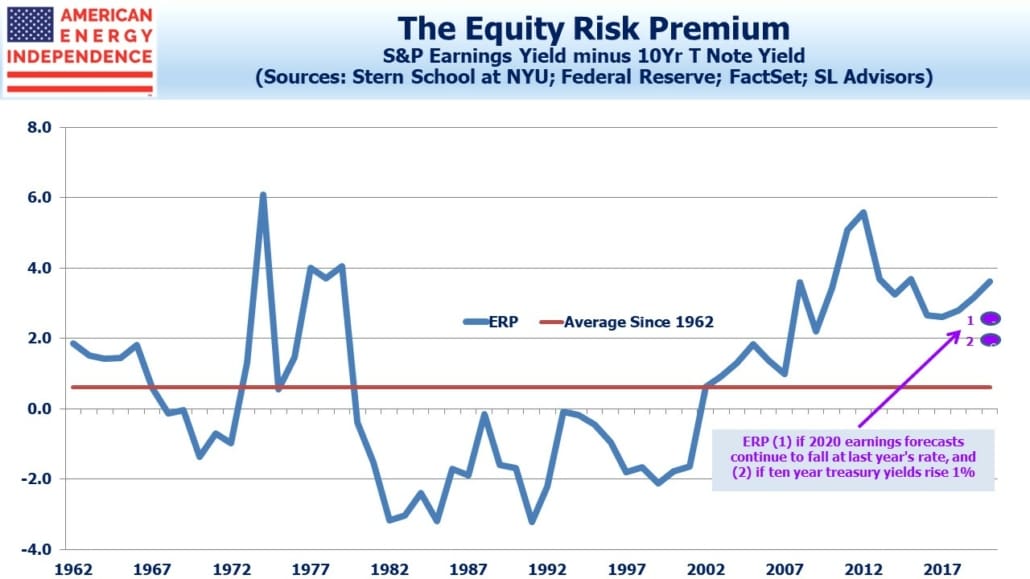

We’ve been using the Equity Risk Premium (ERP) as a measure of the relative attractiveness of stocks for many years. The ERP is the earnings yield (i.e. the reciprocal of the P/E ratio) minus the ten year treasury yield. It compares stocks with bonds, allowing today’s relationship to be compared with history. The S&P500’s P/E is currently 18.1, based on Factset‘s 2020 earnings forecast of $178. That’s an earnings yield of 5.5%, producing an ERP of 3.6 when compared with the ten year treasury yield of 1.9%. Since 1960, the ERP has averaged 0.6, so it currently favors stocks.

The Cyclically Adjusted Price/Earnings Ratio (CAPE), another valuation tool, has been disastrous. It’s shown stocks to be expensive, because it compares the current P/E with the long term average. The flaw in this simple approach is that it ignores interest rates. Stocks are historically expensive, but bonds are even more so. CAPE practitioners have missed out on an enormous rally.

We first wrote about the ERP in 2012 (see The Price of Fear) when it was 6.3. It’s been providing a bullish signal for stocks ever since, as we’ve often pointed out. A year ago it was 4.4. During 2019 yields fell, earnings grew and multiples expanded, all of which supported the market’s 31% return.

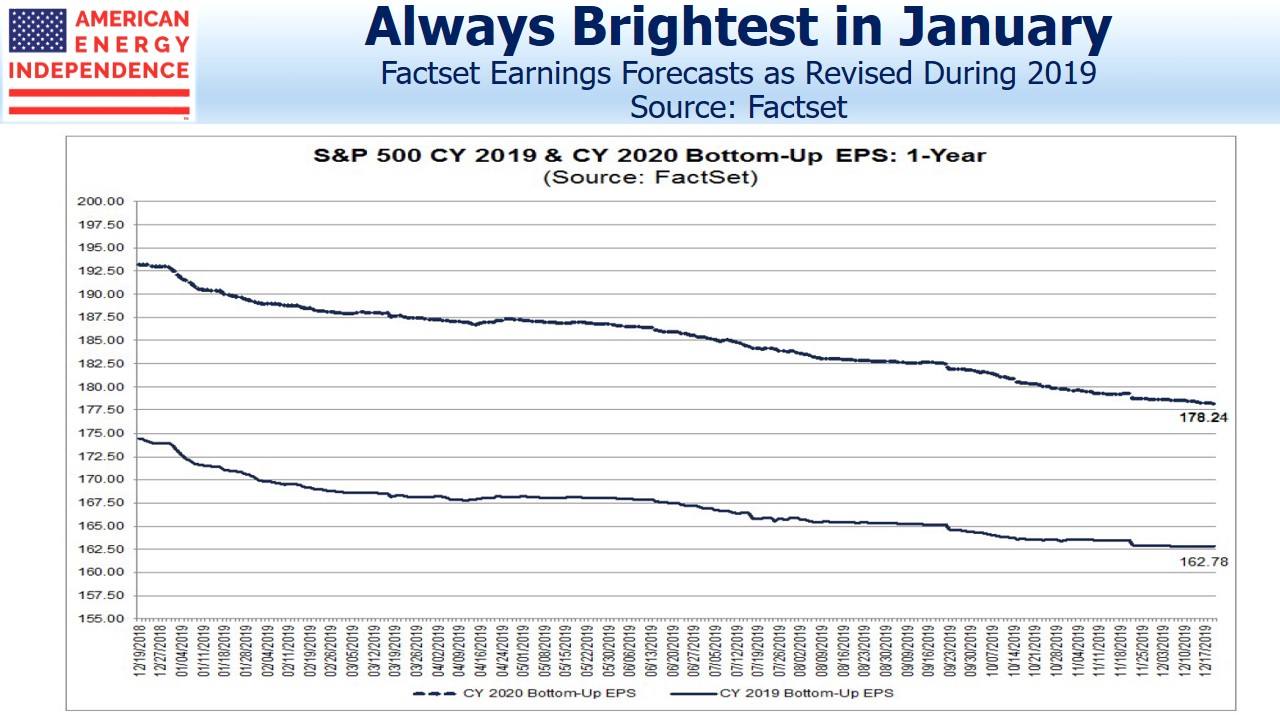

I was chatting with a friend the other day about valuations, and the ERP. Factset bottom up earnings for 2019 began last year at $174 and edged down all year to $163. That’s often the case – sell-side analysts and management guidance typically open the year with optimism that subsequent events gradually erode.

At the end of 2018, the 2020 earnings forecast was $193. It’s already fallen almost 8% to reach its current level of $178. Although at 3.6 the ERP remains wide compared with fifty years of history, it’s less so over the past decade. If the same downward path to earnings forecasts continues, 2020 will come in close to 2019 at around $164. That would push the ERP down to 3.2. A 1% jump in long term rates, always a possibility and more likely than a 1% drop, would move the ERP to 2.2.

Stocks remain a good investment, although they have been substantially more attractive at different points over the past decade. Bonds continue to be an extremely poor long term bet. But it wouldn’t take much for equity valuations to be mundane. One exception might be energy, especially pipelines and other midstream infrastructure, where low valuations should provide more downside support if the broader market takes a tumble. In Pipeline Bond Investors Are More Bullish Than Equity Buyers, we highlighted how cheap pipeline stocks are compared to bonds. Energy was the worst performing sector of the past decade. One result is that it’s far cheaper than the broader equity market.

Wishing all our clients and readers a happy and prosperous 2020.