Why Shale Upends Conventional Thinking

Long time subscribers will recall that back in 2015 this blog sought ever more creative and different ways to communicate the same message, which was that MLP prices had fallen far enough and represented compelling value. Bear markets have an unfortunate tendency to last longer than their opponents would like. Although the sector rebounded strongly in 2016, some of those 2015 blog posts were premature.

One lesson is that if you’re going to write constructively during a bear market, marshall your arguments and prepare to spread them over more weeks than you might anticipate. Last week MLPs and crude oil rediscovered their once close relationship, to the detriment of investors in energy infrastructure. Forewarned, your blogger will not expend all his constructive thoughts right away.

Prior to the Shale Revolution, MLPs were fairly described as having little correlation with commodity prices. Pipelines were a toll-like business model whose returns were driven by volumes. Today, much of the point of investing in the sector relies on the growth prospects made possible by the Shale Revolution. Ten years ago the need for new investment was limited; today it’s clear that to exploit newly accessible hydrocarbons, infrastructure needs to support these new locations. North Dakota was not known for oil, nor was Pennsylvania known for natural gas.

Therefore, the returns on energy infrastructure investments are nowadays more sensitive to growing domestic production and the consequent utilization of existing as well as planned infrastructure. To take one example, Plains GP Holdings (PAGP) anticipates a substantial increase in EBITDA if growing oil production absorbs more of its available pipeline capacity. Oil production reacts to prices; PAGP’s prospects are linked to those of its customers.

Last November’s strategy shift by OPEC to cut production was an ignominious admission that their prior effort to bankrupt the U.S. shale industry through low prices had failed. It represented a watershed event, the moment when it became clear that a new paradigm was in place, as we noted in The Changing Face of Oil Supply.

“Short-cycle opportunities” are what every oil company needs. Shale now counts the biggest integrated oil companies among its proponents. Exxon (XOM) CEO Darren Woods recently noted that a third of their capex budget is devoted to such opportunities. The key here is the liquidity of the oil futures market. If your project’s timeframe extends beyond the availability of hedge instruments, your IRR is going to be driven by things you can estimate but not control. The real revolution of shale is its short capital cycle; numerous wells are drilled cheaply, with fast but sharply declining production. Capital invested is returned with a year or two and risk can be hedged. Conventional projects require huge upfront commitments with long payback times and consequently uncertain economics.

The recent sharp drop in oil prices hasn’t been pleasant for producers anywhere. But consider the planners of a conventional project – a Final Investment Decision to proceed is a little less certain. Once capital is committed beyond a certain point, there’s little choice but to press on and accept whatever outcome markets deliver. Whereas shale producers, the group whose success ostensibly caused the 2015 crash, can cut back activity with comparative ease. They can just stop drilling, and wait. They can take advantage of even brief rallies in crude futures to hedge production and increase output.

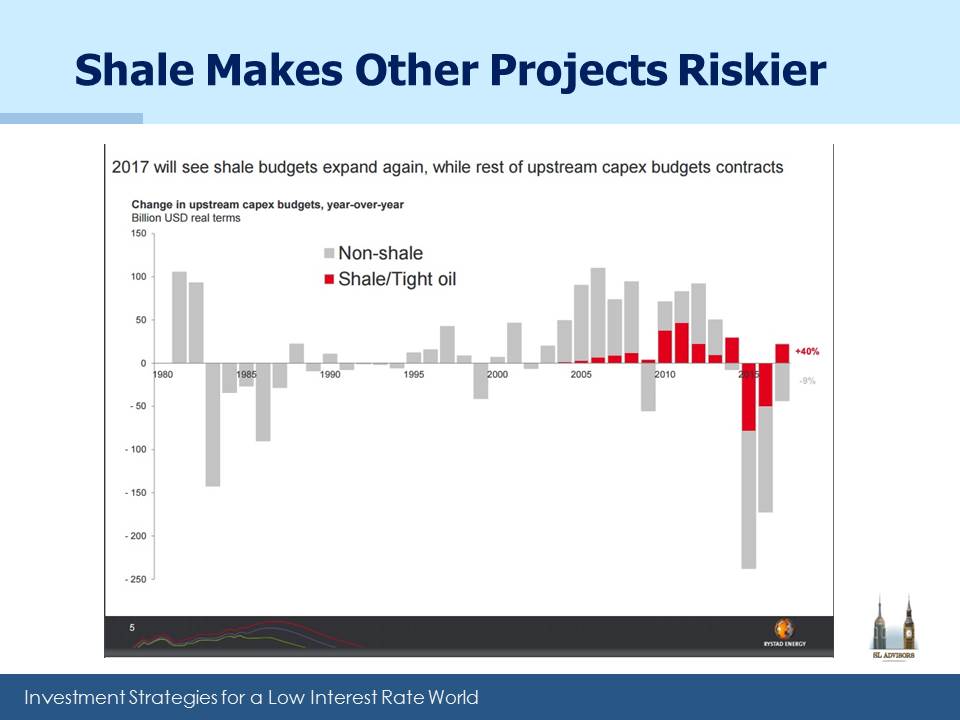

This is why capex on conventional projects continues to fall, as shown in the attached chart from a recent presentation by Lars Eirik Nicolaisen of Rystad Energy. The longer term problem is shaping up to be insufficient investment in new supply to offset depletion of existing fields and new demand (estimated to require around 6% of new supply annually, about 6MMBD, or Millions of Barrels a Day).

The recent drop in crude demonstrates no shortage of supply currently, but also makes providing new supply less attractive in the long run.

MLP investors easily recall the 50.8% drop in the Alerian Index from August 2014-February 2016, its low coinciding to the day with that for oil. We don’t know where crude prices will go over the short term, but it’s becoming increasingly clear that the U.S. is set to gain market share because its short-cycle opportunities represent a substantially more attractive risk/return than conventional projects.

Reaching the long term requires navigating the short term. While you’re doing that, consider how you’d seek your company’s Board approval for a conventional oil project requiring ten years of output to recover its upfront cost. Those shale guys in the Permian could wreck your assumptions, and then protect themselves from the damage they’d wrought by quickly cutting their own capex and production. Without an adequate response, you might feel like moving to West Texas.

We are invested in PAGP

A few weeks ago I did an interview with friend Barry Ritholtz for his Bloomberg series “Masters in Business”. It was just posted online, so for those that are interested you can find it here. Comments on MLPs are at the 65 minutes mark.