Serious Energy Forecasts Are Rare

The International Energy Agency (IEA) issued a report forecasting an oil glut by 2030, with 113.8 Million Barrels per Day (MMB/D) of supply capacity versus demand of only 105.4 MMB/D. They expect oil demand to plateau over the next few years. By contrast, OPEC sees continued demand growth, albeit slowing to around 1 MMB/D by 2030.

The IEA has taken on the role of energy transition cheerleader, and their forecasting is increasingly colored by an optimistic view of the penetration of renewables and EVs. By contrast, capital is flowing more freely towards traditional energy. This is most clearly seen in transactions such as Exxon’s acquisition of Pioneer Natural Resources, or Chevron’s deal to buy Hess.

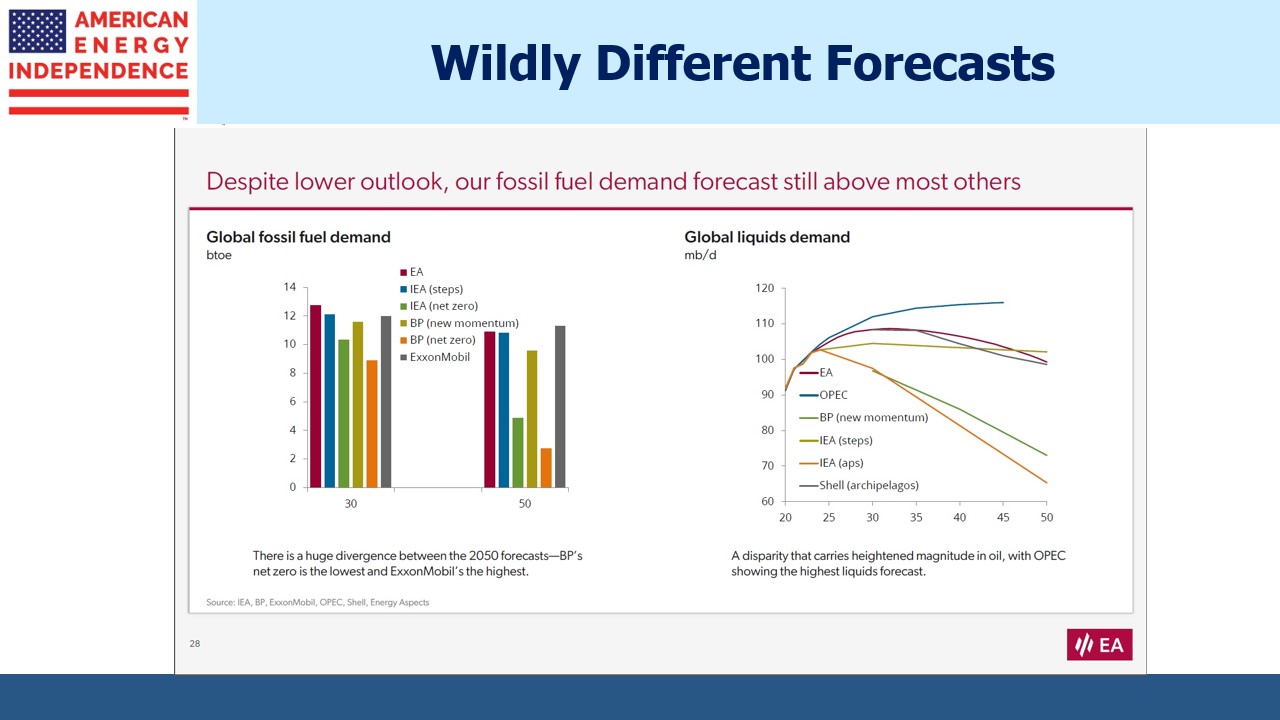

Most long term energy forecasts are intended to support the narrative of a rapid energy transition away from fossil fuels. Few offer a neutral, plausible scenario. The IEA is not alone in their partisan stance. European energy firms are especially sensitive to criticism and understand that the media equates their public outlook with their future exploration and production. BP is so cowed by environmental extremists that all their public forecasts show declining oil and gas consumption. Their Net Zero 2050 scenario sees even less than the IEA’s Net Zero and less than a quarter the demand of ExxonMobil’s outlook.

My partner Henry and I watched a webinar organized by Wells Fargo featuring Amrita Sen of Energy Aspects. One thing that struck us was how the Administration is trying to control oil prices. They have shown a willingness to vary the imposition of sanctions on Russia to keep prices below $90 a barrel. Sen recounts how a US delegation visited India during a run-up in oil and told them it was now fine to buy Russian oil, sanctions notwithstanding. Lower oil prices allow tighter sanctions.

Another useful insight concerned the growing caution of refineries to invest in costly upgrades given the uncertain long term outlook for refined product demand. Sen thinks this will lead to a tighter global market for gasoline within the next five years.

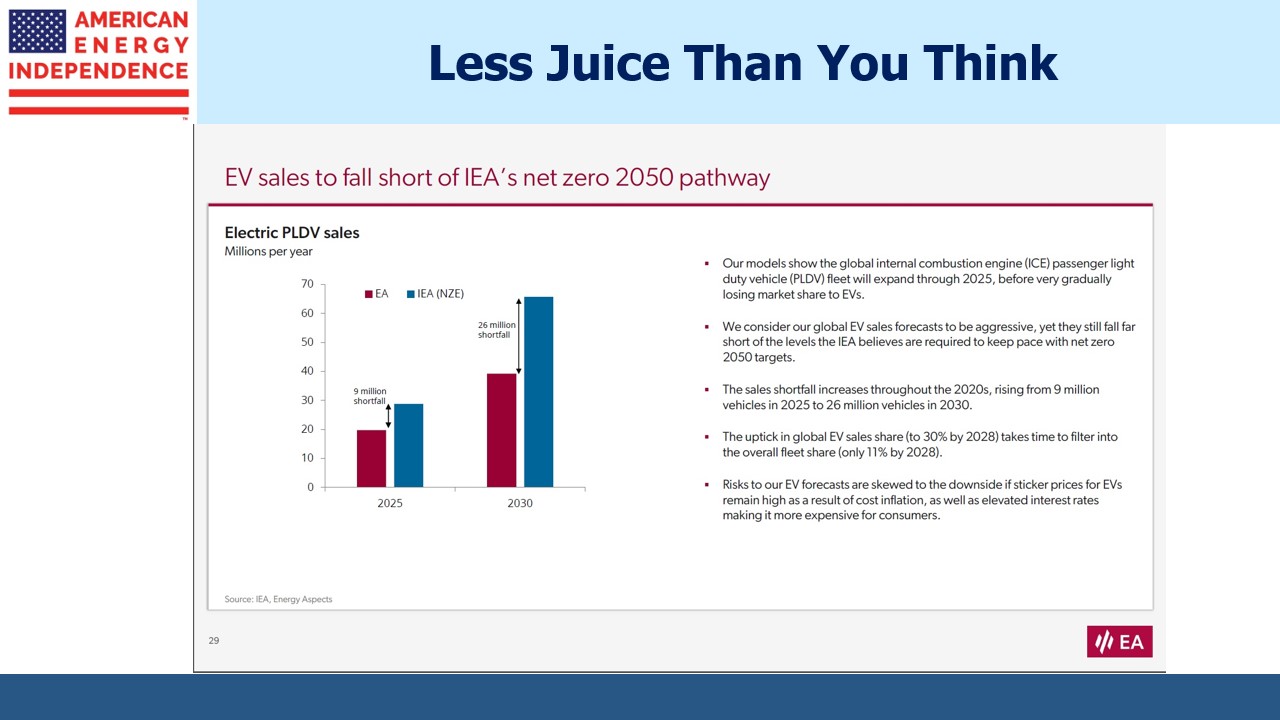

The IEA also has an optimistic EV outlook. Energy Aspects sees an increasing shortfall in actual sales versus the IEA, with the EV fleet by 2030 being less than two thirds of the IEA’s forecast. This underpins the warning of an “oil glut” that provided the headline for coverage of the IEA’s latest forecast.

The US should stop funding the IEA. It’s a waste of money.

NextDecade (NEXT) had more good news with South Korea’s Hanwha Group announcing a 6.83% stake in the LNG company. Through various subsidiaries Hanwha expects its holding in Next to reach 15%.

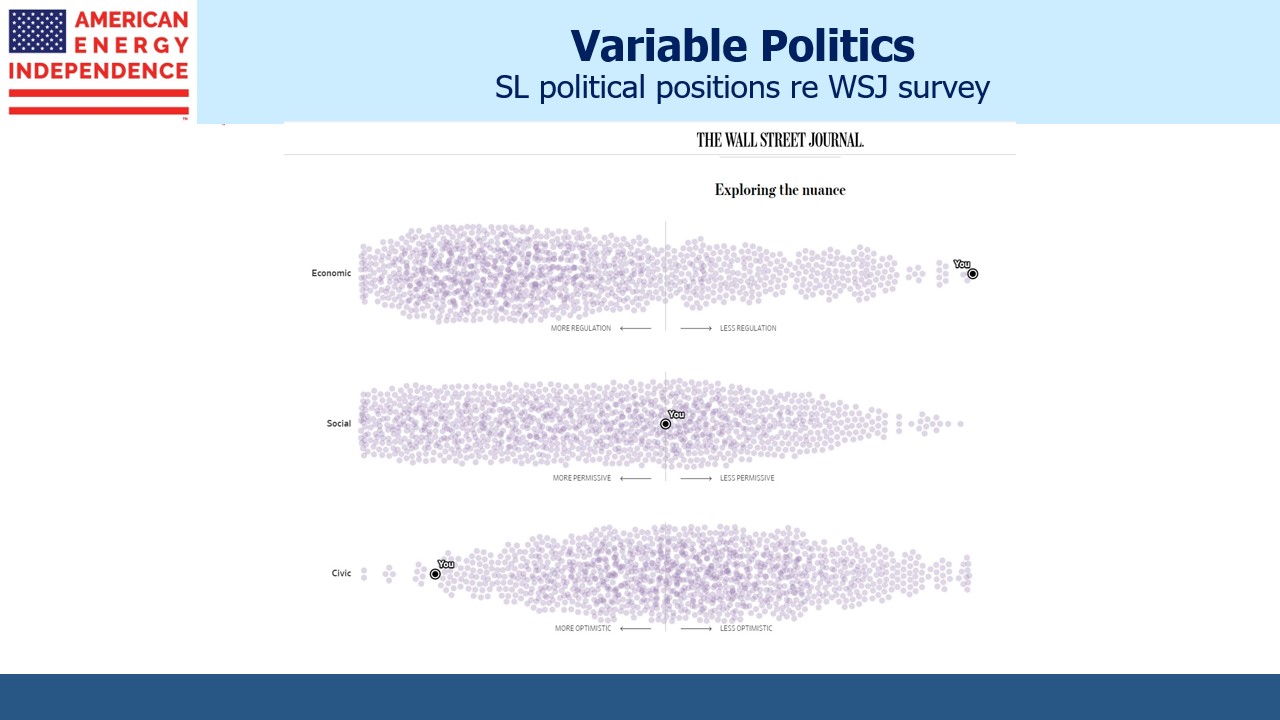

Last week the WSJ published an interactive poll (see What Type of Voter Are You?). If you subscribe to the online version you can see where you rank compared with 1,200 respondents on economic, social and civic dimensions. The point is that only a small minority of us fall neatly into red or blue voters, even though those are the choices on offer.

I’m on the extreme right on economic issues, favoring deregulation and low taxes; dead center on social issues; and in the 1% of most optimistic on the civic scale. This includes questions such as “How proud are you of America’s history (answer: Very) and agreeing with the statements “The US stands above all countries in the world” and “Life in America is better than 50 years ago for people like you.”

The last question is self-evidently true based on incomes. But I’m regularly surprised at how negative polls are. Things could always be better, but jobs are plentiful, we’re not at war, life expectancy is improving (although it dipped with the pandemic and opioid crisis) and there’s never been a better time or place to be alive. Things could be a lot worse. I generally see the glass as half full – for most Americans this is easily supported by the facts, and anyway life is more fun that way. Try the survey – it’s brief and your result will probably be interesting.

Elections overseas reveal voters to be in a surly mood. Right wing parties achieved surprising gains in EU elections. France’s President Macron called a snap election which is looking like a poor decision. Britain’s ruling Conservative party, having delivered Brexit with no discernible benefits, is heading for their biggest loss in a century. And Mexico just elected a populist whose agenda doesn’t look encouraging for the owners of capital.

These are country-specific issues and don’t represent a political shift. The UK is moving left while France is moving right. But the dissatisfaction perhaps you and your friends feel isn’t limited to the US. You’re just not going to hear it from me.

We have three have funds that seek to profit from this environment: