Rising Oil Output Is Different This Time

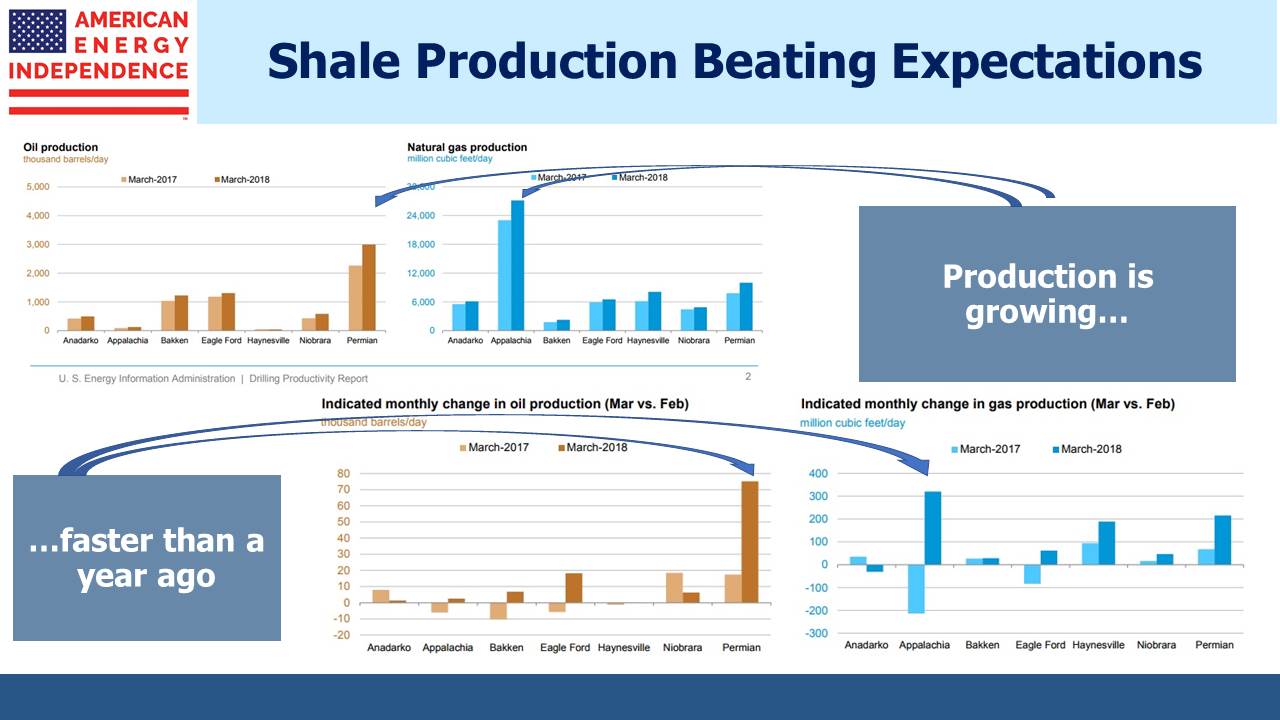

Although we’re used to reading about growth in U.S. shale production, recent figures from the Energy Information Administration are still striking. Crude oil output from the Permian in west Texas is set to reach 3 Million Barrels per Day (MMB/D) in March, up by more than 70K from February. Output is growing at an increasing rate. Natural gas output is also growing – Appalachia (how the EIA refers to the Marcellus Shale in Pennsylvania, Ohio and West Virginia) is expected to produce around 27 Billion Cubic feet per Day (BCF/D) in March. The Permian represents close to a third of all U.S. crude output, and the Marcellus just over a third of natural gas.

In December, the EIA forecast Permian growth of 515K in daily output over 18 months from June 2017 to the end of this year, so the March 2018 increase is almost three months’ worth. The International Energy Agency is similarly optimistic, predicting that the U.S. will be the world’s largest oil producer by 2019. This seems like good news if you’re American and especially if you’re employed or invested in the energy sector. But the cloud on the horizon is whether this presages a repeat of the 2014-16 oil price collapse that was caused by surprisingly fast U.S. output. The WSJ noted that U.S. crude output looks set to outpace global demand in 2018, rekindling unpleasant memories. One observer tweeted “US shale firms remove pistol, aim at own foot, and fire.” However, crude prices barely dipped on the news.

U.S. oil and gas producers promise greater financial discipline following vocal investor feedback. Achieving an acceptable return on capital is now more fashionable than growing production. Chevron, Anadarko and ConocoPhilips have all recently announced dividend hikes, thoughtfully providing investors with a little Valentine’s Day love.

The bullish case for energy infrastructure rests on sustainable production growth, so although pipeline owners don’t drill for crude oil the financial health of their customers is important. Although U.S. output growth may exceed net new demand, existing oil fields experience aggregate global depletion of 3-4MMB/D, so new supply needs to cover this as well. In spite of the Shale Revolution, there’s still a need for other new sources of supply. If U.S. producers are sincere about their financial discipline, this should lead to more sustainable growth in output and good business for energy infrastructure.