Revising The Gas Outlook Higher

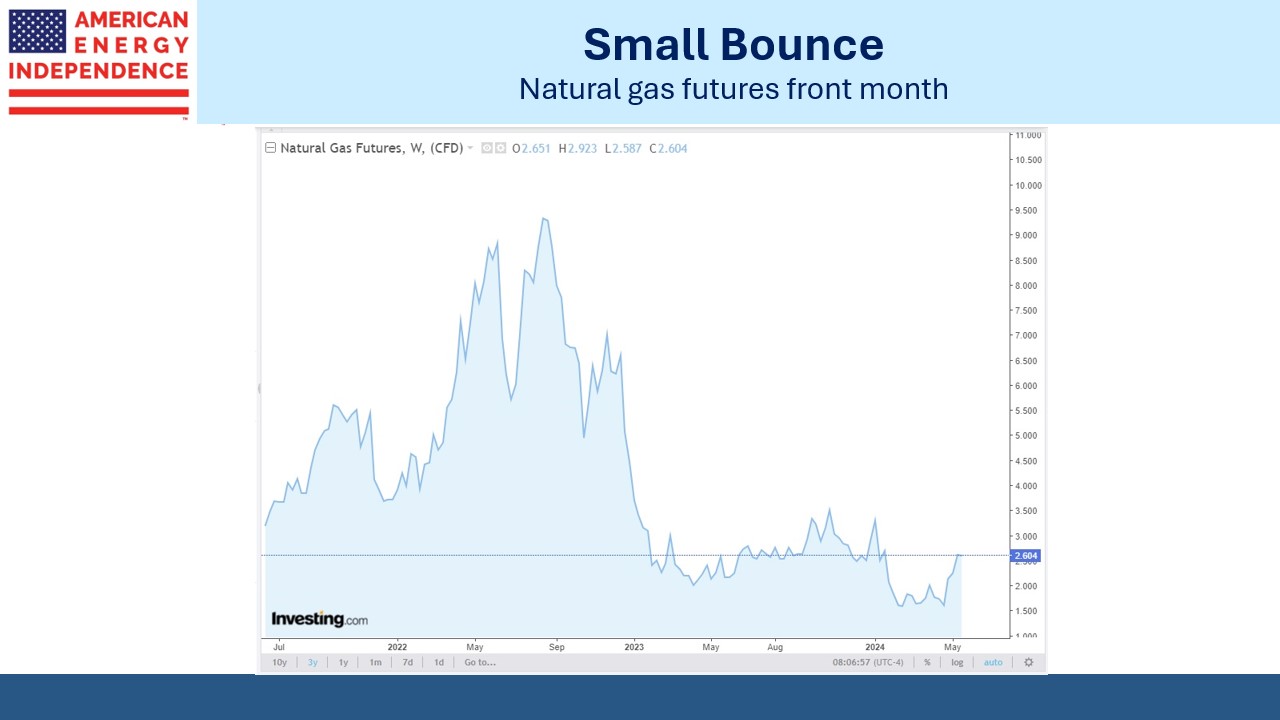

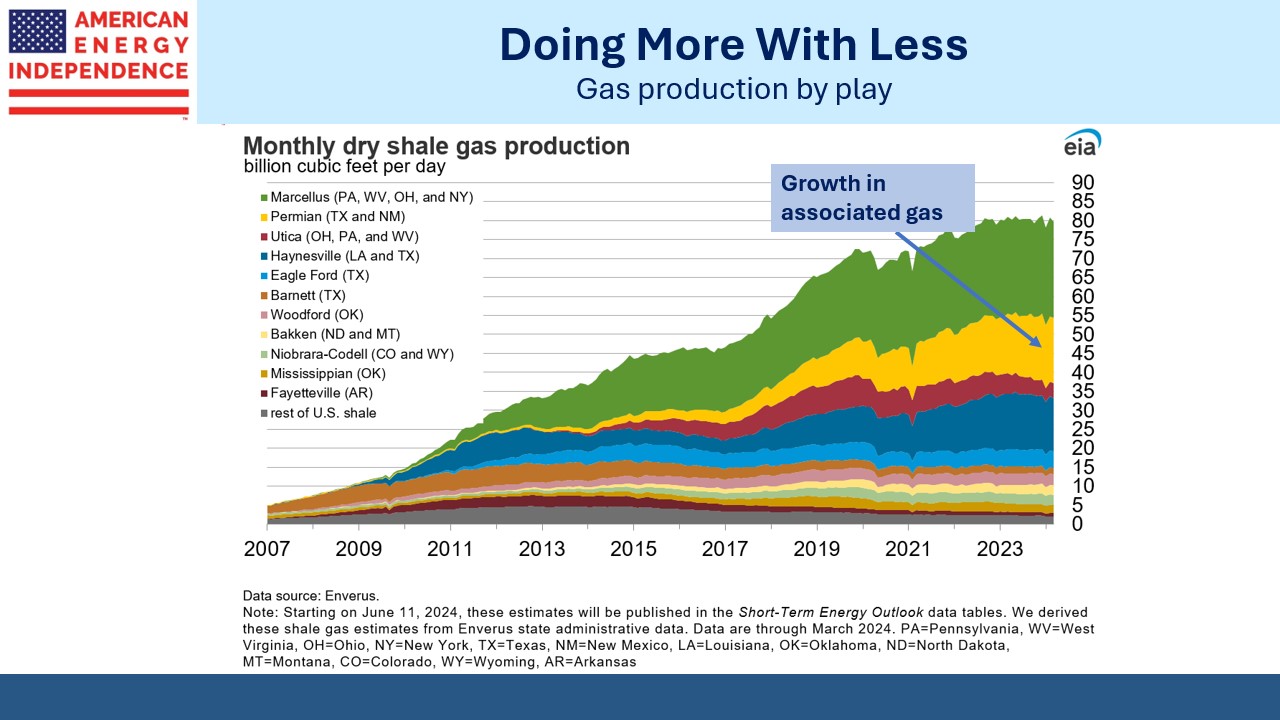

Natural gas prices have been recovering in the US following several months below $2 per Million BTUs (MMBTU). The techniques of horizontal drilling and hydraulic fracturing (“fracking”) have enjoyed steady improvement, allowing break-evens to fall. An additional factor has been associated gas from the Permian in west Texas. E&P companies want oil but they get gas anyway, and in many cases the production is becoming more “gassy”.

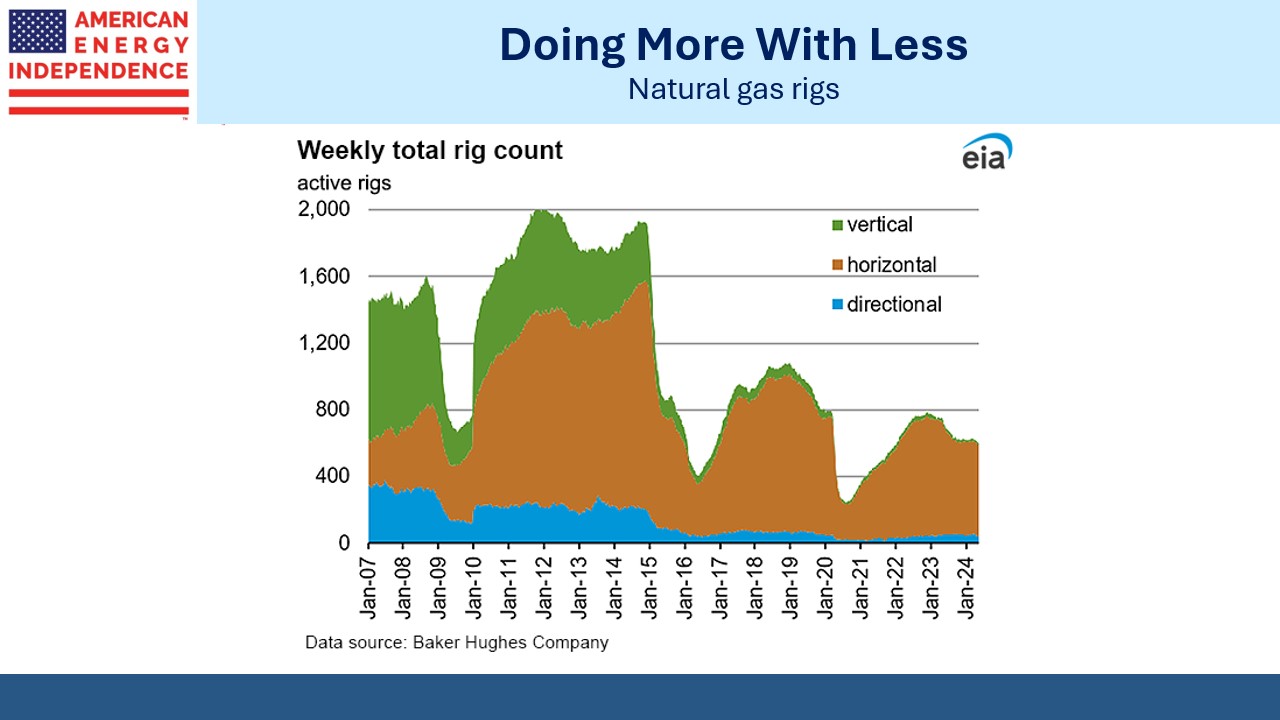

Natural gas rigs employed are 27% lower than a year ago. This reflects improved efficiency but also production cutbacks in plays that are all or mostly gas (“dry gas”). Late last year natural gas production surged, averaging 104.6 Billion Cubic feet per Day (BCF/D) in November. Full year 2023 production averaged 102.4 BCF/D, up from 97.5 BCF/D in 2022. This year it’s likely to fall slightly to 101.6 BCF/D, demonstrating the old saw that the cure for low prices is low prices. But it should rebound in 2025.

That’s because demand growth is coming. Public utility companies quickly turned the conversation to AI power demand on earnings calls. Forecasts of 5% annual revenue growth are not uncommon in this sector. It’s caused a surprising turnaround in utility stocks. Following –7.2% performance last year, the S&P Utilities ETF (XLU) is +12.7 YTD. The recovery coincided inconveniently with our warning that many of these companies face substantial future capex (see To Lose On The Energy Transition Buy Utilities).

It’s hard to overstate the level of new investment in data centers. JPMorgan estimates $300BN globally this year, up from $200BN in 2020. They see $500BN by 2027. The big spenders are Microsoft, Google, Amazon, Meta, Apple, IBM, and Oracle. Nvidia’s recent results provided real-time confirmation of the spending on AI chips.

AI power demand is on track to double from 2022-26.

JPMorgan estimates that the increase in power demand should require an additional 1.4 BCF/D of natural gas by 2027 and 6.2 BCF/D by 2030.

The Energy Information Administration (EIA) has consistently forecast declining natural gas consumption in the US power sector. Unlike many forecasters, the EIA is non-partisan so they don’t regard their publications as providing cheerleading support for renewables. The International Energy Agency does just that, devaluing their output.

The EIA’s outlook has been predicated on renewables gaining market share. Since 2010 solar and wind have gone from 2% to 15% of US power generation. Casual reporting often presents this as evidence that weather-dependent electricity is taking over. But natural gas has gone from 23% to 42% over the same period.

By the numbers, America’s biggest electricity story is the growth of natural gas which has displaced coal. Intermittent power is growing, but thankfully is not yet to the point at which we fear dunkelflaute, the German word for cloudy or windless days.

In January Texas, which relies substantially on windpower, set a winter record for natural gas provided electricity.

Feedstock for LNG export terminals is set to increase by 9.4 BCF/D through 2030 based on facilities already under construction. This will take total US LNG export capacity to 26 BCF/D, including NextDecade’s Rio Grande Stage 1 with 2.2 BCF/D (see What’s Next For NextDecade?).

However, JPMorgan assumes 86% utilization given the possibility of excess global LNG supply by then, resulting in 22.4 BCF/D of exports. roughly a quarter of current production.

The combination of AI power demand and LNG exports will require an additional 15 BCF/D of production by 2030, bringing us to around 120 BCF/D. Achieving that increased level of output will require activating wells with higher break evens. However, natural gas bulls will need to temper their enthusiasm because JPMorgan believes a price of around $3.50 per MMBTUs will be sufficient for the market to clear.

The EIA has sharply reduced their forecast natural gas price since early last year. They previously had it oscillating either side of $5 per MMBTUs but have adjusted that roughly $1 lower.

The arbitrage between global LNG prices and US looks likely to remain for the foreseeable future. The European TTF benchmark trades at $11 per MMBTUs and the Asian JKM at $12. Both these offer enough margin to cover the transportation cost from the US. We’re just capacity constrained.

The Golden Pass LNG project, co-owned by Exxon Mobil Corp. and QatarEnergy LNG, faces possible delays as the general contractor filed for bankruptcy. 3,000 workers were laid off. It’s scheduled to be operational in less than a year, and that timeline must presumably be in doubt.

US natural gas has a bright outlook. It’s a blue flame future.

We have three have funds that seek to profit from this environment: