Priced For A Pragmatic Energy Transition

The other day a NYTimes columnist contrasted the relative outperformance of oil stocks with plunging solar and wind. He concluded that the stock market is oblivious to the threat of climate change whereas the UN and other scientists believe we must reduce Greenhouse Gas (GHG) emissions to zero by 2050. The writer, Jeff Sommer, briefly contemplated who was right – the market’s apparently sunny outlook or the scientists’ dour one. He quickly concluded that the market was wrong. Well, he is a journalist. At the NYTimes.

Sommer thinks energy investors are focused on the short term and ignoring climate change. I’m an energy investor, and I think about the energy transition all the time. If you invest in this sector you have to have a perspective on how the world’s use of energy will evolve. The International Energy Agency believes the world will eliminate GHGs by 2050, but all the data points to global energy consumption increasing and emissions maybe falling by then but certainly not reaching zero. It’s the difference between what some people think should happen and what others think will likely happen.

Energy stocks began pricing for the risk of climate change and the energy transition many years ago. The fear that crude oil reserves and natural gas pipelines would become stranded assets, abandoned well short of their useful lives, has been steadily gaining importance for at least the past decade.

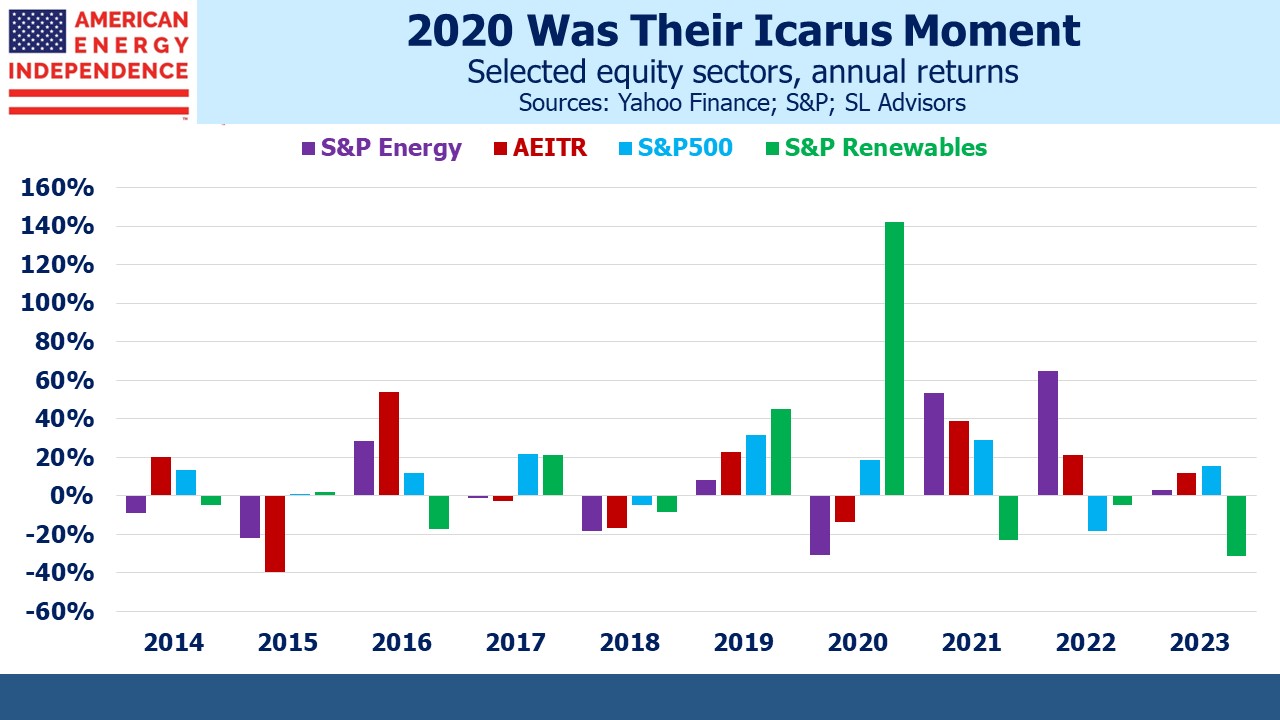

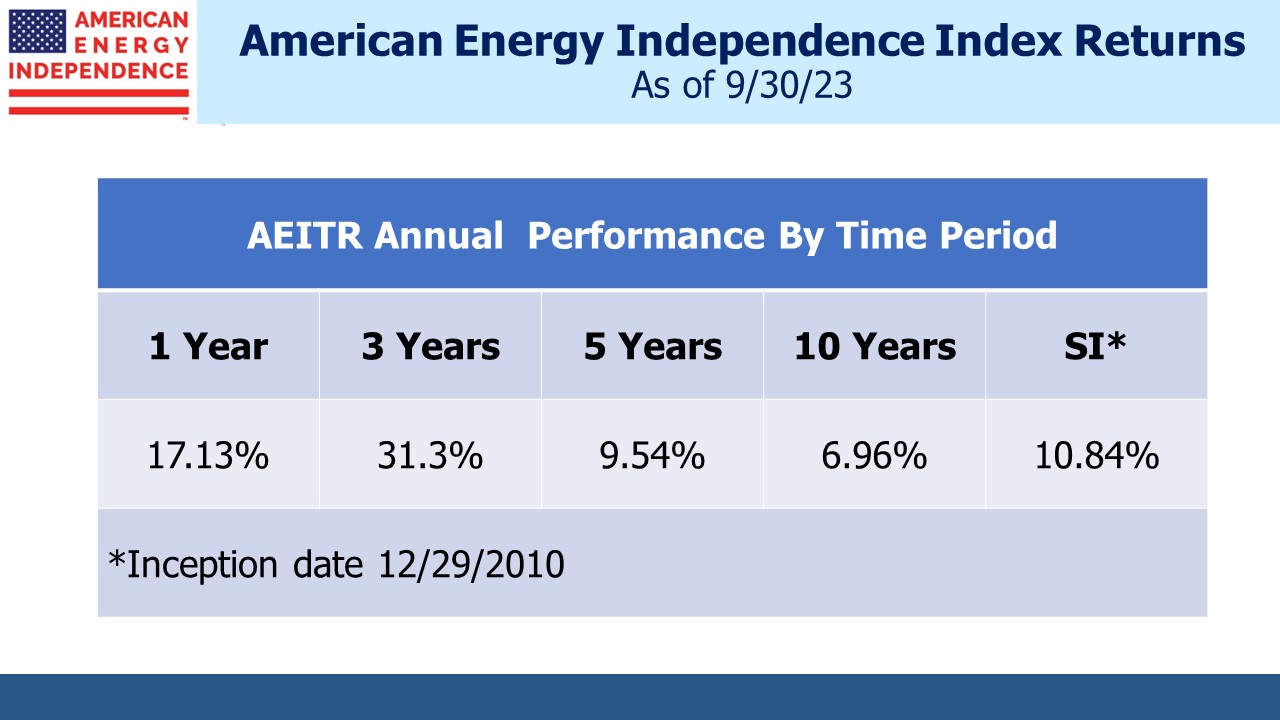

The S&P Energy index, which is dominated by Exxon Mobil and Chevron who together represent 45%, has lagged the S&P500 for seven of the past ten years and three of the past five. Along with the American Energy Independence Index (AEITR), both have underperformed the market over ten years but are approximately even over the past five. This reflected investors’ discounting the impact of the energy transition.

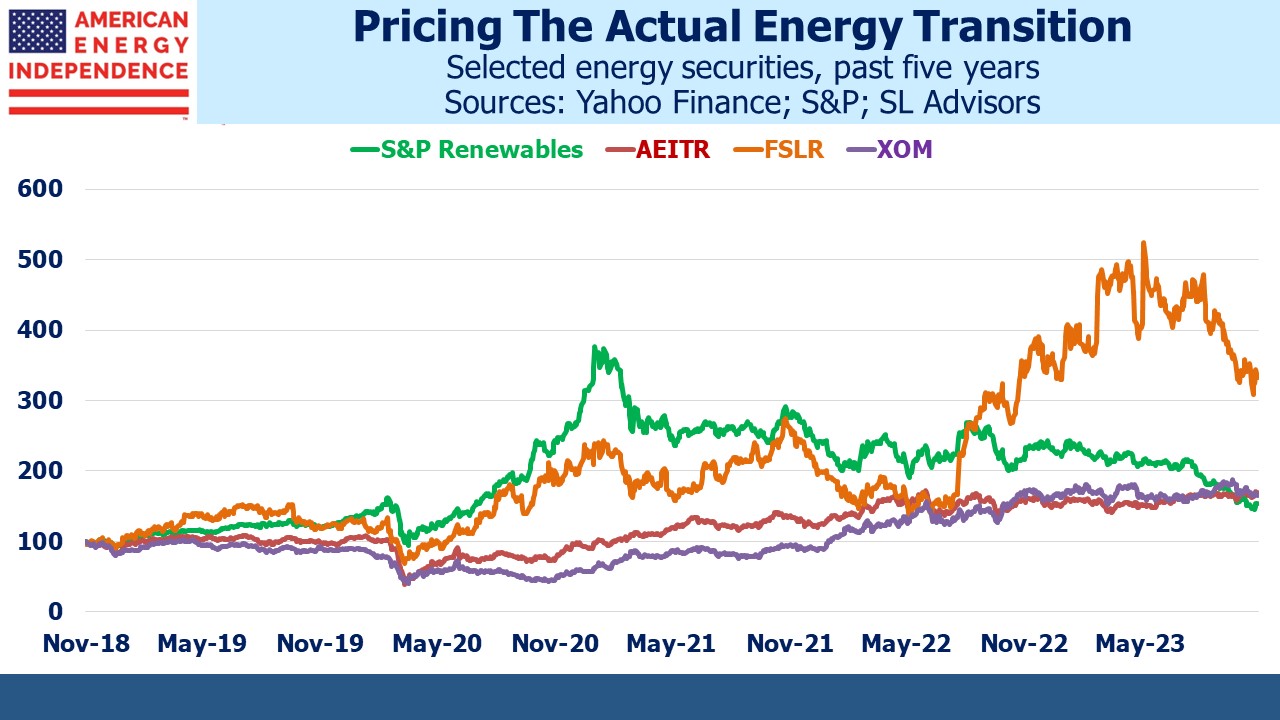

In 2020 investor excitement about the prospects for renewable energy peaked. The S&P Clean Energy index (“S&P Renewables”) had a huge year but has since lost half its value. That’s because many of these companies aren’t doing that well. Orsted, one of its top ten holdings, is likely to book a $5BN+ loss on its US offshore wind business. First Solar swung to a $281MM operating loss last year on revenues of $2.6BN. Over the past five years, an investment in pipelines has outperformed renewables.

But it’s not true to suggest energy investors aren’t considering climate change. It’s foremost in the thinking of most who have exposure there, and one of the top reasons for those who avoid the sector.

This is most visible in valuations. Midstream energy infrastructure corporations yield over 6% with a Distributable Cash Flow (DCF) yield of 11%, forecast to rise to 12% next year (JPMorgan). Large MLPs yield 8% with DCF yields of 14%. These are attractive valuations by most historical standards, and they’re only available because many investors still assume fossil fuels are going away within the next decade or so.

Political soundbites matter. Just over four years ago, candidate Biden said, “I guarantee you. I guarantee you. We’re going to end fossil fuel.” He wasn’t specific about when, and in a more sober moment during February’s state of the union he conceded, “We’re still going to need oil and gas for a while.”

The market is priced for his first statement and only warily acknowledges the second.

S&P Renewables soared on the election rhetoric and has plummeted on the financial results, reflecting Ben Graham’s quote that in the short run, the market is a voting machine but in the long run it is a weighing machine.

Renewables stocks have continued falling this year, even though the 2022 mis-named Inflation Reduction Act provided huge subsidies. First Solar (FSLR), the biggest component of S&P Renewables, is down by a third since March. It trades at around 18X 2023E earnings, modestly less than the S&P500 at 19.8X, so even now hardly looks out of favor. JPMorgan rates it “Overweight” calling it a “safe haven”. They have a $220 one-year price target, which is up 50% from here, and forecast 2024 EPS at $14, up from $8 this year.

Wells Fargo rates FSLR overweight with a $215 price target. They expect EPS to double next year.

This does not look like a stock short of love from sell-side analysts.

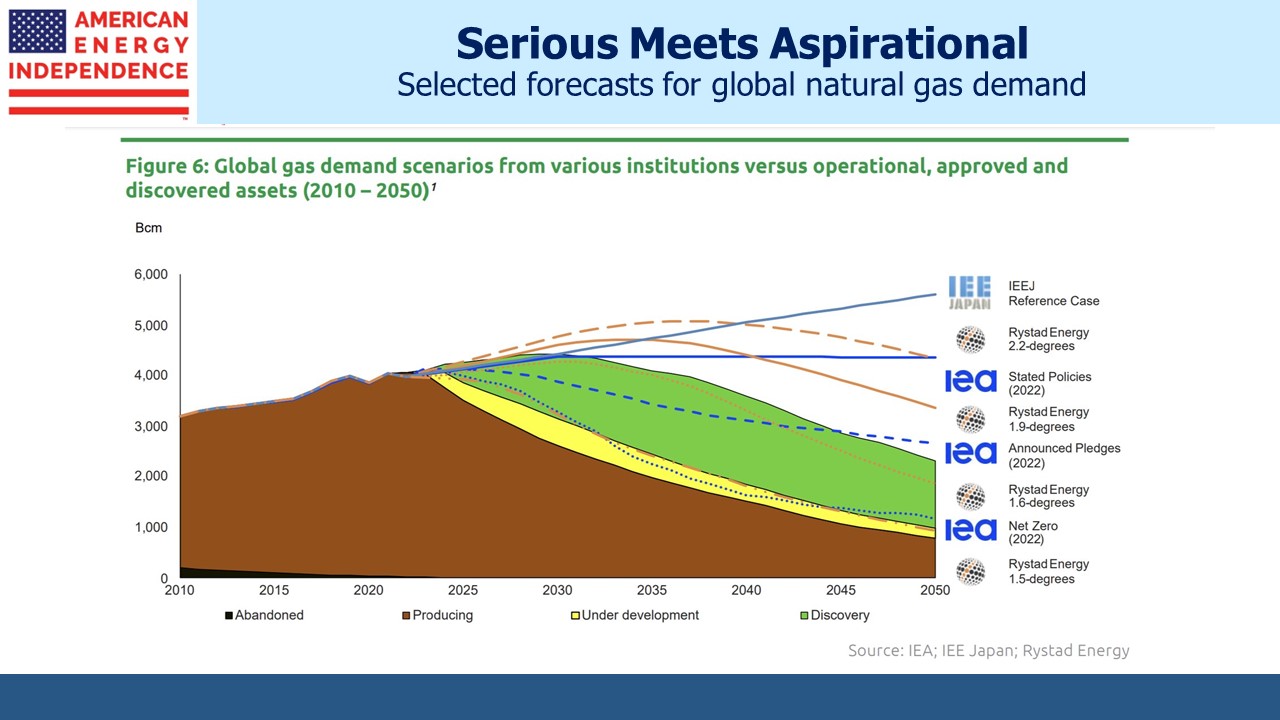

Often long term energy forecasts confuse aspirational with likely. This natural gas chart shows both. The IEA Net Zero is not in our future. Their Stated Policies one is plausible. Making such projections objective draws the ire of climate extremists. You have to screen out the hyperbole.

Jeff Sommer of the NYTimes is confusing recent market performance with valuations. Energy stocks, especially midstream, are cheap. They’ve been cheaper to be sure, especially during the first few months of the pandemic in 2020. But they are still priced defensively in our view.

The FSLR example shows a bullish outlook for solar panels. It’s just no longer priced as if Biden’s election rhetoric was anything more than a soundbite to pick up some gullible far-left votes.

The energy transition is clearly priced into energy stocks. What’s not priced in is the certainty of the world eliminating GHGs by 2050 (“Zero by 50”). That’s an extreme forecast, and while theoretically possible it’s becoming steadily less plausible every day. By their actions, people around the world are showing concern about emissions while stopping short of economic suicide by following the most extreme policy prescriptions.

Zero by 50 is intended to limit global warming related to human sources of GHGs to 1.5 degrees C above 1850. Temperatures today are already 1.1 degrees warmer than that benchmark. We’re living with it, not yet extinct.

Cost-effective emissions reduction looks like smart risk management of our only planet. Reducing living standards around the world with impetuous choices does not.

We have three have funds that seek to profit from this environment: