Adults Are Taking Over The Energy Transition

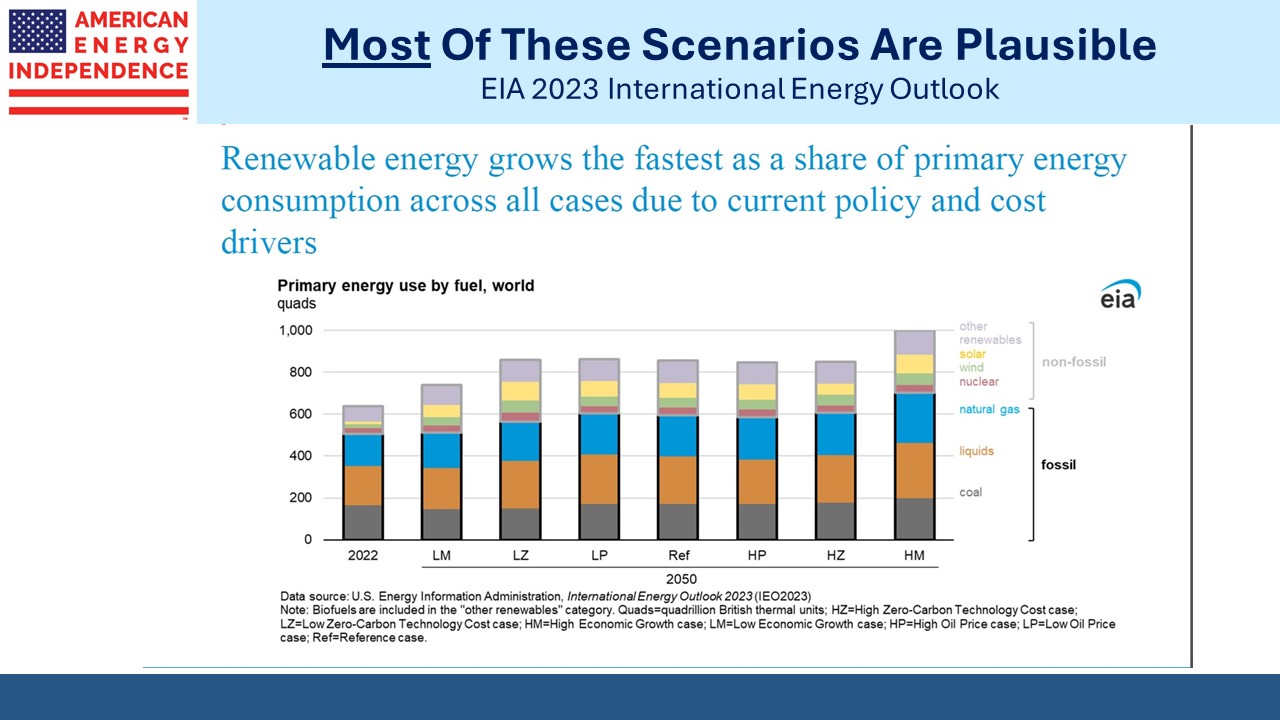

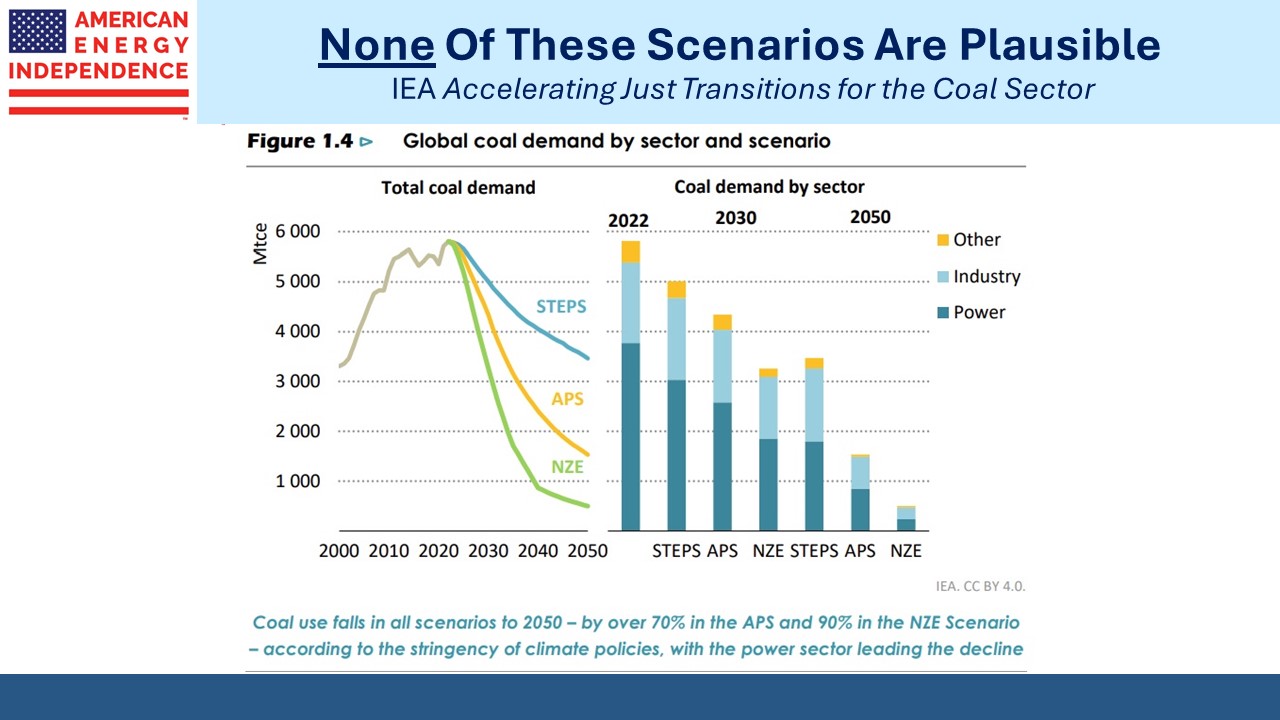

Progressives will maintain that the planet is on track to burn up, but realists will see an unfolding positive story. Transitioning our energy systems is incredibly expensive, slow and inflationary.

JPMorgan just published research (The Energy Transition: Reality check needed) acknowledging this and calling for a reset.

No big company says anything about energy without approval from its senior executives. It’s hard to think of a more highly charged topic. Forecasts that don’t assume “Zero by 50” are immediately seized upon by climate extremists as absence of fealty to the UN’s goal. BP handed off their Statistical Review of World Energy, probably after concluding it offered climate critics a soft target.

Wall Street banks like JPMorgan are voluminous publishers of investment and economic research. Jamie Dimon can obviously peruse only a tiny fraction of this output. But you can be sure he read this one given the sensitivity of the topic. Moreover, you can assume he broadly agrees with its conclusions. He has recently been critical of the Administration’s pause on new LNG permits, and has said it’s impractical to think we can suddenly stop using fossil fuels, which currently provide 82% of the world’s primary energy.

Combined with other moves, such as withdrawing from Climate Action 100+, it shows that the bank is taking a pragmatic, realistic approach. In his annual letter Dimon said, “One of the best ways to reduce CO2 for the next few decades is to use gas to replace coal.”

JPMorgan’s Reality Check research estimated that coal to gas switching could reduce emissions by as much as 17%.

We think this is not just another piece of Wall Street research but reflects JPMorgan’s pragmatic assessment of the energy transition and their role in it. Jamie Dimon has called the Department of Energy’s pause on new LNG permits “enormously naive.”

Jamie Dimon is the adult in a room full of juvenile climate extremists.

Russia’s invasion of Ukraine pushed energy security up the policy agenda for western Europe. The pandemic boosted government spending, leaving less fiscal room to fund the transition, and the inflation that followed pushed up interest rates. These three factors have rendered objectives that were already barely reachable now implausible.

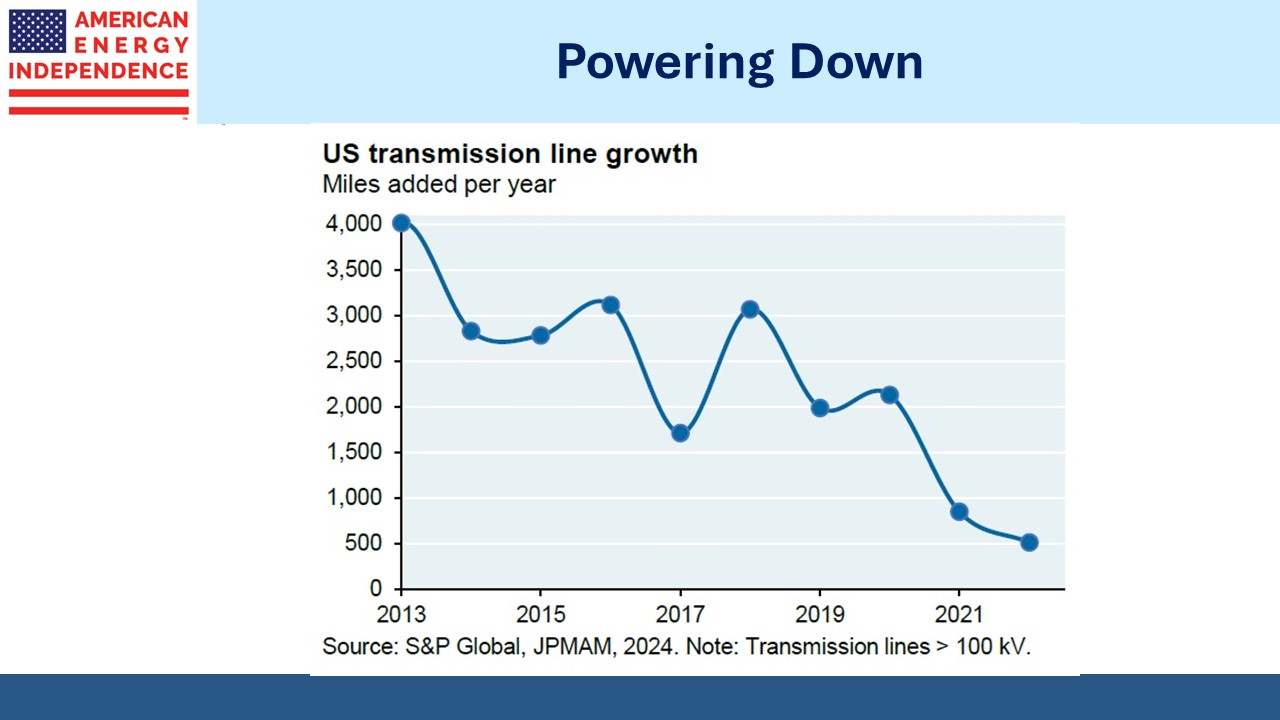

Reality Check has many other useful insights. Just the planned solar and wind buildout to 2030 will take 0.5% of global annual GDP. The energy required would emit 207 million tonnes pa of CO2, equivalent of Argentina, assuming today’s energy mix of 82% fossil fuels.

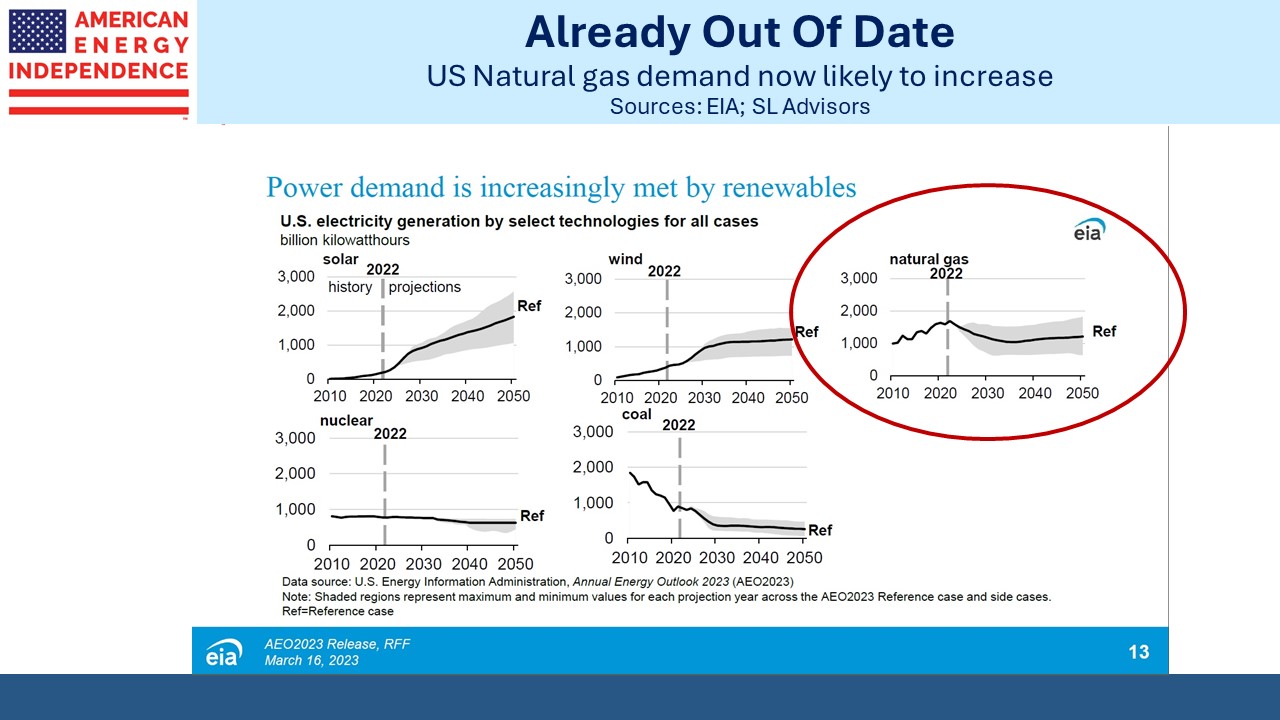

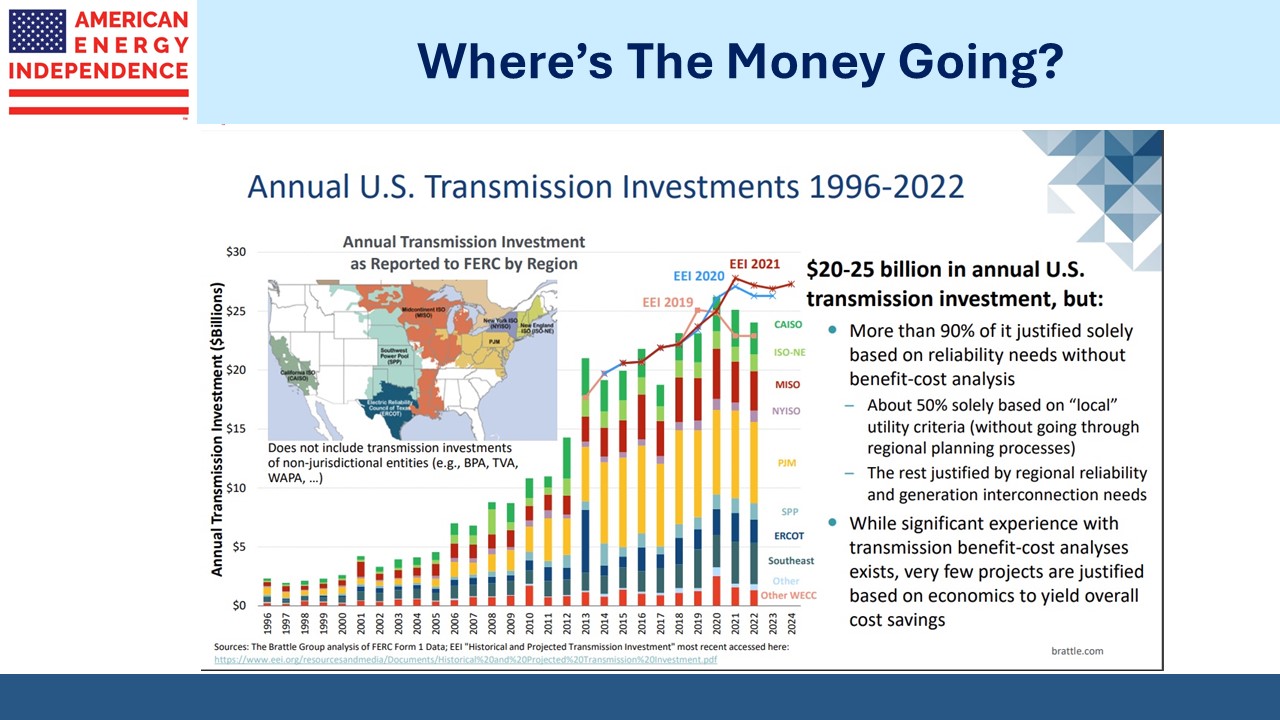

This type of analysis heralds a more practical approach built around what’s possible versus the fantasies of climate extremists. It means more demand for natural gas, to the benefit of US producers and the associated infrastructure that supports them.

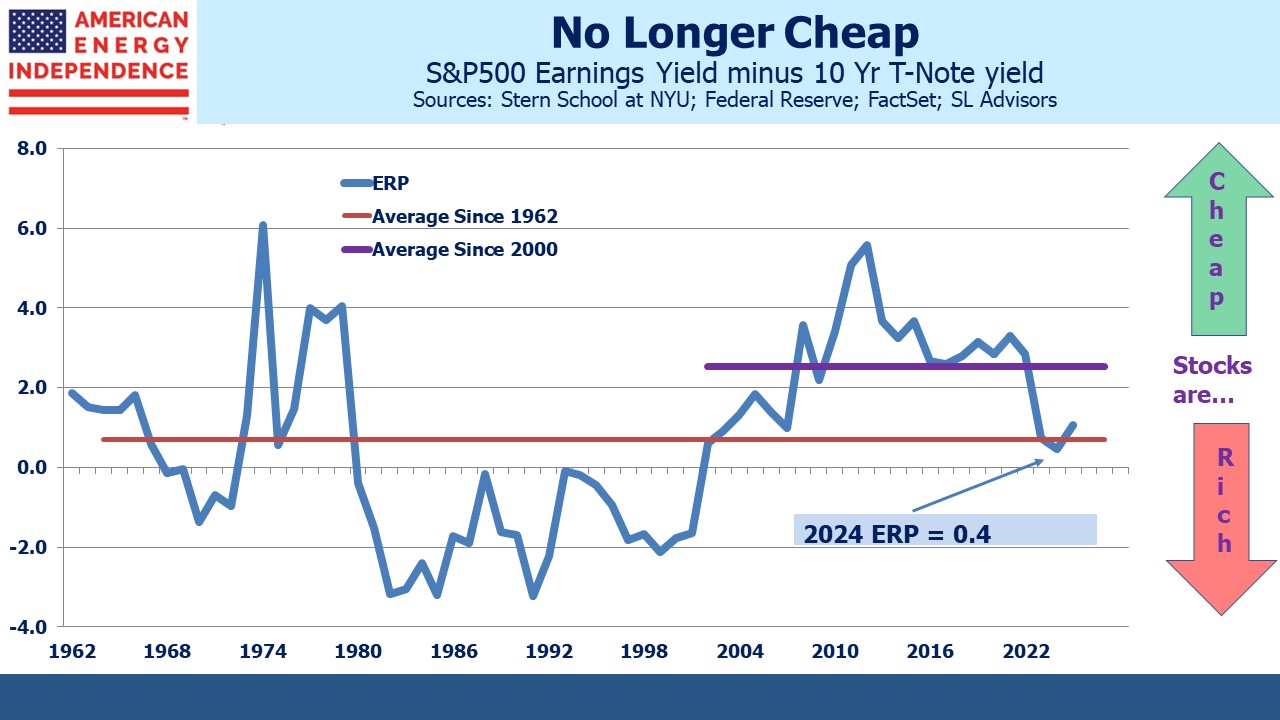

Wells Fargo’s Midstream Energy Weekender suggested that the sector is due to reprice higher. Their favored metric of Enterprise Value/EBITDA (EV/EBITDA) is at 8.2X. Five years ago it was around 11X, and performance since then has been good. To put these figures in context, if EV/EBITDA improved by one turn (ie 8.2X to 9.2X) that would equate to a roughly 20% price appreciation since pipeline companies are typically financed with 50% debt.

Wells Fargo also noted, “a growing realization that a confluence of factors could drive significant growth in US natural gas demand over the next 5+ years.” LNG exports, increased domestic manufacturing and demand from AI centers were the reasons cited. As regular readers know, we have long argued that natural gas infrastructure assets are cheap.

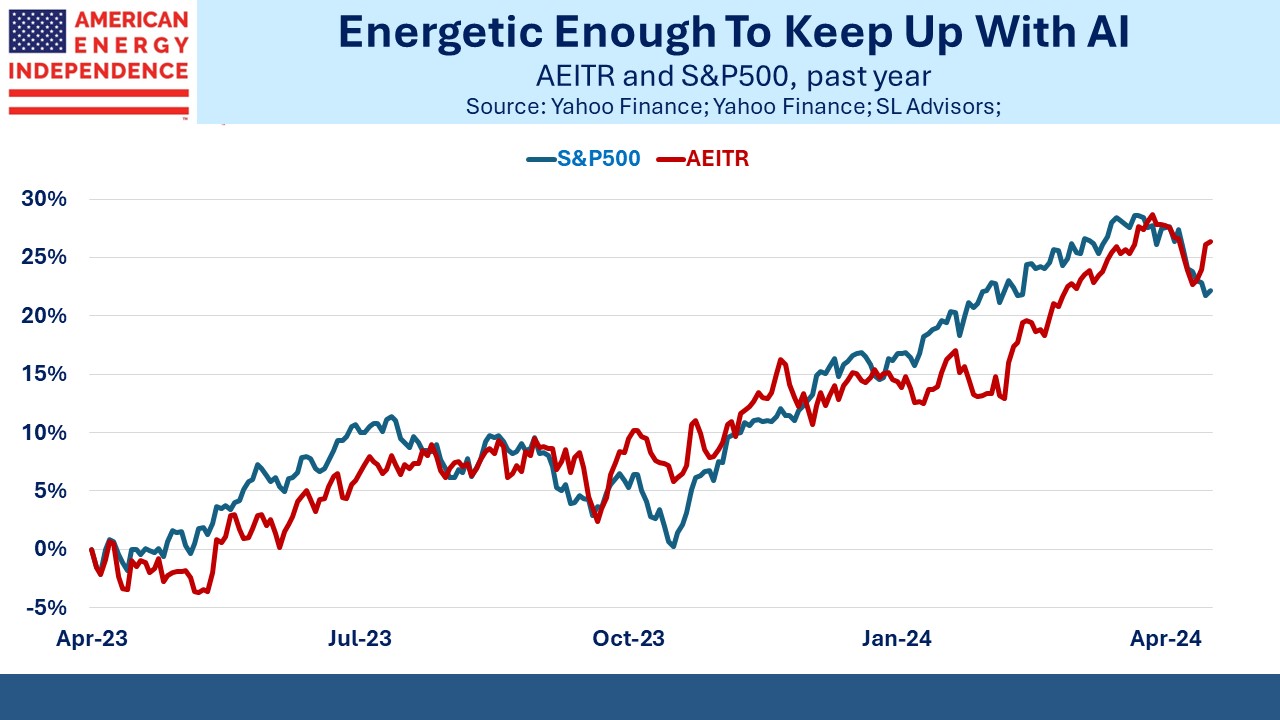

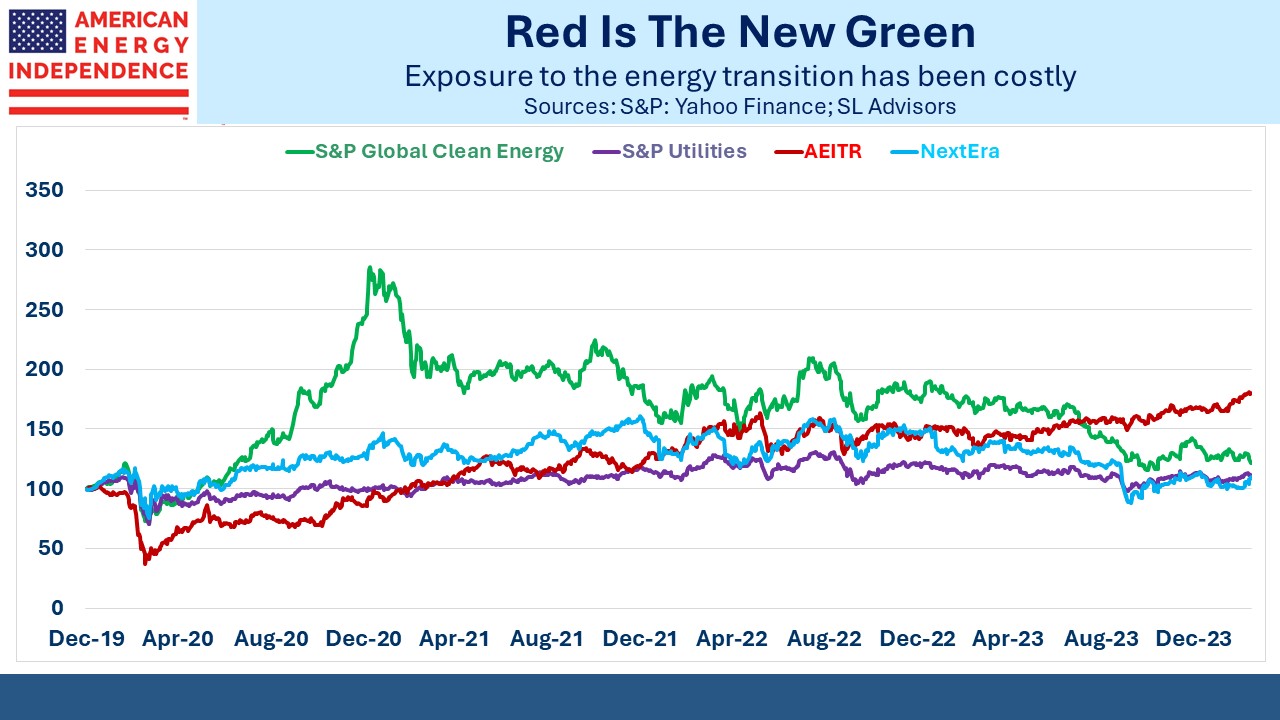

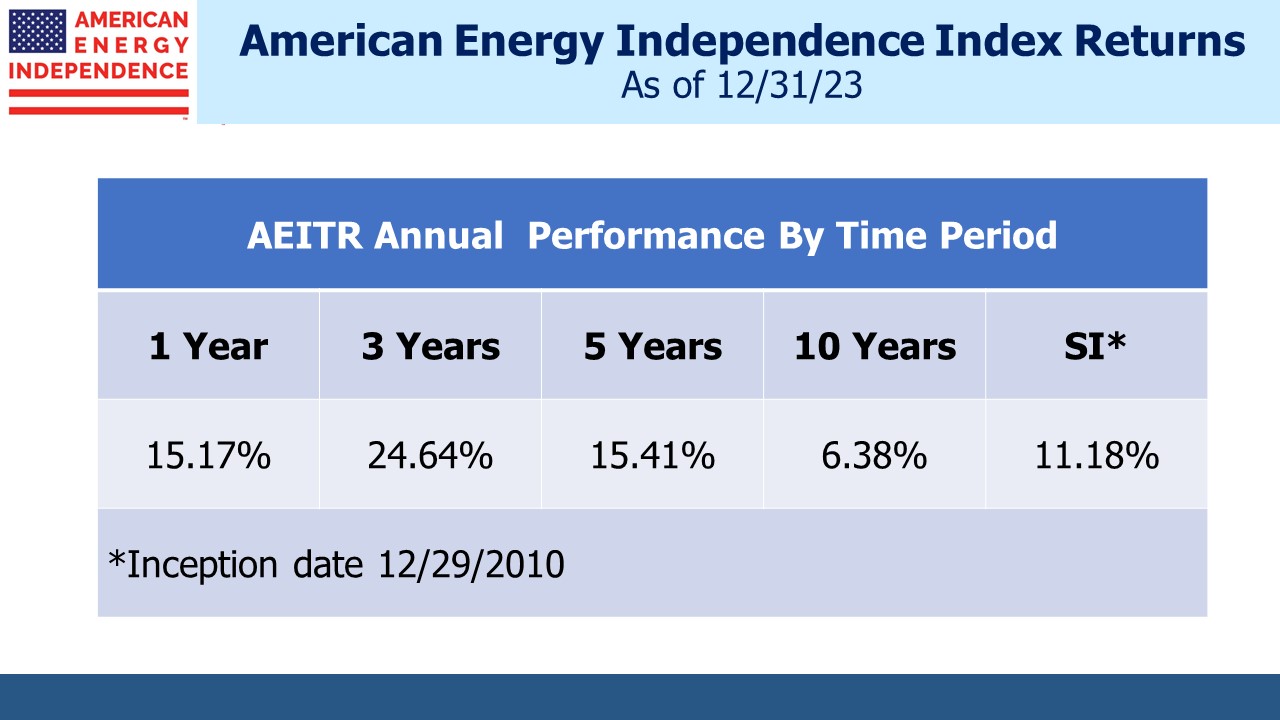

There are signs that investors are beginning to act on this opportunity. Over the past year the American Energy Independence Index (AEITR) has kept pace with the S&P500’s AI-fueled run and last week moved ahead. YTD the AEITR is +10% vs the market’s +5%.

Tesla’s stock price continues to adjust to the new reality of declining EV demand. A couple of weeks ago an Uber driver in a Kia EV with 14% battery charge remaining said he loves his car. Charging only took about 30 minutes and he could usually find a charging station within 30 miles. After dropping me at the airport he was planning to do just that.

Robert Bryce reminds us that Stanford University’s futurist Tony Seba forecast in 2014 that “By 2025, gasoline engine cars will be unable to compete with electric vehicles.” Seba predicted that Internal Combustion Engines (ICEs) would be obsolete by 2030. Tony Seba is a soft target.

Your blogger will shortly be buying a new car. I’m not opposed to an EV – they work well as golf carts for example. But the inconvenience of charging, the waiting time involved and range anxiety demand a price discount to an equivalent ICE in my opinion. Around 25% would be enough to induce me to buy one. The market’s not there yet although it’s heading in that direction. So I’ll be buying a conventional car.

We have three have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF Inflation Fund