Pity the Equity Analyst

This week I felt a pang of pity for a sell-side research analyst. Not an obviously sympathetic constituency, you might well retort. There are many other categories of employment more deserving of such consideration – indeed, probably too numerous to list here. But I did, and here’s why.

This particular analyst (he’ll remain nameless because I don’t wish to embarrass him) has been a relentless cheerleader for Master Limited Partnerships and increasingly so as their prices have plummeted. That’s already sufficient reason for me to express my sympathy. You may have spotted that we have something in common.

Explaining why MLPs keep falling in willful defiance of what an evident minority asserts is compelling valuation can be tiring, and some become weary of it before others.

Plains All America (PAA) is the midstream infrastructure MLP most clearly linked with falling crude oil prices. Like most MLPs they rely on issuing equity to fund their growth plans, and PAA has been growing in recent years to accommodate increased domestic oil production. Acknowledging the unwillingness of investors to fund growth as well as the reality of falling domestic production, PAA recently cut their 2016 growth plans from $2.1BN to $1.5BN.

On Tuesday, January 12th PAA announced they had raised $1.5BN through a convertible preferred security yielding 8%, some 5% less than the yield on their equity. It was privately placed with several institutions, and as a result PAA has no need to issue equity through 2017. Moreover, it was pretty cheap capital since it is convertible to equity at the holder’s option in two years or at PAA’s option (under certain circumstances) in three. In any event, it is junior to all their other liabilities and is in reality equity (which is how PAA regards it). Private equity investors, not normally accused of superficial research, saw fit to invest $1.5BN in equity in an MLP.

So you have a piece of news that is unambiguously positive, in that PAA raised capital on surprisingly inexpensive terms from informed investors and is no longer a seller of its own equity. Now let’s return to our sell-side analyst.

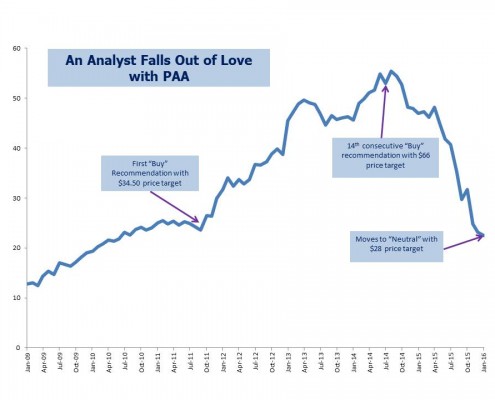

Research reports include a history of the Certifying Analyst’s prior recommendations on the stock. PAA had been a Buy (called an “Overweight”) since October 2011, at which time it was trading at $30 with a price target of $34.50. Through 19 subsequent revisions the Buy recommendation remained, with the price target regularly adjusted so as to be always 10-20% higher than the current price. In October 2014, with PAA at $58 the peak price target of $66 was recorded.

To quote a friend of mine, from that point down was a long way and on Monday, January 11th just prior to PAA’s announcement, its stock closed at $20.36, 70% below its target of fifteen months earlier. Now put the numbers aside, and consider what the past fifteen months have been like for the sell-side analyst. He has doggedly articulated the bullish case through the most relentless selling. He has noted the fee-based nature of PAA’s cashflows, the highly regarded management and their history of solid execution. His analysis is widely read and his day must have increasingly been one of verbal jousting with his firm’s salespeople as they relayed client dissatisfaction and most likely anger. When losing money on an investment it’s some small solace to blame one of the unapologetic cheerleaders.

Sell-side analysts can be highly paid (although one suspects that MLP analysts face a supply/demand imbalance similar to crude oil). But even highly paid people have a breaking point, and this week our analyst reached his. We know this because on Wednesday, January 13th following PAA’s $1.5BN capital raise the sequence of 20 consecutive Buy recommendations was finally broken with a switch to Neutral. The unspoken message was clear:

I am tired of this. Let me hide in the obscurity of the current market price. I no longer wish to explain what cannot be explained to my colleagues or my clients. I am out.

This is how it feels to sell after intending to never sell. If you’re planning to panic, it’s best done immediately.

How do I infer this from a research report that doesn’t make such a confession? Because of what it does say. Acknowledging that the capital raise was undoubtedly good, our analyst nonetheless downgrades the stock because of lack of visibility around crude oil. Of course the crude oil price remains both highly visible and unpleasant. Moreover, because all good research must include a Mathematical basis by which the current price target is derived, the discount rate on PAA’s future cashflows was arbitrarily jacked up to 11% and a zero growth rate was assumed on their terminal value beyond ten years. This last point will seem obscure but is important – PAA is highly unlikely to forego forever price increases on its assets in the future. Or put another way, how do you change the spreadsheet inputs so as to get the desired output, which is an innocuous price target close to the current market so I don’t have to talk about PAA anymore.

Also of note was that our analyst didn’t rely on any of the familiar criticisms of industry bears, such as that the MLP model is irretrievably broken, that contracts will suffer widespread renegotiation or abrogation in bankruptcy court, or that MLPs are a Ponzi scheme. This is because he for one can’t find much evidence of that or he would most assuredly have relied on such to justify his about-face following a 70% drop. He’s just had enough.

Meanwhile, on Wednesday PAA yielded 14% on an unchanged dividend newly declared. Its General Partner, Plains GP Holdings (PAGP) which we own yielded 11.5%. The analyst isn’t even forecasting a dividend cut.

The point of this story is not to argue that PAA or PAGP are cheap, but to show why MLPs remain so weak. The people involved are reaching the limits of their tolerance for remaining bullish when the P&L’s of countless MLP holders say very loudly that any MLP proponent must have an IQ lower than room temperature. The facts as reflected in market prices relentlessly say so. One guy’s had enough, and I feel his pain but shan’t follow his lead.