Pipeline Real Yields Are High

When investors ask what return they should expect from an investment in midstream, we typically suggest dividends plus growth plus buybacks. Dividend yields are around 5%. Wells Fargo is forecasting 4% dividend growth next year, and buybacks of around 2% of market cap. 5% + 4% + 2% suggests an 11% total return, assuming no change in valuation.

Valuations are attractive, with Distributable Cash Flow (DCF) yields above 9% and expected to grow 5-10% over the next few years. Leverage of around 3X Debt:EBITDA is becoming the norm for investment grade midstream companies. An 11%pa return over the intermediate term looks reasonable.

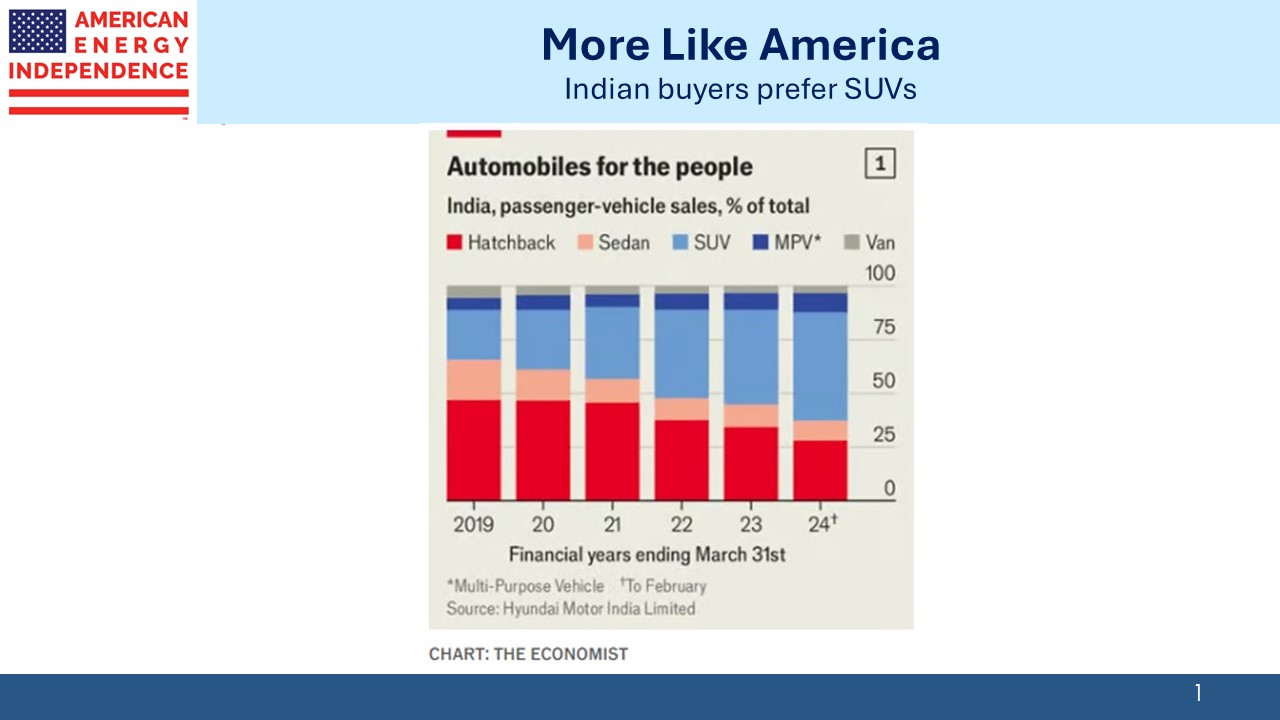

But what about over the long run? For years the energy sector has labored under the fear of stranded assets as the world moves away from hydrocarbons. Experience shows that this was unfounded. Developing countries are driving consumption higher as they seek western living standards. India for example is seeing SUVs increase their share of a rapidly growing domestic auto market.

Status is one reason, but the poor state of Indian roads is another. The clearance between the bottom of a car and the road is critical when potholes and poorly designed speed bumps proliferate. Bigger cars need more gasoline. India is a long way from peak emissions.

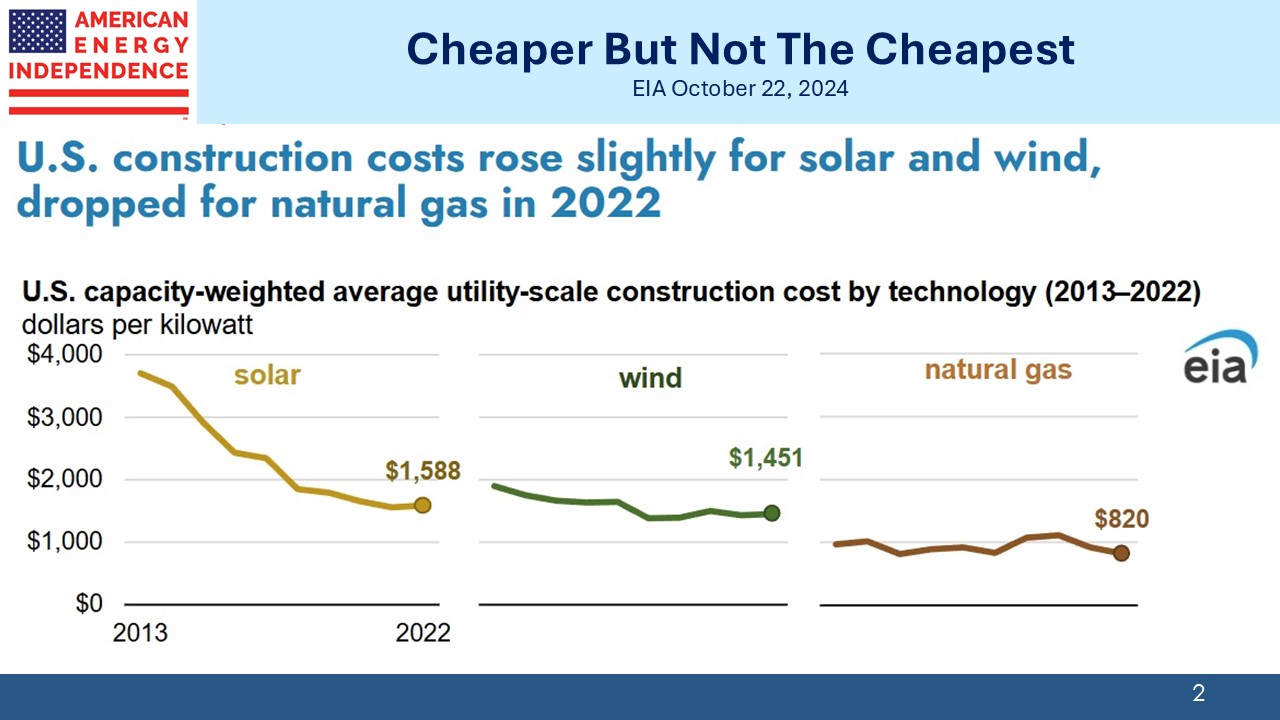

Solar and wind are failing to meet the promises of climate extremists. Sloppy reporting routinely claims that these two are the cheapest forms of electricity. This is still not the case as a recent post by the Energy Information Administration showed. And it omits the cost of either battery storage or dispatchable power (usually natural gas) for when it’s not sunny or windy.

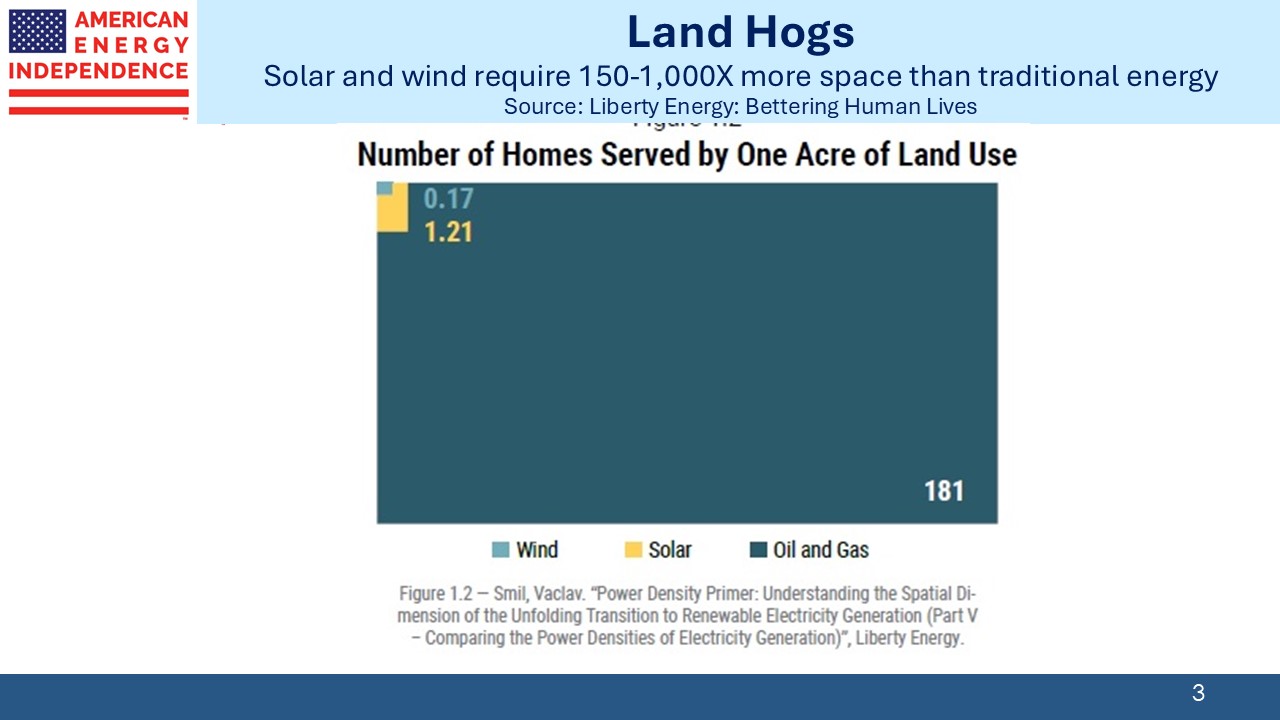

Renewables require vast amounts of space. Unlike hydrocarbons, they are not energy- dense. Vaclav Smil, probably the most intelligent writer on energy, shows that an acre of land dedicated to solar power serves 1.21 homes. In the case of wind, it’s 0.17.

You know where this is going.

There are approximately 145 million US homes. Powering all of them with solar power would require 120 million acres of land dedicated to solar, about 5% of all the land in America. We could put solar panels on every rooftop and we’d still need a lot of space.

If we relied fully on wind it would take almost 38% of our landmass.

We’re going to use more solar and wind, but climate extremists need to embrace nuclear and coal to gas switching to be taken seriously.

The election showed that Democrat climate policies resonate less than illegal immigration and inflation.

Pipelines that move hydrocarbons, especially natural gas, will be here for the foreseeable future. These infrastructure assets have long lives and deliver predictable cashflows that are linked to inflation. Wells Fargo has calculated that roughly half the industry’s EBITDA relies on contracts that incorporate tariff hikes linked to PPI.

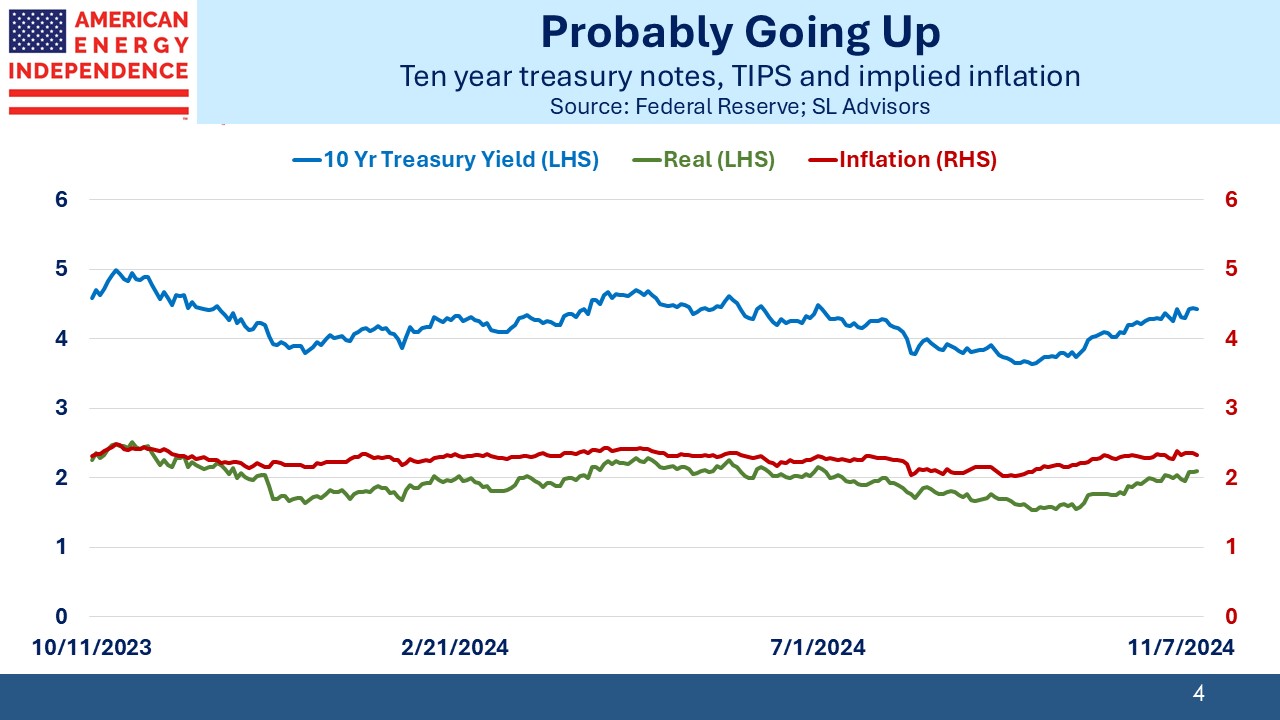

Ten year real yields, as defined by Treasury Inflation Protected Securities (TIPS) are 2.1%. With ten year notes at 4.45%, implied inflation is 2.35%. It’s been edging up, and while Republican policies are good for the energy sector there’s little reason to think inflation will be 2%.

Trump ran on an expansionary fiscal platform. Ejecting illegal immigrants, good policy though it is, will tighten the labor market for low-skilled workers. And tariffs could push up prices depending upon how they’re implemented.

Recognizing the risks, Fed chair Jay Powell has paused further rate cuts.

Investors need to protect themselves against inflation that’s 3% not 2%.

The approximate 5% yields on midstream energy infrastructure translate to a real yield of 2.65%, 0.55% better than TIPS. But while TIPS will keep up with inflation, midstream will likely do better. JPMorgan expects dividend growth rates of 8% for large-cap c-corps over the next couple of years and 4% for large MLPs, both of which are above plausible inflation forecasts.

Given the reliable cashflows that characterize the sector, with dividends likely to consistently grow well in excess of inflation they should have real yields comparable to if not below TIPS. Dividend yields of 4.5% wouldn’t seem unreasonable, similar to treasuries.

The dividend yield on the S&P500 is a paltry 1.2%. Stocks offer a negative real yield of –1.15%, 3.8% less than pipelines, even though the latter comes with widespread inflation-linked tariffs.

Although pipelines have outperformed the market for the past five years, there remains a compelling case for investors seeking inflation protection to own them. That should apply to every one of today’s savers.

The point of investing is to preserve purchasing power. In our opinion midstream offers the best chance to do so.

We have two have funds that seek to profit from this environment: