Pipeline Earnings Or Cashflow?

Wells Fargo has recently suggested that the market may start paying more attention to the P/E ratios of midstream stocks. The sector has historically been valued using Free Cash Flow or Distributable Cash Flow (DCF), which is FCF less the maintenance capex necessary to preserve the value of existing assets.

P/E hasn’t been used much in the past because depreciation tends to understate the cash flow potential of infrastructure. The tax code allows for pipelines and other assets to be depreciated, while their ability to generate cash flow improves over time. Properly maintained, midstream infrastructure consists of appreciating assets.

I’m often reminded of the Transcontinental Gas Company’s pipeline built in the 1950s to move natural gas from Texas to population centers in the north east as far as New York City. This pipeline, long ago depreciated to zero, is part of the Transco system owned by Williams Companies. Allowing the owners to write down their investment for tax purposes didn’t reflect the actual value of the asset.

Wells Fargo thinks that the entry of generalist investors into midstream will encourage a more conventional approach to valuation. They cited South Bow (SOBO), the liquids pipeline spinoff from TC Energy last year, which looked unattractive based on DCF but better on P/E, and subsequently outperformed the sector.

Wells Fargo goes on to note that the midstream sector does trade at a P/E discount to the S&P500 (18.2 vs 21.7).

There has been some discussion that the new administration may reintroduce accelarated depreciation on some assets such as real estate although this could extend to infrastructure as well. By frontloading depreciation expense instead of using the straight-line method, it would depress near term earnings making P/Es look less attractive.

The spurt in power demand from data centers is likely to push capex higher for some of the natural gas-oriented pipelines. Because of this, investors relying on P/E are still likely to consider DCF and FCF yield as well in order to gain a more complete understanding of a company’s prospects. Earnings and cashflow are both important.

Friday’s strong payroll report cast more uncertainty on the prospects for further rate cuts from the Fed. The FOMC has the luxury of doing nothing for several months while the new administration’s policies take shape. Tariffs are widely considered inflationary. Extending the low tax rates due to expire this year will add fiscal stimulus to an already strong economy.

It’s a short step from the FOMC on hold to worrying about a potential resurgence in inflation. Should this happen, pipelines could offer useful protection since valuations are still attractive and roughly half the sector’s EBITDA comes from tariffs that have explicit inflation escalators built in. This was behind 2022’s 21% return on the American Energy Independence Index versus the S&P500’s -18%, when CPI inflation peaked at 9%.

Last year the world’s temperature averaged 1.5C above pre-industrial levels, the first time we’ve reached this threshold beyond which scientists warn that irreversible climate change is likely. It’s an incongruous thought at a time when most of the continental US is enduring well below average temperatures.

Sometimes I flippantly note that if global cooling was caused by rising CO2 levels, I’d be moved to install solar panels, buy a Tesla and adopt all the other virtue-signaling behavior of liberal zip codes. There’s a reason I leave New Jersey for Florida at this time of year.

What we’re seeing is the wholesale failure of progressive policies to reduce emissions, because they ignore the desire of developing countries to raise living standards with increased energy consumption and they naively believe intermittent, weather-dependent energy is the total solution.

It’s possible that policymakers may learn from this and adopt a pragmatic path to success, which would be a worldwide effort to encourage coal to gas switching for power generation. Critics of this approach argue that natgas still generates CO2. But it’s on average only half as much. Don’t let perfect be the enemy of good. Emissions would come down.

The US has achieved the world’s best combination of reduced CO2 and economic growth by doing exactly this. The correct choice is to encourage similar behavior around the world, especially in emerging Asia.

The China Coal Transportation and Distribution Association expects output to rise 1.5% this year, an outcome wholly inconsistent with reducing emissions and one that makes a mockery of the constraints imposed on their citizens by liberal US states.

Even with the US withdrawing again from the Paris Climate Accord, we are well situated to support the successful implementation of such a coal-to-gas policy. This is the world’s best option. US exports of LNG can do more to reduce global emissions than the failing efforts of the past couple of decades.

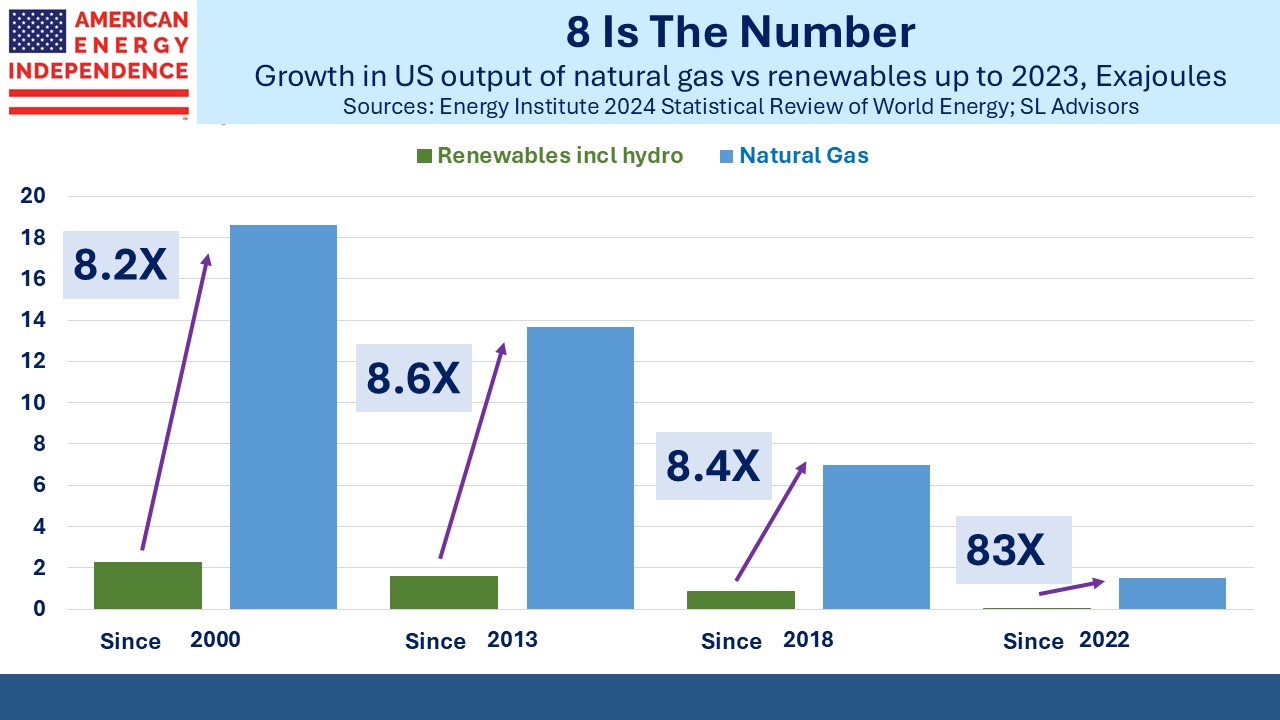

We’re invested in natural gas infrastructure because we expect this will increasingly become clear to policymakers. Growth in US natural gas output continues to swamp renewables.

Last week my daughter and I braved frigid cold to ski in Vail with long-time friend and client Bill Edwards, whom we annually credit with also being Vail’s Best Ski Instructor. Like many of our clients, he was a friend first. Any skiing ability I have is a credit to his patient instruction over many years. The lapses are my own work.

We have two have funds that seek to profit from this environment: