Pipeline Earnings Good; Investors Skeptical

We’re in the middle of earnings season, and last week several companies provided 1Q reports. The energy sector continues to struggle to excite investors. Although pipelines stocks delivered very strong performance through March, in recent weeks investors have started to question the rally’s resilience.

As a result, sentiment could use a boost from strong earnings. Of the companies we follow, results so far have been at or ahead of expectations. Enterprise Products Partners (EPD) generated almost $2BN in EBITDA during 1Q19, handily beating forecasts. On the earnings call they discussed the conversion of their Seminole pipeline to carry crude oil instead of Natural Gas Liquids (NGL) from the Permian to Mount Belvieu: “…given its location and interconnects, we will always have flexibility to convert this pipeline back to NGL service depending on the pipeline supply demand balances for crude oil and NGLs in the future. I doubt that anyone else will be able to offer this type of future flexibility to Permian producers and to markets.” We get some questions about the likelihood of excess pipeline capacity in the Permian, and this optionality is useful.

There was another interesting exchange on propane exports, where EPD conceded to a drop in market share from 80% to around 50%. They’ve concluded that their pricing was too high, and plan to be more competitive. Energy Transfer (ET) CEO Kelcy Warren complained on their fourth quarter call about spending to protect his turf from competition from fringe private equity projects. EPD shares the same distaste for new, greenfield projects competing with more economic brownfield expansions on their existing footprint. EPD CEO Jim Teague commented that, “…we’re not going to make the mistake of having prices that (and) invite more competition.”

Takeaway infrastructure for Permian crude production often comes with associated natural gas. Inadequate takeaway infrastructure has led to flaring, and recently pushed prices at the Waha hub collection point negative. On April 3rd, some Exploration and Production (E&P) companies paid $9 per MCF to dispose of natural gas. Forward price remain negative through 2021. The crude oil that they’re seeking is sufficiently profitable to cover this additional overhead. Under the circumstances, one might think E&P companies would be pushing for additional natural gas takeaway infrastructure. However, Williams Companies (WMB) CEO Alan Armstrong reported that few were willing to commit volumes on terms to support such an investment.

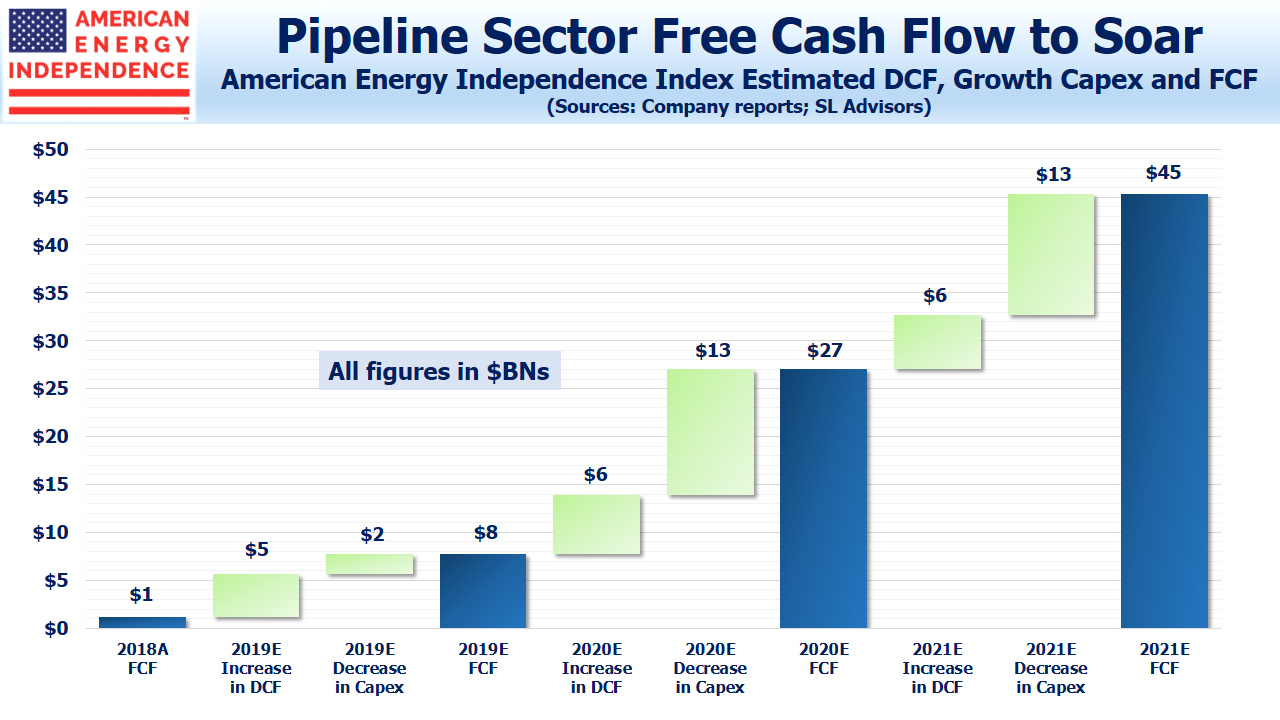

Earnings reported so far support our free cash flow bridge below, first published last week.

WMB earnings were in-line with expectations, and their 2019 growth capex guidance was lowered by $200MM to a range of $2.3BN to $2.5BN.

Capex guidance was generally among the more keenly examined numbers, given past years’ focus on growth projects. Last week we noted that such investment peaked last year, which is supporting growing free cash flow (see The Coming Pipeline Cash Gusher).

Oneok (OKE) logged 12% year-on-year distribution growth, with Distributable Cash Flow (DCF) providing 1.43X coverage while continuing to advance key projects on schedule. Lower payout ratios are the new normal, to provide more flexibility and reduced need to issue equity.

Enlink (ENLC) disappointed with lowered guidance for 2019 natural gas output from Oklahoma, although their overall report was within expectations. Its 14% DCF yield is very attractive and we like the management team.

Crestwood (CEQP) raised 2019 EBITDA and DCF guidance with continued strength from their Bakken assets,and expects 20% DCF growth through next year. Their 13% DCF yield seems unreasonably high.

Western Gas (WES) reported 7% annual distribution growth, but the competition to buy parent Anadarko (APC) will dominate their performance until it’s resolved.

With Occidental (OXY) outbidding Chevron (CVX) for APC, many are surprised that the consolidation and implied vote of confidence in shale from a major oil company isn’t drawing in more support for the energy sector. Berkshire’s (BRK) proposed $10BN investment in OXY via 8% preferred securities with warrants for 80 million shares at an exercise price of $62.50 represents either (a) a valuable endorsement of growing U.S. oil production, or (b) proof of the high cost of capital facing a still unloved energy sector. Whichever it is, the APC M&A saga can surely only be good for midstream energy infrastructure.

More earnings reports are due next week. So far, what we’ve seen is increased capital discipline, lower leverage, growing cash flows and higher coverage ratios. This is consistent with our overall, constructive outlook for the sector.

We are invested in BRK, CEQP, EPD, ENLC, ET, OKE, WES and WMB.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).