Oneok-Magellan Outcome Too Close To Call

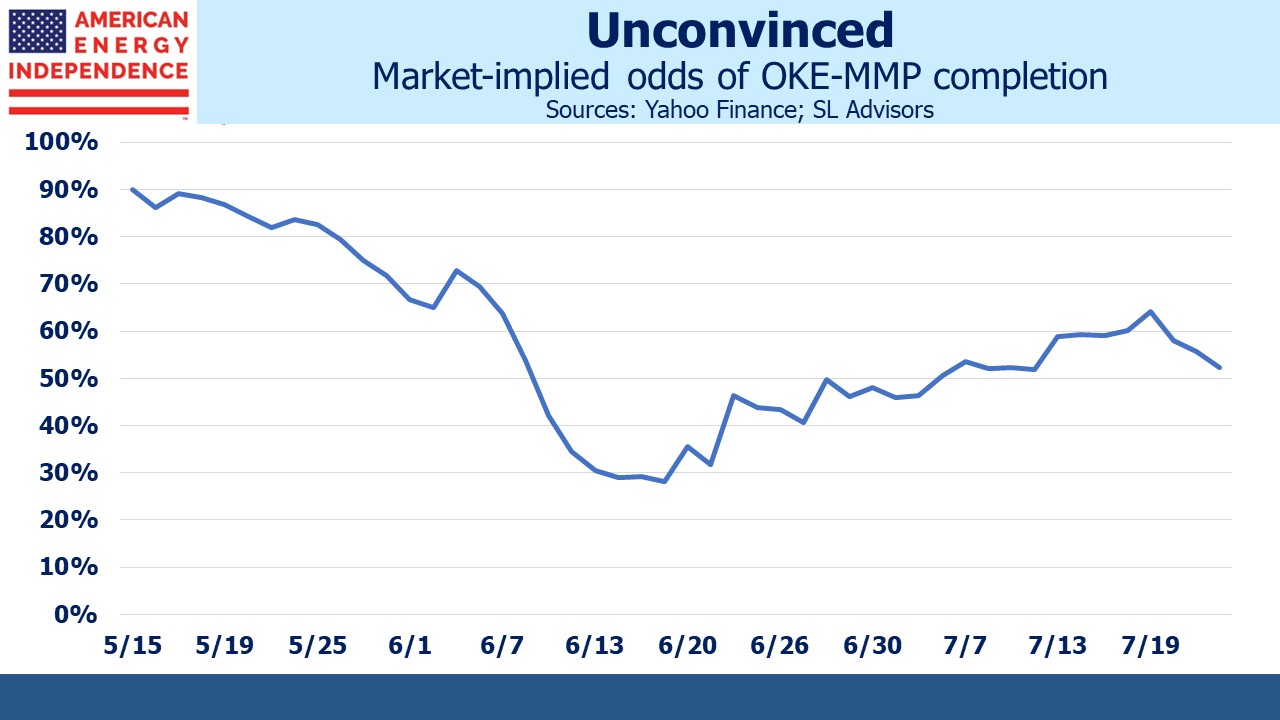

The market currently assigns barely 50/50 odds of the Oneok-Magellan (OKE-MMP) merger receiving shareholder approval from both companies. When the deal was announced in May approval was judged to be highly likely, but it soon receded as analysts offered only lukewarm approval. We offered our view (see Oneok Does A Deal Nobody Needs) within a few days. In mid-June Jim Murchie of Energy Income Partners (EIP) wrote an open letter criticizing the transaction as not good for MMP unitholders, especially long-term investors whose recapture on deferred taxes will exceed the $25 per MMP unit being offered in the transaction.

EIP released a second open letter on July 17 which reinforced their reasons for remaining opposed to the merger. They contrast MMP’s current fear that electric vehicle adoption will threaten their refined products pipeline volumes with recent previously expressed confidence in their outlook. They calculate that the deal premium is inadequate to compensate MMP unitholders for the tax payments they’ll have to make. EIP correctly argues that while MMP unitholders already had the deferred tax liability that will come due if the deal closes, they currently have some control over when to realize that liability. The OKE-MMP transaction will make those deferred taxes due now. Control over the timing of one’s tax bill has value, which this transaction fails to acknowledge.

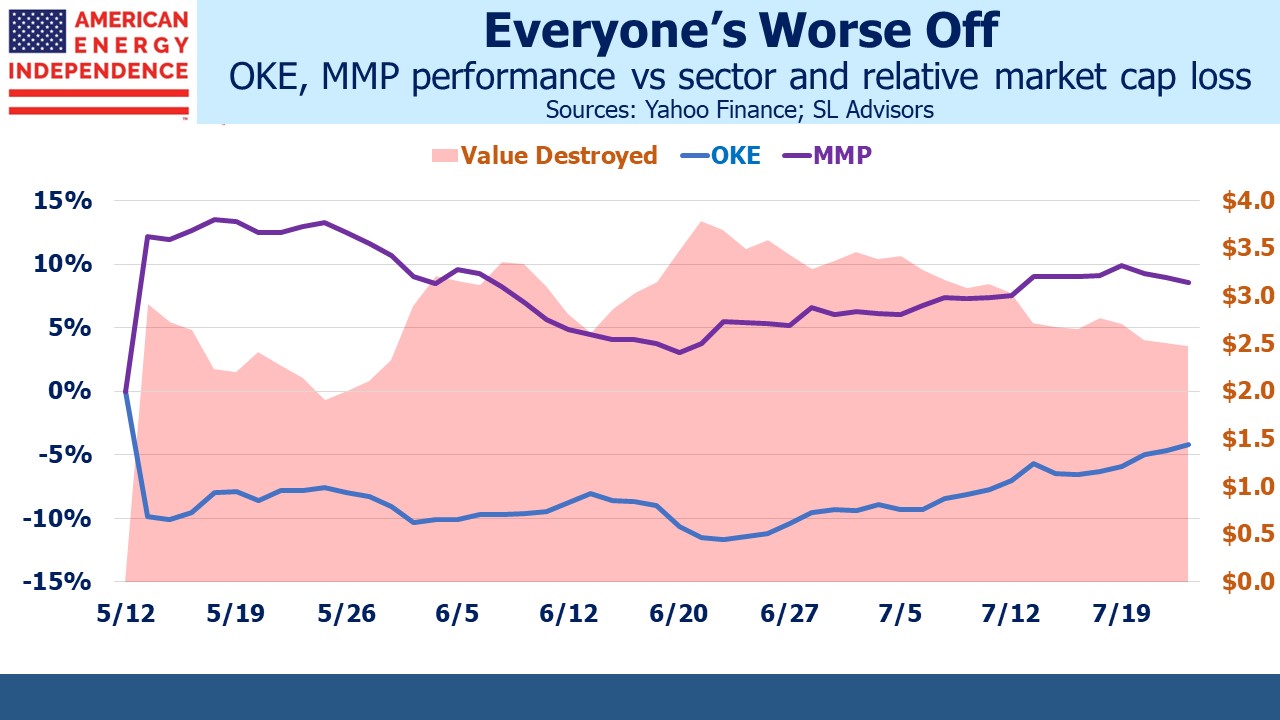

The deal’s odds of success bottomed out in mid-June with EIP’s first letter. They subsequently recovered but have dipped again over the past week with the second letter. The market has already offered its opinion on the transaction, and it is value-destroying.

The 22% premium promised with the initial press release quickly evaporated as OKE stock sank, reducing its value as partial payment for MMP units. From the day preceding the deal announcement, MMP is today up 9% compared with its sector, defined as the American Energy Independence Index (AEITR). OKE has lagged the AEITR by 4%. Because OKE’s market cap is around 2.3X MMP’s, an investor holding a market weight position in both companies is worse off than if she had simply held the AEITR. In aggregate, OKE and MMP investors together are $2.5BN worse off than if they had been invested in diversified midstream energy infrastructure. It’s therefore fair to say that even the modest likelihood of the deal’s approval has already destroyed $2.5BN in value. If the deal closes, investor losses will be even greater.

We remain unconvinced of the deal’s merits and solidly opposed, eagerly awaiting the opportunity to vote NO twice – once on our OKE holding and again on our MMP holding.

Sometimes the most profitable capital allocation decisions are to divest assets rather than acquire them. This is the case with Kinder Morgan (KMI) and their sale of the Transmountain Pipeline expansion project (TMX) to Canada’s federal government in 2018. KMI had found themselves caught in the middle of a political dispute between oil-producing Alberta who wanted the added capacity to transport its crude to the Pacific coast, and liberal British Columbia who opposed it. Canada’s PM Justin Trudeau led the Canadian government’s acquisition of TMX for C$4.5BN, arguing its completion was in the national interest.

Five years later TMX is less than a year from completion and the cost looks like C$30.9BN, around 4X what KMI estimated when they began the project in 2016. As recently as February 2020 the Canadian government, which was by then the owner, estimated C$12.6BN. Then Covid forced a suspension of activity. Ongoing legal challenges from environmentalists and flooding added delays. Other drivers of higher costs cited include: “general construction industry and materials cost inflation, supply chain challenges, labor shortages, preservation of indigenous archaeological discoveries along the pipeline’s route, and low contractor productivity.”

Because the Canadian government wants to recoup its investment, the ballooning cost of TMX will be reflected in higher tariffs for shippers using the pipeline. Precise charges depend on the amount of capacity a shipper has committed to use and the term of the agreement. But RBN Energy, who recently published a detailed analysis of TMX, estimates that some customers could wind up paying more than C$10 per barrel.

To illustrate how expensive this is, Enbridge’s Canadian Mainline pipeline, which runs from Edmonton to the US midwest where it connects to pipelines to the US gulf coast, offers similar pricing. So Canadian Mainline will be competitive with TMX for access to crude oil export terminals even though it covers almost 3X the distance.

The outcome vindicates KMI’s decision to sell TMX. At the time the company said they would shut down the project if they couldn’t sell it. Had KMI retained TMX and continued construction throughout its tumultuous last five years, the spiraling cost would have weighed significantly on its stock price. Asset sales don’t come with a post-disposition IRR, but this might be the best capital allocation decision KMI has made in a very long time.

We have three funds that seek to profit from this environment: