Oil and Gas Output to Reach Records Next Year

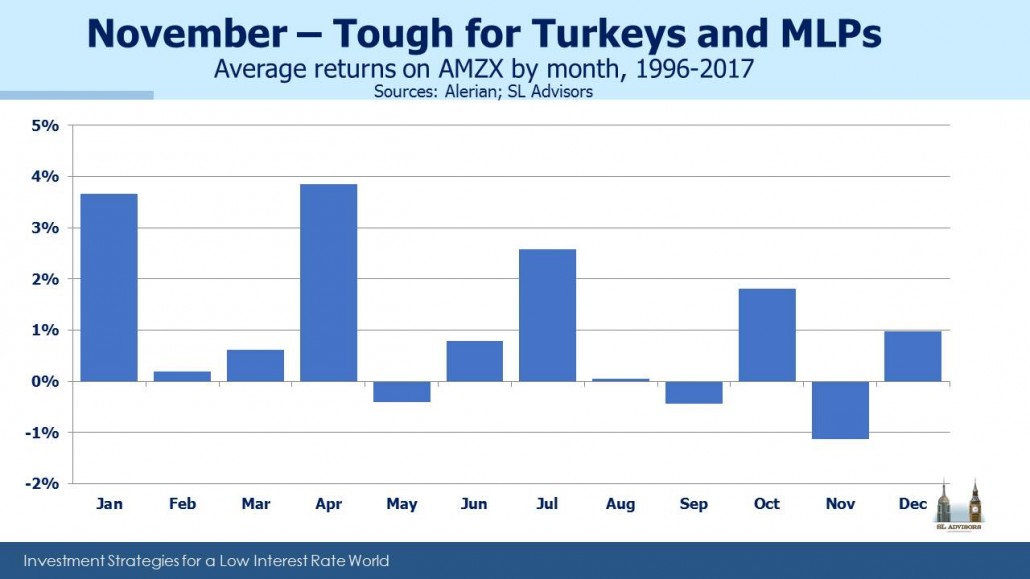

Seasonal patterns can be interesting when there’s some plausible substance driving the relationship. For several years we’ve noted the persistence of November to be weak, with the best returns occurring early in the calendar year (see Why MLPs Make a Great Christmas Present). The predominance of individual investors (rather than institutions) in the sector accounts for much of this. Most of us probably take stock of our investments around year-end, perhaps enjoying a welcome break from overindulgence at the dinner table. Any resulting portfolio shifts therefore take place shortly after.

K-1s are another factor; if you’re thinking of selling a publicly traded partnership, why wait until January when you’ll receive another K-1 for the partial year. Similarly, if you’re contemplating buying, you might as well delay until January so as to avoid a K-1 for the last part of the year. In both cases this leads to more sellers than buyers late in the year and the reverse in January.

Every year there are reasons to suppose that the seasonals won’t work. We’ve written many times that MLPs have lost the support of their traditional investor base, and that energy infrastructure corporations (“C-corps) are now as big as MLPs (see The American Energy Independence Index). So that may dilute the impact of individual tax-driven decisions over time. Anecdotally though, there has certainly been some individual tax-loss selling recently. Returns ex-energy have been strong, and some investors are booking losses in MLPs to offset other taxable gains.

But it’s also true that those not invested in energy infrastructure are far more numerous than those who are. As despondent as today’s investors may be, we have regular conversations with others with capital to commit who see potential opportunity in attractive valuations and the beaten down sentiment of existing holders.

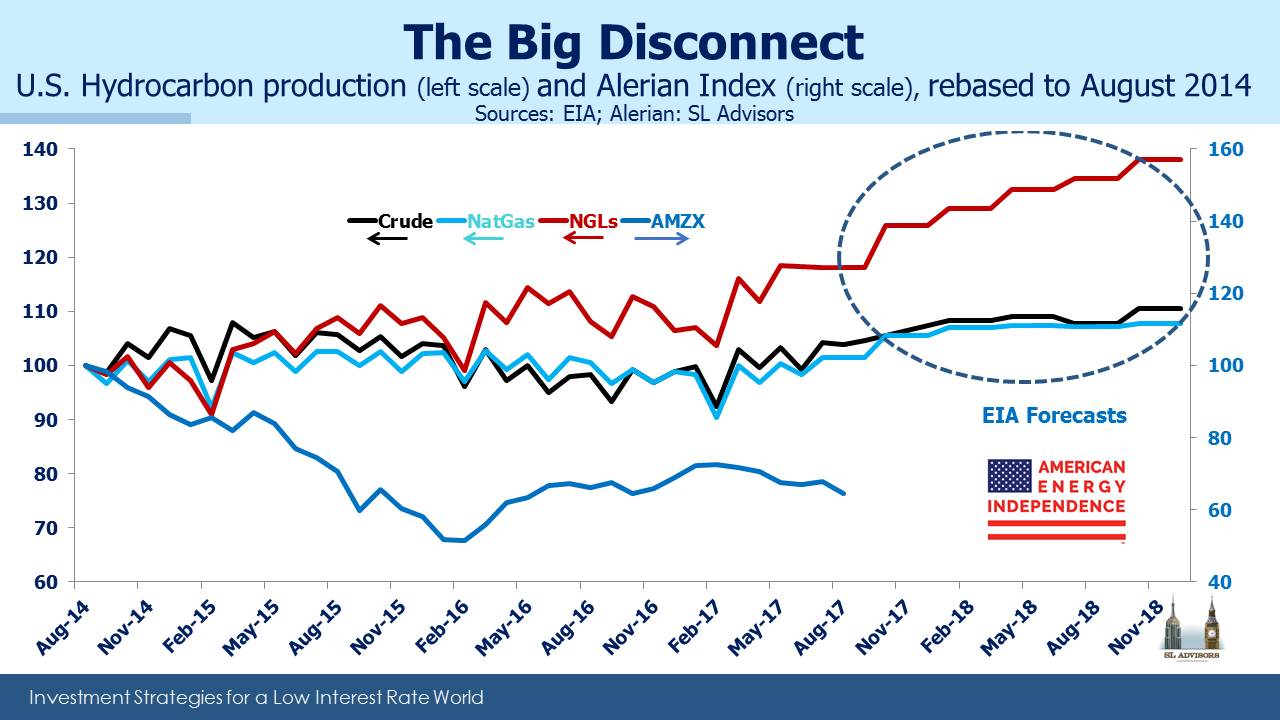

The second chart captures the common refrain of investors frustrated by growing U.S. hydrocarbon production that so far hasn’t raised stock prices for the energy infrastructure businesses that support it. They’re right. Since the August 2014 peak in the sector, production levels have recovered and are now higher than they were three years ago. A recent report from the Energy Information Administration (EIA) forecasts record output next year in crude oil, natural gas and Natural Gas Liquids (NGLs). The Alerian Index has disconnected from this volume growth, in part because traditional investors were alienated by the distribution cuts to fund growth and reduce leverage that many businesses undertook (see Why the Shale Revolution Hasn’t Yet Helped MLPs). But the volumes are certainly coming. Today’s investors are getting paid with attractive distributions to wait for new investors to respond to the opportunity. The seasonal pattern may yet provide the catalyst.

On a different note, long-time readers will be aware of our disparaging comments about non-traded REITs, a nasty little security with no legitimate place in a retail investor’s portfolio because of the exorbitant fees charged (up to 15% of an investor’s money). Three years ago in one warning blog about the sector, we referenced American Realty Capital Properties founded by Nick Schorsch (see A Scandal That Should Shock Nobody). Former CFO Brian Block was recently sentenced to 18 months in prison for six counts of fraud. If your advisor recommends non-traded REITs, it may be because they’re more in his interests than yours.