Oil Futures Say Shale's Here to Stay

A couple of months ago (see Why Shale Upends Conventional Thinking) I promised to spread constructive thoughts about Master Limited Partnerships (MLPs) across the ensuing weeks and months rather than use them all up on the first drop in prices. Two months and several percent later such parsimony was well advised. If your preference is to invest with a stop-loss, thus ceding to others the timing of your exit and avoiding the need to think too hard, MLPs may not be your best choice.

Lower oil prices may lead to lower U.S. output (although it hasn’t happened yet) and consequential pressure on the owners of infrastructure as excess pipeline and storage capacity build. If the 2015 MLP collapse was an epic, 2017 is so far a single episode in a mini-series of unknown length.

The bear case is plain enough. U.S. oil production remains stubbornly high (at least from OPEC’s perspective). Since crude oil is now below the price that prevailed when OPEC shifted strategies, U.S. shale output is more than offsetting last year’s agreed production cuts. The agreement is being surprisingly well respected with few reports of cheating. However, while OPEC members are complying with production cuts their exports remain at previously high levels, drawing down inventories. ClipperData’s Matt Smith pointed this out last week, adding that April was the first month when Saudi Arabia cut exports in what may presage a more meaningful reduction in global supply.

A certain amount of self-confidence is necessary to buy securities that others are selling — how else does one buy, anyway? But just because one is bullish does not render the naysayers stupid. If crude oil falls far enough production in the U.S. and elsewhere will slow. Shale drillers are not immune to prices, and in fact are better able to respond than most due to the short-cycle nature of their projects (see What Matters More, Price or Volumes?). The secular improvements in horizontal drilling and hydraulic fracturing are relentlessly lowering break-even prices for the Exploration and Production (E&P) companies that are active there. These E&P firms are the customers of MLPs, so we care very much about their success.

There is a type of circular irony here, in that continued growth in U.S. output aided by productivity improvements is causing energy sector stocks to weaken. The very success of shale in America ought to be a problem for others, not for domestic E&P companies or the MLPs serving them. For now, production and price are negatively correlated – shale supply stubbornly refuses to surrender to lower prices. Or more realistically, efficiency improvements maintain production higher than it might otherwise be but nonetheless lower than would be the case at, say, $60 a barrel.

Production may slow and the worriers be proven right. So let’s complicate matters by considering a number of facts shared in the many earnings reports over recent days.

EQT Corporation (EQT) reported lower than expected natural gas output because, as CEO Steven Schlotterbeck explained, “A couple of our frac contractors decided to pay us the penalties to take their frac crews to jobs that were more profitable.” In other words, demand in the Permian in West Texas is sufficiently strong to induce frac suppliers to break contracts in the Marcellus, in Pennsylvania. Think about this, you have a profitable shale well that you wish to drill and have contracted a crew to drill it and instead they pay you a penalty not to drill the well because economics are that much better elsewhere.

There are many indications of new capital being invested in shale drilling. Western Gas (WES) reported that their sponsor Anadarko (APC) had sold Eagleford and Marcellus assets in 1Q17. WES owns infrastructure supporting these plays, and as a result CEO Benjamin Fink said, “we therefore expect increased drilling activity behind each system.”

Similarly, ENLK’s Barry Davis noted of their sponsor, Devon Energy (DVN), “Devon recently announced the potential divestiture of certain properties in Johnson County, an area that was not competing well for ongoing capital investments in their portfolio, from an EnLink perspective, we could benefit from a transition of those assets from Devon to a producer who is committed to developing the area over the long term.”

APC and DVN are not short of investment opportunities, but are concentrating their capex budgets on their best ones. They’re evidently finding interested buyers in assets whose sale proceeds will finance even more profitable opportunities. The new money will work those assets harder than the previous owners, which WES and ENLK see as good for them. In commenting on the Permian, ENLK’s Barry Davis further noted, “In the core areas where we are positioned, oil weighted breakeven prices or (sic) around $30s per barrel making economics very attractive, at today’s prices the resulting rates of return are in the range of 80% to 100%.”

Early last year, during what turned out to be the late stages of the MLP MOAB (Mother Of All Bears), we looked at Crestwood (CEQP) and their bankrupt E&P customer Quicksilver Resources (see How Do You Break a Pipeline Contract?). Owning a pipeline that supports a play whose owner can’t pay his debts is not what MLP investors like, and some wondered if CEQP would wind up owning infrastructure that was under-used or repriced.

Quicksilver’s assets were sold in bankruptcy court to Bluestone Natural Resources. Fifteen months later, CEQP’s CEO Robert Phillips commented, “And finally, in the Barnett, Bluestone our new producer has been running a very active work over program, consistent with what we are seeing from other producers in the Barnett as well these very inexpensive work over programs are high return, expenses for the producers. And we are continuing to see volumes over and above our estimates work over program led to a 4% volume increase over the fourth quarter and the first quarter.”

As we saw before, financial distress for an E&P company need not lead to production cuts, but can instead result in a more efficient owners maintaining or even growing output.

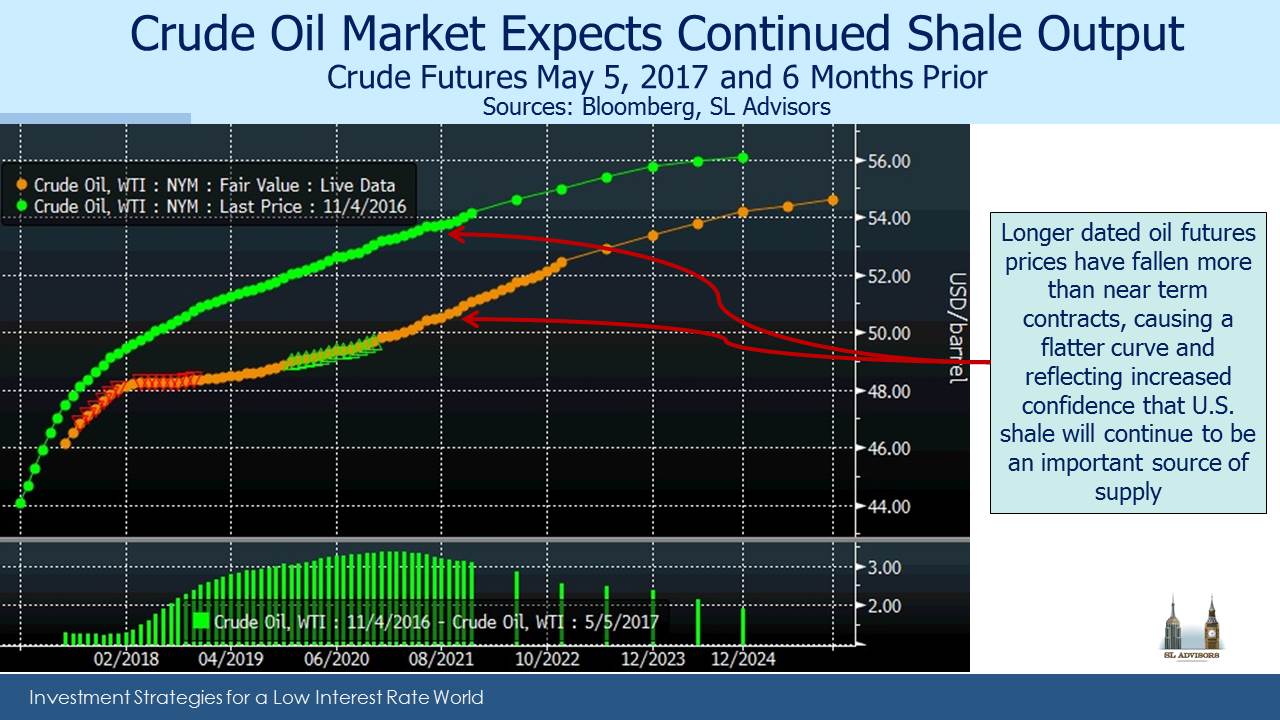

The oil futures curve provides an interesting perspective. Falling MLP prices suggest lower crude prices will ultimately cut shale output and reduce the use of existing and planned infrastructure. But in fact deferred futures contracts have fallen farther, which only makes sense if the market expects shale output in 4-5 years time to continue being an important source of supply. If the prospects for the shale industry were dire, oil traders would bid more for longer term contracts expecting to profit from ultimately less U.S. production. But in fact they’re doing the opposite, suggesting oil traders wouldn’t short the U.S. shale industry.

Predicting the short term moves in MLPs will inevitably require being an oil trader. Your weekly blogger cannot change that. But studying the earnings reports, transcripts and futures market over the last couple of weeks does offer a more granular perspective on the many positive developments taking place in U.S. shale.

We are invested in CEQP, ENLC (GP of ENLK) and WGP (GP of WES)