Offshore Wind vs Onshore

A couple of weeks ago in Windpower Faces a Tempest, we highlighted the challenges facing offshore wind both in the US and Europe. A good friend of mine, a lawyer who has made his career doing energy deals, took issue with the blog post. A spirited text message interaction ensued, continued in person over two rounds of golf together this weekend.

Most lawyers are proficient debaters. Our younger daughter is heading to law school, perhaps inspired by my observation that she never loses an argument, just runs out of time. My legal friend eloquently argued his case in between parring most holes, challenging me to match him on two dimensions. My putting suggests I was more focused on the shortcomings of windpower.

In the blog post, I used offshore windpower examples to illustrate the challenges facing the industry. The US is almost all onshore wind, where the economics are better. Offshore windpower is more common in other countries such as the UK. I was criticized for conflating challenged US offshore wind with far larger and generally successful onshore.

The US Energy Information Administration (EIA) publishes data on windpower generation by state. In 2022 five states in the central US (Illinois, Iowa, Kansas, Oklahoma and Texas) were responsible for half our output.

The Administration has a goal of adding 30GW of offshore windpower by 2030. The US Department of Energy reports that 52 Gigawatts of offshore windower is in development, half of which is off the coasts of New Jersey, New York and Massachusetts. These are the economically challenged projects highlighted in the earlier blog post, and also by RBN Energy (see When The Wind Blows – Potential Project Cancellations Highlight Difficulties For Offshore Wind). Less than 1 GW is under construction. The struggles of many offshore projects are threatening the 30GW goal.

The US has 145GW of installed onshore windpower capacity. The EIA reports that wind provides around 10% of our electricity, with natural gas at 40%. According to the Energy Institute’s Statistical Review of World Energy, renewables (mostly solar and wind) provided 8.8% of America’s primary energy last year, up from 8% in 2021. Renewables are growing, but past energy transitions took decades and so will this one. Natural gas rose from 32.2% to 33.1%. Renewables’ % growth rate is much higher, but America’s biggest source of added energy last year was natural gas.

The intermittency of solar and wind remains a significant obstacle at higher levels of grid penetration. If weather-dependent energy is 5% of your power supply a calm cloudy day doesn’t much matter, but at increased levels it becomes part of the baseload. Electricity needs to be available 100% of the time. Batteries are becoming part of the solution, as are natural gas power plants because they can adjust their power output fairly easily. But the low costs sometimes floated for renewables often ignore the needed backup.

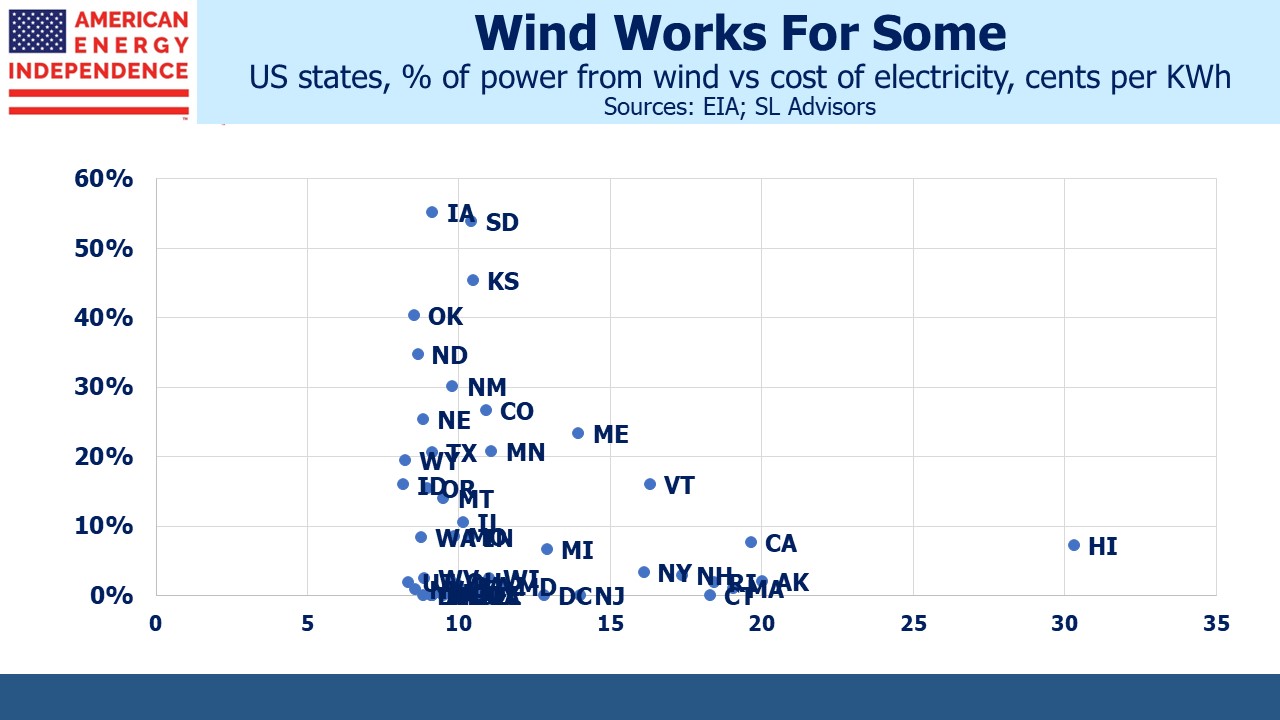

Germany, which generates a fifth of its primary energy from renewables, is an example of the consequent high energy prices that accompany such policies. California is another. Within the US there’s no clear link between windpower penetration and electricity prices. Iowa gets over half its power from wind and enjoys relatively cheap electricity. It must be a reliably windy place.

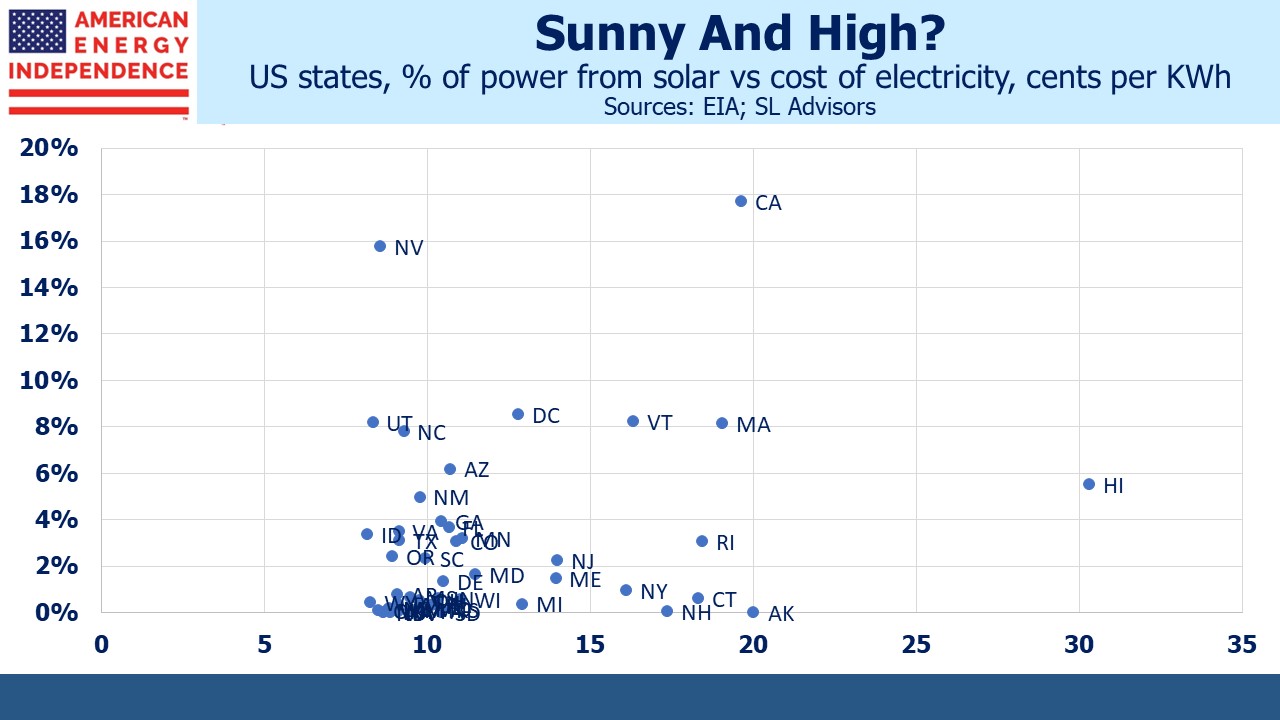

By contrast, solar power does tend to correlate with higher prices. It’s not just California (18% solar) but states such as Massachusetts and Vermont where one would think their northern latitudes render them unattractive locations. Prices are even more clearly linked with a state’s politics. Red states have cheaper power than blue ones.

Why would anyone want to live in a place that relies on intermittent power.

It’s not just climate extremists pushing the narrative that renewables are the complete solution to our energy needs. Liberal states such as New York and Massachusetts pursue policies that impede additional natural gas use. The Bay state has among the dumbest energy policies around. Six years ago Enbridge gave up on their Access Northeast natural gas pipeline, which would have supplied New England with cheap Marcellus gas, because of unsupportive policies in the region. Nonetheless, last year 77% of electricity in Massachusetts came from gas, almost 2X the US average. Some of it was imported expensively from foreign countries as LNG.

If we face an existential climate threat these fanatics should also embrace nuclear power as a vital solution. Finding a place to store nuclear waste remains unresolved, and costs are currently prohibitive. Georgia Power’s Vogtle nuclear plant started operations in March, years late and at $35BN cost double the original estimate. But France gets 32% of its primary energy from nuclear. America is 7.6%. The global figure is 4%. We should emulate the French.

My learned friend and I agreed on much, including that natural gas will be a significant energy source for the foreseeable future. But he was right to note that US offshore wind is a trivial source of power today. Next time I’m putting for the win he’ll probably distract me with a positive comment about renewables. I’m betting I’ll still make it.

We three have funds that seek to profit from this environment: