Natural Gas Liquids – The Forgotten Cousins

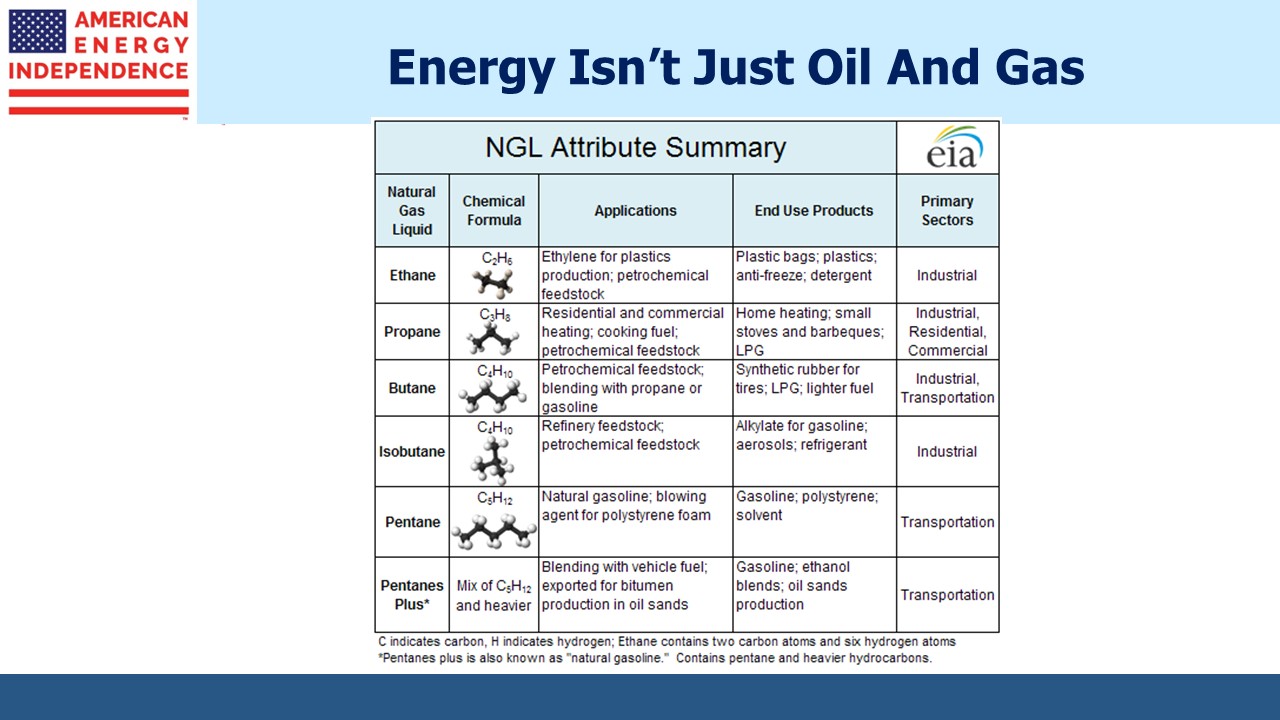

Media coverage of reliable energy tends to focus on oil and gas. Oil comes in hundreds of different grades of complex hydrocarbon molecules. Natural gas, methane, is the simplest hydrocarbon of them all with a molecular formula of CH4. In between methane and crude oil lie Natural Gas Liquids (NGLs) – successively more complex combinations of carbon and hydrogen. Methane, also known as “dry” gas, is measured in cubic feet or BTUs. NGLs are measured in Millions of Barrels per Day (MMB/D). When NGLs are found with methane, it’s called “wet” gas.

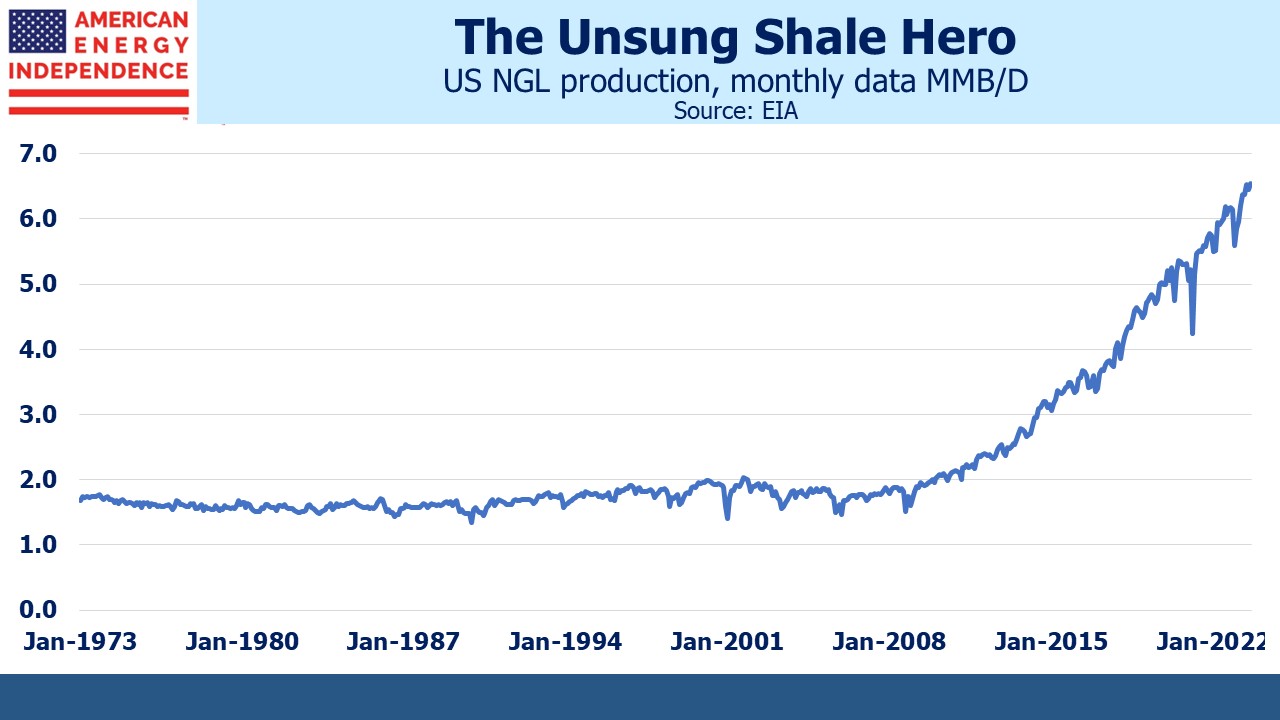

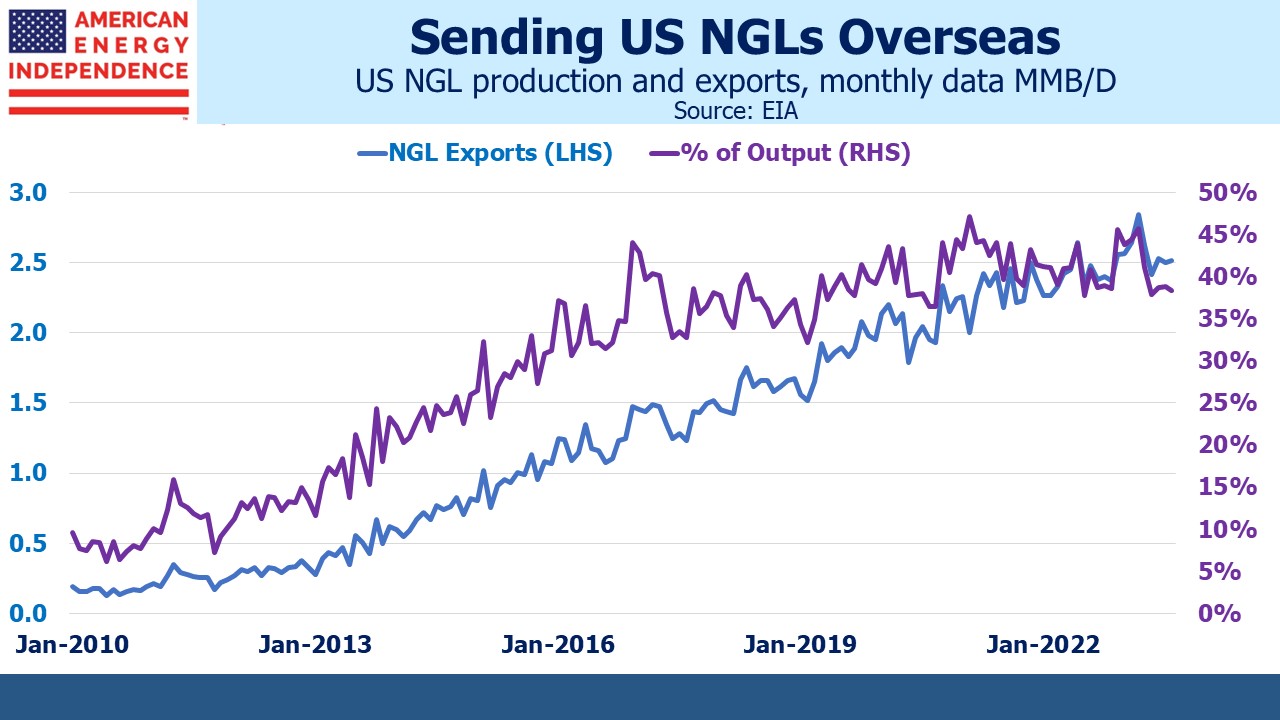

NGLs don’t get much attention, but they should because their growth over the past decade has been more impressive than for either of their better known cousins. Over the past fifteen years, US NGL production has tripled, to 6.5 Million Barrels per Day. This growth in output has fueled a big jump in exports, up more than 10X since 2010. Just under 40% of our NGL production now goes overseas, up from 10% in 2010.

One of the important roles played by midstream energy infrastructure companies is to separate these hydrocarbons from impurities present when they’re extracted, and from one another. They also make money storing, moving and exporting NGLs, creating multiple opportunities to “touch a molecule” as the vertically integrated companies often point out.

Ethane (C2H6) is used in the US for the production of ethylene from which most plastics are made. In many other countries plastics are made from Naphtha, which is derived when crude oil is refined. The abundance of ethane in the US has supported increased plastics production and foreign direct investment in new petrochemical facilities from companies seeking to benefit from US NGL growth

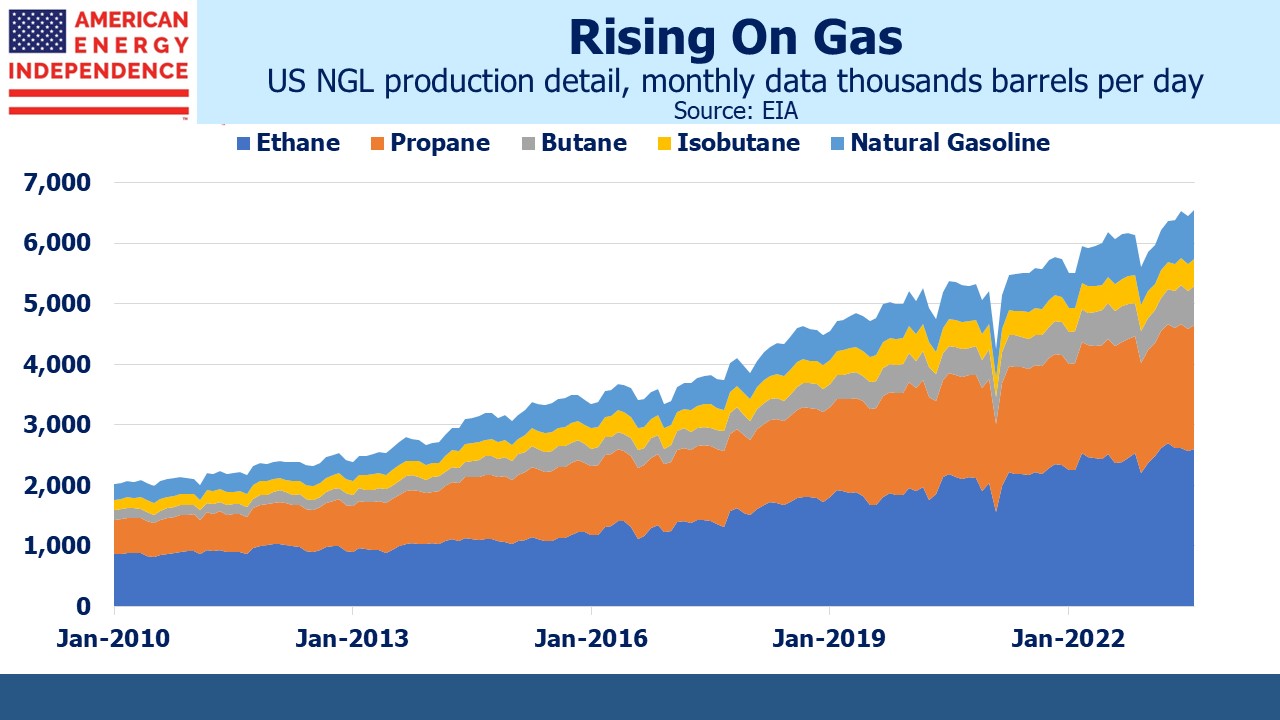

Ethane production has tripled since 2010. Propane has increased by 3.6X. Most of us are familiar with propane from its use in outdoor grills for barbequing. Propane is also used by farmers for drying crops. In regions not supplied with piped natural gas, such as SW FL, restaurants often cook with propane which is delivered in large upright cylinders.

Butane is sometimes blended with propane or gasoline. Isobutane is used in refining. Pentane is used to make polystyrene foam.

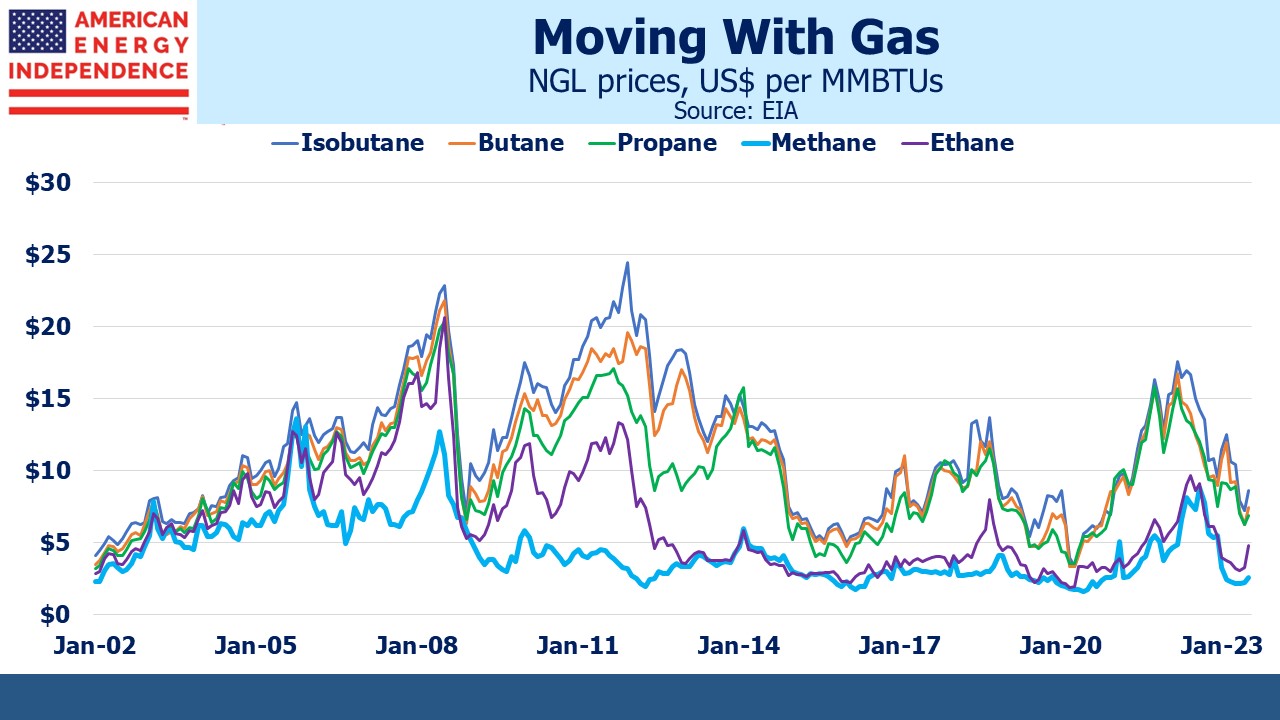

NGL prices typically move together, and for the most part they’re all more valuable than natural gas on an energy equivalent basis. The chart shows prices expressed in this form to equalize for the fact that each NGL has a different energy content, measured in Millions of British Thermal Units (MMBTUs).

Ethane occasionally dips below methane, which can lead to more of it being left in the natural gas stream that is delivered to homes and businesses. This is known as “ethane rejection” when the ethane isn’t valuable enough to justify separating it out from the methane.

Crude oil (not shown in the chart) is currently 5-6X more expensive than US natural gas on an energy equivalent basis. Crude oil is much easier to handle and transport, with transatlantic shipping costs of 3-7% of the price of the commodity. By contrast, converting natural gas to LNG so it can be moved by tanker can cost as much or more than the value of the commodity itself.

This also explains why, unlike crude oil, regional natural gas prices vary so widely around the world. It’s easier for price discrepancies to prompt oil arbitrage than for natgas. For example, US gas is among the cheapest in the world, but we have 12 billion cubic feet per day of LNG export capacity via liquefaction plants, so exports are capped by this physical constraint regardless of relative pricing.

January natgas futures for Dutch TTF, the European benchmark, are $14.50 per MMBTUs. January futures for the JKM benchmark used in Asia are $17.10. US Henry Hub January futures are $3.00. This is why US LNG export capacity is set to double over the next four years. The world wants more US natural gas, which will underpin prices here somewhat as more liquefaction plants come online.

In reviewing the many uses of NGLs, it’ll be clear that few of them can be replaced by renewables. Plastic bags, synthetic rubber, refrigerant, polystyrene and lubricants don’t lend themselves to being provided by solar panels or windmills. Climate extremists will argue that we should use less of all these products, but there’s little evidence of public policy embracing such a view. New Jersey outlawed plastic bags last year so we keep several cloth bags in the car for grocery trips. The United Nations Environmental Programme reported in 2020 that a cotton bag needs to be used 50-150 times before it has less climate impact than a plastic bag.

In 2018 the Danish Environmental Protection Agency suggested it was 7,100 times.

Nonetheless, I still carry my cloth bag conspicuously in the supermarket parking lot, especially when I see a Tesla driver. We both look disingenuously green. But I think our investments in natural gas infrastructure are more helpful to the planet than reusable grocery bags or electric vehicles, because they help reduce coal demand.

We have three have funds that seek to profit from this environment: