MLPs Glimpse Daylight

Tromso, Norway, sits 215 miles inside the Arctic Circle. It is one of the planet’s most northerly human settlements. Around January 25th at lunchtime, its inhabitants drop what they’re doing and gather outside for their first glimpse of the sun in two months. It’s only visible for four minutes, but the first natural shadows after interminable darkness are a welcome confirmation of Spring’s approach. One resident told a visitor, “If you haven’t lived through a winter like ours you can’t imagine what it’s like.”

This Fall our church welcomed a new rector. He’s English, which allows us to discuss Premier League football at a depth inaccessible to other congregants. His beautifully written sermons are delivered with humor and grace. A recent homily opened with Tromso’s dawn, and led to a discussion of maintaining religious faith during spiritual darkness. I hope our rector isn’t disappointed that for me, emerging from Tromso’s dark winter also evoked the secular feelings of an MLP investor maintaining conviction in the profitable path to American Energy Independence. If you haven’t lived through a bear market in energy when stocks are making new highs all year, you can’t imagine what it’s like. Sunlight can’t be far away. Even in Tromso, winter ends.

At their darkest, MLP fund outflows during 4Q17 were comparable to the worst of late 2015 and drove valuations relentlessly lower, creating a negative feedback loop. As income-seeking investors left the sector (see The Changing MLP Investor), the consequent selling has tested the conviction of others. Some just gave up – the relentless slipping of prices during a rip-roaring bull market in almost everything has eroded the confidence of many.

However, it’s looking as if December may be the dawn for battered energy infrastructure investors, with the late-year seasonal pattern once again playing out (see November MLP Fund Flows Overwhelm Fundamentals). The most recent data shows that the fund outflows have virtually finished. Taxes are probably the catalyst. In November (often the weakest month), uncertainty about what the GOP tax bill would ultimately mean for MLPs further damaged already fragile sentiment. Bloomberg’s The Senate Tax Plan Sets a Trapdoor for MLPs in late November epitomized the concerns some had about adverse tax changes.

Tax-loss selling has been another big influence. Most investors have realized gains this year and selling energy losers offers a way to reduce taxable gains. Moreover, winners are more plentiful than losers, leaving investors with few places to find losses other than among their energy infrastructure holdings.

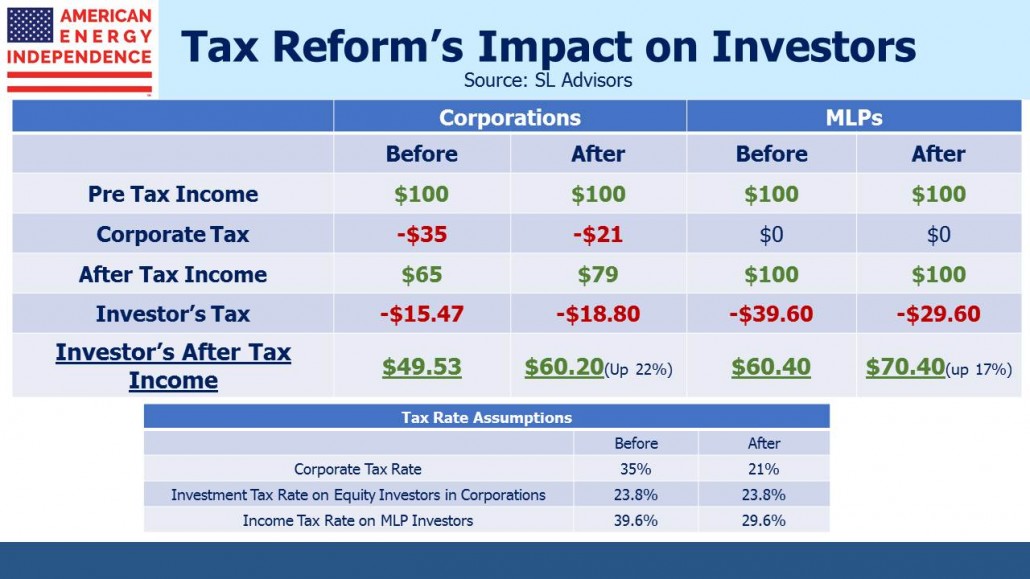

But taxes also provided support more recently, because the final legislation was beneficial to MLPs. The tax-deferred portion of distributions is typically taxed at ordinary income rates, but that will now benefit from the 20% discount for pass-through businesses. There was some further good news for General Partners (GPs), in that Incentive Distribution Rights payments will also receive preferential pass-through treatment rather than being taxed as ordinary income. In spite of initial concerns, given a few days to assess the final bill it’s clear it provides a welcome boost to the after-tax income of both MLP and GP investors. Bloomberg’s trapdoor wasn’t triggered. The table below reflects the final legislation passed by Congress last week.

The American Energy Independence Index (AEITR) is +4.5% so far in December. After a torrid few months, MLP returns are improving. Although the sector is still negative for the year, the AEITR has bounced +7.3% since the late November Bloomberg story mentioned above. For investors, it just might signal the start of sunny days once more.