MLP Investors Not Yet Convinced

Investors in Master Limited Partnerships (MLPs) have long become accustomed to daily fluctuations in crude oil affecting sentiment for the sector. The slide describing midstream infrastructure as a toll model with limited commodity sensitivity has been dropped from client presentations. It’s no longer credible. The Shale Revolution has shifted the industry from one of stable cashflows with modest growth to one where identifying growth opportunities is the most important element of security selection. It’s why this is the most attractive sector in the equity market.

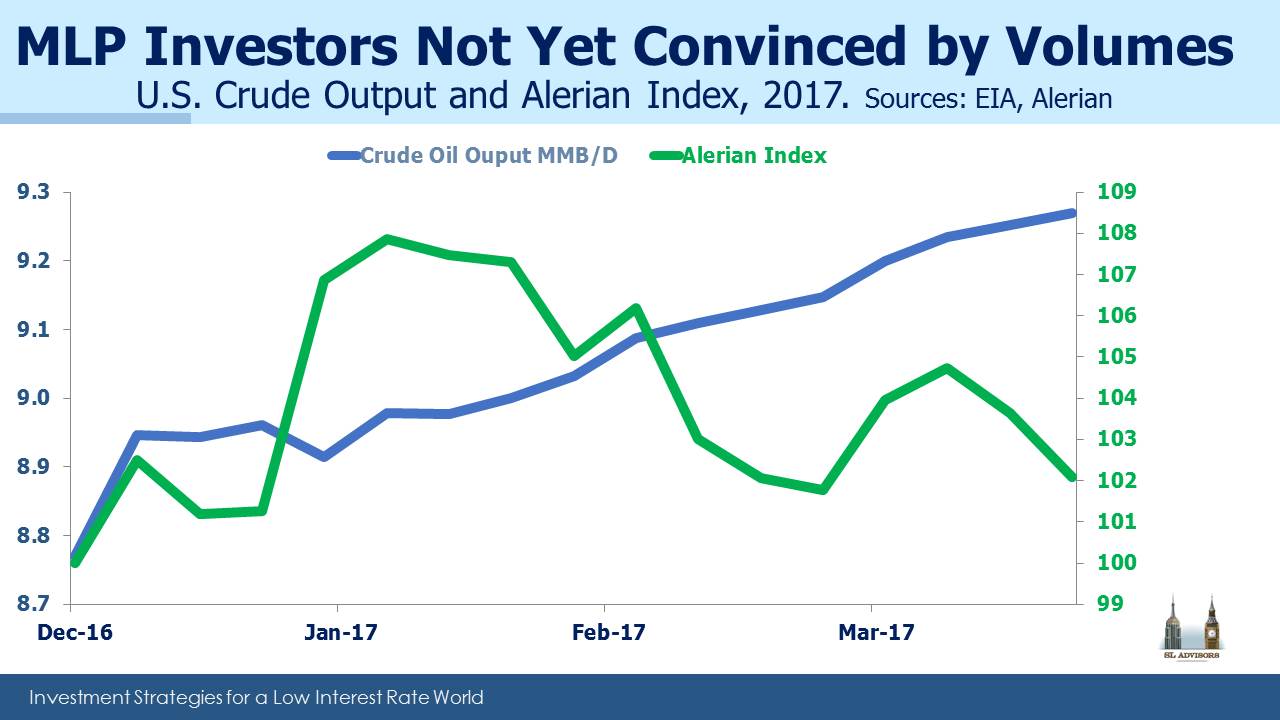

The feedback loop between oil prices and MLPs persists – for short-term traders, lower crude suggests lower U.S. output and vice versa. Daily moves in commodity prices cause investors to recalibrate their MLP appetite, respecting the past pattern that oil and MLPs are irretrievably linked.

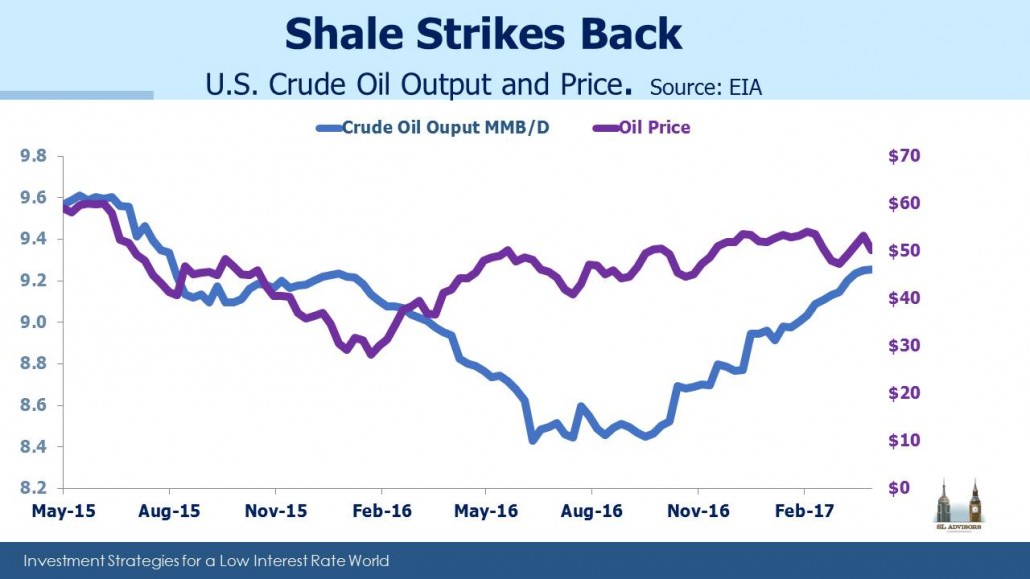

Oddly though, U.S. oil production seems fairly insensitive to prices. As the above chart shows, volumes have been increasing steadily even though the oil price has been going nowhere. It remains stubbornly below OPEC’s $60 objective following their strategy shift in November. During the collapse in 2015 MLP investors feared declining volumes would hurt cashflows, although the preponderance of long term shipper commitments meant that operating results were only modestly affected. Today, all the signs are that volumes will continue increasing. MLP investors are not yet convinced.

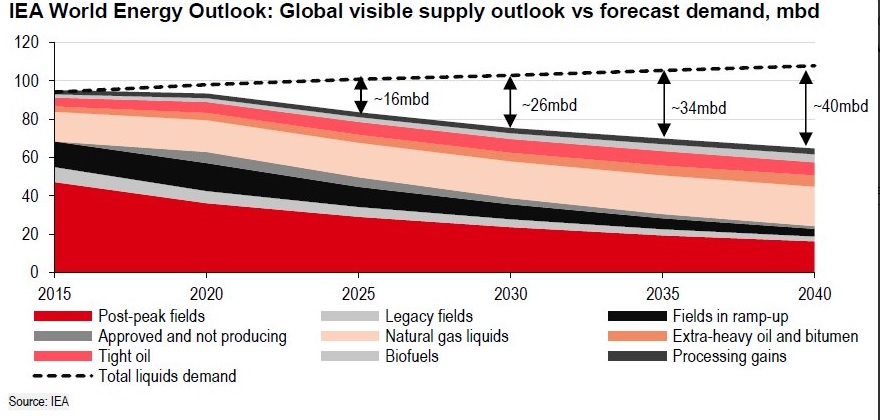

As we noted last month (see Why Shale Upends Conventional Thinking), short-cycle projects are commanding an increasing share of capex budgets of the biggest oil companies because they’re less risky. Shale projects generate output with far less up-front investment, allowing greater synchronization of capital deployed with revenue earned. This should also result in lower oil price volatility. The long lead-time of conventional projects means the supply response function is very slow. A spike in oil prices can’t easily induce immediately greater conventional supply. Short-cycle projects are much more responsive to price. U.S. shale drillers were able to curb unprofitable production quite quickly even while dramatic improvements in productivity allowed output to remain far more robust than OPEC expected. Unfortunately for oil traders, it’s likely to be a far less exciting market than in the past, because the U.S. is increasingly a nimble supplier easily able to adjust supply as conditions warrant.

Earlier last week Plains All American (PAGP) announced open season on a pipeline system from the Permian in West Texas to Cushing, OK. Recent quarterly earnings reports showed that most MLPs have plans to increase capacity in anticipation of greater volumes. In West Texas Leads a New Oil Boom we noted the entry of Exxon Mobil (XOM) into shale. They’re far better able to maintain their investment spending through a cycle than the independent drillers that came before them, which will in turn reduce volatility in output.

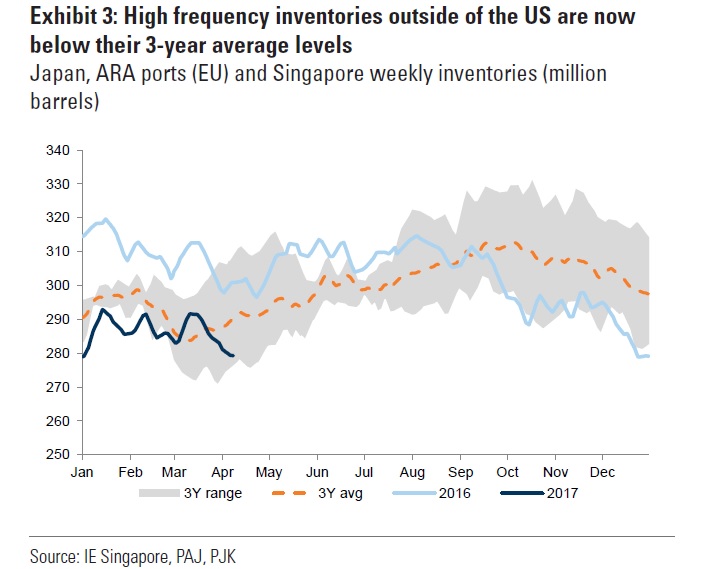

While the U.S. is increasing output, supply is shrinking elsewhere. The International Energy Agency forecasts a growing global supply shortfall, the result of the sharp capex reduction that’s taken place since 2014 (see America Is Great!). For the same reason, the head of Saudi Aramco warned of a looming oil shortage. Goldman Sachs (see chart below) noted that global oil inventories are the lowest in three years. It doesn’t look as if we’ll be short in the U.S., but globally there are plenty of reasons to expect gradually tightening supply.

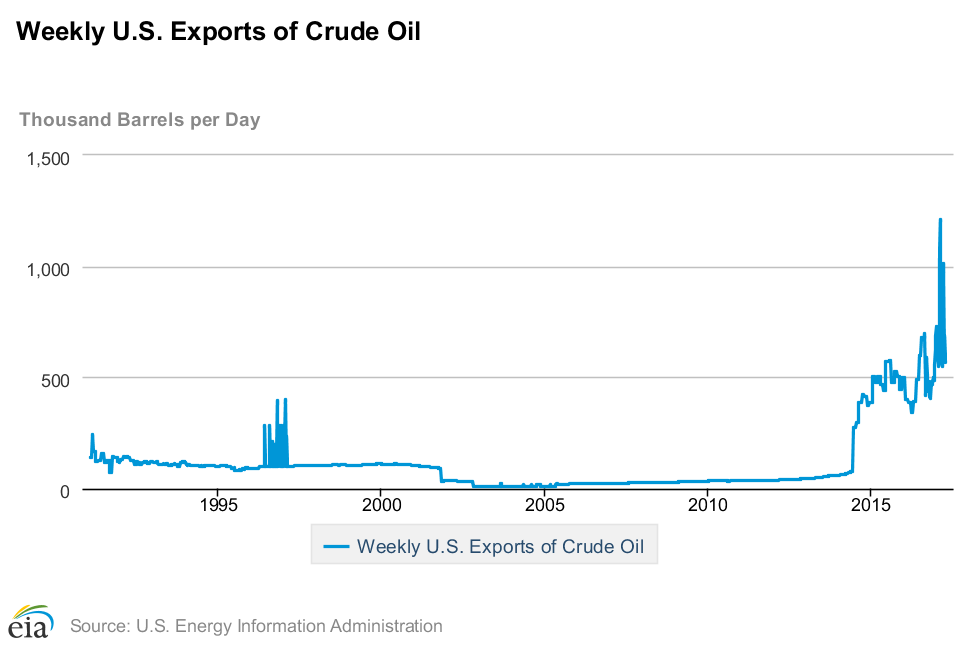

Consistent with this, U.S. exports have also been increasing since Congress lifted the export ban in late 2015. Prior to that, U.S. oil could only go to Canada, and while they’re still our biggest buyer, the next three in 2016 were the Netherlands, Curacao and China.

Investing in businesses positioned to benefit from the growing need to transport oil (PAGP), store it (NuStar GP Holdings, NSH) and provide sand for fracking (US Silica, SLCA) hasn’t been especially rewarding this year. But the signs increasingly point to growing demand for the assets and services provided by companies such as these.

We are invested in NSH, PAGP and SLCA