Midstream Earnings Wrap

Midstream earnings are in, and generally met expectations as has been the case for the past several quarters. Williams Companies (WMB) enjoyed record natural gas gathering volumes of 18 Billion Cubic Feet per Day (BCF/D). This drove 2Q23 adjusted EBITDA of $1,611MM, versus analyst expectations of $1,568MM.

Liquefied Natural Gas (LNG) exporter Cheniere continued a run of positive surprises with a 13% beat of sell-side expectations and once more raised full year EBITDA guidance. Their success contrasts poignantly with the declining fortunes of founder and former CEO Charif Souki, forced out by activist Carl Icahn in 2015. The following year Cheniere began shipping LNG, and today their 6 BCF/D in volumes represents around half of US LNG exports.

Souki went on to found Tellurian (TELL), best described as a “Cheniere wannabe”. Tellurian has been trying for years to sign up customers and raise the capital required to build Driftwood LNG, an export terminal along Louisiana’s Calcasieu River. Souki is either a visionary who was early to recognize the export potential of US natural gas, or an entrepreneur with excessive risk tolerance always looking to enrich himself first. He’s probably a bit of both. When you invest with Souki, you know he’ll make money; you just don’t know if you will. Some have speculated that TELL would have more success raising capital with a new CEO.

We noted Souki’s proclivity for excessive upfront compensation early this year when he negotiated $20 million in annual compensation even though Tellurian is years away from shipping any LNG (see Tellurian Pays For Performance in Advance). Developing Driftwood still looks like a long shot.

Souki routinely borrows against his own stock holdings. In early 2020 when TELL was plunging along with the rest of the energy sector, a margin call forced him to dump shares he owned. More recently, weakness in TELL led UBS to seize Souki’s 30-meter carbon fiber hull yacht Tango, pledged as security.

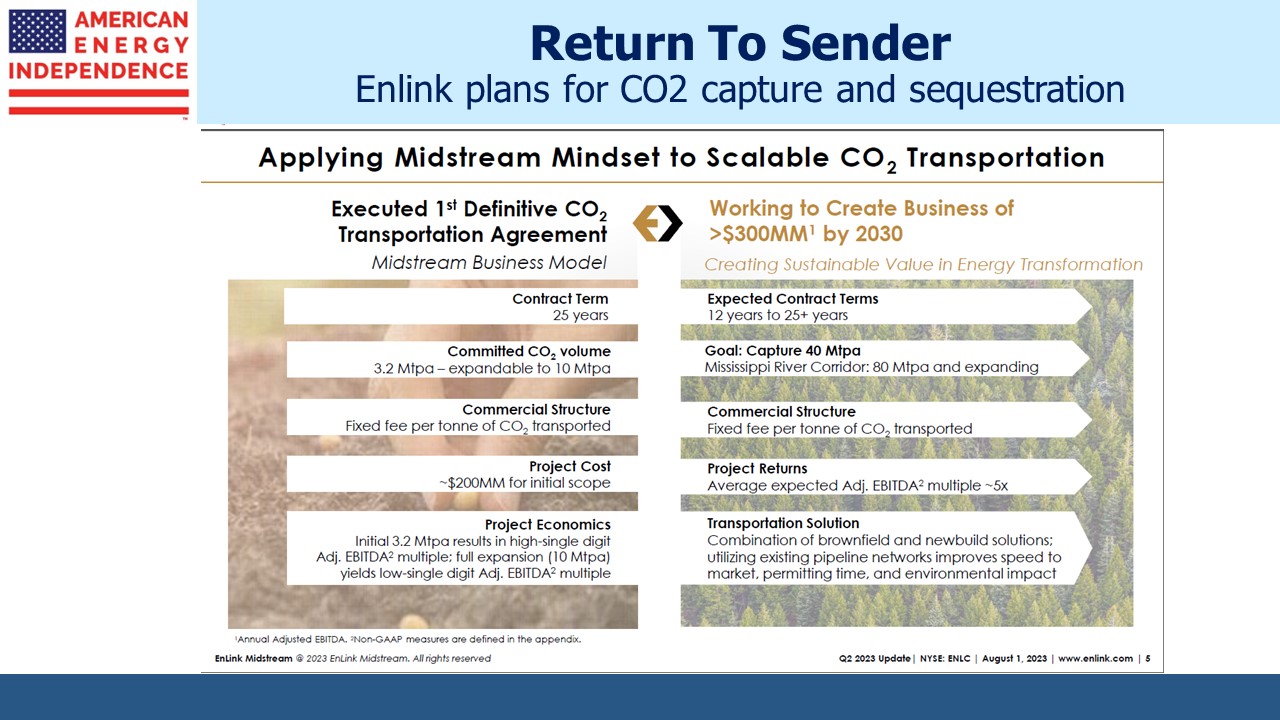

Every midstream company has something to say about their energy transition opportunities. Last year’s Inflation Reduction Act (IRA) increased the tax credits available for Carbon Capture and Sequestration (CCS). At its most generous, the Federal government will pay $180 per metric tonne for CO2 that is extracted out of the ambient air and permanently buried underground.

Even though a generation of young people is growing up mortally afraid that rising CO2 levels represent an existential threat, at around 412 parts per million (0.04%) it’s thinly dispersed in the air around us, and therefore expensive to extract. Nonetheless, Occidental (OXY) is building the world’s biggest CCS facility in Texas. In a few years expect to read that IRA tax credits are offsetting OXY’s tax liability on its conventional oil and gas business.

Sometimes the right geologic formation to permanently hold CO2 is the same one from which natural gas (CH4) was originally extracted. There’s an appealing symmetry in sending the carbon atoms back home after they’ve been separated from the four hydrogen atoms they arrived with while generating a useful chemical reaction that’s left them bonded with two oxygen atoms instead.

EnLink (ENLC) is better positioned than most to do this, since they provide natural gas to a number of petrochemical facilities along the Mississippi River corridor. The emissions from these facilities have far higher concentrations of CO2. 50% or more isn’t uncommon. ENLC is exploring opportunities to capture some of this CO2 and send it in dedicated CO2 pipelines back towards the region that provided the natural gas whose combustion created it. They estimate that they can earn an EBITDA return of around 20% on invested capital. Midstream energy infrastructure long since stopped being threatened by the energy transition and is instead becoming vital to it.

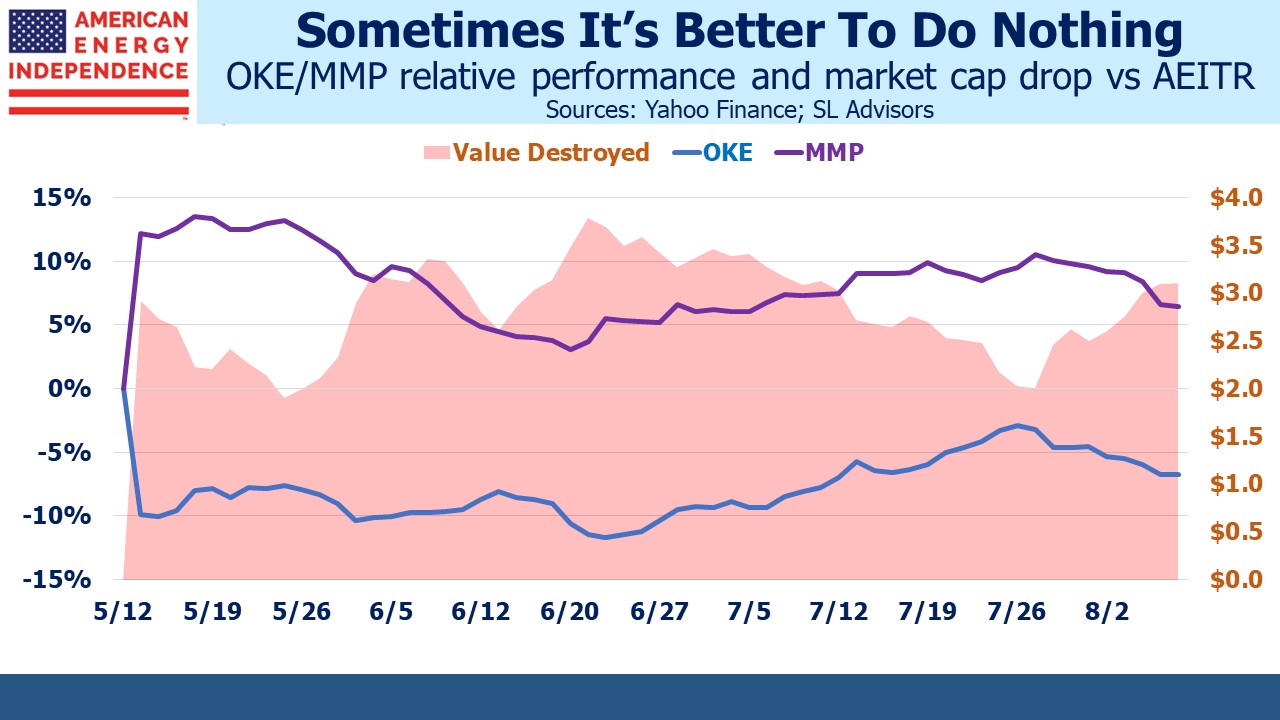

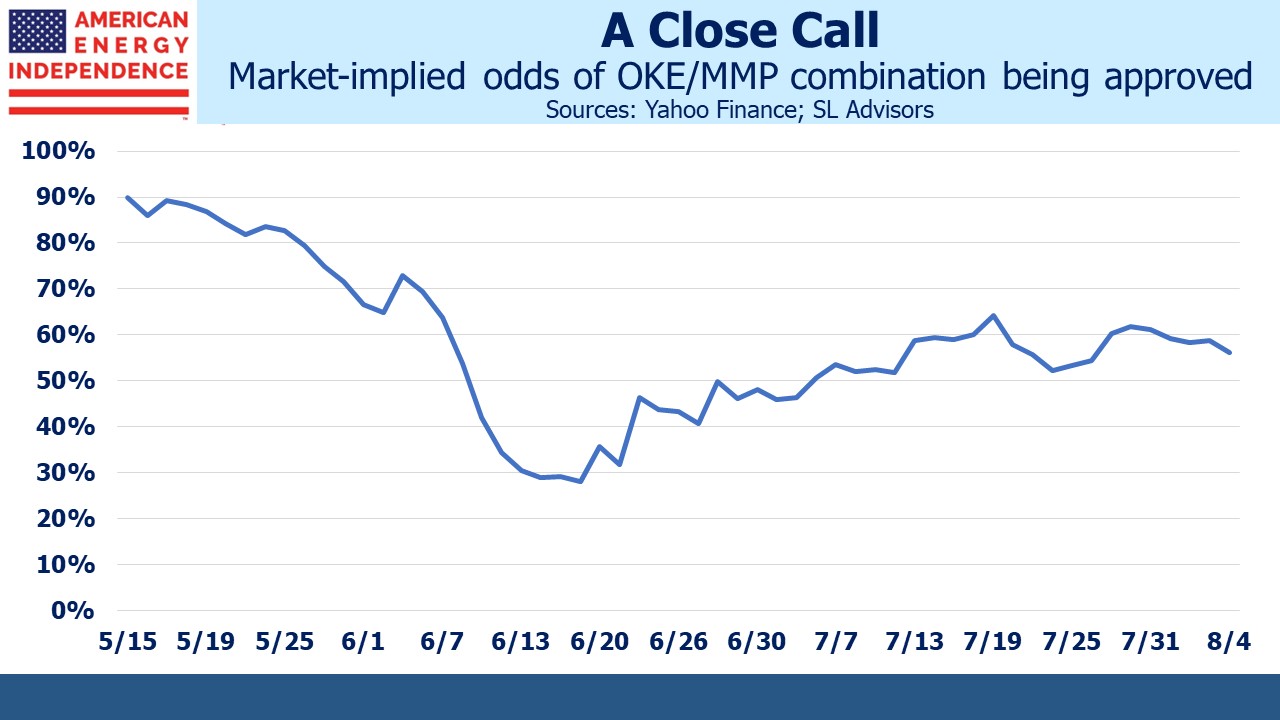

Magellan Midstream (MMP) and Oneok (OKE) reported good earnings as investors in both companies vote on their proposed merger. MMP’s adjusted EBITDA was 8% ahead of expectations and they raised their standalone EBITDA guidance for this year by 2%. OKE 2Q EBITDA beat expectations by just under 4%, and matched MMP’s full year increase in EBITDA guidance of 2%. One might ask why they need to combine when business seems to be going so well.

Votes on the merger are being counted this week, and the market-implied odds of its passage remain finely balanced. We estimate that $3.1BN in value has been destroyed since the announcement in May. Both companies have scheduled a special meeting of shareholders for September 21, at which point the result will be announced. It looks like being a nailbiter.

We have three funds that seek to profit from this environment: