Liberal Energy Policies Remain Good For Investors

The energy transition’s long overdue reassessment was already under way by the time Russian missiles began falling on Ukraine. Fear of stranded assets has been replaced by the sudden need for energy security.

At a recent JPMorgan energy conference, CEO Jamie Dimon repeated his call for a new “Marshall Plan” to ensure energy security for the US and our allies. Appropriately this took place during a “fireside chat” with Cheniere CEO Jack Fusco, who noted that his company provided 1/3rd of Europe’s natural gas imports during 1Q22. Many have noted that there can be no energy transition without energy security. Few companies are more important to Europe in avoiding natural gas rationing this winter.

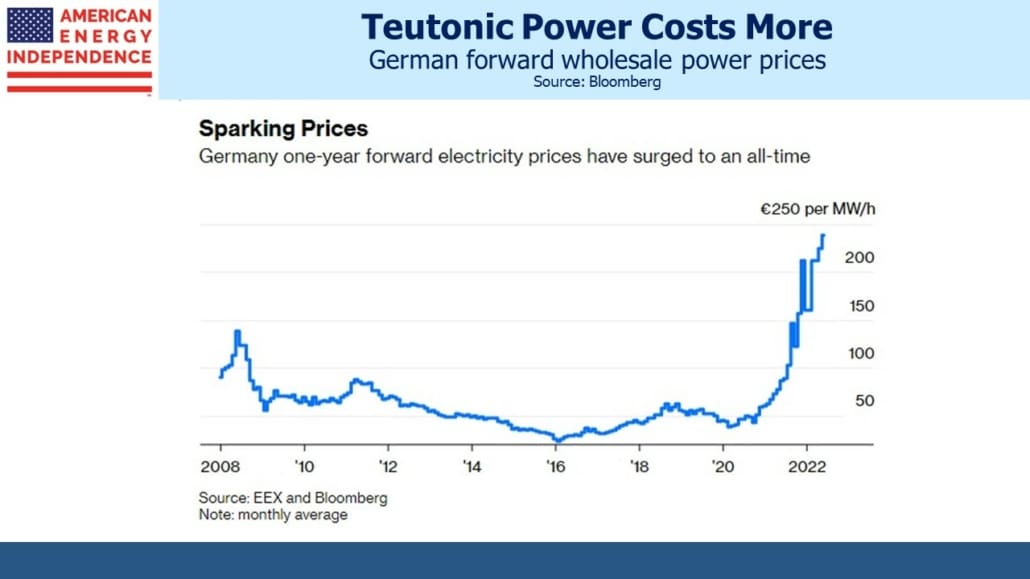

In JPMorgan’s annual report, Dimon reminded that, “… using gas to diminish coal consumption is an actionable way to reduce CO2 emissions expeditiously.” Dimon is no climate change denier but is pragmatically identifying profitable business for the bank. Purists fret that building new infrastructure to support imports of Liquefied Natural Gas (LNG) means locking Europe in to burning fossil fuels for several decades, inconsistent with the UN zero by 50 mission. Meanwhile, German wholesale electricity prices one year out have breached €200 per MWh, up 4X over the past year.

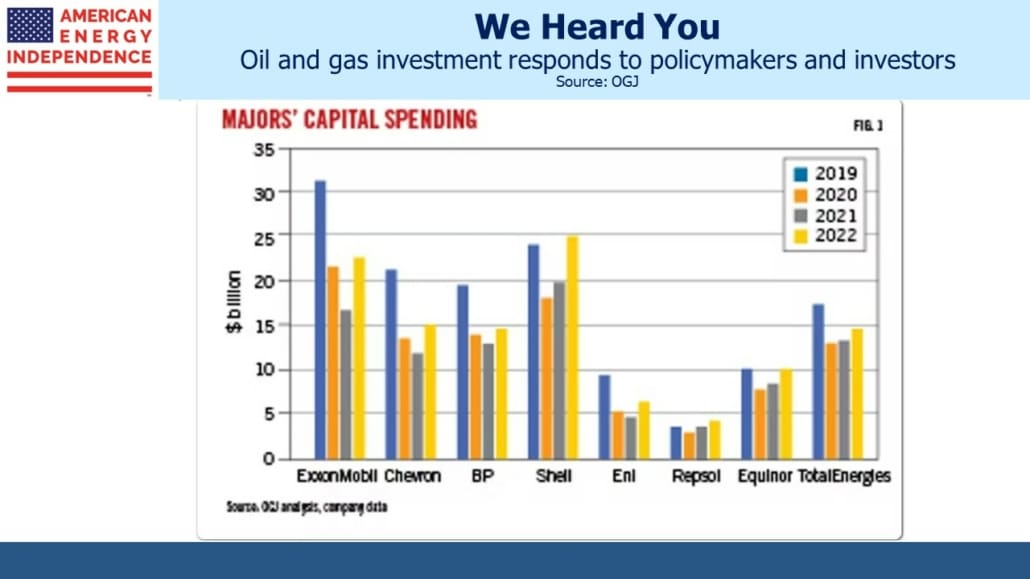

Capital investment in future oil and gas production has been falling for years. The poor returns following the shale bust are the immediate cause, but the message from policymakers has been clear. Oil and gas look like a risky long term investment when governments are promising to stop using fossil fuels just as soon as they can. Now western leaders are acknowledging the public’s ephemeral concerns about climate change, which last until the costs are visible. Higher oil doesn’t seem to have caused a spike in windmill prices. St Augustine* might have said “Lord, give me renewables, but not yet.”

The problems of underinvestment aren’t limited to oil and gas. Goldman’s Jeff Currie expects oil prices to reach $140 per barrel during the summer. In a recent CNBC interview he said, “At the core of our bullish view of energy is the underinvestment thesis.” Currie noted that this month’s pullback in energy sector equity prices would exacerbate the problem by reflecting a withdrawal of capital from a sector that needs it in order to increase production.

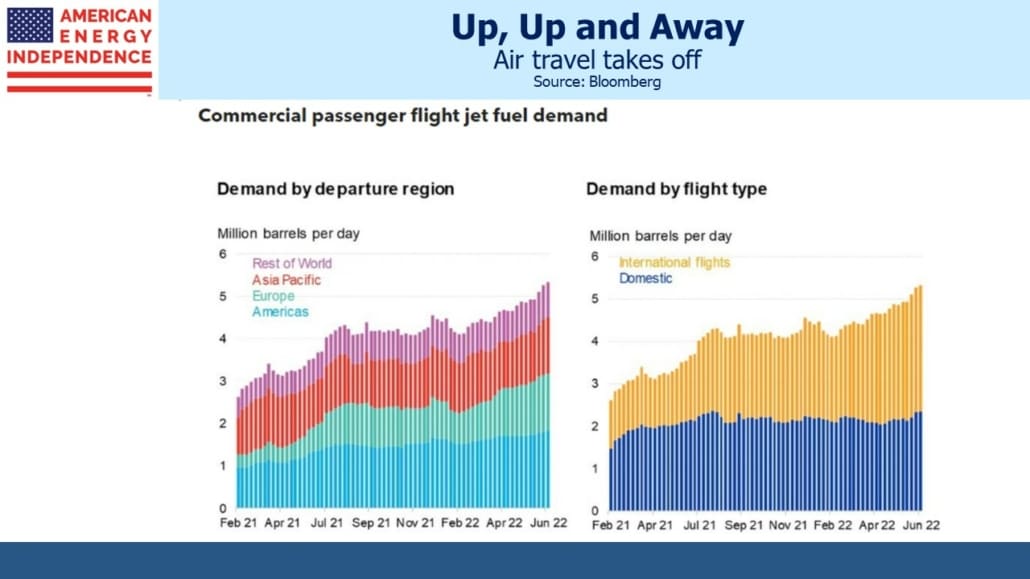

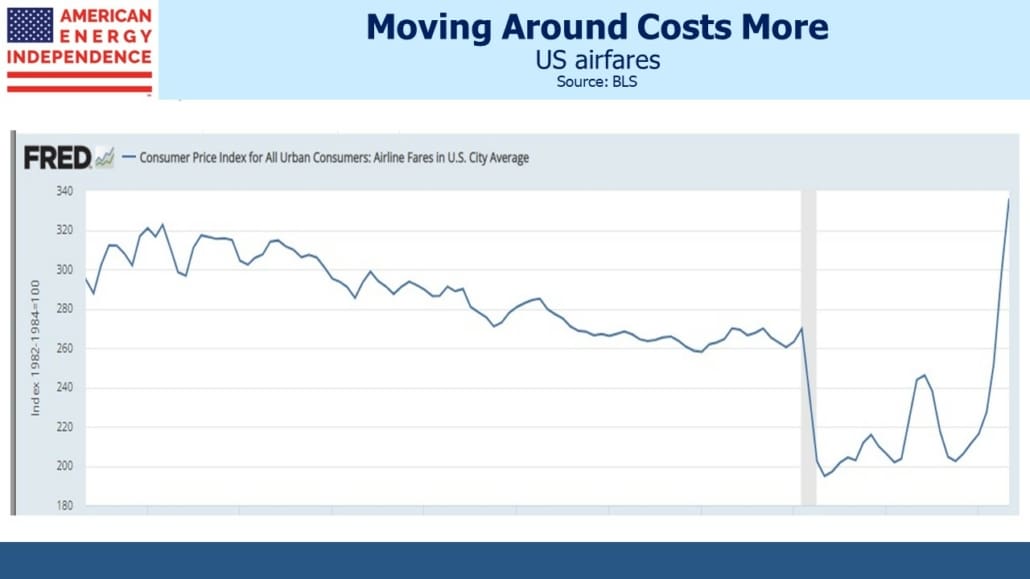

The International Energy Agency (IEA) expects global crude oil demand to increase by 2% next year, taking it above pre-Covid levels to a new all-time high. US airline fares are up 38%. In spite of this, more people are flying around the world, with the aviation sector representing 5% of crude oil demand. International travel is growing the fastest.

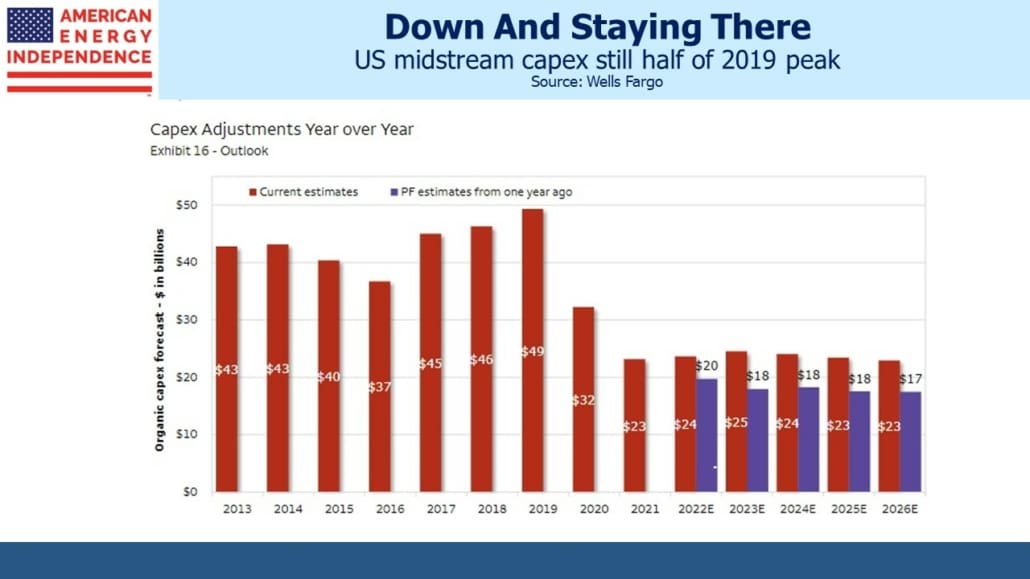

Although global capex is up this year among the world’s biggest oil and gas companies, it’s still down by around a fifth from 2019. This downtrend dates back to pre-Covid, when policymakers were freely vilifying the energy industry. The collapse in prices in 2020 was a further incentive to impose financial discipline.

There’s an illuminating clip from the recent G7 meeting during which French President Macron tells President Biden that the United Arab Emirates is producing at maximum capacity while the Saudis have perhaps a small amount of extra capacity, for the next six months. One might think that Biden wouldn’t need a foreign leader to point this out to him, but this Administration’s energy policy does remind of the Keystone Kops.

Fortunately, in its final communique the G7 said investment in liquefied natural gas was a “necessary response to the current crisis”. It added: “In these exceptional circumstances, publicly-supported investment in the gas sector can be appropriate as a temporary response.”

With gasoline prices rising and little prospect of relief, it’s not hard to see the Republicans running as the party of cheaper energy. They have little useful to say on curbing emissions, so the appeal of such a message will reflect Americans’ concern about climate change. White House actions suggest that they believe only the liberal wing is willing to rapidly phase out fossil fuels. They’ve assessed that swing voters care more about what they pay at the pump.

Therefore, a Republican-controlled Congress following the mid-terms could pass legislation supportive of increased investment in domestic oil and gas production – by making it harder for endless court challenges to block infrastructure projects for example. Signing or vetoing such a bill would offer an uncomfortable choice for a lame duck president.

For now it seems meeting demand growth for traditional energy will drive prices higher. There’s little sign of demand destruction at current levels, and China is still enduring partial lockdowns.

*St Augustine is credited with saying, “Oh Lord, give me chastity, but do not give it yet.”

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.