Learning From EU Mistakes On Energy Policy

The other day my partner Henry Hoffman was commenting on what his family pays for natural gas to heat their home in Pelham, NY. Winters in the northeast US are not for everyone – your blogger misses most of the worst weather by evacuating to Florida for a few months.

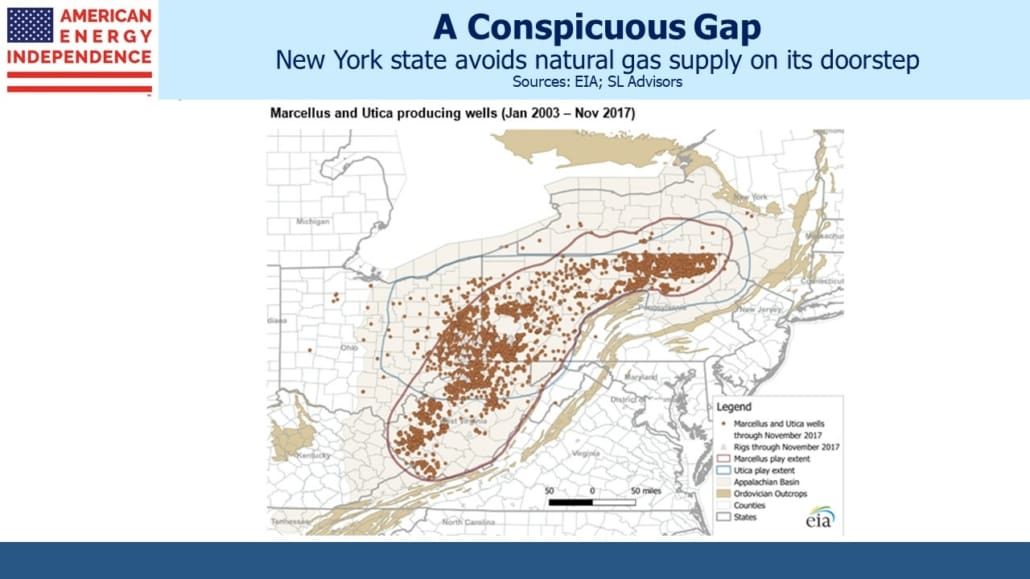

Natural gas is the most common source of heat in most northern homes. The US continues to enjoy the supply benefits of the Shale Revolution, although those benefits are spread unevenly. Pennsylvania became a huge source of natural gas that has kept prices low for those that use it.

US states have significant influence over energy policies. Where climate change is a concern of political leaders, what typically follows are poorly conceived progressive strategies that increase prices and create inconvenience for residents of that state. New Jersey, New York and Massachusetts are three states well positioned to rely on natural gas from the Marcellus shale. Their energy policies could be dubbed “Left-leaning” (NJ), “Liberal” (NY) and “Wacky” (MA).

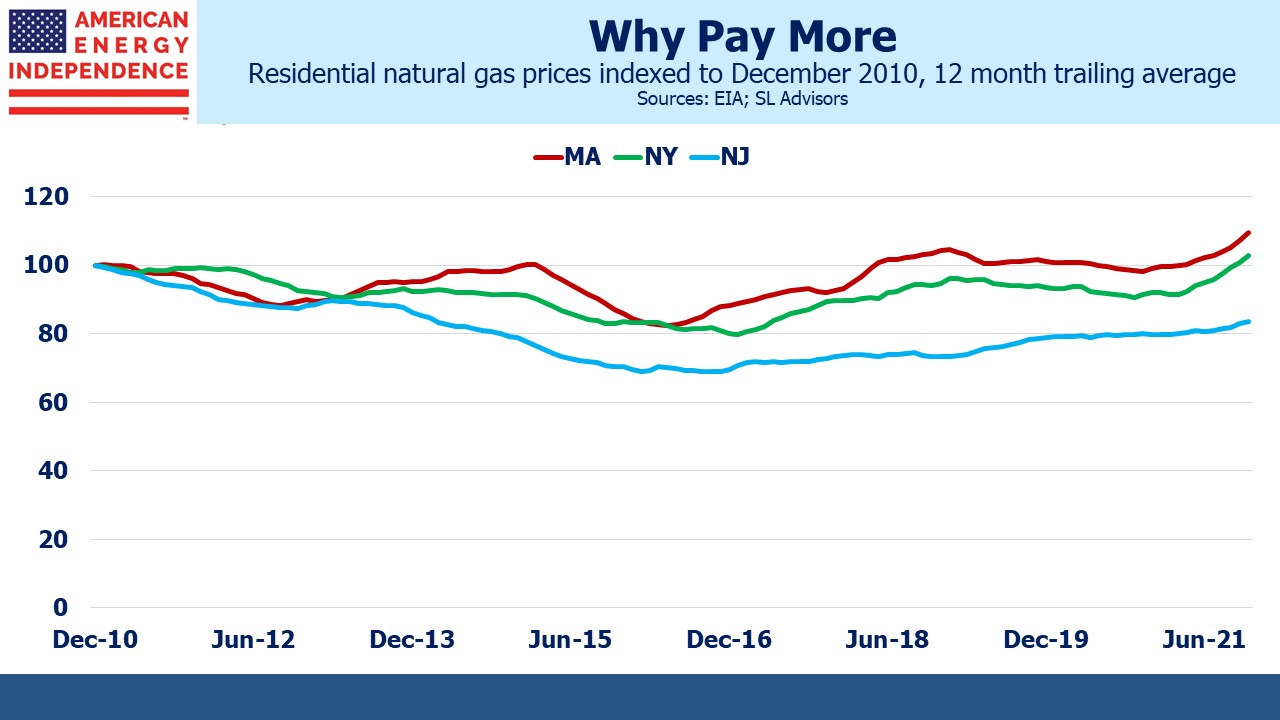

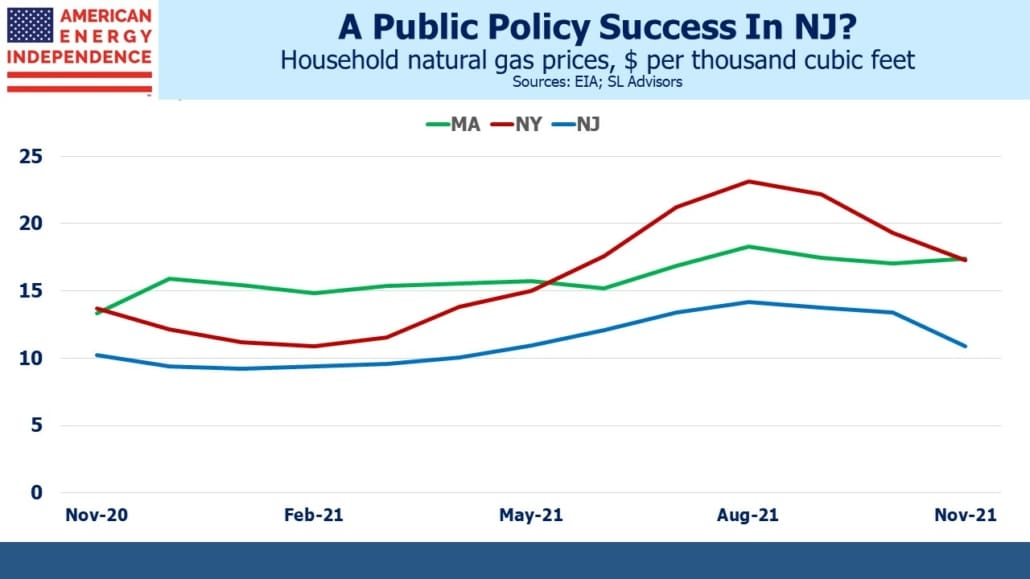

NJ passed legislation in 2020 mandating an 80% reduction in greenhouse emissions by 2050. Among other steps it is developing offshore windpower. So far, these efforts haven’t been too disruptive to life as we know it. The Energy Administration Information shows that in 2020 NJ’s power mix was 50% natural gas and 2% solar and wind. NJ households are paying 17% less for natural gas than a decade ago.

New York state’s governor wants to ban natural gas connections to new buildings in the state, copying a similar plan enacted in New York City. The Marcellus shale even extends into the state, but no drilling is allowed. New York’s power mix is 41% natural gas and 4% solar and wind. NY households have seen natural gas prices rise 3% over the past decade even though the US is a significant exporter and has some of the world’s cheapest supply.

Massachusetts, which relies on natural gas for 78% of its electricity generation (9% solar and wind) and half of its residential heating, has blocked new gas pipelines coming into the state in spite of the fact that they are so dependent on it. Boston regularly imports Liquified Natural Gas (LNG) from the Caribbean and in the past has even bought from Russia. This forces them to compete with European and Asian buyers who have paid prices 10X or more higher than US domestic prices in recent months. Massachusetts has completely missed the benefits of increased US supply, with prices 9% higher than a decade previously.

Energy policy in Massachusetts has managed to combine heavy reliance on natural gas with impediments to access it. Such masochistic virtue signaling receives scant attention other than from the self-congratulating political leaders who have engineered such an outcome.

The result is that over the last decade or so, average natural gas prices in NJ have trended lower than those in more progressive NY and MA. I hesitate to hold NJ up as an example of enlightened energy policy, because there are Democratic political leaders in Trenton probably envious of what NY and MA policymakers have imposed on their residents. But at least NJ isn’t importing LNG from foreign countries.

US states can learn from Europe, where excessive reliance on renewables has led to an energy crisis with eye-watering prices for natural gas. The UK is an example. It gets around a quarter of its electricity from renewables – mostly wind from the usually reliable North Sea. But northwest Europe isn’t always windy, and that contributed to the UK’s sudden increased reliance on natural gas and coal. Renewables are not just limited to sunny/windy days; when they don’t produce they all go down at the same time. Dispatchable energy sources such as natural gas have diversified uptime risk. Ten independent plants are unlikely to fail simultaneously.

One result is that the UK regulator has approved an increase in the cap on household energy bills that will see more than 50% hikes for many within a couple of months. The government has responded with income-based subsidies to soften the blow, only three months after pressing the COP26 Climate Change conference to eliminate “inefficient fossil fuel subsidies.”

Germany has among the most expensive electricity in the world, also because of their switch to renewables.

These expensive and not very impactful moves away from cheap, reliable energy are swamped by increasing emissions in emerging countries such as China, which doesn’t plan to reduce emissions before 2030. This is because they value raising living standards more than curbing emissions, a reality overlooked by climate extremists attempting to impose dysfunctional policies on western communities.

It’s becoming increasingly clear that the energy transition will be disruptive and expensive. Politicians suggesting anything less are not thinking through the issues.

The EU has been farther ahead in seeking to reduce CO2 emissions. As a result, they’ve confronted more of the problems than most US states, and offer some useful examples. In a triumph of pragmatism over religious fervor, the EU recently defined natural gas and nuclear power as clean energy. There are caveats, such as that the natural gas must be displacing a coal-burning power plant and have CO2 emissions below a reasonably achievable threshold.

It’s a sensible move. So far the energy transition has delivered more expensive, less reliable energy without any discernible impact on emissions. Sharply higher prices will test the strength of public support for climate ambitions. States like New York and Massachusetts would be well served to follow the EU’s lead. Cheap natural gas is right on their doorstep.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.