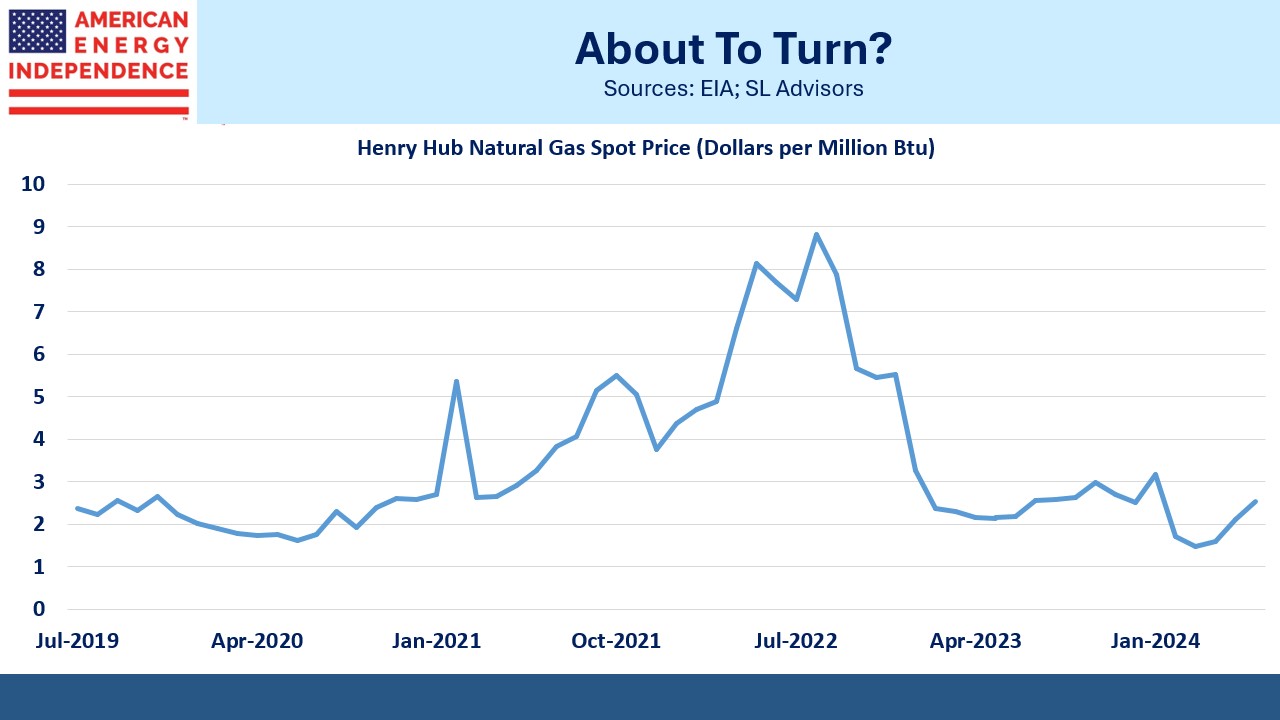

Is Natural Gas Turning?

US natural gas is the cheapest in the world. December TTF futures on the European benchmark are $13 per Million BTUs (MMBTUs). The Asian JKM benchmark is $12.50. The US Henry Hub December futures are at $3.15. Fracking has become ever more efficient, allowing production to continue even at prices that seem ruinous.

Range Resources (RRC), a natural gas producer in the Marcellus and Utica shales in Pennsylvania, is expected to generate net income of over $400MM this year on a realized sale price of $2.60 for its natural gas. JPMorgan forecasts $750MM next year at $3.30. A few years ago such low prices would have been thought unsustainably low.

Cheap natural gas has been a huge boon for America. It underpins our cheap electricity, although increasing reliance on solar and wind is offsetting (see Renewables Are Pushing US Electricity Prices Up). Gas-fired power generation recently hit a new record (see Cash Returns Drive Performance).

Gas remains our biggest source of electricity, and by displacing coal plants has been the most important contributor to falling US CO2 emissions. Cheap, reliable energy has attracted foreign investment, creating jobs while western Europe cuts emissions by de-industrializing.

Horizontal drilling and hydraulic fracturing (“Fracking”) unlocked enormous supplies of US oil and natural gas. Kamala Harris used to be against fracking, but like Joe Biden did before, has now changed her position given the importance of swing state Pennsylvania in November.

How long can gas stay this cheap? Investors Leigh Goehring and Adam Rozencwajg think the turn in prices is near. Their reasons begin with declining growth in production, coinciding with some large fields having produced half of their recoverable reserves. They think the Energy Information Administration’s (EIA) production forecast of 105 Billion Cubic Feet per Day (BCF/D) next year is too optimistic.

The demand side starts with Liquefied Natural Gas (LNG). The price gap between US and foreign markets is easily sufficient to support LNG exports – currently running at 12-13 Billion Cubic Feet per Day but soon to rise as new export terminals become operational. They see an additional 5 BCF/D within three years. Other forecasts expect a doubling by 2030.

AI data centers’ need for power will rely substantially on natural gas. This isn’t just because it’s reliable, not dependent on sunny weather. Electricity from solar and wind includes more harmonic distortions which can be unsuitable for the sensitive hardware use by AI models. There are technologies to reduce such distortions but they add cost.

Power demand is already increasing. The Southern Company, which supplies electricity to Virginia, reported that demand from existing data centers was up 17% in 2Q24 compared with a year earlier.

Natural gas bulls have endured plenty of false starts in recent years, other than the spike that followed Russia’s invasion of Ukraine two years ago. But circumstances may finally be aligning to push prices higher. It looks like an appealing bet.

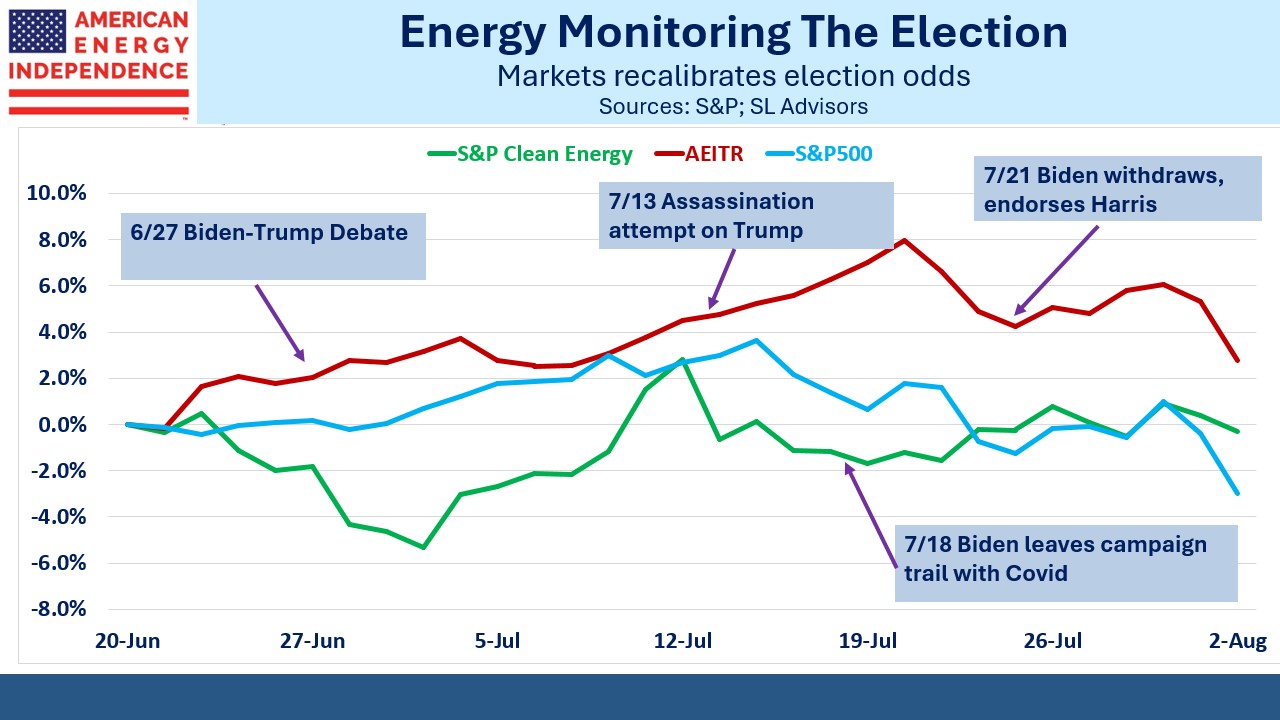

Complicating this outlook is the narrowing polling gap between Trump and Harris. Betting markets still favor Trump although his lead has halved. Energy markets have been attuned to the fluctuating outlook, with the S&P Global Clean Energy index a useful barometer for the odds of a Trump victory.

The spread in relative performance between the American Energy Independence Index (AEITR), or traditional energy, versus renewables, peaked just before Biden withdrew from the race. Since then it’s narrowed – it’s either the Harris Honeymoon or relief that it’s no longer a duel between two old men, depending on your perspective.

Kamala Harris is left of Biden – chosen in part to secure the votes of progressives four years ago. So she’s not obviously good for energy investors. But as with Biden, the actual effect could be nuanced. Left wing energy policies tend to focus on constraining energy supply rather than demand, with the hope that renewables will benefit. It discourages new capex as we’ve seen under Biden (hug a climate protester).

Republican policies favor deregulation, making it easier to produce oil and gas.

One way to think of it is that Republicans are good for domestic output while Democrats are good for prices. Crude oil is a global market and forecasting how a President Trump might affect prices means assessing policy choices towards Iran and Russia.

But natural gas exists as regional markets, so US prices will be driven by domestic considerations. Restricting supply will be hard, but limiting demand will be harder. Owning natural gas producers, such as RRC, may be a hedge on a Harris election win. If it happens, energy investors may feel they’ll need something to cheer them up.

We have three have funds that seek to profit from this environment: