Interesting Perspectives from Plains All American's Investor Day

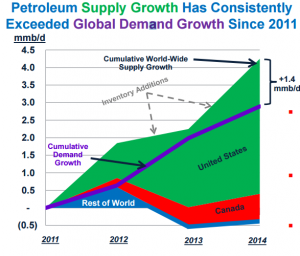

Plains All American Pipeline (PAA) held their Investor Day on Thursday. The presentations included a fascinating analysis of the global oil market with a view to forecasting prices as well as regional supply/demand, since these are important drivers of PAA’s planned infrastructure development. The chart at the left, reproduced from PAA’s Investor Day deck, plainly shows the impact of growing North American output on the global market. Since 2011 global supply has increased by a little over 4 MMB/D, 1.4MMB/D in excess of demand growth which is why inventories have gro wn. Moreover, North America has met more than 100% of this increase in global demand, since output in the rest of the world has net fallen somewhat. This simple graphic illustrates as well as anything that the Shale Revolution in the U.S. has not just been a North American story but has impacted the global oil market, most obviously through the drop in prices since last Summer.

wn. Moreover, North America has met more than 100% of this increase in global demand, since output in the rest of the world has net fallen somewhat. This simple graphic illustrates as well as anything that the Shale Revolution in the U.S. has not just been a North American story but has impacted the global oil market, most obviously through the drop in prices since last Summer.

A corollary to this is that growing U.S. production is reducing import demand, as U.S. refiners process more domestic crude oil. However, U.S. refineries are generally better able to process the heavy crude that we’ve historically imported, and the light sweet crude that is typically produced from domestic fields is not as good a fit for many refining facilities. There are also distribution bottlenecks which are gradually being alleviated, but in combination these two factors along with the ban on crude oil exports account for the discount of WTI crude compared with Brent.

The export ban dates back to the 1970s, and looks increasingly anachronistic today. You might expect the oil industry (excluding refiners who benefit from captive suppliers) to favor repealing the export ban. Greg Armstrong, PAA’s CEO, acknowledged the free market argument in favor of doing so but also conceded limited political support for such a move. It would seem intuitive that allowing domestic oil to be sold overseas would raise its price and therefore increase the cost of domestic refined products, including gasoline, which explains the limited political support.

Surprisingly though, quite a number of independent studies have concluded that allowing U.S. exports of crude oil would lower domestic gasoline prices. The analysis predicts that selling U.S. oil on the world market would increase global supply and further stimulate domestic production, thereby lowering gas prices. It’s not obvious; unsurprisingly, the American Petroleum Institute makes the case but among the many sources they cite are included the Federal Reserve Bank of Dallas and the Congressional Budget Office, two entities not that connected to E&P. So although political support isn’t strong today, the economic case is more supportive than you might first think. Lifting the ban would be good for the domestic energy industry including infrastructure.

On a different topic, Greece is once again in the news as another critical deadline approaches. It may not be much appreciated or even known by their creditors, who are now largely the IMF and the ECB, but as I wrote in Bonds Are Not Forever, since gaining independence from Turkey in 1822 Greece has been in default approximately 50% of the time. Given this checkered history as a reliable debtor, the repayment expectations of Greece’s creditors are barely credible. Under the capital guidelines on developed country debt in force prior to the 2008 financial crisis, Greece’s debt drew the same capital requirements as Germany’s for those banks which held it (which were numerous), in willful defiance of history as well as common sense. Much of that debt is now held by their current creditors, having been transferred from private hands to public in a prior renegotiation. But it seems to me that if it’s stupid to borrow what you can’t repay, it’s stupider to lend what probably can’t be repaid. Greece is an example of the general abundance of debt in the financial system. While not every borrower is Greece, today’s bond investors are offered an unlimited supply to choose from, yet at yields that would suggest scarcity. The thoughtful bond investor is switching asset classes.

We are invested in Plains GP Holdings, the General Partner of PAA.