How to Profit From MLPs Overnight

A few months ago the NYTimes ran an interesting piece on the difference between intra-day and overnight returns on the stock market. The article compared a strategy of buying on the open and selling every day at the close (“IntraDay”), with a strategy of buying on the close and selling the next morning at the open (“Overnight”). Using the S&P500 ETF (SPY), they found that the returns to the Overnight strategy easily beat the IntraDay one.

We looked at the figures ourselves using SPY back to 1993, and while we came up with different numbers the pattern is clear. The NYTimes piece omitted dividends, which would always accrue to the Overnight Strategy and not to IntraDay, since you have to own a security at the close of business on the record date to earn the dividend. So in this case and the one below, Overnight returns will be even better by the amount of the annual dividend.

The stock market is full of patterns, and identifying a profitable one takes far more than simply discovering one that’s worked in the past. For instance, the relative advantage of Overnight over IntraDay on SPY has declined over the years, probably because the hedge funds who look for these things long ago found it and started exploiting it. The best results came in the years either side of the dot.com bubble (1998-2002). Since the IntraDay strategy is by definition a day trade, the persistent success of Overnight versus IntraDay back then is probably a tangible measure of day traders gradually ceding their capital to more sophisticated participants.

It’s also important to identify a reason for any anomaly. A series of rainy Sundays tells you nothing about next weekend’s weather (correlation versus causality). There needs to exist some economic reason for the anomaly for it to continue. Is there a reason to expect persistence in the Overnight versus IntraDay phenomenon, even though the margin has diminished? The NYTimes article speculates that buying in the morning offers traders some ability to respond to adversity during the day, and that closing out a long position in the afternoon protects against an inability to immediately react to an overnight event causing losses. Since humans continue to be the ultimate investment decision makers, this is a plausible explanation.

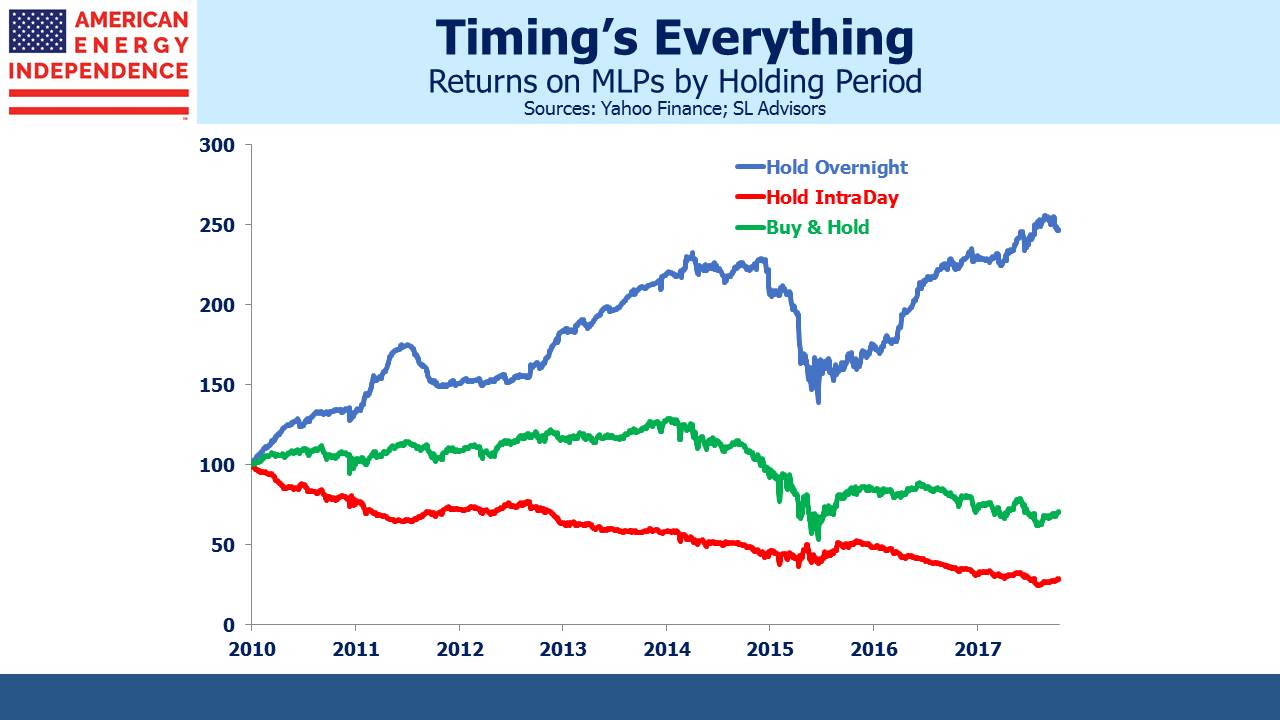

Because MLPs are more retail-dominated than the broader stock market, human foibles are more likely to show up there. The data doesn’t go back as far as SPY, but we looked at Overnight versus IntraDay using AMLP, which launched in 2010. The superiority of Overnight is far more significant than with SPY. Although AMLP has lost 29% of its value before distributions since 2010, the Overnight strategy grew by almost 150% while IntraDay lost 70% of its value. It looks as if MLP investors bounce out of bed full of optimism, only to have those positive feelings ground down by a sector that has regularly spent the trading day selling off from the open.

This means that if you’re considering investing in the sector, you may want to wait until the afternoon. Buyers tend to execute their intentions early. For this group, caffeine-fuelled exuberance gradually gives way to low blood-sugar despondency. After lunch, your buy order will face less competition. In energy infrastructure, it seems, your money really does work harder for you at night.

Put another way, a strategy of shorting AMLP intra-day would have generated a positive return of 150% before transactions costs over the past seven years. Unfortunately, transactions costs of even 0.025% per trade (i.e. 0.05% daily) wipe out the profit. AMLP remains a good short (see MLP Funds Made for Uncle Sam) because of its structural deficiencies, but bad as they are they’re not sufficiently catastrophic to support a day-trading, active shorting strategy.

We are short AMLP