Higher Despite Retail Selling

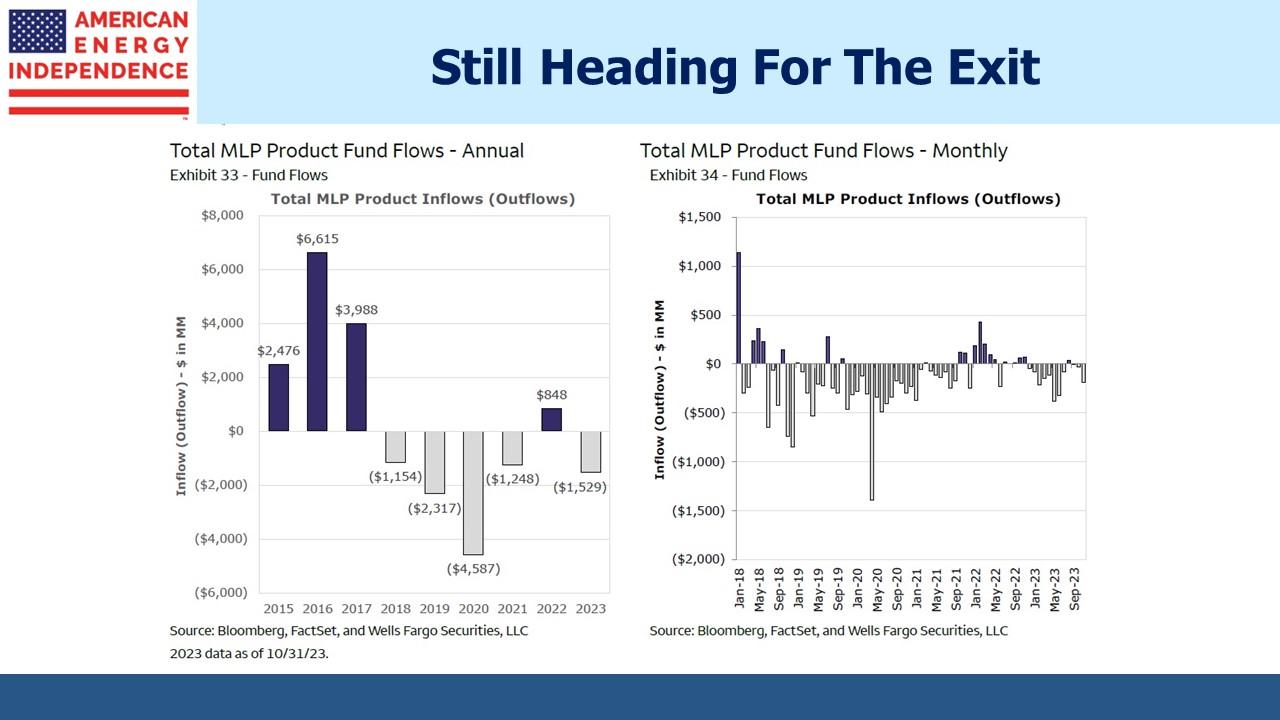

The only negative about the pipeline sector today is the direction of fund flows. It’s regularly covered in this blog and a topic that continues to mystify us. Although we’re still awaiting data for the last two months of 2023, it’s almost certain to be the fifth year of the last six during which retail investors exited MLP funds.

This category includes both the non-RIC compliant MLP-only funds like the Alerian MLP ETF (AMLP) as well as other RIC-compliant funds such as the ones we run. The $4.6BN that investors withdrew in 2020 can fairly be attributed to the pandemic. Leveraged funds were partly to blame (see MLP Closed End Funds – Masters Of Value Destruction).

But the outflows continued the following year even as the sector maintained its recovery. 2022 was an exception, perhaps because nine of the eleven S&P sectors were down as the Fed aggressively tightened policy. Energy was +64% and Utilities scraped out a 1% return.

The monthly data tells the same story, with only 19 out of 70 months since 2018 being positive.

Even more incongruous is that performance has been good. Four of the past six years have been positive, even though there was net retail buying in only one of those.

For investors, the 2020 market collapse caused by the pandemic was sharp but mercifully brief. The S&P500 finished the year +18%. The recovery was well under way entering 2021, as the vaccine rollout progressed. You’d think those pipeline investors not panicked into selling by the Covid collapse and blow up of closed end funds would be unshakeable. Apparently, they weren’t.

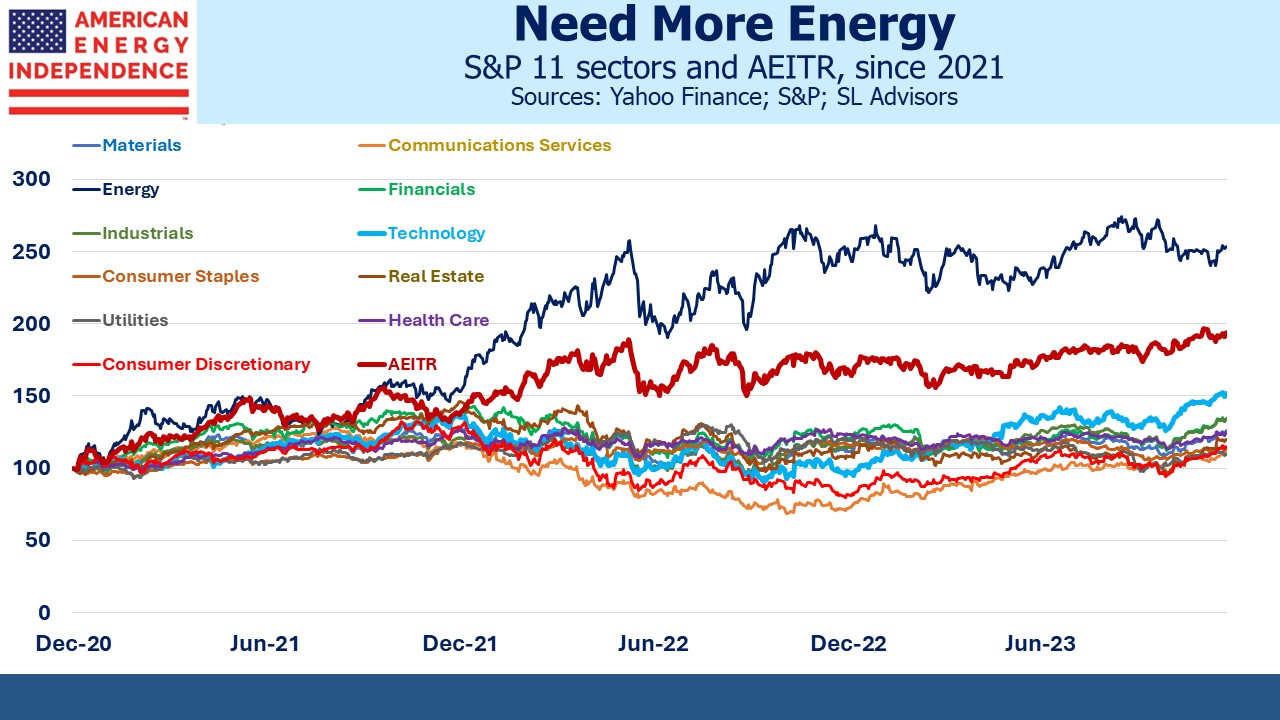

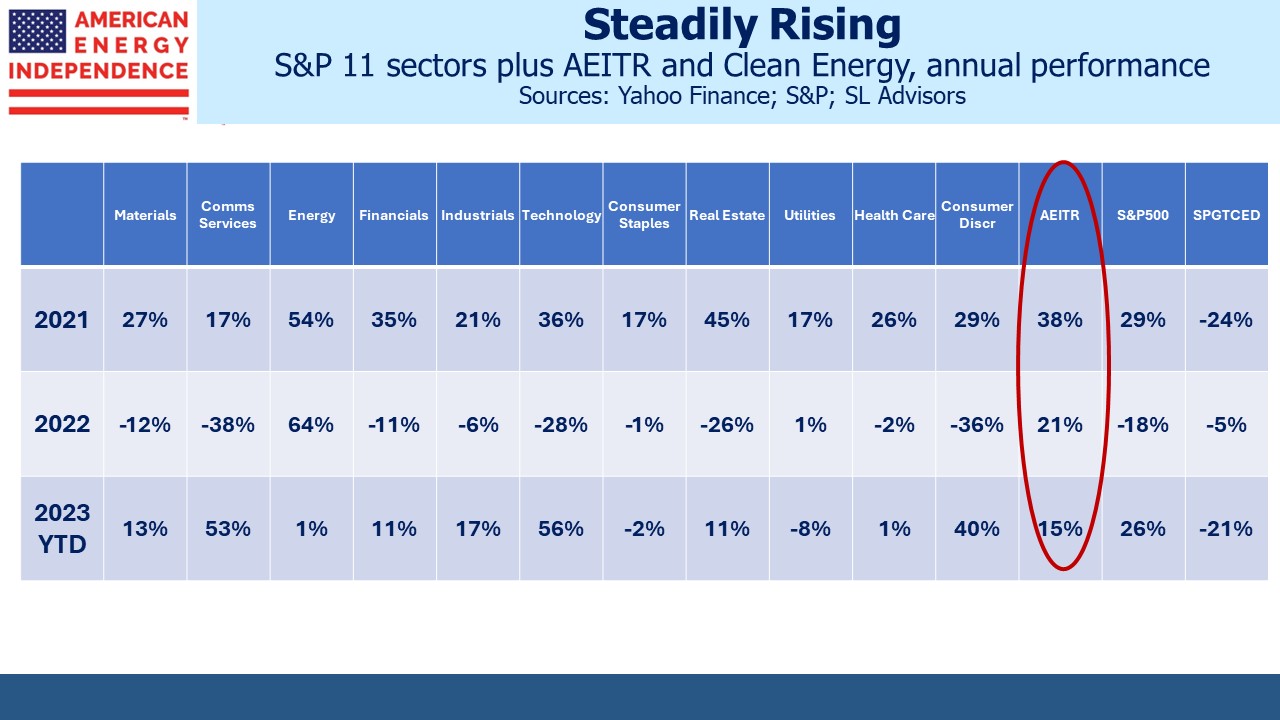

Over the past three years, the S&P Energy sector has easily beat the other ten S&P sectors, returning 36% pa. The “Magnificent Seven” with their AI theme have left the other 493 members of the S&P500 behind. But in spite of this, the S&P Technology sector has lagged energy considerably, delivering 15% pa.

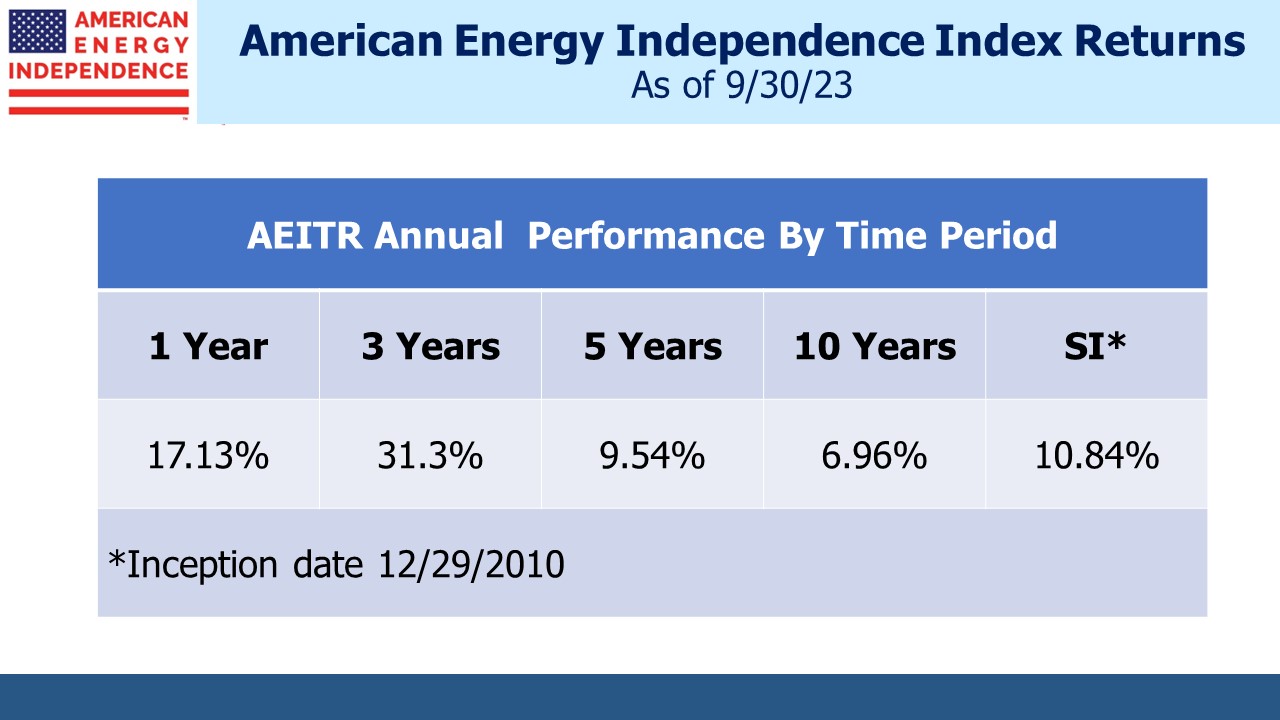

Midstream energy infrastructure also beat the other ten sectors over three years, with 25% pa. There is this incongruity in which retail investors are selling but prices are nonetheless rising. Usually fund flows follow performance and even accentuate the prevailing trend.

The retail sellers are clearly missing out on the pipeline sector’s strong performance. Some are probably motivated to avoid energy because of concerns about climate change, and that must also apply to the legions of investors who choose not to commit capital to the sector. This is in spite of strong operating performance and declining leverage, routinely noted on this blog. In rejecting midstream energy infrastructure, these investors exhibit the antithesis of irrational exuberance – call it irrational gloom.

Pipeline companies have taken the other side of the retail selling. Just one company, Cheniere, has offset the retail outflows from MLP funds with their buyback program in 2023. Adding back those from Kinder Morgan, Targa Resources, Enterprise Products and Energy Transfer results in buybacks of more than double the net outflows. The less informed have been selling to the better informed. It’s why the sector has performed so well in spite of investor selling.

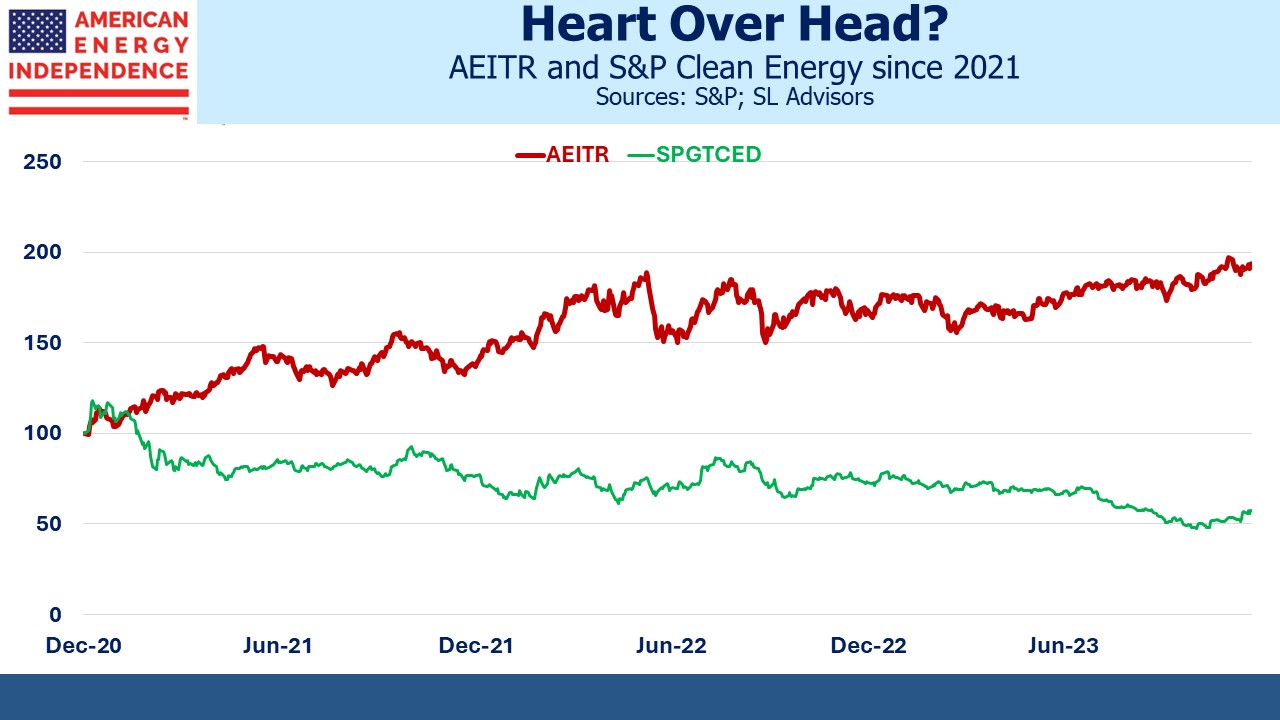

Perhaps those who have been underweight traditional energy for up to the last three years will finally reconsider as we enter 2024. If they’ve been allocated to clean energy they’ll have done even worse.

The S&P Global Clean Energy Index (SPGTCED) has done worse than any of the S&P’s eleven sectors since 2021 and finished behind all of them in two of the past three years. Even a 1% bias within an investor’s energy allocation towards clean energy would have cost 0.5%pa in underperformance.

We’re open to investing in renewables if only we could identify profitable opportunities. Stable visible cashflows are nowhere to be found in solar and wind. Many of the investors who reject traditional energy on non-economic grounds use the same analysis to favor SPGTCED. But they’ve found that Federal subsidies and a conviction that they’re doing the right thing can’t overcome poor economics and the cost of intermittency. If the prospects for steady profits improve we’ll revisit, but don’t feel we’ve missed anything so far.

Pipeline companies will continue their buybacks next year, continuing to offset the net fund outflows. And if retail investors merely stop selling that should provide a further boost.

This blog can be accused of being a persistent cheerleader for the sector. But for the past three years, that advice has aligned with results. We’re optimistic that 2024 will be similar.

We have three have funds that seek to profit from this environment: