The Global Trade in Natural Gas

One of the many benefits of the Shale revolution has been a reversal of the U.S. terms of trade with respect to natural gas (see U.S. Natural Gas Exports Taking Off). We’ve long been a net importer and the Sabine Pass LNG (Liquified Natural Gas) facility in Louisiana was originally intended to augment pipeline inflows with waterborne imports. The discovery of so much commercially viable and cheap domestic natural gas upended these plans and several years and billions of dollars later Sabine became the first of several LNG export facilities.

Owner Cheniere Energy (LNG) just announced their 100th LNG shipment. One of the most stunning developments in this arena has been LNG shipments of natural gas from the U.S. to the United Arab Emirates (see Coals to Newcastle). You have to be pretty good at producing it cheaply in order to cover shipping costs to a region of the world awash in hydrocarbons. And in America, we are.

Natural gas pricing has always been a much more local market than is the case for crude oil. This is because moving natural gas long distances generally requires a pipeline. Seaborne shipments involve chilling gas which is expensive. Consequently, shipping costs for gas are typically a far larger proportion of the value of the commodity than is the case for crude oil, which is why you’ll hear reference to a global crude market but rarely one for natural gas.

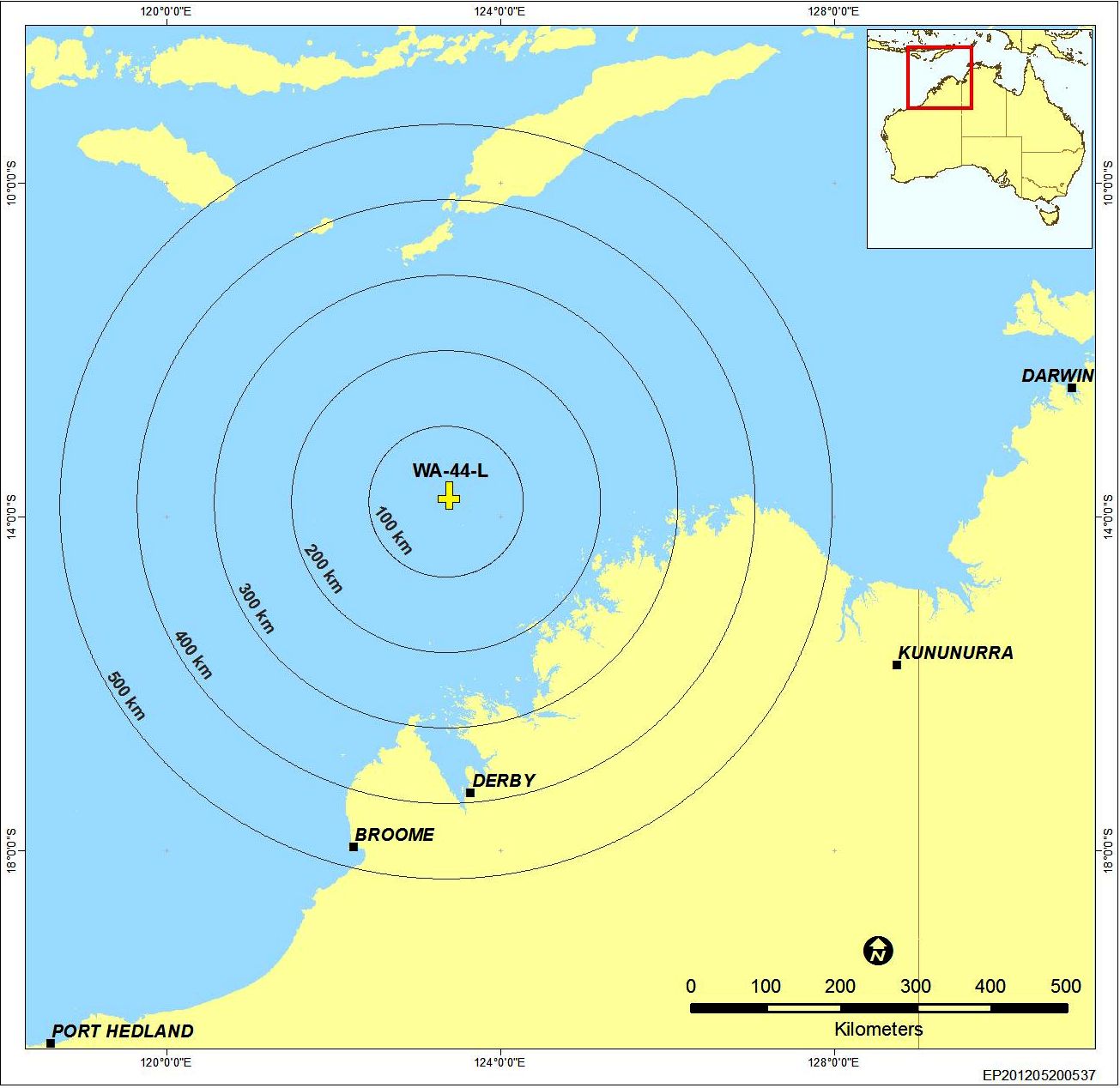

However, this is beginning to change and the commencement of U.S. LNG exports last year is part of this new trend. Although the U.S. is currently an insignificant player, our exports are set to grow steadily in the coming years. Qatar is the world’s biggest exporter but is expected to be passed by Australia next year, which has ten LNG projects at various stages of production. One of the most extraordinary LNG projects currently underway involves liquefying natural gas that is sourced from beneath the seabed around 125 miles from the coast of Western Australia. Shell Australia is building a floating LNG facility called Prelude FLNG.

Prelude’s construction involves components from all over the world. The hull has been built in Geoje, South Korea, one of the very few shipyards in the world big enough to accommodate it. Other key components have been built in Malaysia, Dubai and France. Shell’s website has some interesting videos on the project.

Some numbers will illustrate: at 533 yards, it is longer than four English football pitches (or five American football fields). When complete, it will weigh as much as six of the largest aircraft carriers combined. It will be tethered permanently to the floor of the Indian Ocean, designed to withstand a 1 in 10,000 year typhoon (let’s hope that’s right). When chilled to -260 degrees Fahreinheit, LNG occupies 1/600th of the volume it would in a gaseous state. Prelude’s production could more than fully meet the needs of Hong Kong.

Shell’s Final Investment Decision (FID) to proceed with the project was made back in 2011 and construction began the following year. It’s safe to say the arrival of U.S. LNG exports on the market was not a factor that received much attention during Prelude’s planning. Natural gas prices around the world are lower than was the case when much of today’s LNG export facilities were initiated.

Only last year Woodside Petroleum cancelled a planned A$40BN FLNG project in the same area because of depressed commodity prices. But Shell has pressed ahead, and when in operation later this year Prelude will confront a changing world landscape. Japan has become a more significant buyer following the Fukushima nuclear disaster, which at one point led to a halt in output at all of the country’s nuclear power facilities. China is also seeking to shift away from coal to cleaner sources of electricity generation.

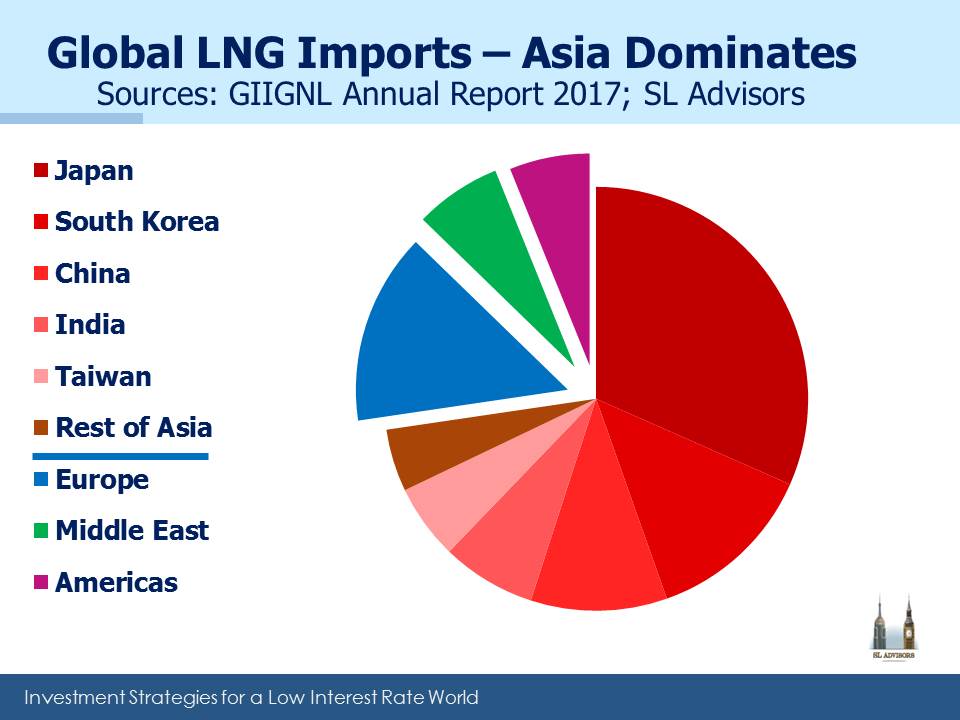

Australian LNG exports chiefly supply China, Japan and South Korea. In fact, as the pie chart shows, imports of LNG predominantly go to Asia which in 2016 received 73% of the world’s total LNG shipments. The global trade in LNG grew 7.5% from 2015 to 2016, up from an annual growth rate of 0.5% over the prior four years. China’s imports jumped by 37% and India’s by over 30%. 72% of LNG trade in 2016 was conducted under long term contracts (defined as greater than four years). LNG trade requires substantial capital investment, so supply/demand certainty is sought by both sides. Altogether, 39 countries import LNG from 19 exporting ones.

Although there are enormous technical challenges in building an FLNG facility, there are some benefits too. Prelude’s location will allow it to draw over 13 million of gallons of water every hour from the ocean to help cool the natural gas it’s processing. And the fact that it’s offshore means that the permitting process need not be quite so concerned with the consequences of a catastrophic failure as with land-based facilities.

All these developments are leading towards increasing trade in natural gas and the concurrent development of a global market, pulling together the many regional ones.

We are invested in Cheniere Energy (LNG)