Gains From Energy

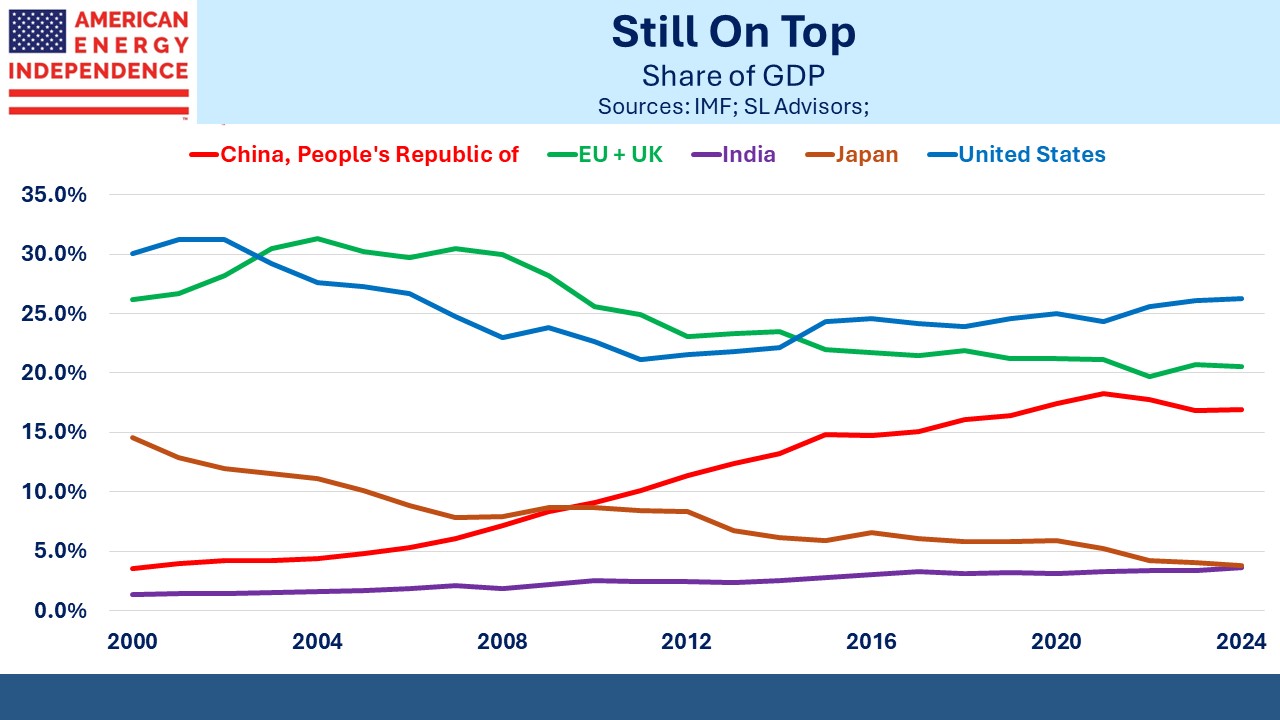

Last week the WSJ published an interesting chart, reproduced below. It was in an article ominously titled America’s Economy Is No. 1. That Means Trouble. The chart shows that US share of global GDP has been increasing for over a decade. We’ve gone from 21% in 2011 to 26% this year.

It’s an amazing performance. A consistent theme since World War II has been the US gradually shrinking its share of the global economy. This was inevitable as emerging economies such as China and India opened up to trade and deregulated their economies.

Military strength goes with economic size.

This trend implied that the US would need to confront a rising challenge from China as their defense budget grew with their economy. It’s a cycle explained by Paul Kennedy in his 1989 book The Rise and Fall of the Great Powers: Economic Change and Military Conflict from 1500 to 2000. He chronicles the arc of previous empires such as the French and Spanish. He coined the term “imperial overstretch”, when maintaining an empire imposes unsustainable costs, ushering in the decline of one and the rise of another.

Kennedy marks World War II as the approximate end of the British empire and the rise of the American one, although it’s more accurate to refer to America’s cultural and economic leadership rather than dominion over foreign countries. Back in 1989 Japan was the new rising power. That forecast soon turned out to be wrong, as China took their place. But maybe that’s also going to be wrong.

The WSJ article naturally found reasons to worry about America’s strong economy. It’s not only journalists at the NYTimes that are trained to find the negative in any story. Fiscal stimulus is partly driving growth. Trump tax cuts, the pandemic, the Inflation Reduction Act, the CHIPS Act and student debt forgiveness ($138BN so far) are all boosting consumption. The massive entitlement bill is coming due as baby boomers retire.

For the first decade of the new millennium, the US and EU roughly tracked each other in declining GDP share. They parted company long before the fiscal largesse noted above.

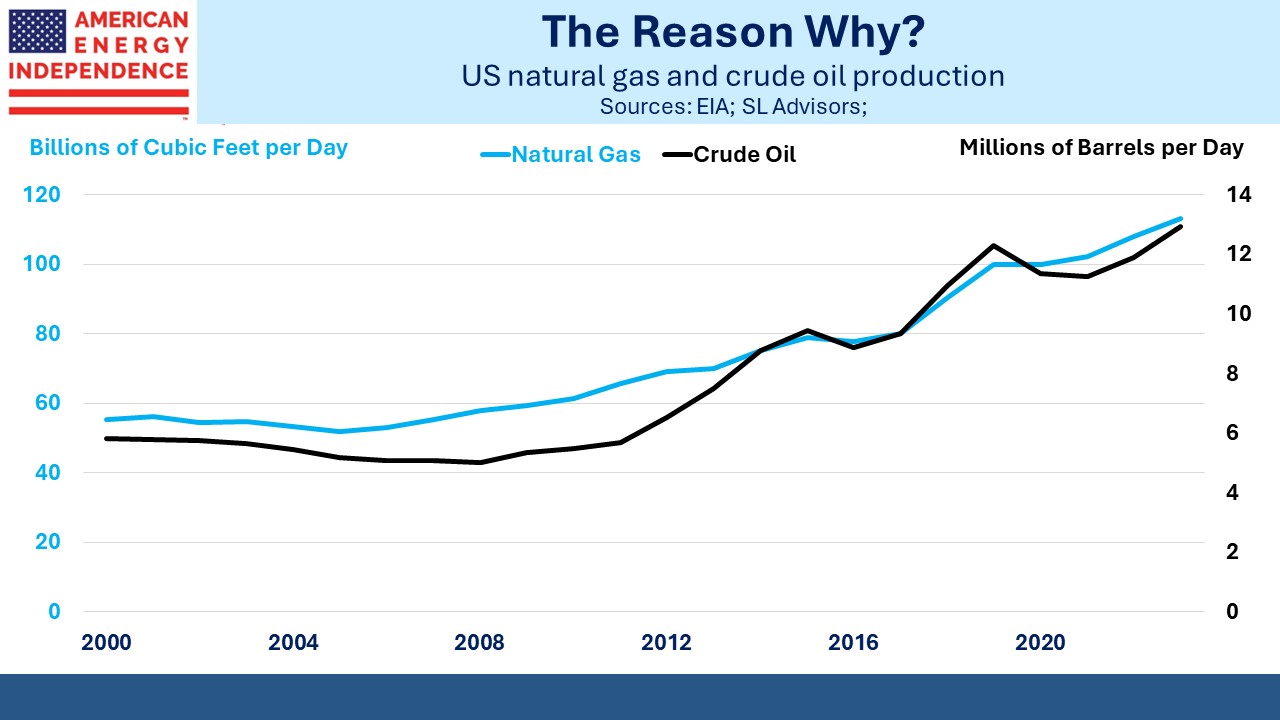

US oil and gas production began their long ascent around fifteen years ago, roughly the same time our share of GDP began increasing. Has attaining American Energy Independence heralded a newfound resurgence in American economic leadership?

A cynic might suggest that a blog on energy will link anything positive to the shale revolution. It’s a simplification to think one caused the other. But there’s also plenty of evidence that low domestic energy prices have boosted growth.

Germany’s disastrous energy policies (see Germany Pays Dearly For Failed Energy Policy) have so effectively constrained their own manufacturers that some are moving production to the US. Their emissions are coming down because they’re de-industrializing, to America’s benefit.

Japan’s population is shrinking, creating a GDP headwind. China’s population has also peaked, and they’re confronting too much infrastructure spending that hasn’t boosted productivity enough.

The latest example of the role American energy plays is the growing need for natural gas to power new data centers. Tudor Pickering is the latest firm to publish a report on the topic. They estimate as much as 8.5 billion cubic feet per day in new production will be required.

I have yet to read a story predicting more solar panels and windfarms due to AI.

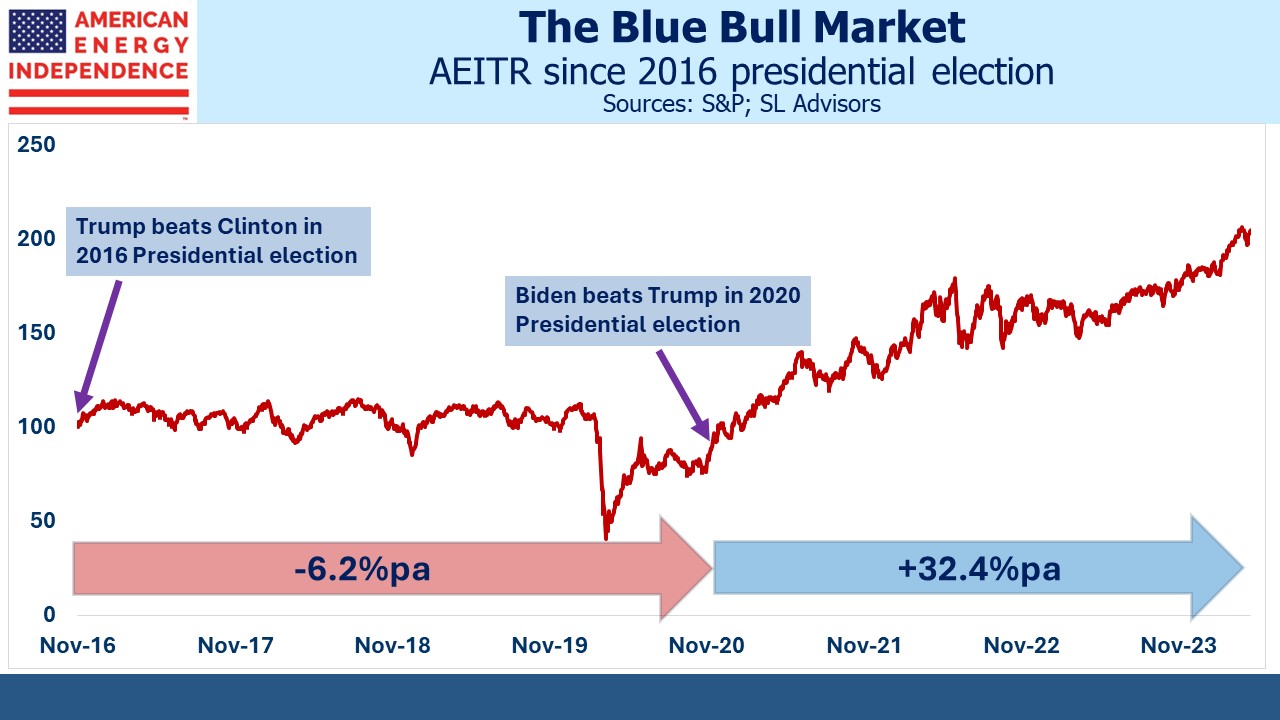

America’s gains in GDP aren’t easily attributed to either party, since they’ve continued with both Democrat and GOP presidents. Republicans will be tempted to claim success as the party of deregulation. But investors in pipelines as defined by the American Energy Independence Index (AEITR) have done much better under Biden than Trump.

The White House isn’t drawing attention to this, because Democrat progressives would prefer it wasn’t true. It shows that the institutional advantages of our economy have made this possible. These include private ownership of mineral rights, easy access to capital and a culture of entrepreneurialism.

There’s another reason why the US is gaining GDP share. Americans just work harder than Europeans. Nicolai Tangen heads Norway’s $1.6TN sovereign wealth fund that invests the profits from Norway’s oil and gas output. He said that American companies outpace Europeans on innovation and technology. He cited a difference in, “the general level of ambition.” He suggested that Europeans strive for a better work-life balance, meaning they work less.

I left the UK for New York 42 years ago. I agree with Tangen. That’s why I moved here. Americans are more ambitious and less afraid of failure. My generation cared little for work-life balance 20, 30 or 40 years ago. We get it now. I’m not sure the younger generation is made the same way but that’s another story.

We have three have funds that seek to profit from this environment: