Fuzzy Thinking On The Energy Transition

Indonesia and Malaysia are apparently among the few places on earth with geology suited to hold CO2. This has drawn the interest of Exxon Mobil among others, who recently secured “exclusive rights to CO2 storage” according to CEO Darren Woods. Meeting the “Zero by 50” goal requires burying 1 billion tons of CO2 annually by 2030, 25X today’s capacity.

Schlumberger is investing as much as $500MM to buy Norway’s Aker Carbon Capture Holding. And Occidental is building the world’s biggest carbon capture facility in Texas.

These are all examples of how the energy sector is positioning to continue providing reliable energy while also helping mitigate CO2 emissions.

Policymakers have an ambiguous posture towards energy companies. They like to blame them for producing fossil fuels but want them to continue so that prices on 80% of the world’s energy don’t shoot up. There’s little support nor technical capability to stop using what moves the world’s economy.

This shows up in myriad ways. A UBS banker recently complained about having to align financing decisions with a world warming by 1.5 degrees above 1850 levels. We’re already at 1.1 degrees, so almost there. Judson Berkey, group head of engagement and regulatory strategy, noted that more realistically we’re “hurtling towards a 2.8 degree warming.”

“Banks are living and lending on planet earth, not planet NGFS,” added Berkey, referring to the Network for Greening the Financial System.

If companies aren’t running their businesses consistent with Zero by 50, how is a bank supposed to make lending decisions under this more onerous constraint?

JPMorgan Asset Management and several other big firms withdrew from Climate Action 100+ because they concluded their interests weren’t properly aligned. Political leaders haven’t been effective in persuading voters to accept higher energy prices to speed the transition.

So the world follows ambiguity – not confronting China as it ramps up coal consumption; ignoring the boost to emissions to increase their living standards; pressing banks to pretend there’s no demand for traditional energy financing. Coal finance is among the most controversial areas for banks, because the world is supposed to be phasing out its use albeit with varying degrees of commitment.

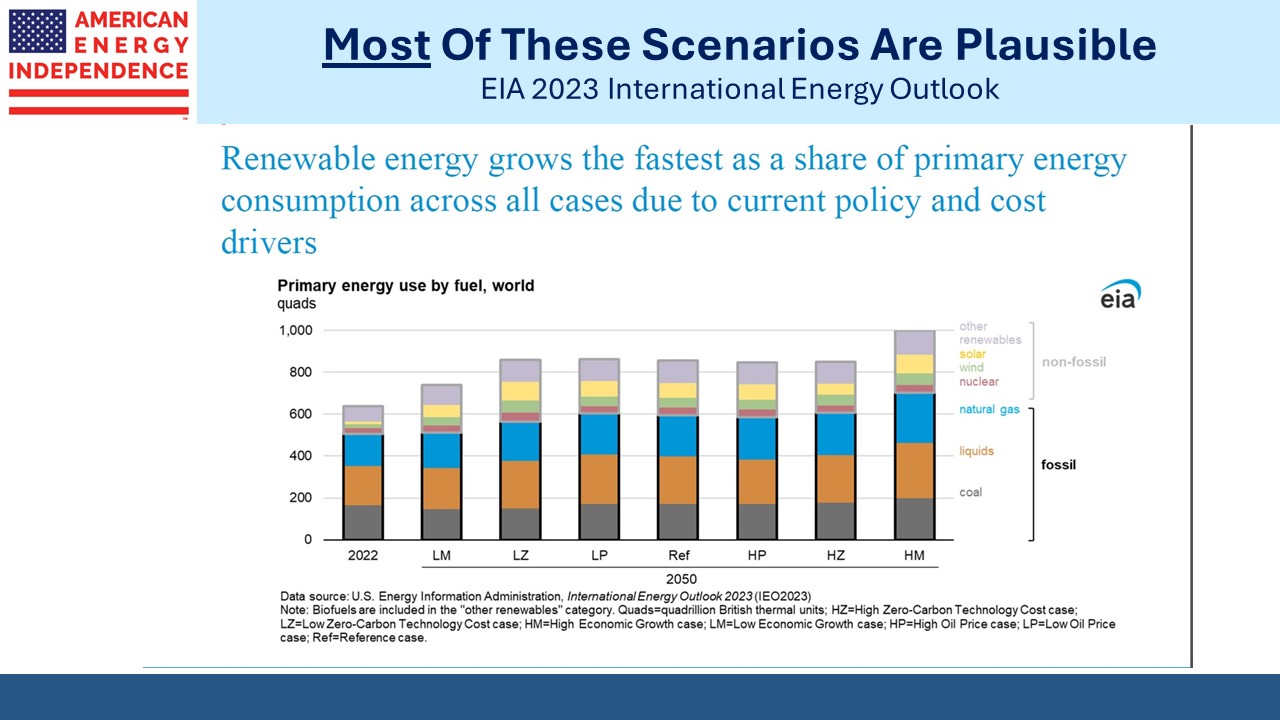

The US Energy Information Administration in last year’s International Energy Outlook shows 2050 coal demand flat in their Reference Case and little changed in their six other scenarios.

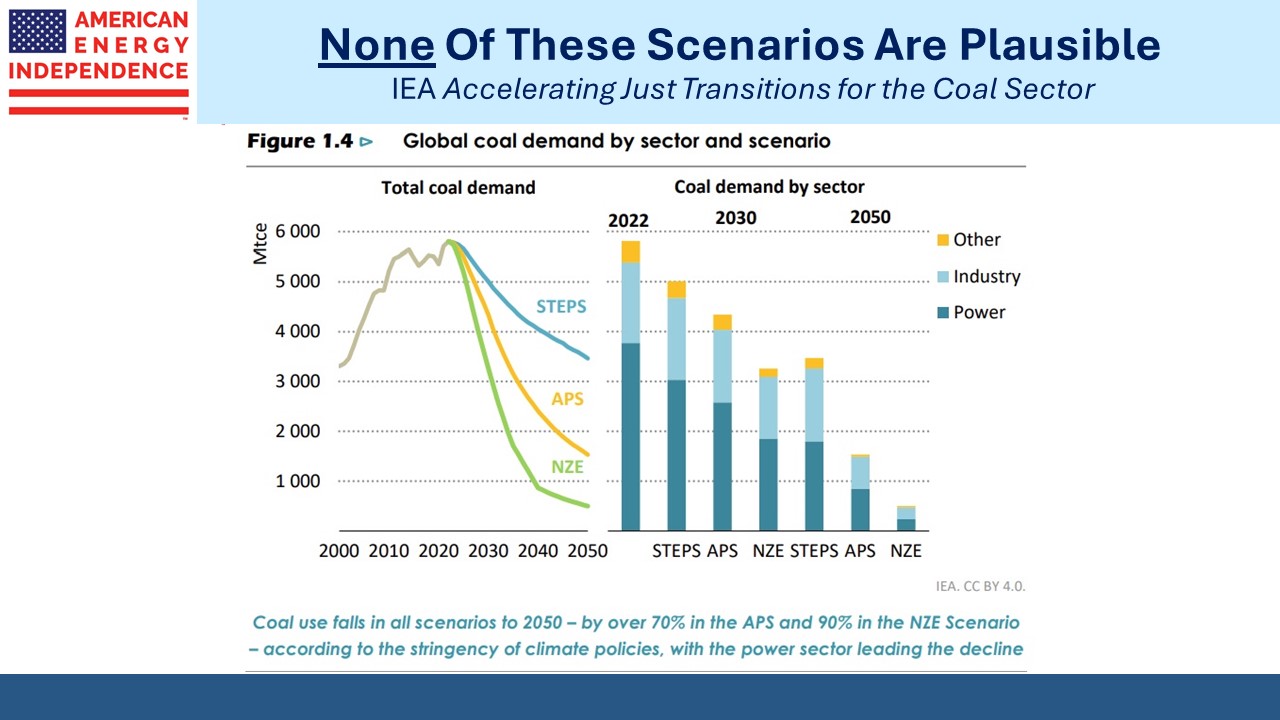

By contrast, the International Energy Agency (IEA) recently published Accelerating Just Transitions for the Coal Sector. As is common nowadays, the IEA’s forecasts are aspirational and routinely show fossil fuel consumption peaking at the time of publication. There’s no IEA scenario in which coal demand rises, even though last year saw record consumption.

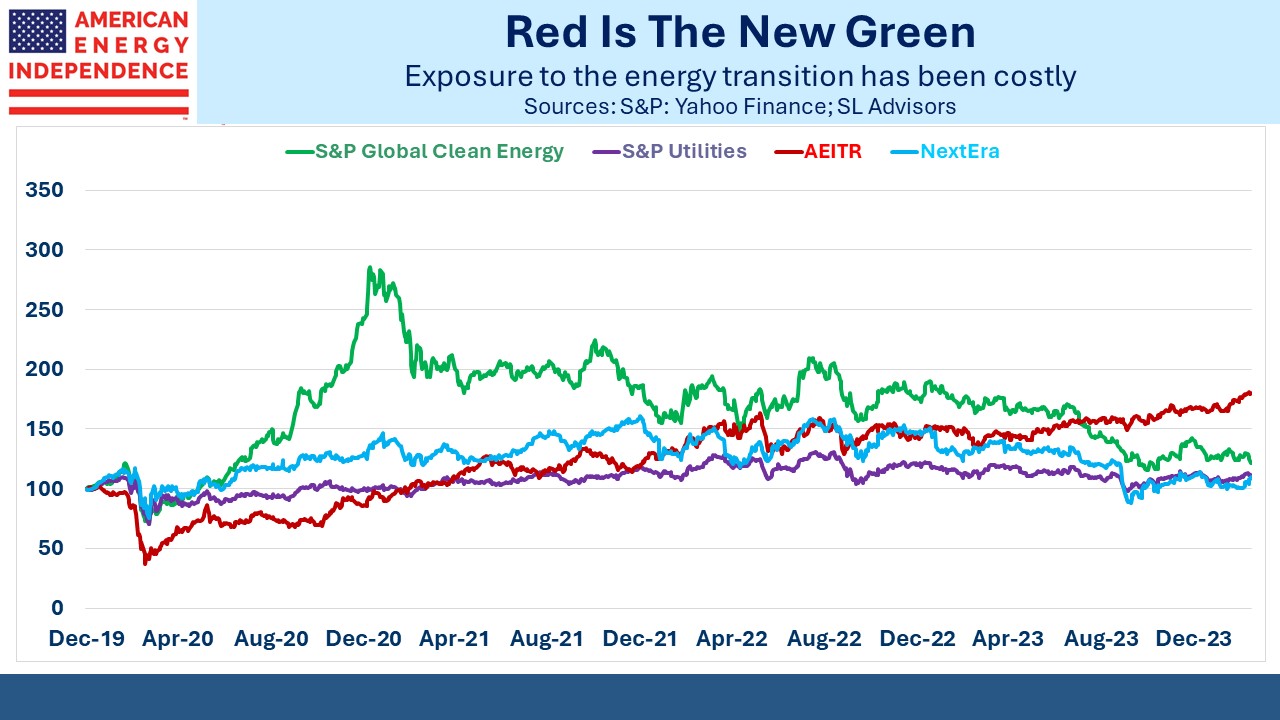

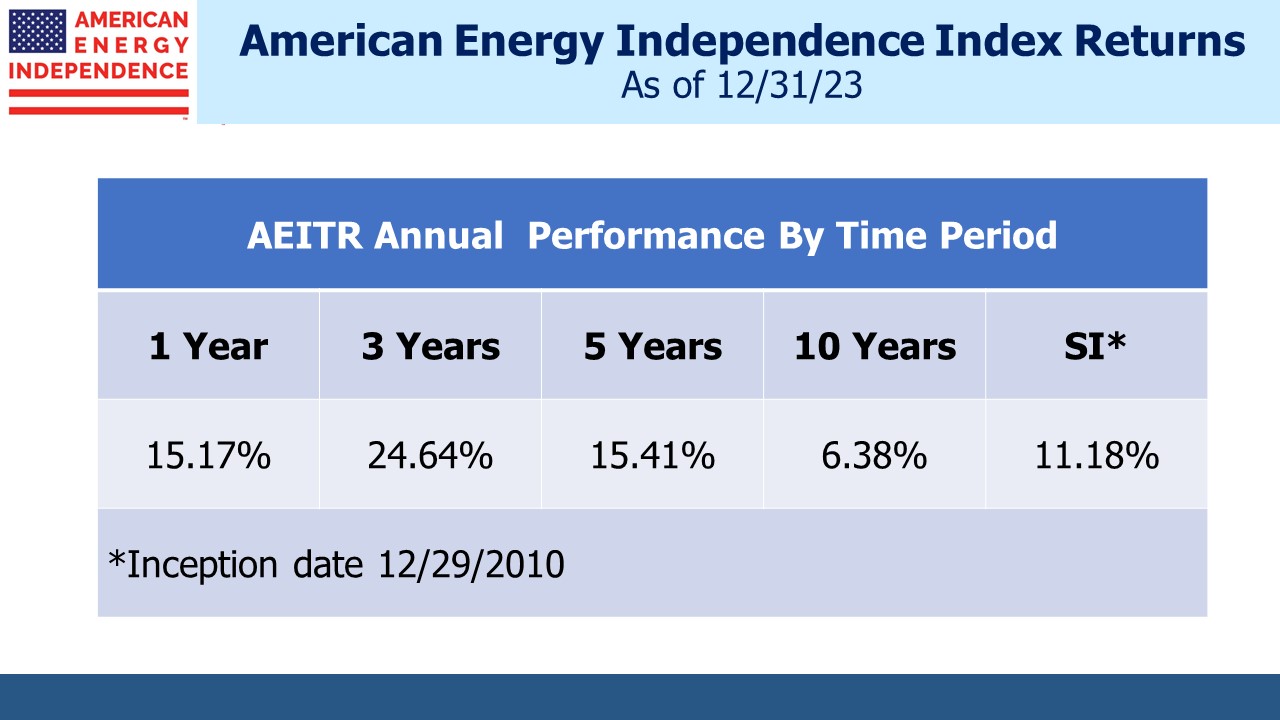

Markets are looking through this. Midstream energy infrastructure, as defined by the American Energy Independence Index continued to outperform utilities. That’s because NextEra and their peers are responsible for delivering the energy transition. On one side sits the unappealing economics of renewables which push up power prices. This is in part because increased solar and wind use raises the amount of redundant capacity needed to back up weather-dependent electricity.

On the other side sit political and regulatory pressure to decarbonize the grid.

Clean energy is also a huge investment disappointment. The sector’s operating margins are often unattractive and sometimes negative.

According to Wells Fargo, Ohm Analytics revised down their forecast of residential solar installations to –19% versus last year. Wells Fargo is at –25%. One reason is that installers are going bankrupt.

Ohm retains a positive longer-term outlook on residential solar for two reasons that are heavy in irony: (1) rising utility bills, and (2) increasing grid instability. Data center build-out is a recently appreciated area of demand growth following decades of no growth in electricity consumption.

Higher prices and reduced peak demand buffers are a consequence of greater reliance on renewables. As power grids operate with diminished excess capacity the risk of a power outage rises. This will play out over the next several years.

In brief, Ohm is forecasting increasing residential spending on solar panels because increased utility spending on solar panels is raising prices and reducing the flexibility of the grid. If too many households become self-sufficient in electricity generation and unplug from the public system, the substantial fixed costs of maintaining and building distribution infrastructure will get spread across a declining set of customers.

That’s a problem for another day.

The energy transition is an engrossing story, but we believe the best returns will continue to come from traditional energy and midstream infrastructure which continues to allocate capital based on IRR with limited impact from ESG-type influences.