From Top Hats To Tightening

The beginning of my career in finance overlapped with the presence of morning suits on the floor of the London Stock Exchange. Mullens & Co, founded in 1786, held the privileged role of “government broker”, meaning they transacted directly with the UK Treasury and were an important intermediary in financing the UK government. As recently as 1980 when I started work, their brokers still wore top hat and tails, supposedly to ensure their visibility across the exchange floor but also to emphasize status.

Mullens hired from the most exclusive public schools (confusingly for Americans these are actually private) and I recall their people were all snobs, rarely acknowledging my scruffy presence in a mere business suit. In 1986 Mullens was acquired by SG Warburg which was later absorbed by UBS. Sartorial standards in finance have been sliding ever since.

The London Interbank Offered Rate (LIBOR), another anachronistic vestige of old school Britain, is also on its way out after its weaknesses were slickly exploited by derivatives traders 15 or more years ago. It seems odd today, but this benchmark of money market rates was not derived from actual transactions.

Banks indicated where they “would” lend eurodollars (an offshore deposit) to a high quality credit for periods of one month to one year. But such highly rated banks rarely needed to borrow at LIBOR. So it was based on theoretical trades, and most eurodollar business was transacted at rates other than LIBOR. It was that quintessentially English invention based on unwritten assumptions and reliant on fair play all round.

The enormous growth in the derivatives market and shrinking need for banks to borrow from one another eventually led to far more trading profits relying on the benchmark than were involved in actually setting it. Being unmoored from transactions left LIBOR vulnerable to exploitation by unscrupulous traders who conspired to obtain favorable settings. There were prosecutions and jail terms for the miscreants, and naturally hefty fines imposed on the banks that employed them.

LIBOR was broken and never recovered, but so integral was it to vast numbers of derivatives trades, US residential mortgages and other contracts that its phase out has been slow. However, it now has less than a year to go and is generally being replaced by the Secure Overnight Financing Rate (SOFR).

A good portion of my career was spent analyzing the eurodollar futures curve for imperfections. To show that your blogger can similarly move on from the 20th century, I have therefore switched to SOFR futures to measure the yield curve and market expectations for Fed policy.

Which brings us at last to Fed chair Powell’s speech at Jackson Hole last Friday. Only two years earlier, the Fed unveiled a newly interpreted mandate which sought full employment while tolerating inflation temporarily above target. It’s fair to say events since then have exceeded expectations. The FOMC’s mandate could more correctly be expressed as addressing whichever of their two metrics has strayed farthest from its optimal level.

Hence, we were warned to expect, “a sustained period of below-trend growth” that will “bring some pain to households.” Those unfortunate enough to find themselves unemployed as a result can claim their sacrifice is for the greater good. They took one for the team. In case it wasn’t already clear, Powell added that “estimates of longer-run neutral are not a place to stop or pause.”

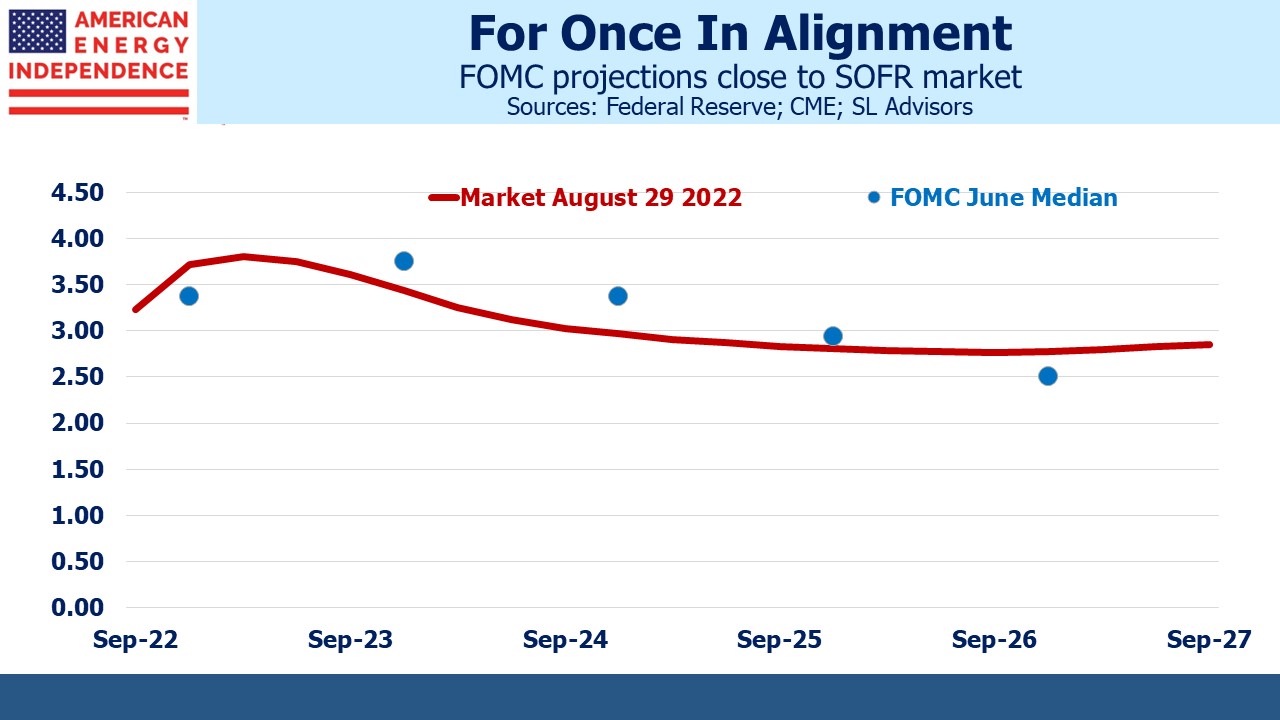

The yield curve is close enough to the “dot plot” from the Summary of Economic Projections that the FOMC and the market are in reasonable alignment. They’ve warned us that the policy rate will be moving higher because, “Our responsibility to deliver price stability is unconditional.” We are reminded that, “The historical record cautions strongly against prematurely loosening policy.”

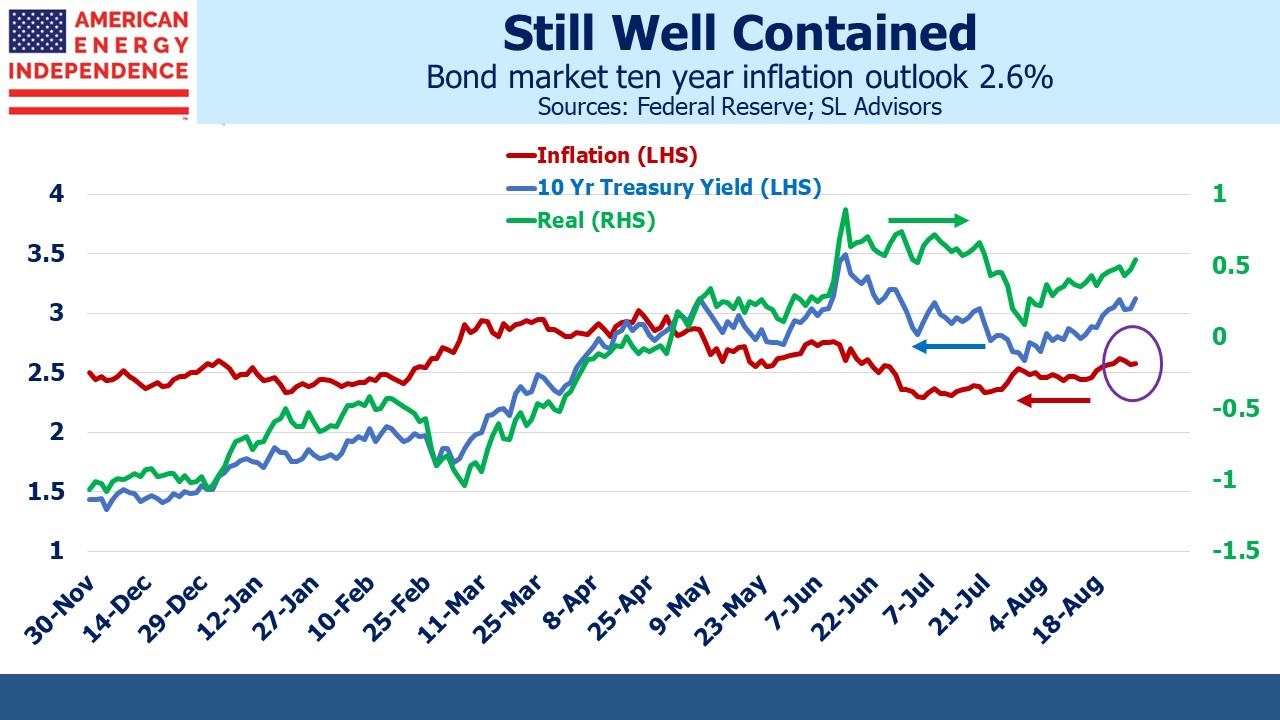

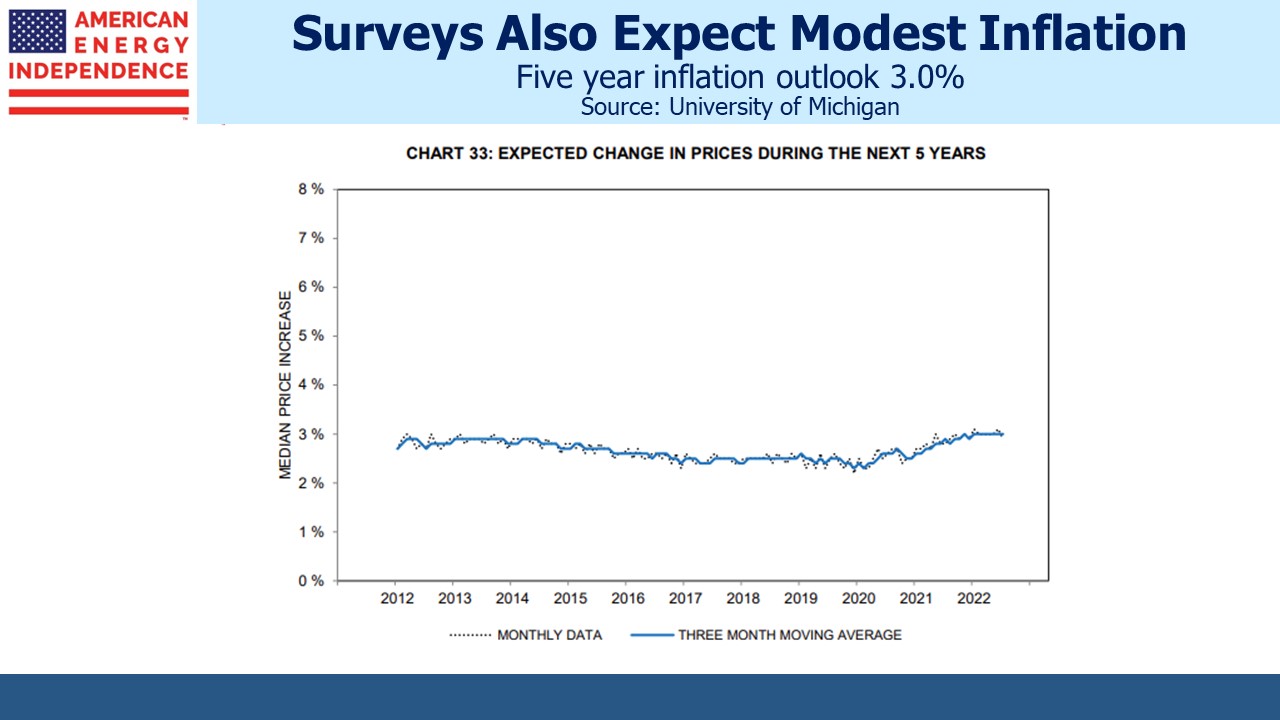

The expressway to higher rates already offers an exit ramp in the form of persistently modest long-term inflation expectations. The University of Michigan survey expects five year inflation of 3%. Ten year Treasury Inflation Protected Securities (TIPs) yields imply 2.6%. The Fed retains the faith of investors even if their forecasting record is consistently poor.

Which means rates will go up until they don’t; FOMC officials will be pestered to define “vanquished inflation”; success in bonds will require identifying the inflexion point.

Rarely short of opinions, friends and clients may be pleasantly surprised to find no trade recommendation in this blog post. For once the Fed and the yield curve are in harmony.

Given the market’s serene inflation outlook, prudence surely dictates that investors plan for an upside miss. According to research from Wells Fargo, around half the EBITDA of the pipeline sector reprices its tariffs based on an inflation index, often PPI. With 6% yields amply covered by free cash flow, we believe it remains attractive.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.