Fed Catches A Few Gullible Bankers

Silicon Valley Bank (SIVB) succumbed to poor risk management in holding long term bonds funded with demand deposits. If that’s all there was to banking we wouldn’t need many banks. But at a strategic level, Quantitative Easing (QE) as pursued for too long during the pandemic created the conditions for poor decisions.

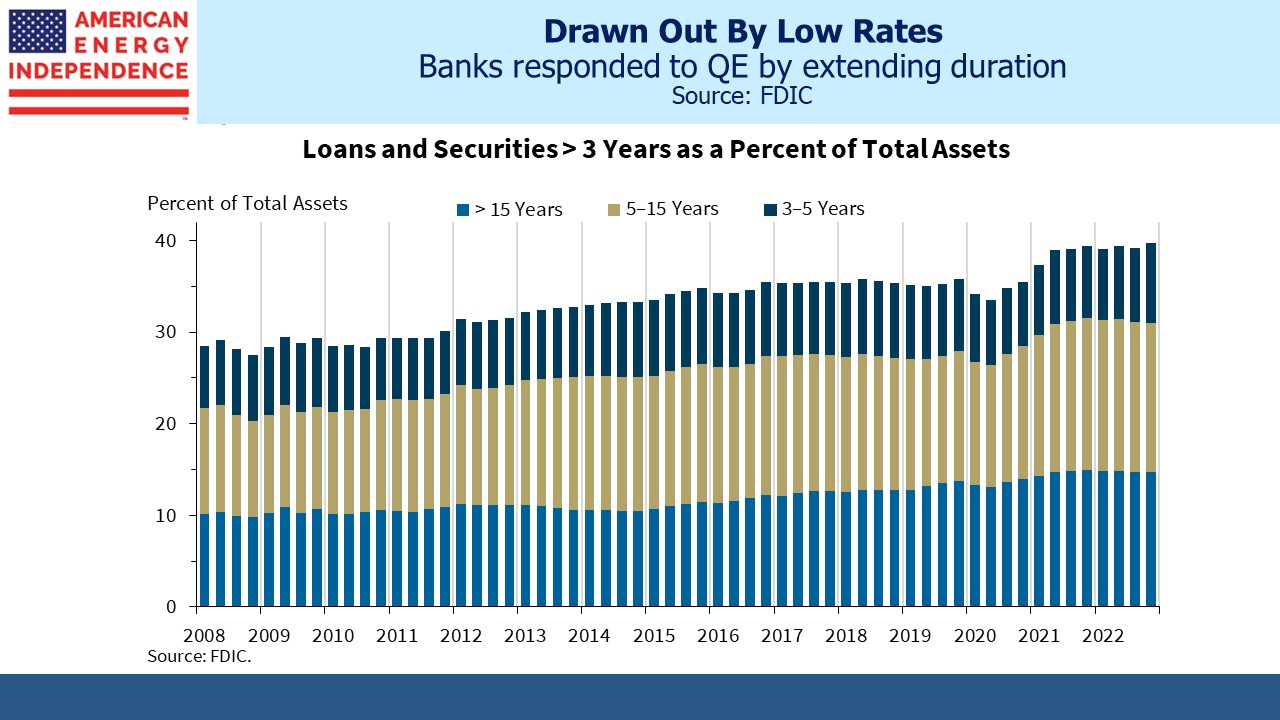

Central bank strategy for many years has been to slowly squeeze the commercial return out of the government bond market. The banking system has responded by steadily lengthening the duration of its assets, moving out along the curve in search of increased yield. This sloppy thinking is now being exposed.

Since the 2008 Great Financial Crisis (GFC), the portion of all bank portfolios invested in loans and securities more than three years in maturity has grown from 28% to 40%. QE logically ought to have had the opposite effect on discerning chief investment officers, but the data suggests it caused the banking sector to compete with the Federal Reserve for yield.

Having been squeezed by the Fed on the asset side, sharply tighter monetary policy has created competition for deposits. Two year treasuries recently touched 5%, a level which beats savings accounts and even offers a plausible, safe alternative to stocks. Our big economic imbalances trace their roots to the $1.9TN Covid Recovery Plan shortly after Biden’s inauguration, and the Fed’s lethargic withdrawal of QE with ultra-low short-term rates. Both stoked inflation.

Nonetheless, SIVB made poor choices.

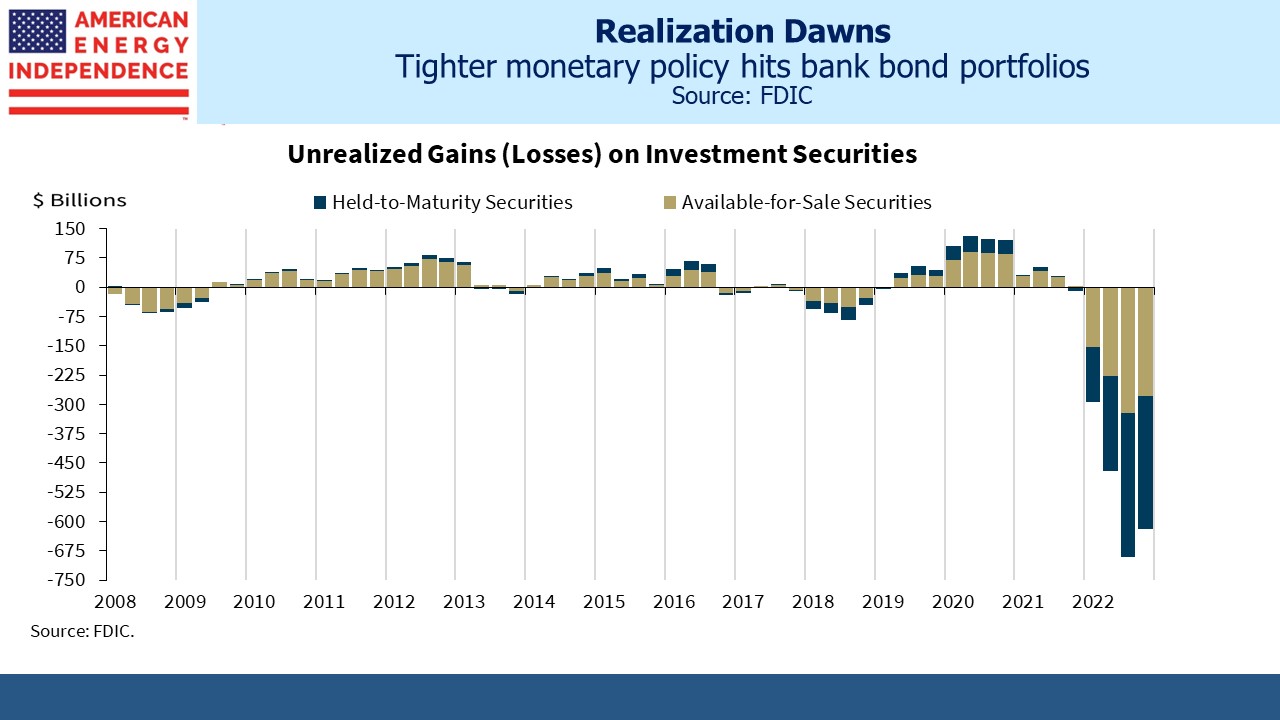

The result is a stunning leap in unrealized losses on banks’ holdings of securities. Not all of this is flowing through income statements. When bonds are classified as “Held To Maturity” (HTM), their mark-to-market losses show up in other comprehensive income under shareholders’ equity. In effect the losses are spread over the life of the bonds through a negative spread between the yield earned and cost of funding.

Ten year treasury yields dipped below 2% a few months before the pandemic in August 2019 and only moved back above 2% early last year. A sizeable portion of banks’ securities would have been purchased during that environment and now their deposit retention is competing with treasury bills at close to 5%.

The $620BN in unrealized losses represents around 28% of the banking system’s total equity capital of $2.2TN. Losing a quarter of the industry’s capital in a year, even if the losses are unrealized, does look like a regulatory failure. If not the beginning of another financial crisis it is at best likely to put a crimp on loan growth at banks that have found they took too much duration risk. And it may cause corporate clients and anyone with accounts over the $250K FDIC insurance threshold to shift large deposits to the biggest banks rather than analyze the credit risk they are enduring as depositors. For hundreds of smaller banks, that would start to look like a crisis.

YE2022 unrealized losses on HTM bonds at JPMorgan were 14% of common equity, but they’re 26% at Wells Fargo and 44% at Bank of America. 1Q23 results are unlikely to look any better.

Like a three card monte professional, the Fed convinced too many bank investment departments that low rates were here to stay and then sprung the trap with rapid hikes.

Skill in risk management is unevenly distributed. For every Jamie Dimon who avoided excessive duration risk, there are plenty of other CEOs who didn’t think that hard. We don’t have any clients with bond losses because, as one client kindly noted to me on Friday, we’ve shunned the asset class since the GFC. Only now are yields beginning to justify modest exposure.

It’s hard to imagine the Fed moderating policy because of bond losses at banks, but at the margin it means tighter credit conditions and that is the Fed’s objective. It also means that substantially higher short term rates of say 6-7%, especially if implemented over a brief period of time, would exacerbate the problem. The returnless risk that bonds represented for so many years has consequences.

At the CERAWeek energy conference last week, NextEra CEO John Ketchum surprised attendees by criticizing the expense of offshore wind projects. NextEra regards itself as a leader in renewables and is adding 45 gigawatts of power output from onshore wind and solar over the next few years. Such facilities typically operate 20-30% of the time. Offshore wind utilization tends to be 30-40%, since the wind blows more reliably at sea.

But Ketchum reported challenges with salt water corrosion, hurricanes, availability of ships and the installation of subsea cables. A renewables champion offered a dose of realism

Lastly, author and energy realist Alex Epstein testified before Congress last week on the Administration’s mis-use of the Strategic Petroleum Reserve last year to try and lower gasoline prices before the mid-term elections. Epstein showed more poise and energy understanding than his Democrat interlocuters in explaining why Biden’s expressed desire to end fossil fuel use has reduced investment and led to higher prices.

As we often tell clients, extreme greenies have helped impose capital discipline by discouraging growth capex. We have an alignment of interests. If you meet a climate extremist, give them a hug and offer a drive to their next protest.

We have three funds that seek to profit from this environment: