ESG Isn’t Ready For The Energy Transition

Investing based on Environmental, Social and Governance criteria (ESG) continues to gain following. Committing capital to companies that strive to do good appeals. Naturally, every company claims ESG credentials – because the criteria are so flexible it’s an inclusive definition. My favorite is Lockheed Martin’s regular membership of the Dow Jones Sustainability Index. If a company that builds machines to blow up people and things can have an ESG portal, it demonstrates the infinite flexibility of ESG.

Blackrock offers 30 socially responsible funds and leads AUM in the space with $60BN. Investors are often surprised to learn that energy stocks are included, but for example, the $25BN iShares ESG Aware MSCI USA ETF (ESGU) has a 3% weighting to energy. Conventional ESG thinking is that companies that handle fossil fuels, which provide over 80% of the world’s energy, are not deserving of the ESG imprimatur. But Blackrock invests in pipeline corporations such as Williams Companies. Natural gas offers the greatest opportunity to lower CO2 emissions, by displacing coal. The EU looks as if they’re finally reaching the same conclusion, via changes to their taxonomy that would classify it (along with nuclear) as clean energy based on meeting certain criteria.

Although ESGU’s energy weighting is a pragmatic choice, the energy transition will create challenges for those who seek a moral purpose from their investments along with outperformance. Evy Hambro, Blackrock’s global head of thematic investing, sees the energy transition boosting infrastructure spending. Hambro recently said, “What we’re likely to see is strong demand that will keep prices at very very good levels for the producers for many years into the future, and that could be decades.”

Hambro expects prices for copper, cobalt and other minerals vital to electrification to enjoy a long bull market. But spending on infrastructure will also boost traditional energy demand, because concrete, steel and other inputs won’t suddenly be produced using windmills.

This creates a conundrum for ESG funds. Positioning for a world that’s decarbonizing implies a much bigger allocation to Basic Materials, which along with Energy is only 5% of ESGU’s holdings. Apple, Microsoft, Google and Amazon are almost 20% of their portfolio. Many observers question the move to carbon neutrality these companies and others claim. Apple manufactures consumer electronics; Amazon delivery trucks are ubiquitous, and all have cloud-based offerings that require server farms consuming vast amounts of electricity.

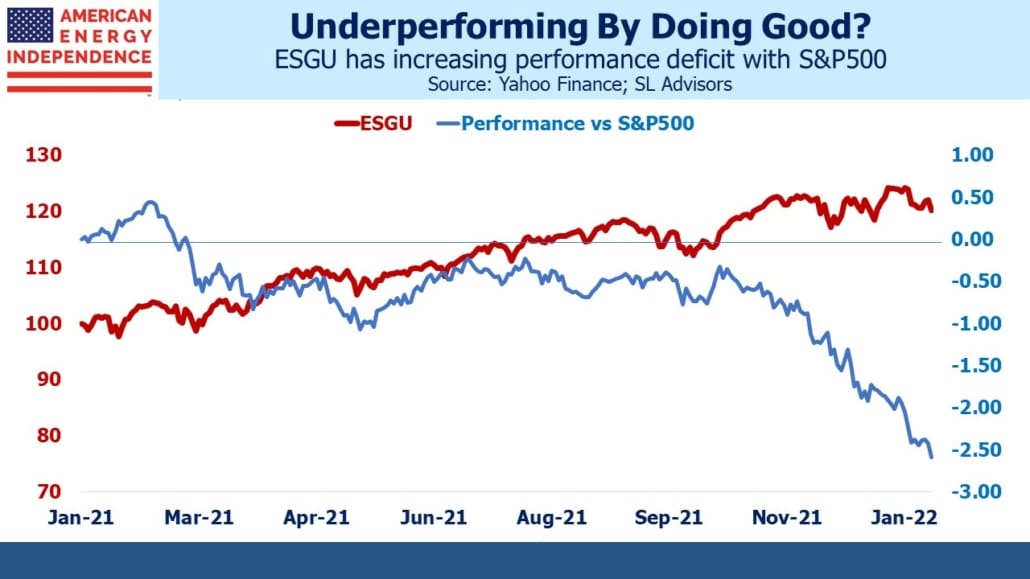

Given the infinite flexibility of ESG funds, their most important attribute has been relative outperformance. This has been driven by fund flows, and there are signs this tailwind may be easing. As we noted last year (see Pipelines Are ESG) ESGU was beating the S&P500 for a couple of years. Its portfolio only deviated modestly from the index, demonstrating how many ESG-eligible companies there are. But over the past few months ESGU has started to lag.

The energy transition is fundamentally inflationary. This is axiomatic – reducing emissions will cost money, raising the price of energy. Otherwise we’d already live in a world full of solar panels and windmills. The energy crisis roiling Europe, a result of poor planning and too much dependence on windpower, is a case in point. ECB member Isabel Schnabel recently gave a speech warning about the inflationary effects of decarbonization.

ESGU is very highly correlated with the S&P500, because their holdings are so similar. Although it had modestly outperformed the market in the past, 2021 relative performance was negative. The past three months have been especially poor, leaving it 2.5% worse off over the past twelve months. This period of underperformance corresponds to heightened inflation fears with sectors like Basic Materials and Energy doing well.

ESG has long enjoyed a very flexible set of criteria. Relatively strong performance led some to believe that companies with high ESG standards were generating better performance metrics, such as ROE or profit margins. However, the evidence was never compelling, and more likely is that investor bias towards ESG funds has been self-fulfilling.

That may have started to reverse. It’s likely a portfolio designed to profit from a long bull market in commodities, as forecast by Blackrock’s Hambro and others such as Goldman’s Jeff Currie would look quite different from today’s ESG funds. The irony is that concern about climate change is high on the ESG checklist, and yet decarbonization may leave ESG funds underinvested in the sectors most likely to profit from this.

It’s fortunate that ESG is so flexibly interpreted, because if recent trends continue we’ll likely see new offerings that combine ESG with heavy commodity exposure.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.