Energy’s Slow Transition

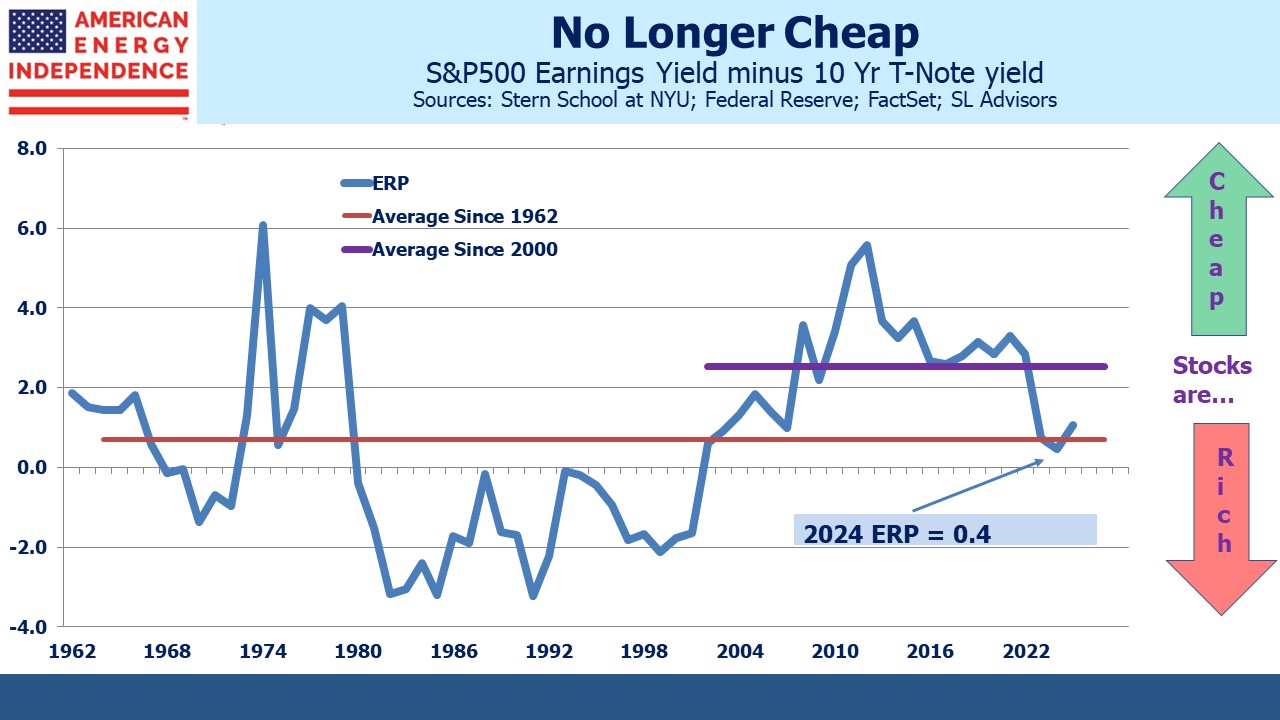

Treasury bills yielding 5.3% are not the worst place to put some cash. Long term expected returns on US large cap equities are generally 5-7%. Schwab expects 6.2%. JPMorgan is at 7%. The Equity Risk Premium is the lowest it’s been in over two decades. S&P500 earnings projections for this year and next are roughly unchanged over the past three months, but stocks are +10% driven by the AI boom.

The Fed doesn’t target asset prices, but the release of the FOMC’s projection materials last week confirmed that they expect to cut rates later this year. Stocks duly rose.

The Fed is walking a precise path. FOMC forecasts for the Fed Funds rate are aligned with the market. December SOFR futures are at 4.5% versus the median blue dot at 4.6%. Policymakers can be forgiven a degree of immodesty. They have quelled inflation without causing a recession.

On the back of this success, they now plan to cut rates with inflation still above their target and the unemployment rate below their projected equilibrium. This drew criticism from Larry Summers who thinks they’re too eager to cut rates. The counter argument is that current Fed policy is restrictive, and having avoided a recession to this point they don’t want to stay too tight for too long.

The economy is doing well, and the margin for error is on the side of slower rate cuts or none this year. If the unemployment rate dropped back to 3.7% the 4.6% year-end projected Fed Funds rate would look optimistic.

With stocks historically expensive against bonds, which themselves don’t look that cheap, there shouldn’t be any great rush among investors to commit new cash to equities.

The exception is midstream energy infrastructure, which has quietly been delivering strong returns for over three years and is drawing the attention of more buyers.

Williams Companies CEO Alan Armstrong told the CERAWeek energy conference that the need for permitting reform has made building infrastructure more difficult. This has reduced competition within the midstream sector, leaving incumbents in a strong position. Climate extremists (hug one) have done this. Armstrong said Boston burns garbage, oil and coal to generate electricity rather than allow pipelines to bring in natural gas from Pennsylvania.

We agree with Armstrong that any serious effort to reduce emissions should exploit cheap natural gas to displace coal. As the world concludes that the UN IPCC “zero by 50” goal is out of reach under current policies, pragmatism will favor solutions like this.

In 2017 we wrote about Stanford University’s Tony Seba (see A Futurist’s Vision of Energy). Seba tells you what the future will look like. His presentations are engaging and his forecasts far from mainstream. This makes them exciting, by forcing the viewer to contemplate a world very different from today.

Seba’s not the only person to have made spectacularly wrong energy forecasts. Vaclav Smil is a brilliant writer on energy whose many books include How the World Really Works. Smil eschews long term forecasts, recalling a 1983 meeting of the Internation Energy Agency (IEA) where he drew some comfort because his, “was less ridiculous than that of the World Bank’s chief economist.”

In 2017, Tony Seba opened his presentation with a photo of horse-drawn carriages in New York’s 1900 Easter parade followed by a 1913 photo of Fifth Avenue with all cars and no horses. It’s great theatre and draws the audience to embrace the notion that dramatic change is all too common.

At the time of that presentation, Seba forecast that by 2030 EVs would be 100% of US auto sales and that global oil demand would be 70 Million barrels per Day (MMB/D). We’re halfway to that deadline. Today US EVs are 10% of sales if you include hybrids. Global oil demand is at a record 103 MMB/D and the IEA regularly revises its forecasts up.

Seba’s website still uses the 1913 photo labelled “Where is the horse?”

Unbowed by the improbability of the 2017 forecasts, Seba currently expects 95% of US passenger miles to be “served by on-demand autonomous electric vehicles owned by fleets, not individuals.” Never mind that the average US car is over 12 years old and that today fleet-owned autonomous cars are limited to a few experiments in places like Tempe, AZ.

Change is coming, and sometimes it’s faster than expected. Tony Seba is not short of invitations to speak at events. However, profits do not come to those following his vision.

Seven years ago, Exxon’s US EV forecast was a 10% market share by 2040, likely to be a big miss. They also forecast 115 MMB/D of global crude oil demand at that time, which is quite possible given recent trends.

Aramco CEO Amin Nasser told CERAWeek that the “current transition strategy is visibly failing” and that emissions will increasingly be determined by the “global south” (meaning the developing world including Asia). He’s right.

This energy transition will last decades as did previous ones from wood to coal to oil and gas. Futurists are fun but the incumbents are where the money is.

We have three have funds that seek to profit from this environment: