Energy Transition Profits Are Elusive

Rivian’s R1T truck has a special storage compartment for golf clubs. Nothing else so eloquently describes the conundrum facing the auto industry. America is not an obvious market for EVs. It’s a vast place, so we drive greater distances. Gasoline is cheaper than in other developed countries. And we like big cars – two thirds of US sales are light trucks and SUVs.

Progressively tighter standards on CO2 emissions are pushing auto makers to develop EVs in order to be able to keep selling cars. Given US consumer tastes, those cars need to be big. But the golf storage capabilities of the R1T surely address a very narrow sliver of the market. I can attest that the parking lots of country clubs are devoid of light trucks. And the guys at Home Depot loading their trucks with lumber to build a deck are not contemplating how that new wedge will get them reliably up and down from off the green.

Moreover, golf clubs are generally politically conservative. Climate change is not a common topic on the tee box or in the bar afterwards.

The golfing light truck owner more worried about global warming than his short game is a niche market.

Nonetheless I know two, and like all my friends who own EVs they love them. But each also has a traditional car to complement their $60K Tesla or $100K Rivian. EV owners always have another car.

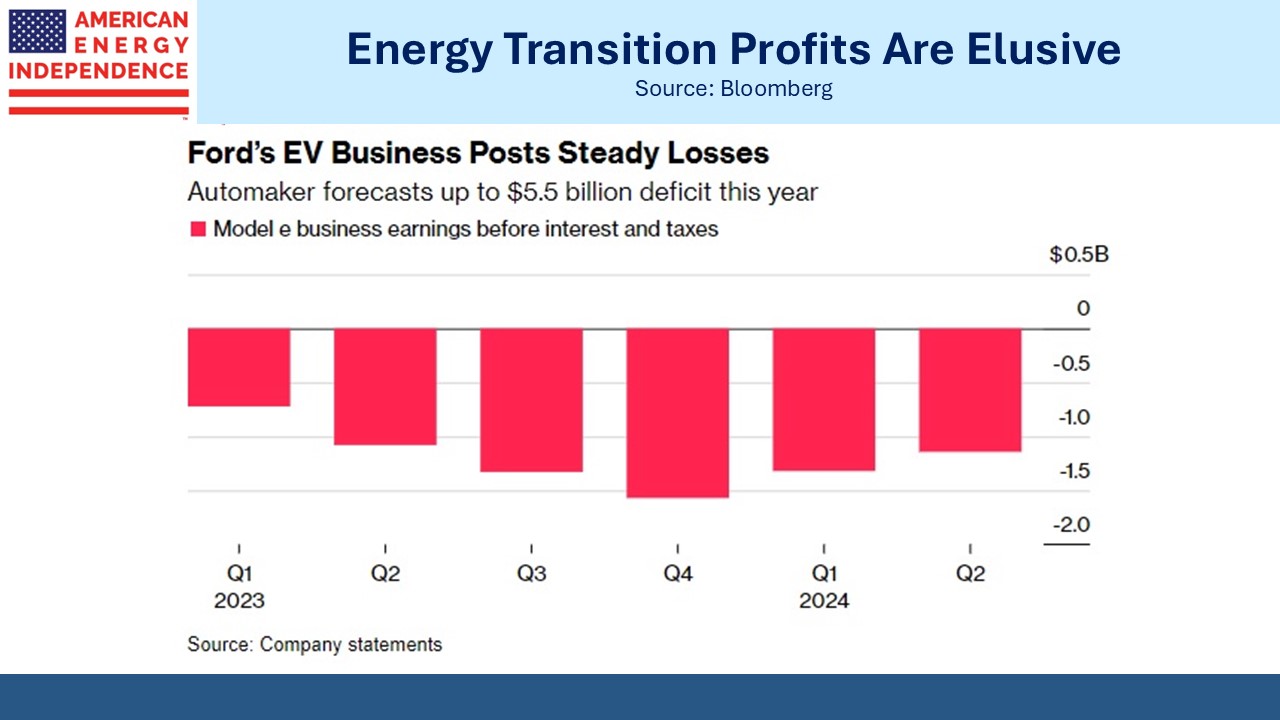

Seven years ago Ford fired then-CEO Mark Fields because the board felt he wasn’t moving the company aggressively enough into EVs. New management addressed the problem, and so now Ford is losing $BNs on EVs. They recently dropped plans to produce an EV SUV. The writedown could be as big as $1.9BN, and they expect to lose $5.5BN this year on EVs. While bigger gasoline-powered cars are more profitable to manufacture, the reverse is true with EVs. Batteries don’t scale easily. Ford has decided to slow their EV push.

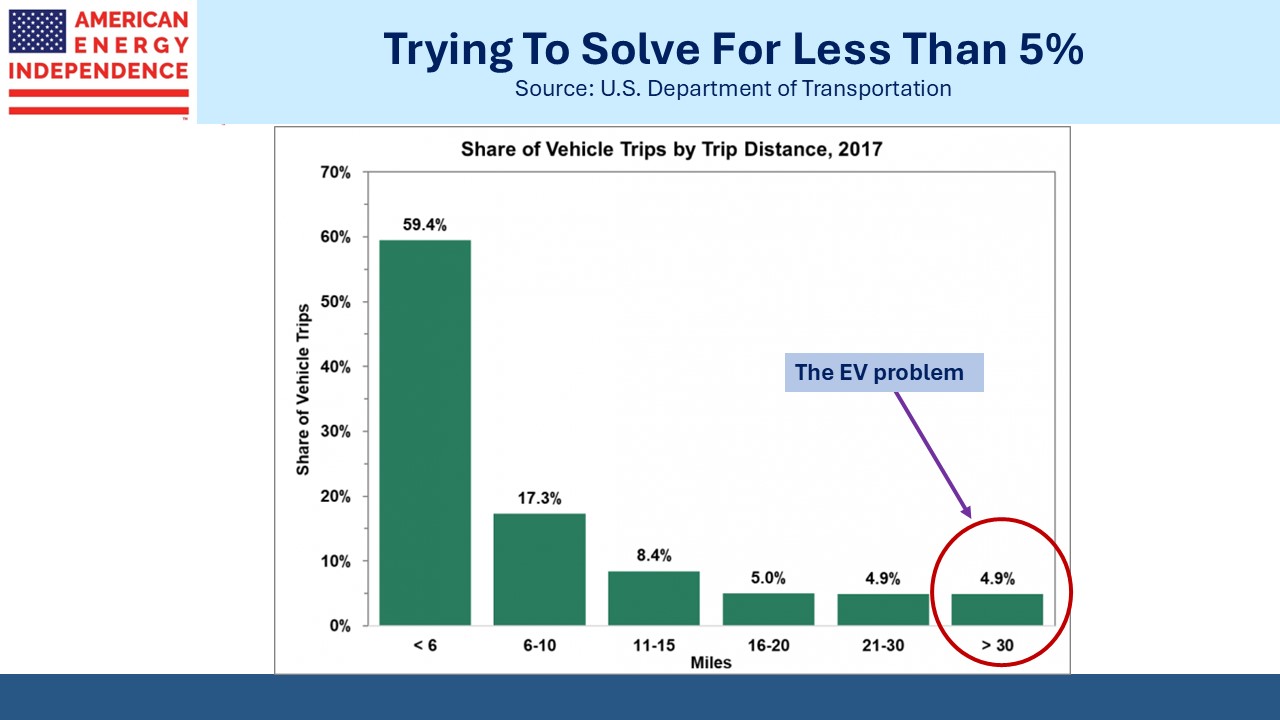

A survey several years ago showed that car journeys are overwhelmingly short, with fewer than 5% over 30 miles. I’ve never run a car business, but it looks to me as if the auto industry is squandering substantial sums trying to build a car that covers 100% of trips, instead of producing one that does almost all of them. Range anxiety kicks in at much more than 30 miles, so although the survey doesn’t offer that detail, an EV can probably suffice for 97-98% of an owner’s trips.

Since all the EV owners I know have a second car, instead of aspiring to build an EV that renders the long distance back-up unnecessary, why don’t manufacturers offer very cheap EVs for local trips? Consumers could keep the gas-powered car in the garage, brought out infrequently for that 200 mile journey to see grandma. Offer souped-up golf carts. Or take advantage of China’s substantial support of its domestic battery manufacturing to import their cheap EVs instead of imposing 100% tariffs.

Developing countries are demanding $TNs in transfers to help them transition to low-emission energy systems. In a neat twist, by importing Chinese EVs they would be subsidizing our energy transition rather than the other way around. Transportation sector emissions would fall. The addressable market would extend beyond the virtue-signaling residents of blue counties, and golfing light truck owners.

Public policy doesn’t treat climate change as the existential threat policymakers claim it is. Otherwise, we would freely import Chinese EVs and solar panels. The Sierra Club would be calling for a Federal regulatory structure for nuclear power that enables a vast buildout. We’d be pushing our cheap natural gas on developing countries to displace coal.

The White House hails tighter emissions standards that will, “…create good-paying, union jobs leading the clean vehicle future.”

That’s fine but admit that the energy transition is outrageously expensive and competes with other priorities.

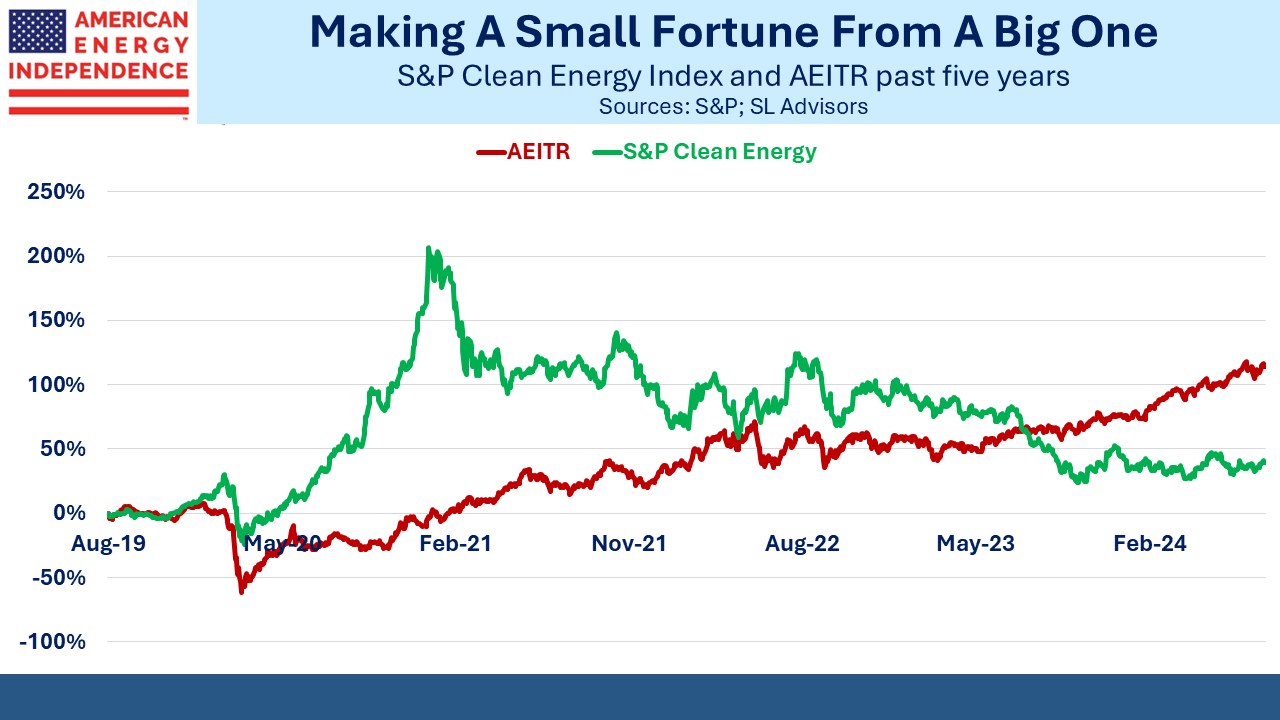

Ford, like the rest of the auto industry, is finding energy transition profits elusive. Tesla is the notable exception. Windpower is generating billions in losses (see Windpower Faces A Tempest) . The S&P Clean Energy Index has performed miserably over the past five years, returning 6.9% pa compared with 16.4% pa for the American Energy Independence Index.

If you want to make a small fortune investing in the energy transition, start with a big one.

Midstream energy infrastructure companies can take the tax credit opportunities created by the Inflation Reduction Act while also generating reliable cashflows from their existing business. They can selectively invest in carbon capture or hydrogen hubs where Federal largesse is sufficient to tip the economics into profitability. But there’s no existential threat to their traditional business, because energy transitions have historically taken decades. This one will too.

Many investors like us are concluding that pipeline companies are among the best ways to participate in the energy transition.

We have three have funds that seek to profit from this environment: