Energy: Transition Or Security

Who can’t be moved by the pictures of women being trained to fire automatic weapons, and crates of Molotov cocktails being prepared in backyards. The Ukrainian people are drawing the world’s admiration and financial markets’ attention. There are numerous possible paths for the war to follow, and each one brings its own set of investment outcomes with risks. It’s hard to have high conviction on any assessment, because few of us have the background. But run through all the scenarios you can imagine, and every one of them includes Europe finding alternatives to Russian natural gas.

Sunday’s extraordinary meeting of Germany’s Bundestag was a watershed. For decades European nations have underspent on their defense needs – something Trump brought up regularly including in this meeting. Past presidents rarely did.

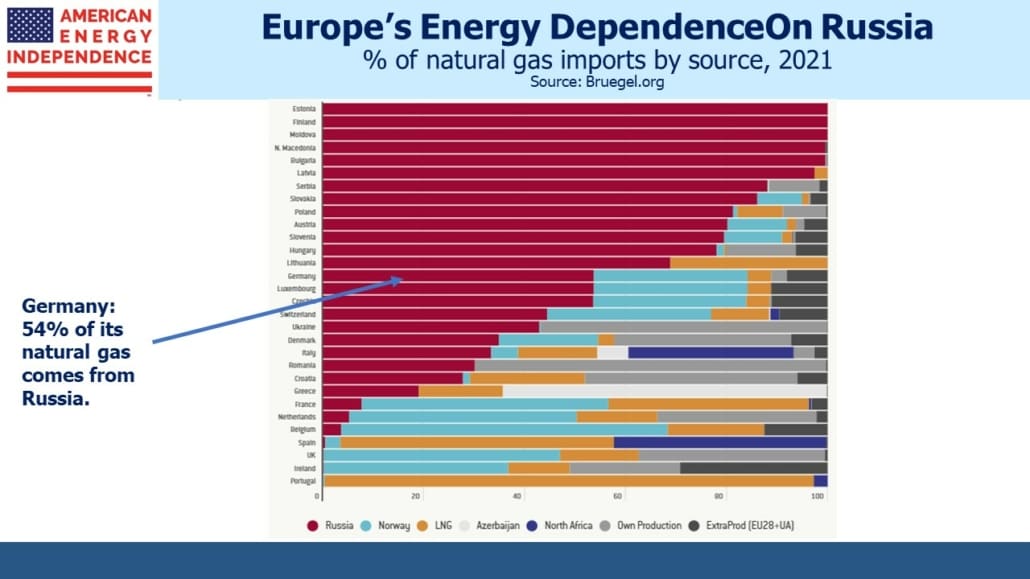

Now Europe will rearm, starting with Germany’s decision to spend an additional €100BN on defense. And they will build two import terminals for Liquified Natural Gas (LNG). Germany is especially exposed, since Russia provides over half their natural gas which itself constitutes over 30% of total energy consumption. Switzerland, Denmark and Italy all rely on Russia for over a third of their natural gas. Of the four, only Italy has LNG import capability. Landlocked Switzerland doesn’t have that option.

For an in-depth look at Europe’s natural gas options to prepare for next winter, read Preparing for the first winter without Russian gas.

Even if Putin was implausibly replaced with a non-despot, the shift in European energy security will roll on, because planning takes years and the prior policy has been discredited. Amid all the uncertainties of a war in Europe, their need for alternative LNG and the US’s ability to help provide that is a reliable outcome. Tellurian and NextDecade, two nascent LNG companies with contracts but not yet secure financing, have both rallied strongly on improved expectations that their projects will be completed.

What’s less clear is whether US energy policy will change. Europe’s energy security is suddenly a big concern. Chevron CEO Mike Wirth called for US policy to support investment in our domestic energy industry. It’s too early to tell whether it will become US policy to provide that security through increased oil and gas production. Probably not with a Democrat administration, although Senator Joe Manchin has called for the US to end imports of Russian oil, which is a start.

The west is edging towards placing sanctions on Russian oil and gas exports. It’s a good time to avoid any overly-confident forecasts unless they’re like US midstream where any outcome confirms its increased importance.

Today’s investors in pipelines own a call option on US energy policy shifting in response to Europe’s suddenly changed need. The sector isn’t yet priced for it, so US midstream energy infrastructure can only benefit and has no discernible downside from a policy reassessment.

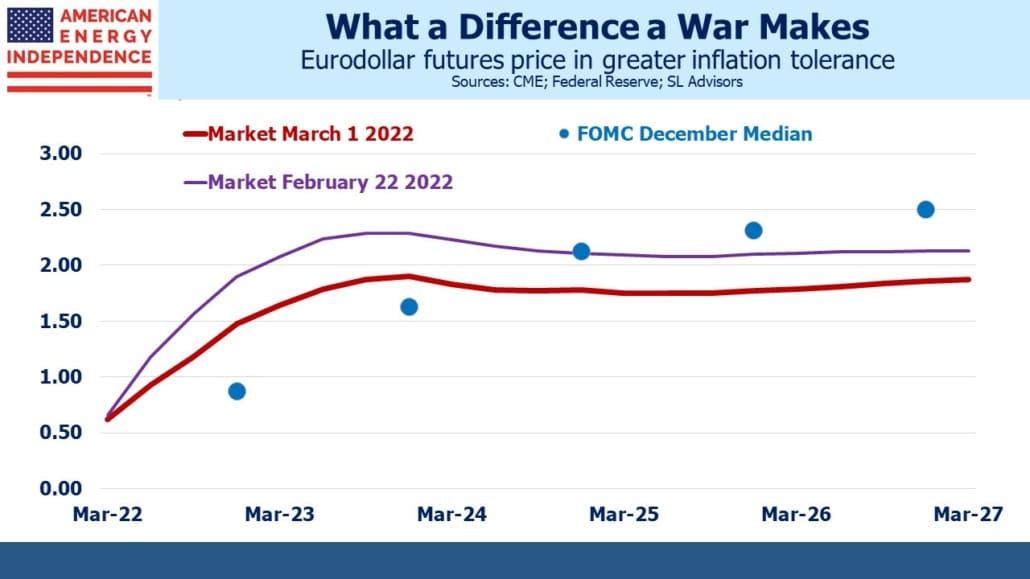

What’s also changed is the inflation outlook, which must be higher in almost every scenario. Europe’s pivot on energy policy is bullish for prices. This will feed through to inflation. 2023 eurodollar futures yields have fallen by 0.40% two days, sharply reducing the expected path of short term interest rates. Higher energy prices will constrain growth while boosting inflation.

Given the Fed’s bias towards maximizing employment and greater tolerance for inflation risk, the market’s repricing makes sense. Elevated crude oil because of the energy transition or geopolitics seems the type of upward pressure to which the Fed would find little benefit in responding.

Here again, pipelines with their PPI-linked tariffs represent a good way for investors to construct portfolios with inflation protection. Ten year inflation as measured by TIPs and treasury notes has edged up 0.15% in the past week despite the drop in nominal yields.

The energy transition as pushed by climate extremists offers the antithesis of energy security, since it seeks reduced supply. Proponents of renewables like to argue that they create independence too – the utopian ideal of a countryside packed full of solar panels and windmills would seem to be free of imported fossil fuels from unreliable suppliers. But so far renewables remain insignificant, and the immediate problems are not going to be solved with solar and wind.

The physical security of renewables doesn’t receive much attention, but fragile solar panels are easily damaged by hard objects. If progressive policies had made it to Ukraine so that the country ran on solar, the Russians could have disabled their power supply with airdrops of ball bearings. The energy transition is colliding with energy security. As US consumers pay more to fill up at the pump, they’ll demand more oil not more windmills.

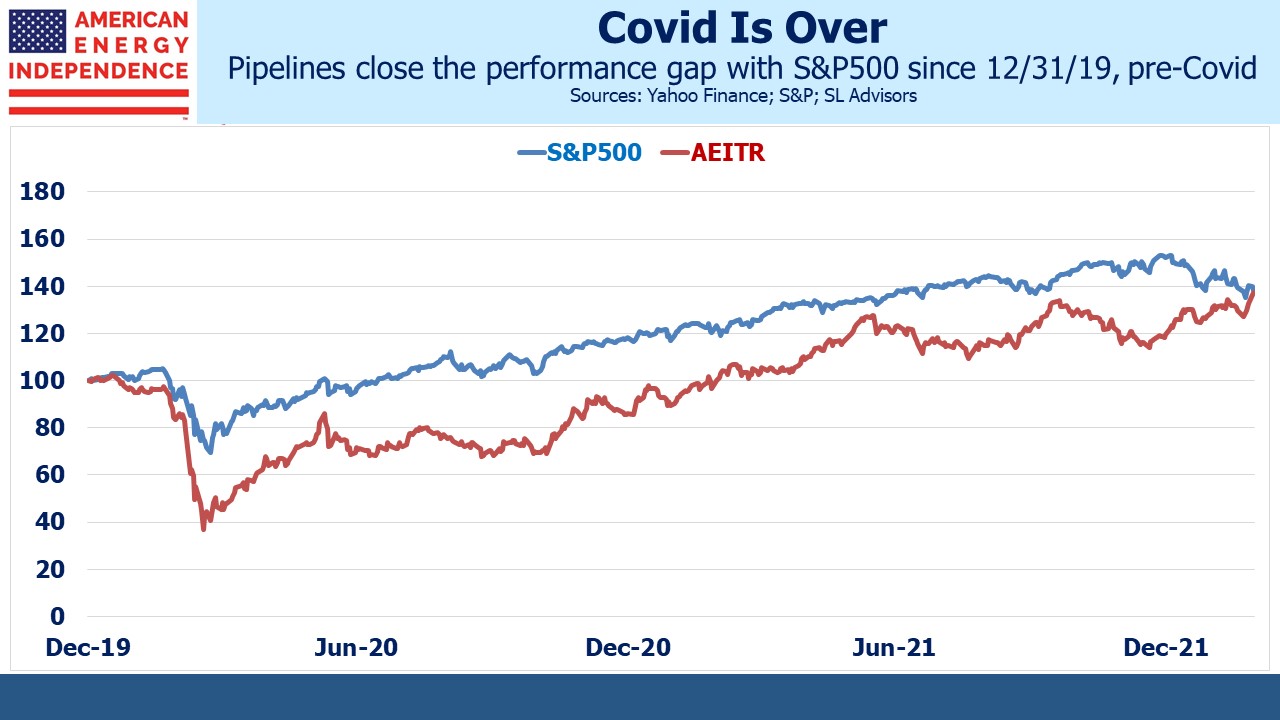

The American Energy Independence Index (AEITR) has been outperforming the S&P500 ever since its March 2020 Covid low. The reassessment of energy policy triggered by Russia’s invasion has given AEITR a further boost, so it’s now recouped all its relative underperformance since pre-Covid. Last week’s events make an investment in the sector even more compelling.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.