Energy Stocks Continue To Lead

Fed chair Jay Powell wasn’t to blame for Thursday’s equity market sell-off, no matter what journalists thought. His comments were dovish, reaffirming the Fed’s desire to see meaningful improvement in employment before moderating their bond buying. Tightening is nowhere in sight. Had he said the opposite, markets would have probably fallen further, which simply means bonds are in a bear market.

Powell’s comment that he would only be concerned about bond weakness if it led to tighter financial conditions suggested that the Fed would be inclined to counter such a development, perhaps by increasing their own bond purchases. He expects any increase in inflation to be temporary. Fixed income investors aren’t so sanguine and are demanding fair compensation for increased risk. To own bonds at current yields requires a faith in the Fed’s forecasting ability not supported by their track record. They have no insight that isn’t found in many private sector forecasts; but they do have the power to act.

The Fed’s beige book provided a mildly encouraging outlook, but mentioned the word “shortage” 31 times, the most in a decade. It applied to difficulties in filling many different job types, petrochemicals and chips used in automobiles. CNBC reported that raw materials costs for a new car had risen $1,152 in the past year. Today’s Fed cares more about unemployment than adequate returns to bond buyers. It’s correct and democratic, but translates into inadequate interest rates.

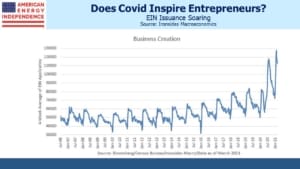

We were also surprised to see evidence of very strong new business formation. Thanks to Barry Knapp of Ironsides Macroeconomics for pointing out the surge in IRS issuance of Employer Identification Numbers (EINs), one of the first steps in launching a new business.

Stocks are attractive but, in some sectors, vulnerable to higher rates. This is most apparent among growth sectors such as technology, which has been supported by low rates for years. Ten year treasuries at 2%, 0.5% higher than now, still wouldn’t make bonds a buy. But because the net present value of a growth stock is more reliant on distant cashflows than is the case for the overall market, rising rates hurt more. If you think of a growth stock as analogous to a zero-coupon bond (returns backloaded) and compare it with a similar maturity coupon-bearing security, you’ll appreciate that growth stocks have greater interest rate sensitivity (duration), just like a zero-coupon bond.

OPEC’s decision not to increase supply for now gave a further boost to the energy sector. Pipelines are providing useful protection against rising rates, since both are going up with the reflation trade. After several years of negativity, it’s a long way from a crowded trade. We expect Free Cash Flow (FCF) to continue growing this year, such that pipelines will offer a FCF yield of 10% by year’s end; double the S&P500. The American Energy Independence Index (AEITR) is now back above its pre-Covid 2019 year-end level, and is narrowing the performance gap with the S&P500.

Exxon Mobil (XOM) has doubled in price since October. Its dividend, increasingly secure as crude rallies, still yields over 6%. It’s hard to see a strong bearish case even following such a strong rally.

The strength in energy has coincided with weakness in solar stocks. The Invesco Solar ETF (TAN) is –7% YTD, versus the AEITR which is +20%. Over the past year, solar stocks have outperformed significantly, but as growth stocks they’re vulnerable to rising rates.

Maybe solar investors have considered the two maps showing the global disposition of coal-burning power plants, which vividly portrays where the world’s increased CO2 emissions will be coming from. Developing countries, many of them in Asia, will be adding significant power capacity reliant on coal. Increasing global trade in natural gas is preventing this damaging development from being even worse.

The hype around renewables makes it seem as if America can singlehandedly save the planet if we’d just shift to 100% solar and wind. New York’s mayor Bill de Blasio wants to ban natural gas hookups for new buildings by the end of the decade. If you’ve visited New York recently you may conclude that de Blasio’s chronic mismanagement is curbing the need for much new construction anyway. But he epitomizes the simplistic view that is oblivious to what’s actually happening.

The world’s going to use more of all kinds of energy in the next several decades, as economic growth in emerging economies drives up demand. We’ll use more renewables, natural gas and, unfortunately, more coal. Unless we can flip those dots, each of which represents a new source of coal-based emissions, to something cleaner (natural gas is the obvious choice), we’d better plan on living with more CO2.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.