Energy Infrastructure Earnings Rise With Volumes

Last week was a busy week of earnings reports for many sectors, including energy infrastructure. Growing energy sector profitability is feeding through to higher returns to investors. Over the past month the S&P Energy Sector ETF (XLE) has outperformed the S&P by over 9%. RBN Energy has a good blog post (see Better – E&P Profits Appear Ready To Take Off This Year After Turning A Corner In 2017), highlighting that the 2017 impairments are unlikely to be repeated and that higher oil prices will drive improved operating margins.

Enterprise Products Partners (EPD) reported 1Q18 EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) of almost $1.7BN, 11.5% ahead of consensus. That was a significant beat for such a large, stable business as every segment did better than expected. EPD has a premier position on the Gulf Coast and is a leading exporter of U.S petroleum liquids. On the call, CEO Jim Teague highlighted the value of midstream companies in getting product to the global market. “The name of the game for U.S. production is exports, exports, exports, exports, of crude oil, natural gas, ethane, LPG, petrochemicals and refined products.” Last year EPD trimmed its forecast distribution growth in order to redirect more cashflows into growth projects. Income seeking investors were underwhelmed, but it simply reflected EPD’s response to the changing MLP business model.

1Q18 earnings reported by Oneok (OKE) beat expectations by 4%, driven by strength in their Natural Gas Liquids segment in the SCOOP and STACK play in Oklahoma. Pembina (PPL) announced a 19% year-on-year dividend increase as their Veresen acquisition and assets recently placed into service powered EBITDA growth. Targa Resources (TRGP) reported a solid quarter and positive outlook. They are the leader in providing gathering and processing in the Permian Basin, but even more interesting was the volume growth they saw elsewhere, in North Dakota and South Texas. Tallgrass Energy Partners (TEP) reported on their earnings call increasing throughput on their Pony Express crude pipeline that links the Bakken in North Dakota to Cushing, OK. 1Q18 volumes averaged 290 thousand barrels per day (MB/D), up by 22MB/D on 4Q17, and are expected to reach 350MB/D this month. This shows that it’s not just Permian crude output that is growing, with U.S. production reaching 10.6MMB/D. Record earnings and volumes were reported by a good number of names.

Most dramatically, Cheniere Energy (LNG) announced consolidated EBITDA of $907MM, up 88% on a year ago and 46% ahead of expectations. They raised full year guidance by 14%. Surging demand for U.S. exports of Liquified Natural Gas underpin the outlook. Higher crude prices are also improving the competitive position of U.S. exports since global natural gas pricing is often linked to crude oil while U.S. domestic gas prices remain among the lowest in the world.

Energy infrastructure businesses do better when their customers are thriving. Growing oil and gas production is creating tightness in some of the support functions. We recently highlighted the Midland-Houston spread for crude oil, which should normally be limited by the $2-3 pipeline tariff to move crude from the Permian wellhead to customers on the Gulf Coast (see Dwindling Pipeline Capacity Causes FOMO). Limited pipeline capacity had caused the differential to increase to over $6, as producers were forced to utilize more expensive rail or truck transportation. Last week the spread reached $12, beyond the cost of rail transportation and therefore indicating greater use of trucks.

The losers are oil producers without contracted pipeline take-away capacity. The pipeline industry often complains about “freeloaders”; pipelines are built once enough capacity has been contracted out to meet required return thresholds. Oil and gas producers who don’t make those early commitments can still access the pipeline once it’s built. They benefit from the support of their peers who underwrote the infrastructure development. But when pipeline capacity is tight, these “walk-up” customers have to pay market rates, which rise. Plains All American (PAA) will announce earnings on Tuesday, and as the biggest crude oil pipeline operator in the Permian, their comments on demand for takeaway capacity will be especially interesting.

Not everything was good. Marathon Petroleum (MPC) acquired Andeavor, orphaning MLP Andeavor Logistics (ANDX). We highlighted in last week’s blog that corporate parent TransCanada (TRP) had said their MLP, TC Pipelines (TCP), was no longer viable as a funding vehicle, rendering them of little use to TRP. Subsequently, TCP slashed their distribution by 35%. The recent FERC ruling was the cause. Spectra Energy (SEP) and Enbridge Energy Partners (EEP) were similarly weak as investors contemplated their “orphan” status. One subscriber asked us if he should avoid MLPs entirely that have a separate General Partner (GP), given recent developments. As regular readers know, we only hold MLPs that have no GP, to avoid just the sort of issue faced by TCP investors.

Williams Companies (WMB) set new volume records for gas on its TransCo system, but offered little new regarding a potential combination with their MLP Williams Partners (WPZ). Their Analyst Day later this month is expected to offer an update. WPZ investors face the risk that a combination with WMB will trigger a tax bill for deferred income.

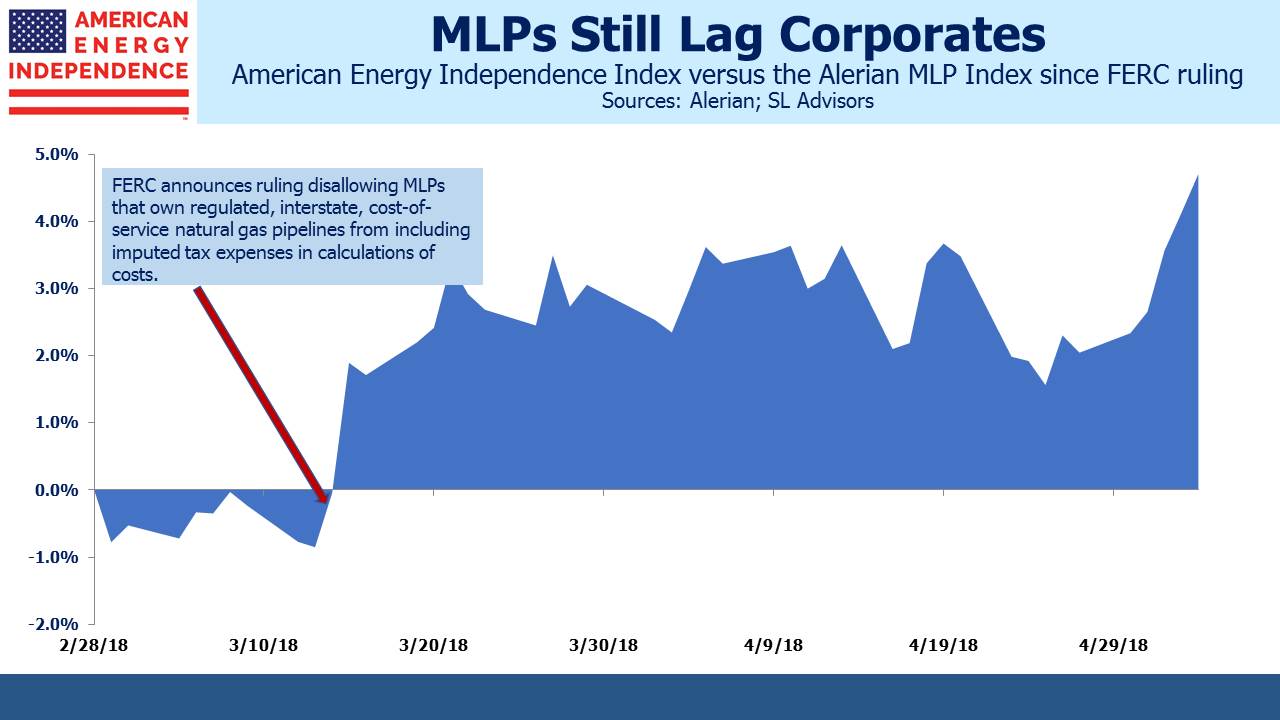

Broad energy infrastructure as defined by the American Energy Independence Index continues to outperform the narrower Alerian MLP Index (AMZ), a trend set in motion by the FERC ruling in March. AMZ remains below its pre-FERC announcement level. Although MLPs retain an important tax advantage over corporate ownership of energy infrastructure assets, the several dozen distribution cuts by MLPs since 2014, as well as unwelcome simplification transactions, have clearly soured their traditional investor base. MLPs are evolving towards more internally-financed growth, which is for now impeding distribution growth.

On Tuesday, we’ll be ringing the NYSE closing bell to celebrate the recent launch of our ETF. Check us out on CNBC at 4pm.

We are invested in EPD, LNG, MPC, OKE, PPL, TRGP, TEGP (GP of TEP) and WMB