Cost Overruns Plague Big Projects

Earnings continue to meet or modestly beat expectations. 4Q22 EBITDA at Enbridge of $3,911MM beat expectations by $16MM, or around 0.4%. The small margins between actual and expected at many companies highlight the visibility of their earnings.

Along with TC Energy, both companies have a long history of dividend growth — 28 years at Enbridge and 23 years at TC Energy. However, the two big Canadians represent a disproportionate share of the sector’s growth capex. Costs for TC Energy’s Coastal GasLink project continue to spiral upwards, now C$14.5BN and more than double its initial forecast. The project’s value has been written down by C$3BN, and a further writedown is expected as additional funding is provided.

Although both Canadian firms are generally well regarded, we have maintained them at below-weight positions in our portfolios because of their extensive capex programs. We estimate that their 2021-23 capex is 38% of the sector’s, ahead of their 31% share of market cap. Enbridge expects EBITDA growth this year of 2.5-6.5%, and TC Energy 5-7%.

The problems with Coastal GasLink highlight the difficulty big construction projects face in North America. Labor is tight and environmental extremists are adept at using legal challenges to impose costly delays. Kinder Morgan executives must thank their good fortune at unloading the Trans Mountain Pipeline (TMX) project to the Canadian Federal government in 2018. After delays and cost overruns it’s now scheduled to be in service next year, costing C$21.4BN versus the C$12BN estimated when Canada bought it.

Our northern neighbor has long struggled to get its oil to market. TMX became embroiled in provincial politics, with liberal British Columbia unsympathetic to land-locked Alberta’s need to move its produced crude oil to the Pacific coast. The ill-fated Keystone XL was another failed effort to solve that problem by sending crude south.

Canadian natural gas also travels great distances to reach its market, a problem TC Energy’s Coastal GasLink is trying to solve. Tourmaline sends its gas 3,000 miles via pipeline from British Columbia to Cheniere’s LNG export facility at Corpus Christi, TX where it’s loaded onto LNG tankers. From there it supplies buyers in Europe and Asia at prices 10X the Canadian spot market.

Coal to natural gas switching remains a powerful means of reducing CO2 emissions. Unfortunately, Pakistan just announced plans to quadruple coal-generated electricity and use less LNG because of high prices. Russia’s invasion of Ukraine turned Europe into a significant buyer of LNG, which has made it harder for poorer countries to use it. Pakistan is facing a balance of payments crisis and a debt default looms.

This illustrates that energy security and affordability are more important to developing nations than the energy transition. Some officials in India believe they’re more vulnerable to extreme weather events because of a warmer climate, such as the floods that destroyed neighboring Pakistan’s cotton crop last year. More likely is that these and other countries will raise living standards first and worry about emissions later, when they’re better able to absorb the higher costs of mitigation and low-carbon power. Obviously solar and wind aren’t cheaper, or Pakistan would be emphasizing them instead of coal.

In Germany a project to blend natural gas with green hydrogen in a 70/30 split has been running successfully since the fall. Green hydrogen relies on solar or wind power to run the electrolysis that separates it from water. Utah’s Intermountain Power Project plans to supply southern California with a similar blend by 2025.

Plugging intermittent solar and wind into electrical grids creates instability, requiring battery back-up or natural gas peaker plants. Because it’s not always sunny and windy, 25-35% capacity utilization is the norm. Personally, I have no interest in weather-dependent power. But converting it into hydrogen nullifies the intermittency problem because electrolysis can run when weather permits without any disruption to customers.

Some regions still cling to the belief that everything can run on solar and wind. Eugene, OR, recently added itself to the list of unappealing places to live by banning gas hookups on new construction.

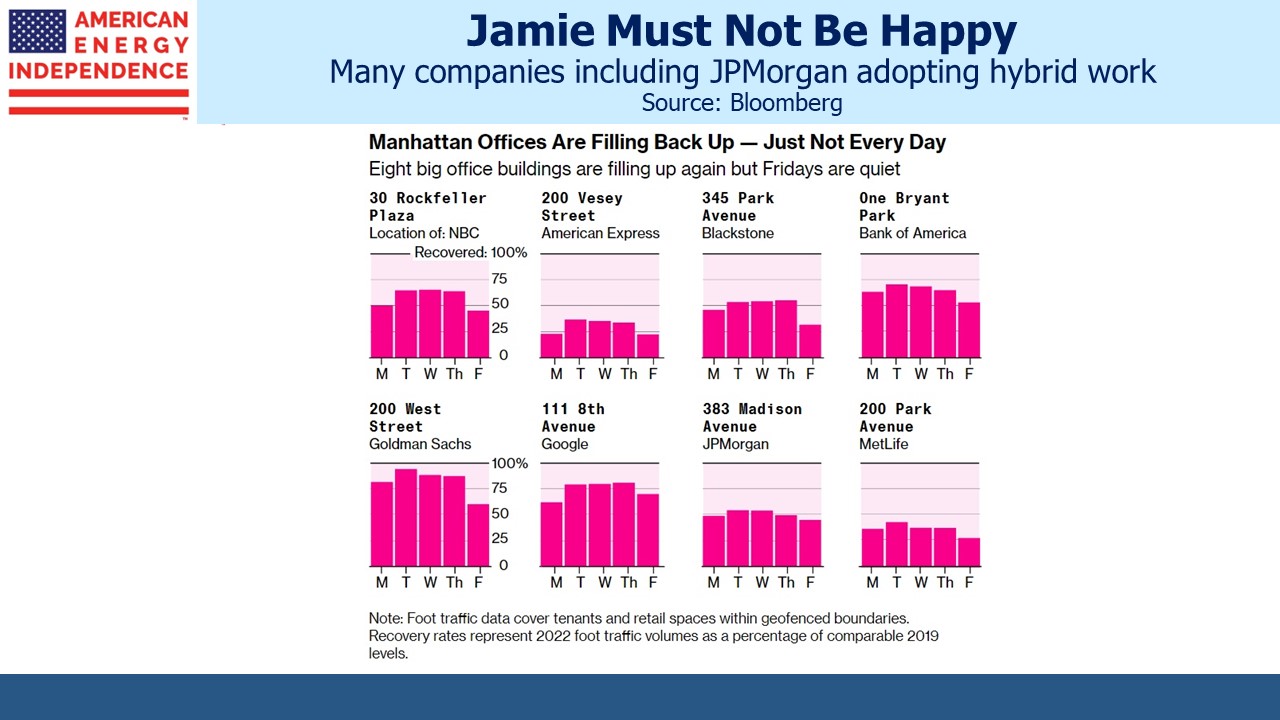

Remote work is expected to curb oil consumption by reducing commuting. Three years on from the outbreak of Covid, hybrid work is common with Fridays an especially popular day to work from home. 25 years traveling from NJ to New York City daily soon lost its appeal for me.

Goldman Sachs and JPMorgan, along with New York’s city government, all require their workers to be full-time in the office. The reality is different – JPMorgan is barely at 50% occupancy even in 383 Madison Avenue, the building they acquired when bailing out Bear Stearns in 2008 that is their de facto HQ while 270 Park Avenue is being rebuilt. JPMorgan CEO Jamie Dimon famously said, “people don’t like commuting, but so what.”

Americans are spreading out in this vast country, improving quality of life and perhaps even reducing emissions somewhat. Hybrid work is challenged to create a corporate culture and support creative teamwork, but it looks like a permanent change.

We have three funds that seek to profit from this environment: