Cheniere Keeps Returning Cash

Cheniere Energy Inc (CEI) has come a long way since its founding by Charif Souki in 1996. Three decades ago the US looked likely to be an importer of Liquefied Natural Gas (LNG) as demand outgrew dwindling domestic production. CEI planned to meet the gap with LNG imports. By 2008 the company’s LNG import terminal was ready at Sabine Pass, LA just as the shale revolution was boosting US production. Domestic gas was cheaper than imports.

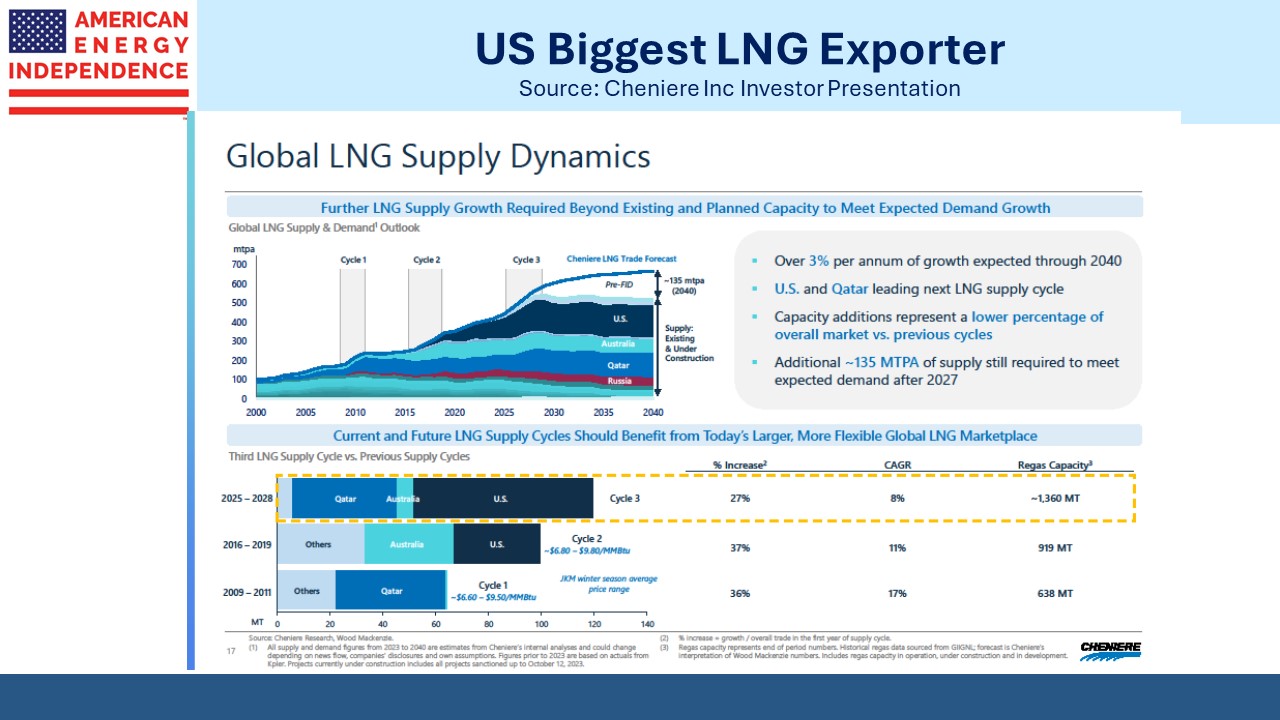

By 2011 Cheniere was preparing to reverse its flow – planning to export US LNG which was becoming abundant and cheap. Today CEI has 30 Million Tonnes per Annum (MTPA) of capacity at Sabine Pass and another 25 MPTA at its Corpus Christi, TX facility. Their $45BN investment in infrastructure allows them to export 8% of US production.

Souki long ago left CEI, forced out by activist shareholder Carl Icahn in 2015. They disagreed over Souki’s desire to add a marketing capability to CEI which would have provided the ability to speculate on natural gas prices. CEI’s business model is to charge a liquefaction fee for chilling natural gas to around –260 degrees Fahrenheit so it can be loaded onto a tanker.

The long term contracts CEI signs with highly rated counterparties provide cashflow visibility that can justify a high multiple on CEI stock. Speculating on natural gas prices offered less certain results and in Icahn’s view would have depressed the valuation.

We always felt Souki’s risk appetite was excessive. After being fired by CEI he founded Tellurian (TELL). Souki’s bullish view on natural gas prices led him to agree Sale Purchase Agreements (SPAs) with buyers that left Tellurian with the price risk.

During the pandemic TELL’s collapsing stock price resulted in a margin call on Souki, who had leveraged his personal holdings.

Investors didn’t share his enthusiasm for betting on higher prices, and TELL’s failure to secure financing led several SPAs to be canceled as the construction timeline was repeatedly pushed back. Souki was once again pushed out.

Earlier this year the Biden administration announced a pause on new LNG permits. This has left TELL languishing in limbo, unable to make commitments to deliver LNG in the future to potential buyers because there’s no visibility on when their proposed Driftwood LNG terminal will be built.

By contrast NextDecade (NEXT) which was once competing with TELL to sign up buyers, has moved ahead with construction of Stage 1 of their Rio Grande LNG terminal and looks likely to move ahead on Stage 2 by the end of this year.

Creating another CEI is the goal of both companies. With their recent update on capital allocation, CEI showed why others want to emulate them.

Although CEI’s $45BN outlay shows LNG terminals require enormous capital commitments, once built the ongoing maintenance capex is modest. CEI reinvests the smallest percentage of EBITDA in the midstream infrastructure sector on upkeep of their existing assets.

This has led free cash flow to boom. They increased their share buyback authorization by $4BN and are aiming to retire 10% of their outstanding shares by 2027. Past share repurchases since 2022 have already retired over 10% of their sharecount.

Having instituted a dividend in 2021, CEI is targeting 10% growth and a 20% payout ratio. They expect to deploy $20BN in new capital on expansion projects by 2026 while also reaching >$20 per share in Distributable Cash Flow (DCF), around a 12% DCF yield based on their current stock price. They’re targeting an investment grade balance sheet with 4X Debt:EBITDA which will further reduce their cost of financing.

CEI plans to add 35 MTPA of capacity to the 55 MTPA already in operation, maintaining their dominant position in US LNG exports. Their shipments are 95% contracted through the mid 2030s with highly rated counterparties including Petrochina, South Korea’s Kogas, Spain’s Iberdrola and Shell. Williams Companies and Kinder Morgan are among those providing supporting natural gas infrastructure.

Exporting LNG is an attractive business model because the infrastructure only gets built when enough SPAs are in hand to obtain financing. 75% of recoverable US natural gas can be profitable at under $4 per Million BTUs, assuring US LNG exports will benefit from cheap supply.

Investors didn’t lose $BNs on TELL because they couldn’t raise much capital. Construction barely started on Driftwood. The cash wasn’t there.

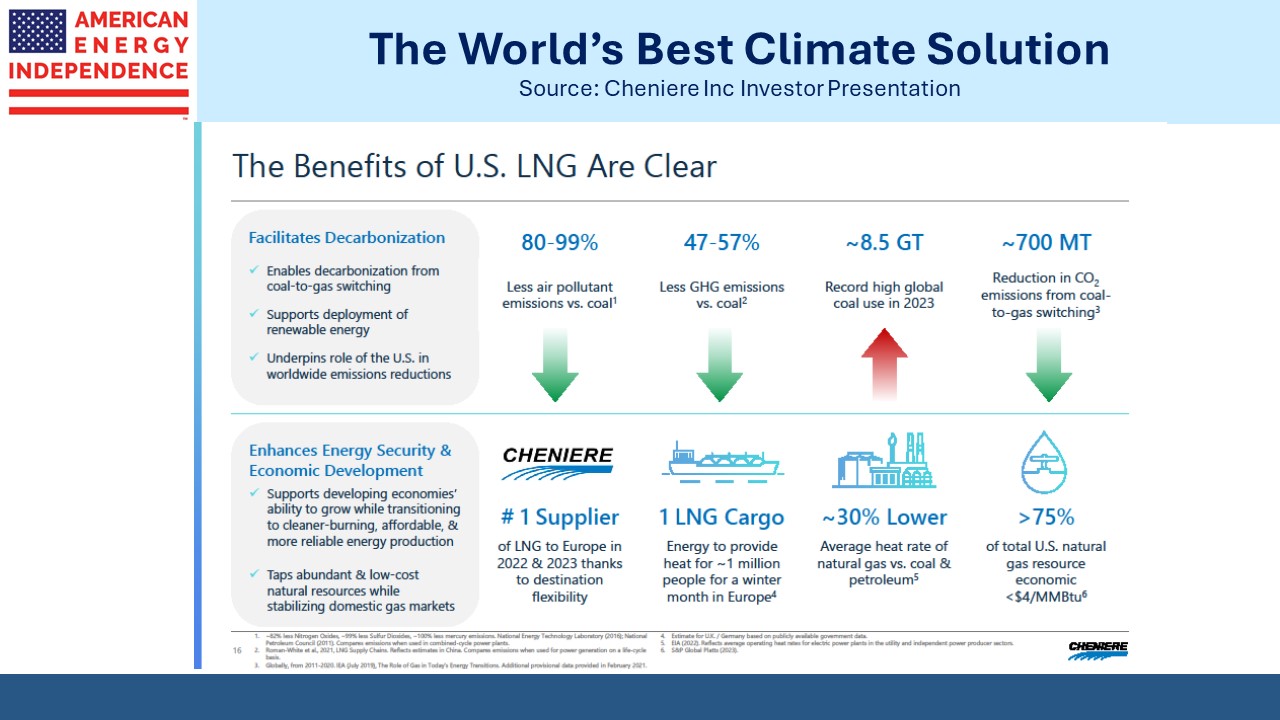

Global coal consumption continues to grow. Natural gas burns with around half the greenhouse gas emissions and can substitute for power generation and many other uses. People who think seriously about the most effective ways to mitigate global warming know US LNG is an important part of the solution. Cheniere’s exports will be in demand for decades to come.

We have three have funds that seek to profit from this environment: